Since Tuesday afternoon, the dollar has been trading below par with the other currencies that compete against it as global trade currencies. It’s been three years since the dollar reached down to this level. While that is far from earth-shattering, the cause is unique—never seen over all the decades the dollar has served as a global currency. It has fallen, as I wrote earlier this week due to flight of major capital from US Treasuries, and that is now the talk of Wall Street.

Suddenly financial news is full of articles asking if this is the death of the dollar, as I warned back at the start of the year we might see later this year due to tariffs, having never been a “dollar collapse” guy in any of my previous years of writing about economics, even when I was working as the editor of Dollar Collapse, founded by John Rubino. (That post I took on because I do believe in the site’s general tenets that the US has been relentlessly moving toward a state of deep economic failure.)

According to reports today, deep tremors felt through the world of finance last week warned even the US Secretary of the Treasury of a possible chain-reaction of troubles forming beneath the dollar that he is supposed to safeguard to where he became the reason for President Trump’s latest retreat from his high tariffs. Digging beneath those reports, I want to explore to what extent he and others in the White House might actually be behind it all!

Is there a conspiracy to take down the dollar right now

As the world’s stomach turned with indigestion over US Treasuries, Zero Hedge asked an inane question in pandering to its largely pro-Trump and pro-Russian audience: If CEO’s truly believe Trump Tariffs are taking us into a depression, why aren’t they firing people left and right? They leaned into the notion that the tariffs cannot be causing harm that runs that deep, having argued that the tariffs will not even be inflationary.

While the ‘Deep TriState’ is starting to see some jobs lost, the rest of the nation continues to show absolutely no signs at all of this imminent recession that CEOs and talking heads keep proclaiming is right around the corner….

Are these CEOs simply asleep at the wheel – if you were the most terrified since Lehman… wouldn’t you be firing people?

Seriously? “Absolutely no signs at all” of a recession? That comes from Zero Hedge, which has thrived for years on showing how the US is imminently sinking into a recession all the time?

Let me initiate my response of disbelief in their feigned befuddlement by giving such an obvious answer to their question that you will know they must have already been aware of the reason CEOs would hold off on firing even if they feared a deep recession before ZH even asked the question:

If you were a CEO with thousands of skilled employees, many of whom had worked faithfully for your company for years, and you had to deal with a US president who imposes severe tariffs that will drastically damage your company and who, then, removes them later the same day and you saw him do this three times, would you fire a major part of your workforce before you’ve even seen a significant decline in orders or a decline in your ability to get parts/resources to fulfill the orders you do have?

Of course not. You would wait to see if these on-and-off tariffs are even going to last for another month. Even a zombie corporation can weather that much time! You wouldn’t risk the possibility that Trump ends all of his wishy-washy tariffs a month from now by claiming he got great deals (whether he does or does not get such deals). You would never put yourself in a position where you might have to face your board members to explain how Trump head-faked you into making a huge decision that left the company without a sufficient workforce because you sent many workers packing.

That is what makes the president’s constant vacillating on his own tariffs so hard to navigate as a business. CEOs right now have no idea how they should adjust their business because Trump is red hot for tariffs one day and retracting them the next. As his Press Secretary says, that’s “the art of the deal.” Unfortunately, having a US president who wheels and deals and cavorts with the entire global economy—if you’re a CEO with a business to plan—is like waking up each morning and getting hit in the face with a hammer.

So, naturally, CEOs are going to wait with some trepidation until they are clearly seeing the tariffs hold and orders slide before they start wildly firing people who will be hard to replace with a bunch of neophytes. No one wants to wind up a fool for getting head-faked right out of business. And that isn’t even to mention the risk of law suits, which you may see (even from your own shareholders, but especially your employees) if you senselessly fire people when business is still chugging along, and you cannot demonstrate any immediate need, outside of fears guided by major daily contradictory US policy changes and reversals. Why rush to fire good workers before the tariffs even have time to start tearing business down? Firing can happen overnight (as we’ve seen with DOGE), but hiring takes a lot of time.

This is why the biggest complaint among CEOs, as I’ve reported for a couple of weeks here, is that Trumpian chaos leaves them unable to make any plans.

Having asked a question they surely must know the real answer to, while saying there is no recession or depression in sight from the Trump Tariffs, ZH then runs an article saying that we have already sunk into stagflation (which is a very bad type of recession):

Another day, another sentiment survey collapsing into the abyss of Trump-Tariff-driven hell…

The Philly Fed Manufacturing Business Outlook survey crashed from +12.5 to -26.4 in April … its weakest in two years.…

The index for new orders also fell sharply, from 8.7 in March to -34.2 this month, its lowest reading since April 2020, and the prices paid index edged up from 48.3 to 51.0, its highest reading since July 2022.

Smells a little stagflationary to us.

