At the start of the year, the US zipped past $34-TRILLION in debt. In July, we zoomed past $35-TRILLION. And now, in even less time, we screamed past $36-TRILLION. The mileposts to financial doom are flying by so fast they are just a blur now, and the rate at which they are going by is rapidly accelerating.

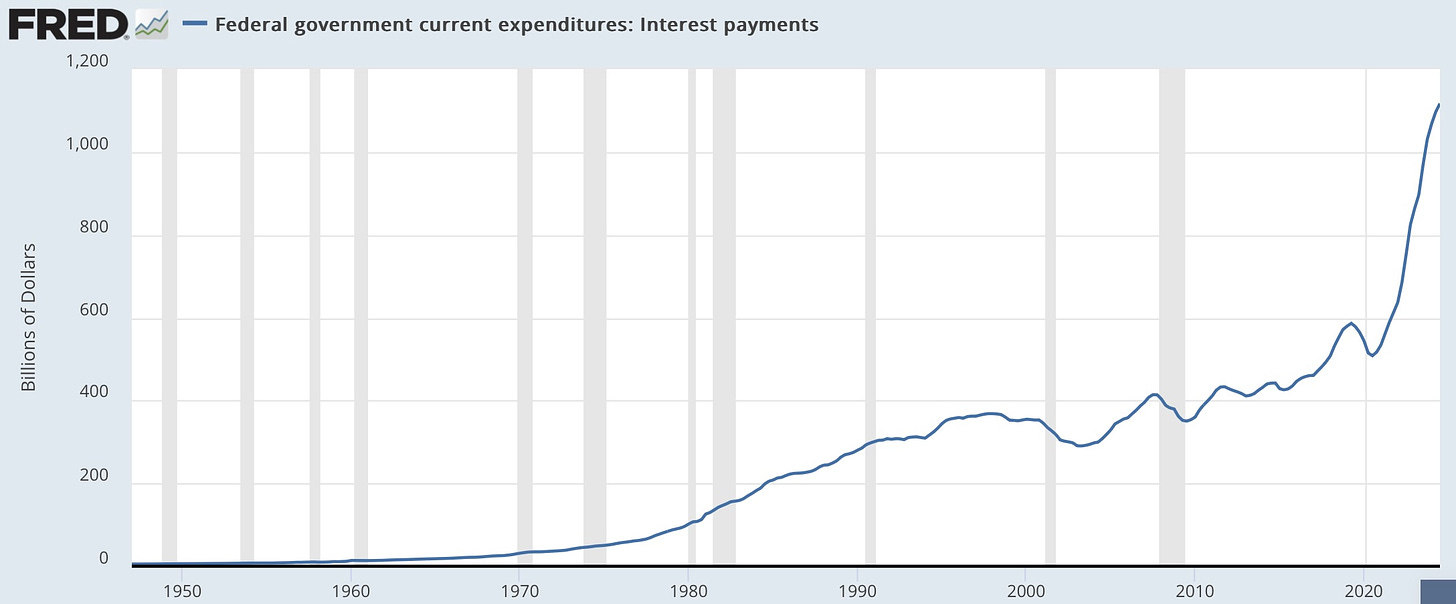

We HAVE to deal with it! It is utterly irresponsible if we wait any longer because we cannot even pay the interest anymore without taking out huge amounts of debt just to cover the interest payments. It’s insane.

You are entitled to your own money

No matter what ANYONE tells you, we can solve the entitlements problem, without any cuts in entitlements, and we can solve it easily. Not easily politically, but easily financially. You ARE morally entitled to the full Social Security benefit that was promised to you on the date when it was originally promised to be deliverable because it was your money in the first place, taken away from you by Democrats and Republicans for decades with the promise that it would be there if you became disabled or when you retire. The money was taken in trust. It IS yours. You ARE entitled to get YOUR money back.

