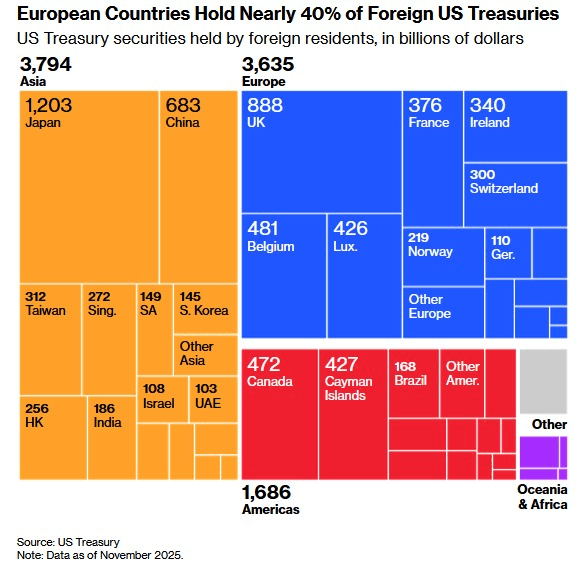

Two predictable outcomes of tariffs and tantrums are now moving full speed. One is the collapse of the dollar, which I’ve warned would be a disastrous outcome of the Trump Tariffs. Having fallen all year under the new tariff regime, it has, in the past week, fallen off a cliff.

One of our stories presents a chart of the dollar’s recent rapid crash and says the chart has taken the internet by storm.

A new chart showing the U.S. dollar’s crashing value has sparked concern online, reflecting widespread economic uncertainty across the country….

The chart, released on X on Sunday by market data outlet Barchart, has sparked widespread online discussion. It shows the U.S. dollar’s value from January 20 to January 25, with the index falling from around 99.10 to 97.14.

Popular X account TheMainMan neWonk wrote about the chart: “Watching the dollar die in real time. Gee, whose policies of the last year are to blame for this?”

Florida Governor Ron DeSantis also posted about the U.S. dollar chart and its declining value, writing, “Ouch.”

“It’s an incredibly worrying trend. The dollar’s rapid decline translates to less buying power for Americans,” Alex Beene, a financial literacy instructor for the University of Tennessee at Martin, told Newsweek. “Even more troubling are the long-term consequences if other countries start to view the dollar as an unstable currency.”

That could be the accelerant. I wrote about this urgent situation yesterday, and it appears that the dollar’s fall has not been fully arrested by the Treasury’s reassuring talk.

The cause is the trump tariffs with the Chinese yen recently giving an added push:

“Recent policies such as extremely high tariffs, increased government debt, and worries about inflation have all contributed to the falling dollar.”

The rapid expansion of the debt under Big Bloated Bill is, of course, a problem for US Treasuries (dollars), too. The inflation, however, is primarily coming at this point from the tariffs; but, yes, inflation drives bond yields up (prices down); so, it is one channel by which tariffs are taking down the dollar.

The other factor, which I’ve also pointed out, is that central banks don’t need many Treasuries when trade is collapsing.

Right now, a tariff-weakened dollar is getting beaten around the ring with blows from all sides.

Recently, major news was delivered about the sweeping collapse of trade with the US, due to tariffs and turf wars, which is really delivering the dollar several major blows, as changes that now look permanent are being agreed upon all over the world.

Not surprising, all of this also has consumer confidence in America suddenly parachuting down to its lowest level since 2014. Note that even goes beneath the levels of drastically undermined confidence during the lockdowns of the Covidcrisis.

The confidence level has been in its recession zone all year. Now it has landed in the ruins of a burned-out basement. Unsurprisingly, real inflation, tariffs, and trade were high on everyone’s minds.

(The rest of this editorial continues for paying subscribers below the following headlines. I will lay out how serious the economic damage done to America via trade destruction has rapidly become and how it all has China basking in newfound popularity and growing wealth …)

Read the full article here

Leave a Reply