The future prices paid index climbed to 63.1, and the future prices received index jumped 28 points to 67.7, its highest reading since June 2021.

That’s a lot of inflation in future prices PAID and received. How do you make sense of ZH’s contradiction? It sounds like they just answered their own question by admitting we are falling into a “tariff hell” that is already deeply recessionary AND inflationary at the same time!

Moreover, it was ZH who frequently ridiculed Fed Chair Jerome Powell for saying back when Biden was still president that he saw neither the “stag” or the “flation” of stagflation. Was the economy that ZH was certain was sinking into stagflation back then suddenly and miraculously healed as soon as Trump became president?

While I have often used ZH’s articles over the years because they are willing to publish insights about the problems in the US economy that many will not publish, it has appeared to me for a long time that they publish all of that because they have a zeal to destabilize the already unstable US and help bring it down.

The site, after all, is owned by a Bulgarian man, whose Bulgarian father worked as a writer/publisher of pro-Soviet disinformation during Bulgaria’s dark USSR days. Disinformation back when Putin was the Soviet head of Eastern European disinformation (which certainly included Bulgaria) has long worked via destabilization. That often means playing the problems in a nation both ways so that the populace feels nauseatingly disoriented. Trump and his destabilizing tariffs are perfect for that kind of play.

Are the Trump Tariffs destabilizing the US as well as the “new world order?”

Just look at a lot of other news all week, including today filing the headlines below, about breakage in the US bond market that undergirds the US economy and government as well as the global economy. The foundation of US finance never wobbled and looked more unstable than it did this month. And that, I suggested as soon as Trump performed his last flip-flop, must have been the reason for his reversal. Now, the news is climbing all over that, and Trump, himself, said he flipped because people were getting “a little bit yippy, a little bit afraid.” That was gross understatement for “all hell was breaking loose among my financial advisors because of what was happening in the Treasury market.”

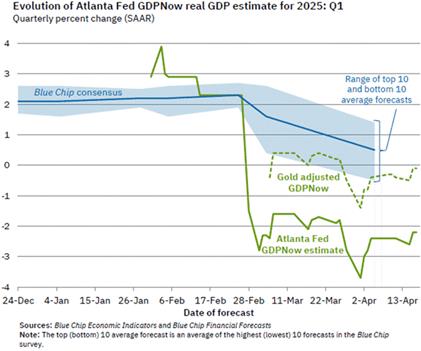

And, so, the Dow tumbled over 500 points again today after Jerome Powell dared say yesterday that the Trump Tariffs were more extreme than the Fed (or likely anyone) had expected and are likely to create persistent inflation as well as economic stagnation (finally admitting to the “stagflation” he said a few months ago he could see no signs of).

That screams the worst kind of “recession” to me and confirms everything I’ve said about inflation rising again and putting the Fed in a bind, which Powell admitted in his Chicago talk this week is going to be tricky to navigate. Powell’s critical comment about the inflation and recession that are likely to come from Trump’s tariffs set the president on fire again against Powell, whom he said now couldn’t get terminated fast enough.

There was already plenty that was unstable in the US and that is being made far more unstable under the current chaos, and I write all about that, so I’m not against ZH for showing the bad in the US, but to say, right when things are falling apart everywhere, “where’s this recession they’re talking about,” that’s nuts by their own standards, if they have any! Or it’s just an attempt to sow confusion, so let me try to offer clarity.

I never write with the goal of destabilizing the US more than it already is (as if I even have that level of persuasive power). I write with a wish of helping people understand the bad that is happening and helping them realize they need to prepare for it and maybe changing a few individual minds about what they want to support, but not with any hope of changing influential political minds. Zero Hedge, I think, exists simply to destabilize by prying at the cracks in the US and adding confusion in the old Putin Soviet style.

Suddenly, the dollar’s collapse is a concern that is all over the news as are the cracks that suddenly showed up in what was long regarded as the safest haven in the world—US Treasuries. There are several stories below about the tremors felt ripping through bond world that turned Trump around on his severest tariffs, but the remaining tariffs are still significant enough (and are absolute in China) to where they will keep working the cracks apart that have appeared in bond world.