The program is broke because, throughout its existence, the top 10% in this nation have only paid the same tax you do on a MINUSCULE portion of their earnings, while most of you, if you are middle class, pay on nearly the entirety of your earnings. The income of the rich has been shielded throughout the program. It’s time to solve the Social Security problem by simply insisting the rich pay a LITTLE closer to the amount you have to pay as a percentage of your income. Remove the cap that shields most of their income.

They still have a thousand ways to shield their income from being considered taxable, and their capital gains are not taxed until realized, making it possible to keep building those profits tax-free for years if they choose to remain invested in certain assets, such as property (or even stocks). Their forms of income have many benefits that the average person’s wage or salary does not have.

The cap protects only the wealthy and covers the lion’s share of their income. So, don’t let anyone tell you you are not entitled to YOUR money and that you should be the one to take it on the chin when the program has to be saved OR that you are socking it to the rich if you expect them to pay the tax on the same portion of their income as you do on yours. (In the very least, 100% of their salary. If necessary, on their income from capital gains, too, which merits NO special privileges.)

If you’ve long complained that the government was taking money from you for Social Security that you’d never see back, don’t let Republicans now be the ones who make sure that happens by trying to solve the problem on your back, taking major cuts out of YOUR money or pushing off your retirement date. Press them to solve it by making sure the wealthy now pay an equal proportion to what you have always paid. Make sure you get YOUR money back.

Republicans have only ever talked seriously about solving it the easy way—the way that protects their big campaign funders and their cronies and part of their own fat congressional salaries. They’re giving you a total snowjob when they tell you the only way to solve the Social Security problem is by assuring that the very thing they warned you about—that Social Security would never give you all your money back—is how this ends by their own doing.

If that is the way this is resolved, it will be Republicans fault that Social Security never gave you all your money back because there is a way to solve this by simply making taxes more EQUITABLE. We’re not talking about giving the rich a bigger hit than the rest. We’re talking no longer giving them privileged shielding of most of their income. You’re not socking it to the rich. You’re saying, “Why should the vast majority of your income be completely untaxable when it comes to Social Security, when almost none of mine is? Pay your equal share.” If there is any cap, it should only be on what they get back, as this is an insurance program; but pay as you go being what it is, that may no even be necessary, as the increase in cash flow would be immediate from all the rich, which the increase in those getting larger benefits due to larger contributions over time, would only happen as they retire.

That alone would not only save your retirement benefits from Social Security, it could assure you of a Social Security raise large enough to fully make up for all of REAL inflation that has never been properly accounted for—the main reason being that government has wanted to find every way to shave CPI down in order to keep Social Security paychecks down. (Just one more reason inflation hurts the poor and middle class more than the top 10%. See Peter Schiff’s article under “Inflation” below.) What inflation means is that the return of your money now comes with far less buying power than the money had when the government took it from you with a pledge to give it back because of the government’s dishonest accounting of CPI under both Republican and Democrat administrations for decades.

The same can be said for solving Medicare’s problem.

President Trump has entrusted problems like this to the wealthiest man in the world, Elon Musk, and another very wealthy man, Vivek Ramaswamy, to solve. Do you think they’re going to solve it by doing what I just described? I’m sure they are not going to suggest raising Social Security (FICA) taxes on themselves to save Social Security. Trump, however, has promised not to touch Social Security, though the neocons will likely press for that as it becomes essential to balance the budget. Don’t let him back away from his promise.

Who created this debt disaster?

Simply put, both parties are fully responsible for the mess. Trump added $8.4-TRILLION to the national debt during his term, so this is far from just a Biden deficit problem. Part of that additional debt was due to his tax cuts. A larger part was due to his mandatory business lockdowns under Covid with the huge economic catastrophe they created and the massive bailouts he created along with those lockdowns to protect businesses and individuals from the financial ruin the lockdowns would have caused. That all led us down the path to the massive inflation you get when you cut production of goods down and lock down large swaths of industry, creating huge shortages, while you protect, and in some cases increase, people’s income during those shortages. That set up the classic formula for inflation of too much money chasing too few goods.

This is just economic facts. It is not about one side versus the other; and Trump deserves absolutely no more shielding than Biden deserves for what he brought about. Biden continued that path and amplified it. Regardless, both parties have delivered this mess, but Trump set a path of higher deficits even before Covid.

