For the past several months, I’ve been theorizing and writing about the compelling idea that another major gold surge would be driven by Chinese futures traders coming out of dormancy to propel gold to $3,000 an ounce and beyond. And remarkably, it now appears that this is exactly what’s unfolding. In this piece, I’ll walk you through the background of this fascinating and unfolding theory—along with the evidence that it’s playing out in real time.

To provide some context, the powerful $1,200 gold bull market of the past year began in the spring of 2024, driven largely by aggressive Chinese futures traders on the Shanghai Futures Exchange (SHFE), while Western investors largely stayed on the sidelines. In just six weeks between March and April, these traders propelled gold prices upward by $400—or 23%—an extraordinary surge. While their activity quieted for a while, I’ve been anticipating their return, expecting them to drive gold to staggering levels—well beyond $3,000 an ounce.

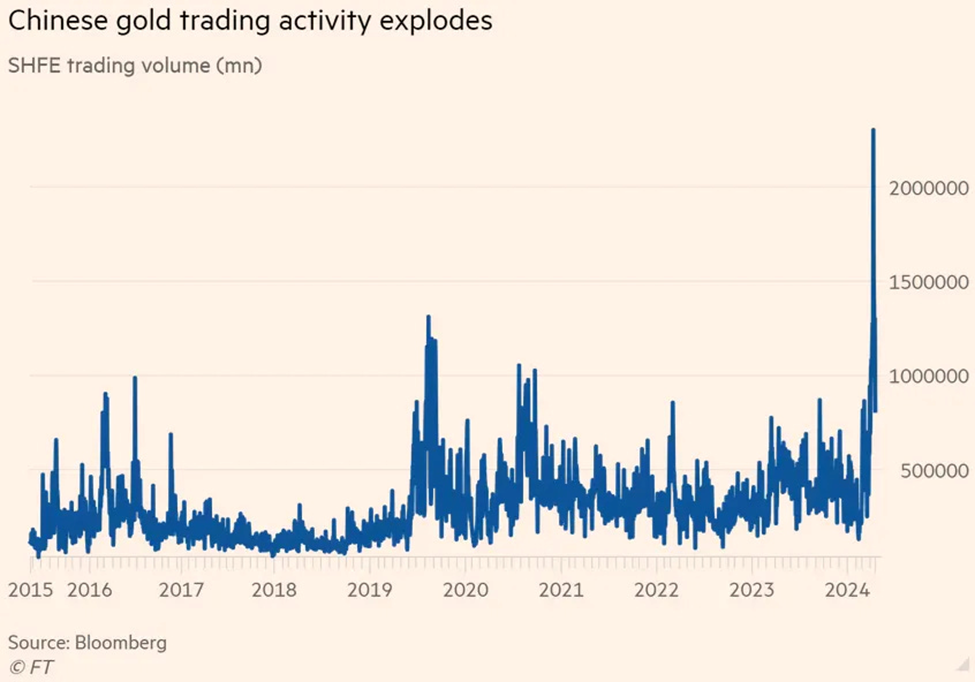

As this chart illustrates, the Shanghai Futures Exchange gold futures were the primary vehicle behind the spring 2024 gold frenzy, a surge that subsequently spilled over into international gold prices:

A fascinating Financial Times article from that time titled “Chinese Speculators Super-Charge Gold Rally” highlighted how trading volume in SHFE gold futures had surged by 400%, propelling gold prices to record highs:

The spring Chinese gold trading frenzy can also be seen in the chart of long open interest in SHFE gold futures:

Now let’s take a look at the current chart of SHFE gold futures, which shows that while gold has been steadily climbing, the move had been relatively orderly and accompanied by subdued volume—until recently. Over the past couple of weeks, however, the tone of the market has shifted dramatically: gold is beginning to rise in a more aggressive, parabolic fashion, and trading volume has surged. To me, this marks a clear confirmation that the long-anticipated Chinese gold mania has arrived—and it’s likely to drive gold to levels that will shock most observers.

