For example, if people need three different jobs to house and feed their families, that’s clearly not good. But the government will paint it as a great thing by telling you that the jobs numbers are strong, failing to mention that the economy is actually so weak that people need multiple income streams just to survive. And in any event, the government can always issue downward revisions later.

But by then, the market and low-attention span media have already absorbed and republished the official economic data.

Many now expect the Fed to cut rates because prior jobs numbers have been revealed to have grossly overestimated job creation. However, the inflation data has also been equally inaccurate. The labor market is much weaker, but inflation is also much stronger than the Fed claimed.

— Peter Schiff (@PeterSchiff) August 5, 2025

What happens when people buy cheaper substitutes because their usual foods have become unaffordable? The Consumer Price Index doesn’t account for these common, day-to-day economic realities. For example, If the price of steak goes up 30%, prompting families to switch to rice and beans, congratulations—the model assumes inflation hasn’t occurred, because now people are “spending less” on food by buying cheaper protein sources. The official inflation rate gets smoothed out with accounting tricks, even as savers watch their purchasing power slowly, steadily melt away.

But this rosy stat ignores those who’ve given up looking for work entirely. They disappear from the denominator. It also doesn’t care if you’re now making half as much in a gig job as you used to in a stable career. If you worked one hour last week, you count as “employed.” Then the government releases jaw-dropping downward revisions to its own data, reducing jobs numbers by 75 percent or more when the changes are announced.

None of this is accidental. Governments and central banks know that consumer and investor sentiment is as much a function of perception as it is of reality. If people believe the economy is doing well, they’ll spend more, invest more, and keep the wheels turning a little longer. That buys time for the next election cycle, Fed pivot, or bailout. But eventually, reality catches up. In the meantime, the Fed claims that its decisions are based on data, all while using a grossly distorted measuring stick to make economic decisions that ripple throughout the entire world.

Every month, we’re spoon-fed a new batch of statistics that say everything’s fine—just don’t look under the hood. As Peter Schiff recently said on X:

“It looks like the Trump administration will pause the monthly jobs reports until they can get the numbers right. That’s a convenient excuse to hide bad data. Soon they may do the same with the CPI. Who needs data anyway? Trump can just tell everyone that the economy is booming.”

Financial markets are increasingly divorced from the real economy. Tech stocks soar on the promise of AI-driven productivity miracles, while small businesses struggle to make payroll. Asset bubbles are inflated with cheap liquidity, while renters face double-digit price hikes and no path to ownership.

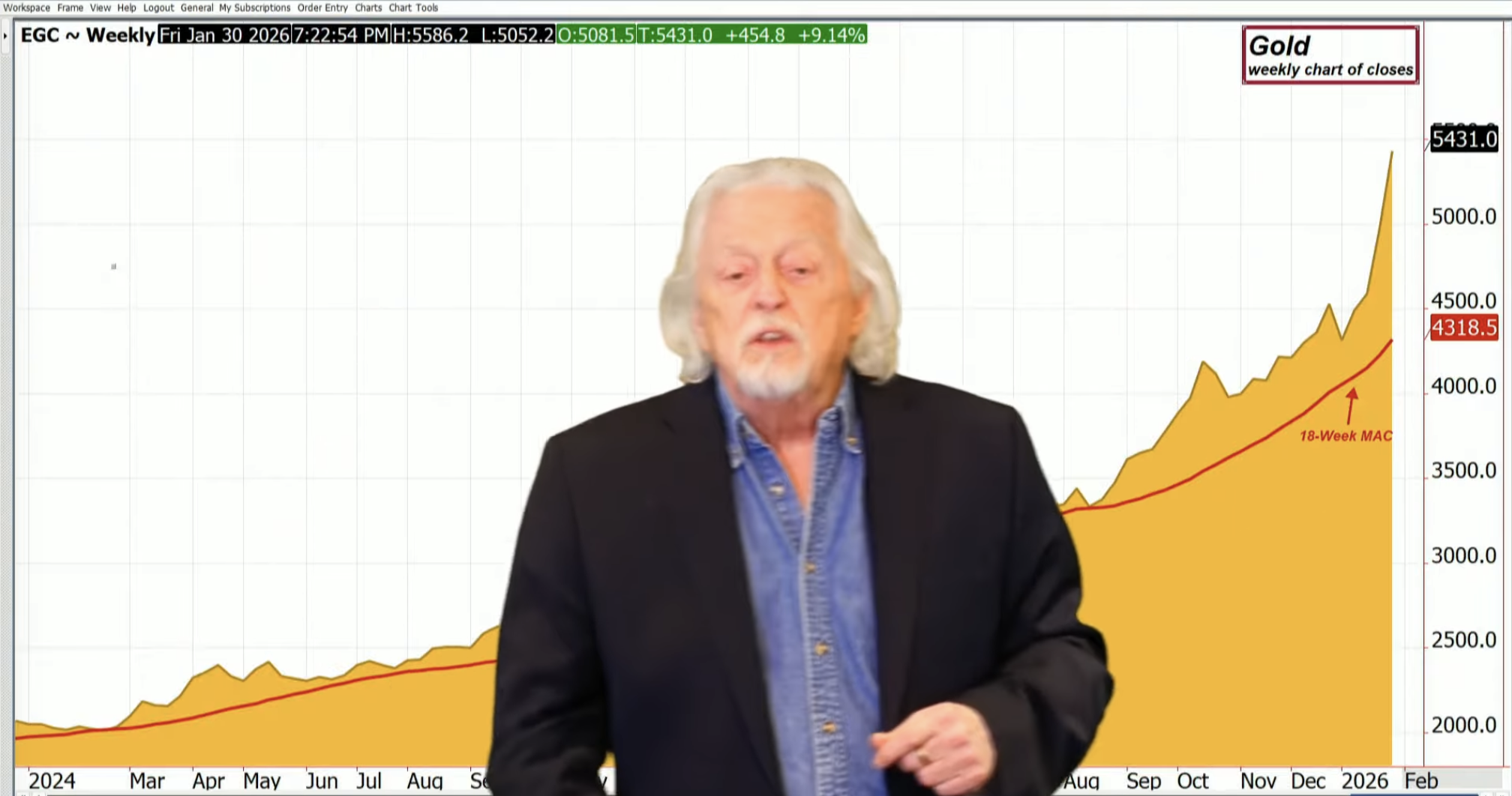

US M2 Money Supply, 2011 to Present

For Wall Street, this is a feature, not a bug. When monetary policy is geared toward asset holders and headline data is massaged to support endless stimulus, you arrive exactly where we are today: boom-bust cycles, endless dollar debasement, and an environment where American families are sacrificed at the altar of central banking.

But bad policy isn’t the only danger. Eventually, people will just stop trusting the data altogether. When every economic report becomes suspect, and when every revision conveniently serves the narrative of the day, faith in the system erodes. And when trust in official numbers collapses, so does the ability to govern effectively. You can’t run a country on spreadsheet gymnastics. Manufactured optimism can only take an economy so far.

Government reports come with assumptions baked in and inconvenient facts left out. When the people managing the economy are more concerned with appearances than reality, the nonsensicality of central planning only becomes even more absurd.

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Read the full article here

Leave a Reply