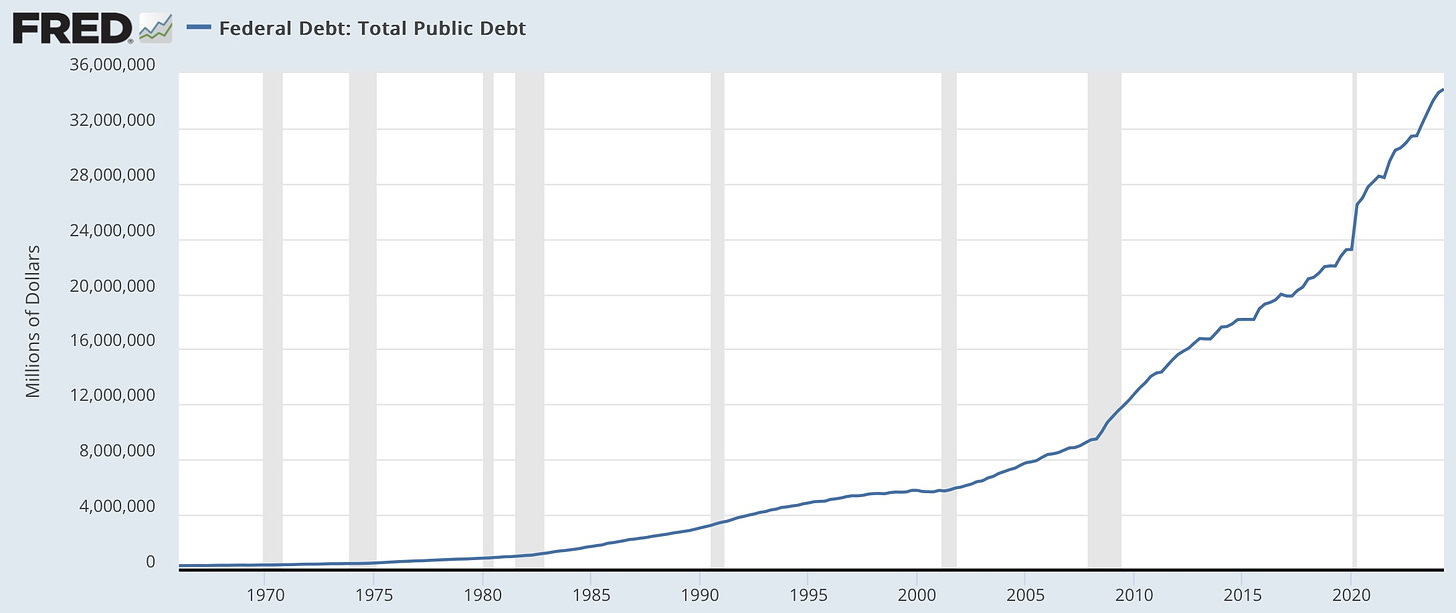

You can see in the following graph of the public national debt, that the debt ramped up under George Bush in response to the hugely catastrophic Great Recession we landed in after eight years of Bush, in spite of (and maybe partly because of) the Bush Tax Cuts that were supposed to improve the economy, not leave as “broke” as John Boehner rightly summarized:

Federal Reserve St. Louis

The national debt continued to climb up that ramp under Obama (with most of his first-year deficits being programs and funding approved during Bush’s final year). The government continued that steep climb under Trump, then skyrocketed in his final year during the Covidcrisis (with much of that explosion due to the huge business and paycheck bailout programs approved by Trump during his final year, helping secure his own businesses).

Trump’s current platform of additional tax cuts in his second term will only make this problem worse as the last tax cuts did not quite pay for themselves and did not leave us in a healthier economy after Trump’s approved Covid lockdowns brought economic ruin. Tax revenue came in significantly lower the year after (2018) the tax cuts (2017). Nominally, revenue rose during the FISCAL year 2018, coming in slightly higher, BUT it rose less than inflation, meaning real revenue was lower.