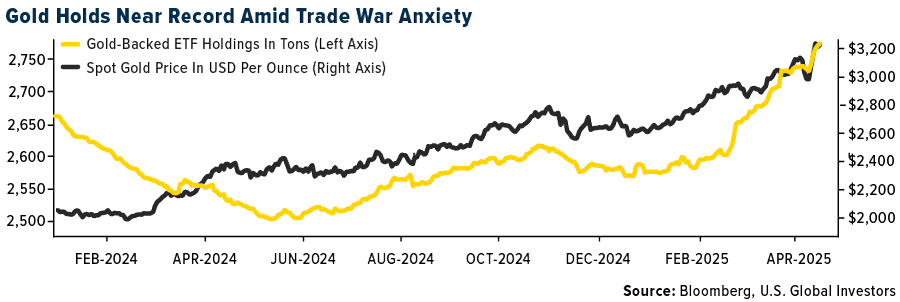

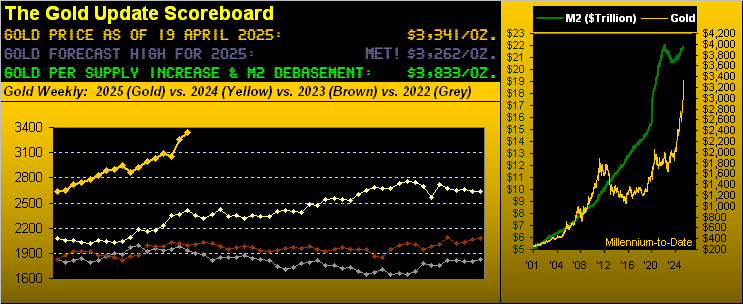

When the global dollar collapses, gold rises, and it has never risen as astronomically as it has been doing recently, and that’s all over the news today, too. Gold isn’t so much rising, as the dollar it is measure by is falling. Gold is the best measure of the dollars decline since it is usually valued in dollars.

Dollar collapse conspiracy?

This all raised a couple of big questions in my own mind two nights ago as I went to bed. Is the US Treasury Secretary just playing Trump in order to intentionally crash the global dollar? While I generally don’t lean into conspiracy theories, much less risk creating any, I couldn’t shake a couple of thoughts the other night:

One of those was that it seemed impossible to believe Scott Bessent and the many smart people who are working with him wouldn’t be able to seen in advance that trashing global trade with high tariffs would have to deeply wound the global trade currency by taking away the “trade” that is the essence of its classification as a “trade currency.” You cannot kill the trade and not kill the currency when its global status is entirely built from all of that trade, which started by anchoring the US currency as the petrodollar for all oil trade in the world, which rapidly graduated to using the dollar for nearly all trade.

The second thought that gripped me was that it is equally hard to believe they would not know that such massive curbs on global trade would cause a deep worldwide recession (likely on the order of the Great Depression) and a return to high inflation. They surely had to have, in the very least, learned that would happen after Trump’s brief lockdowns in 2020 caused huge financial wreckage, including the sudden recession we saw during Covid. Is Bessent and his team so dense they can’t figure that out, or is he lying through his smarmy smile to swindle Amerika?

I struggle to believe that someone who made billions in the world of finance would not realize high global tariffs will assault the dollar by clobbering the very trade that gives the currency its reason to exist as the global trade currency. That barely requires more than 2+2=4 logic.

Now, to his possible credit, one of the stories below claimed Bessent threatened to resign if Trump did not revoke his harshest tariffs once Bessent saw how immediate and wide the damage to US bond trading suddenly erupted, but I don’t know if that claim about his reaction is true. Even if he did express such alarm to Trump, that could also have been a show for cover intended for all who heard him.

I say that because another much darker thought about what little I know of Bessent haunted my mind and begs for more research, so I’ve decided to dig down into that as well and pull in the strange currency-planning meeting that happened around this same time at Mar-a-Lago for some light weekend reading—mine and yours if you’re a supporter. But I don’t want to lay it out without more investigation.

Are these billionaires just strip-mining the United States of America to reap trillions by taking the opposite side of the bet they claim they are making for America via their tariffs—doing whatever it takes behind the scenes to bet against America? There are actually some compelling reasons to believe Bessent would and could do that, which I will lay out—the reasons that haunted my mind about this a couple of nights ago and still do. So, I want to dig deeper into them.

Is Trump also ignorant of the likely damage to the dollar from trade-freezing tariffs, and is he being played -or- is he the biggest player in the whole scheme? I’m more inclined to think charitably about Trump, believe it or not, than I am about Bessent, so I lean into Trump’s just being an ignorant orange in this scheme … if a scheme exists.

Russia has longed to see the dollar crash and has tried to preserve a cozy relationship with Trump. (Some said Russia tried to use Trump a few years ago, but we all know how far short his accusers fell of proving complicity with Russia after a deep and exhaustive investigation by the deep state that wanted to take him down.) Putin, regardless, is bound to be thrilled with the destabilization of the dollar he got to witness this month. It’s possible Trump may not have been able to foresee how trashing trade would trash the trade dollar, but how could someone qualified to be the freakin’ Treasury Secretary overseeing the US dollar not have seen that coming???

I’ll dig into Bessent and lay out other potent evidence beyond Bessent of a conspiracy inside the Trump White House to crash the dollar in the Deeper Dive I’ll start putting together for paying subscribers tomorrow.

Source: https://www.thedailydoom.com/p/the-great-dollar-debacle

Read the full article here

Leave a Reply