I’m focusing on Trump because he’s back, and Biden, who clearly ramped up the debt to an even steeper rate of ascent, is passing out of the way. Trump’s plan is to stimulate the economy with more tax cuts. Since we already cut and saw the quarterly deficit continue to rise and got very little for that deficit spending (only an increase in revenue sufficient to make up for PART of huge inflation, which was very low back when all of this started), we can expect even less stimulus effect from the next cut just due to the Law of Diminishing Returns.

How much bang for the bucks, and where does the buck stop?

Simply put, if cutting taxes could always be assured of raising revenue and never of reducing government revenue, then we should just lower all taxes to zero and have more revenue than ever. Obviously, that math doesn’t work, and the reason why is that the benefit of tax cuts follows a bell curve of diminishing returns. At one point along the curve, you see revenues rise. Travel further, and you get less and less revenue benefit. Further still, and you see revenue fall. All the way to end at a 100% tax cut, you see no revenue at all.

Given how the tax cuts did not quite pay for themselves last time around once soaring inflation gets factored in, you can be sure we’ll be falling down the steeper slope of those diminishing returns if we take the cuts even further, making the US debt that much worse at a time when we are already screaming past the mile markers. Republicans can be counted on to tell you otherwise so the rich can pocket as much money as possible while promising the rest a tiny cut, too.

One thing is abundantly clear about the last tax cuts: they fell far short of meeting the promises that were made for how much the economy would increase. (As opposed to the simpler promise that they would pay for themselves.) The promises were for an 18% increase in GDP. The projections were wrong: We got a 16% increase over all those years, and that’s why they didn’t even quite keep up with inflation, which came in at about 23% over all those years. Revenue should automatically rise with inflation because inflated prices mean inflated business revenues because that is where the prices are coming from—businesses. So, profits should rise by inflation, too, since businesses are creating the inflation in prices as they pass along their own inflated costs and typically mark those costs up. The Trump Tax Cuts failed to keep up with inflation.

Republicans will now start telling you that new tax cuts will pay for themselves, too. It is their mantra. You can expect it. All tax cuts will always pay for themselves in the Republican promise book. That last ones, however, did not quite pay for themselves. They almost did, but the next ones can certainly be expected to do even less. No one gets to pretend the Law of Diminishing Returns doesn’t exist. (Well, they can, but it exists regardless, and punishes their foolishness if they do).

Revenues went up after 2020, though economists say revenues are not up as much as was expected in the absence of the TCJA when taking inflation into account. And the government’s nonpartisan Congressional Budget Office has said the tax law is contributing to rising national debt, and would add hundreds of billions to the nation’s debt if all the individual income tax provisions set to expire at the end of 2025 are extended. (Factcheck)

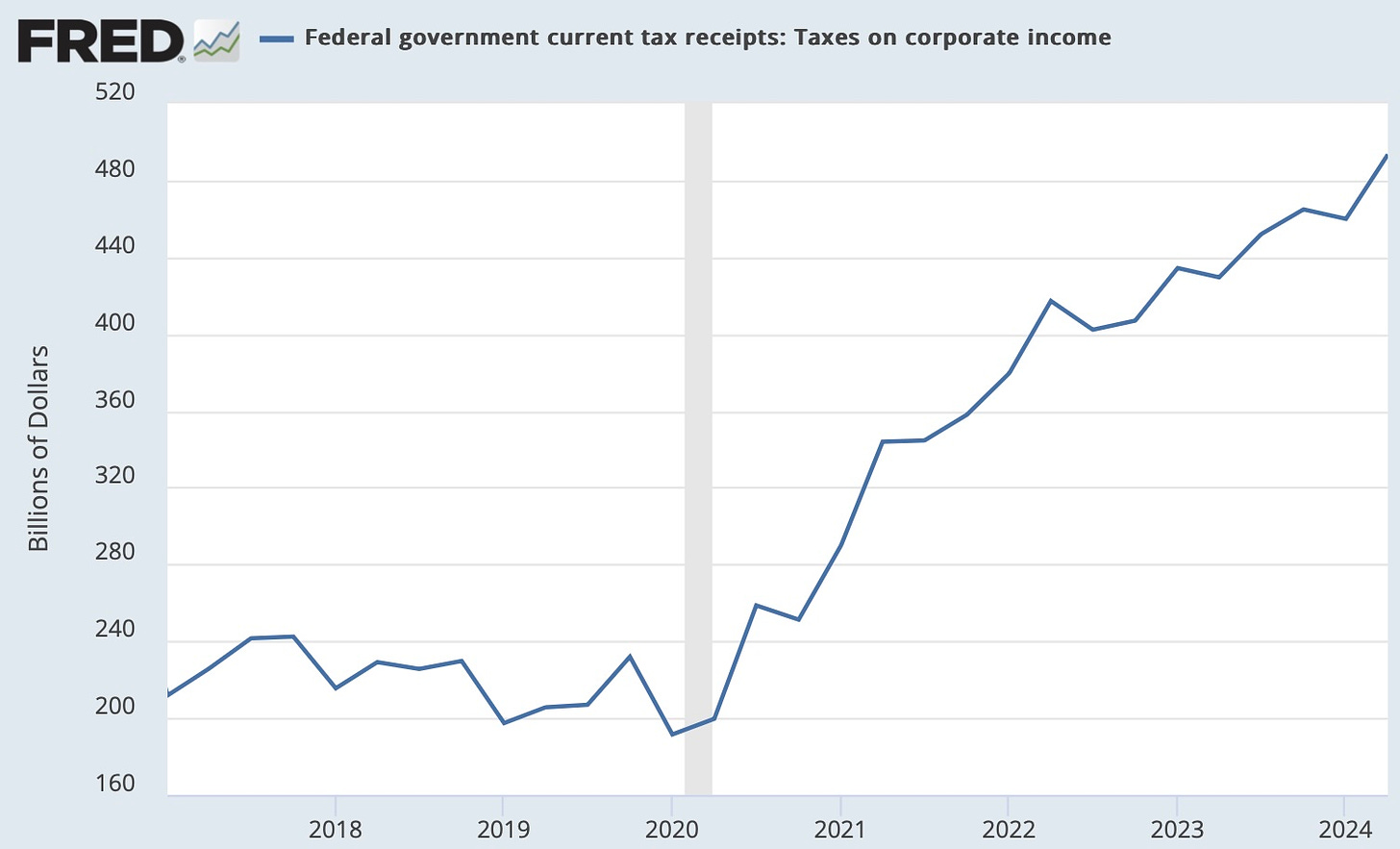

When you see a graph of how much corporate tax revenues soared after Trump’s corporate tax cuts, it looks impressive. Remember, however, that inflation soared during those same quarters, and remember that Congress also pumped TRILLIONS of additional free dollars into the economy during those quarters, aimed straight into the coffers of businesses and individuals. That was all financed. So, of course, the economy grew and revenues rose. It is amazing what a party you can throw when no one is paying for it!

Congress dumped trillions of dollars into the economy in so-called COVID recovery, and that really helped corporate profits, and therefore, corporate tax revenue for the US Treasury. The question is not whether we did better or worse afterwards, but rather, how much the TCJA actually cost us. And, the answer is it likely cost us a lot. In other words, that sharply pointing up graph would have been even steeper. Some estimates are that the TCJA decreased corporate tax revenue by something like 40%.

You cannot throw trillions of dollars into the economy and not get some stimulus out of it; but did we get enough stimulus during those Biden years to make it worth the vast fortune in debt we were (and still are) piling on to get it? It is not the Trump tax cuts driving that graph up. It’s a trillion dollars of debt being added now on the average of every half year. It happened on steroids under Trump in his final year and under Biden on a double dose of steroids.

Look out for yourself

What we do need is MAJOR expense cuts, but they need to be in ways that won’t damage the economy or hurt those on the bottom the most and that won’t take away more of YOUR money, which is what happens if they balance Social Security on the backs of the middle class. It IS your money. You were promised you’d get it back. Make sure you do. Make sure they know they cannot touch that easy money (easy for them in that it is already being collected) to balance the budget on your back. They’ve tapped into it enough over the years. The increase in tax revenue due to lower taxes is not even beginning to cover the increase in debt, so this government has become an increasingly poor return on investment.

Both the benefits of the tax cuts to revenue and the benefits of Biden’s Jobs Act are reflected in the graph’s rise, but sharp as the rise is, it is less than the cost for obtaining it:

Marc Goldwein, senior vice president and senior policy director of the Committee for a Responsible Federal Budget, a nonpartisan group that seeks lower deficits, says the evidence is clear: “The Tax Cuts and Jobs Act reduced revenue. It’s irrefutable. … It definitely increased the deficits.”

As you can see in the last graph, corporate tax revenues from the Trump Tax Cuts and the Jobs Act rose about $250-billion per quarter since the cuts began, but government debt under Trump and Biden, in response to the Covidcrisis, is rising at a rate of about $450-billion per quarter ($1.8-Trillion for fiscal year 2024.) Add in all other tax receipts resulting from the goverment’s massive spending, and the revenue side of picture looks like this

St. Louis Fed

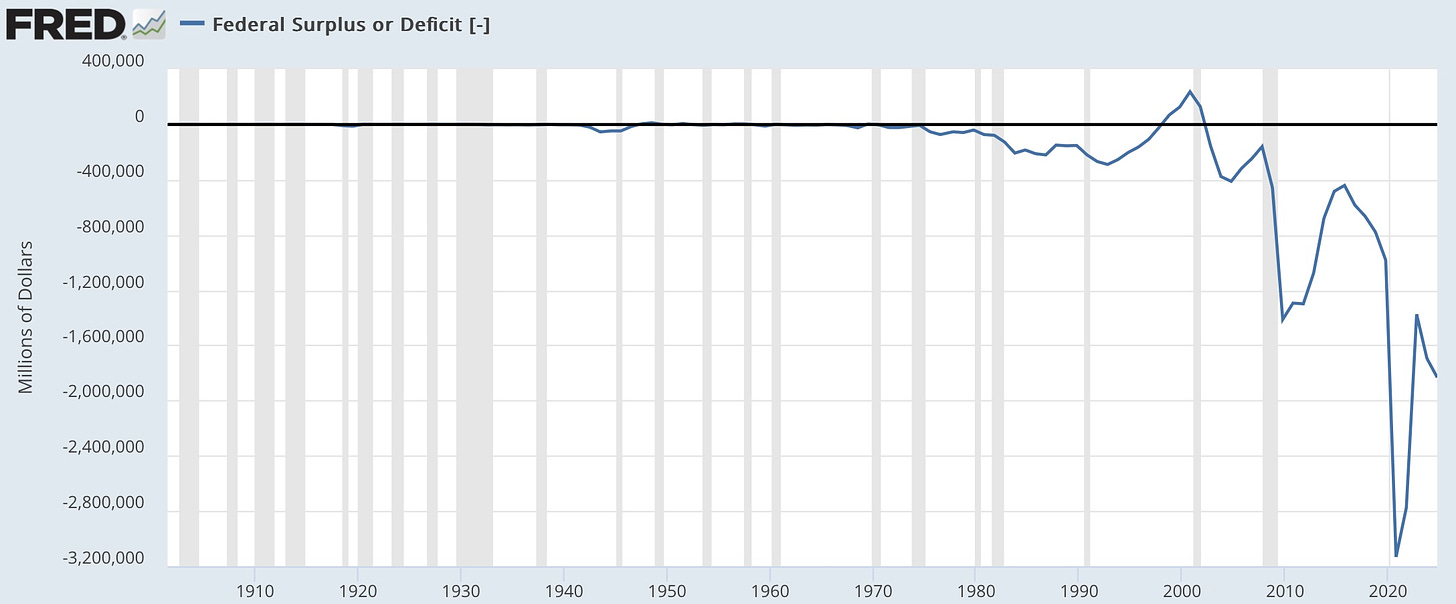

However, government spending has gone up so much that the deficit it is leaving after all that tax revenue growth (the part of spending that has to be financed) looks like this:

Federal Reserve St. Louis

That is a steep hole.

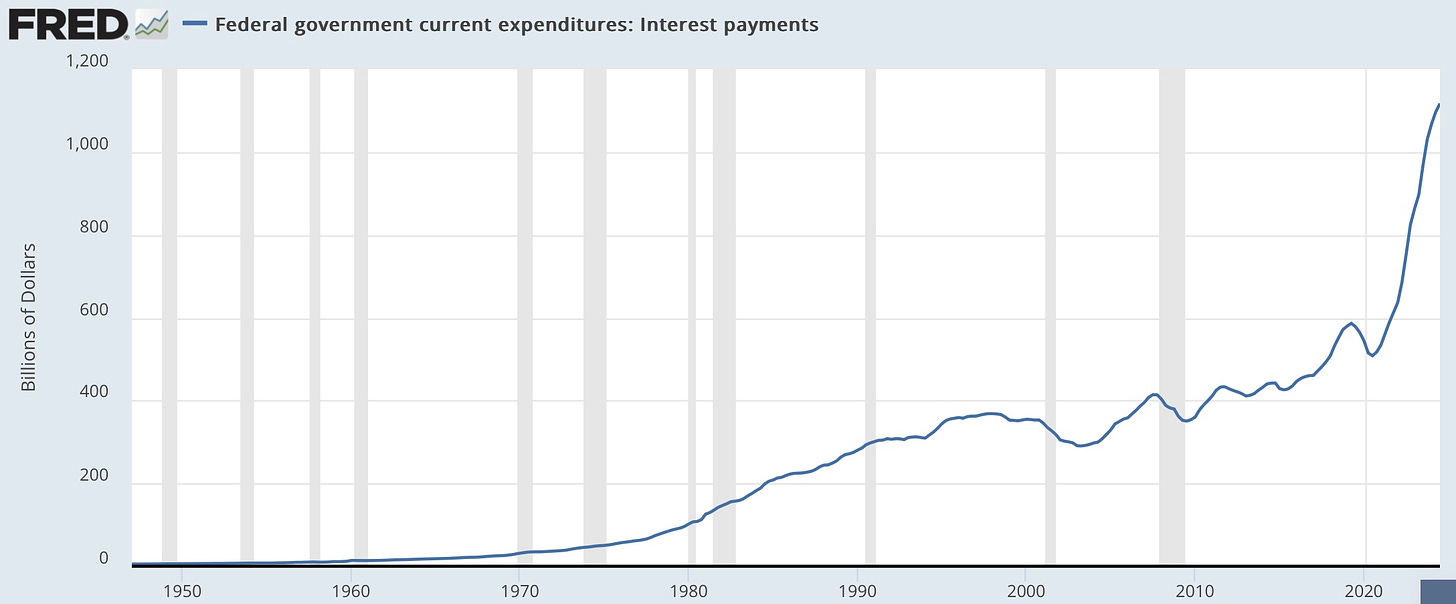

Comparing just the deficits for any given year, the deficit in Biden’s last full fiscal year was $1.8-trillion. In Trump’s last full fiscal year, it was nearly $1-trillion with a good part of Biden’s first year of $3-trillion approved during Trump’s partial final fiscal year that continued into Biden’s partial fiscal year. (Because Presidencies start with calendar years roughly, not fiscal years.) Of course, that huge annual deficit barely covers interest on the debt:

St. Louis Fed

No matter how you cut and stack it, this is all disastrous.

New tax cuts will never pay for themselves. Don’t buy a promise that has already minimally failed, thinking more of the same will do better. It will do worse. Social Security is already yours in that it came from you. Agreeing to receive less is agreeing to turn Social Security into a new permanent tax on you by not ever getting your money returned as promised. It’s a gift to the government to cover their malfeasance.

Read the full article here