A look at the spot price of gold per ounce in Chinese yuan confirms the trend seen in SHFE gold futures—showing that the rally has recently entered a sharply accelerating phase, which is typically a sign of rising public awareness and participation:

Further confirmation that a Chinese gold mania is now underway—and likely just getting started—is the return of a domestic price premium in mainland China. After falling into discount territory in the second half of 2024, the local gold price is once again trading above the international spot price, signaling renewed bullish sentiment and growing fervor among Chinese investors and traders.

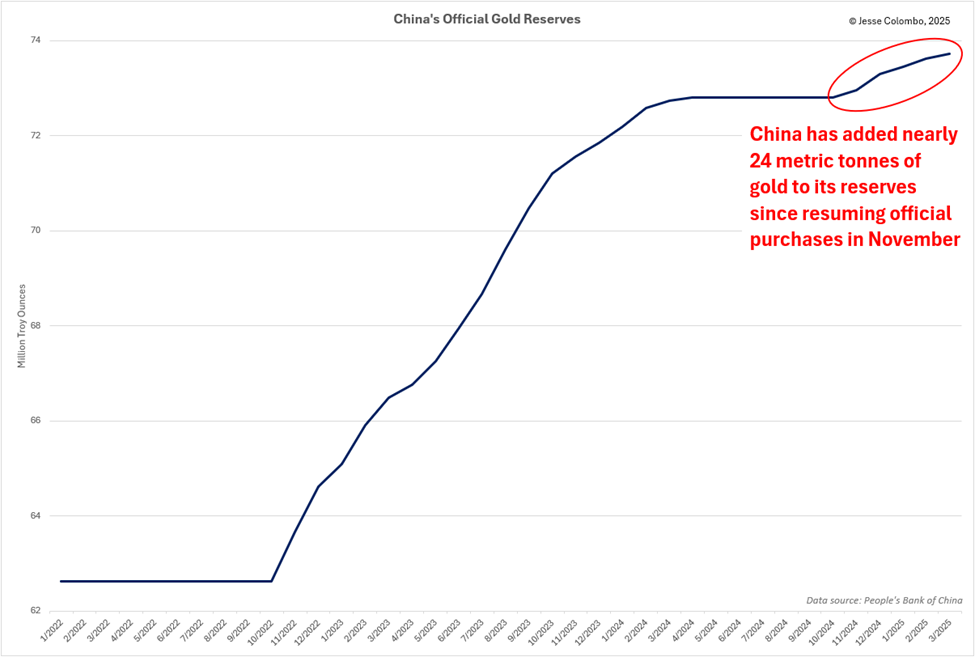

Another strong sign that the Chinese gold mania is underway—and is likely being encouraged by the government—is the resumption of official gold purchases by China’s central bank, the People’s Bank of China (PBOC). After a six-month pause, the PBOC resumed buying in November and has since accumulated nearly 24 metric tonnes of gold.

There’s little reason to believe this trend will end anytime soon. It’s also worth noting that China likely continued acquiring gold through unofficial channels during the pause—but the decision to resume public reporting signals an intent to telegraph that buying to both its citizens and the world, likely for strategic reasons.

Adding further fuel to the Chinese gold mania is a major policy shift in February, when the Chinese government began allowing insurance companies to invest in gold for the first time. This opens the door to potentially billions of dollars in new demand, serving as yet another catalyst for gold’s record-breaking rally.

It’s part of a broader trend in which the Chinese government is actively encouraging all segments of society—from the central bank to corporations and individual citizens—to accumulate gold as a way to fortify the nation against the growing risks posed by fiat currencies and increasingly vulnerable sovereign debt around the world.

The Chinese people have long held a deep cultural affinity for gold, trusting it as a reliable store of value. This behavior has only intensified in recent years amid severe economic turmoil. A sharp downturn in China’s real estate and stock markets has wiped out an estimated $18 trillion in household wealth—an economic crisis that is essentially China’s version of the 2008 Great Recession.

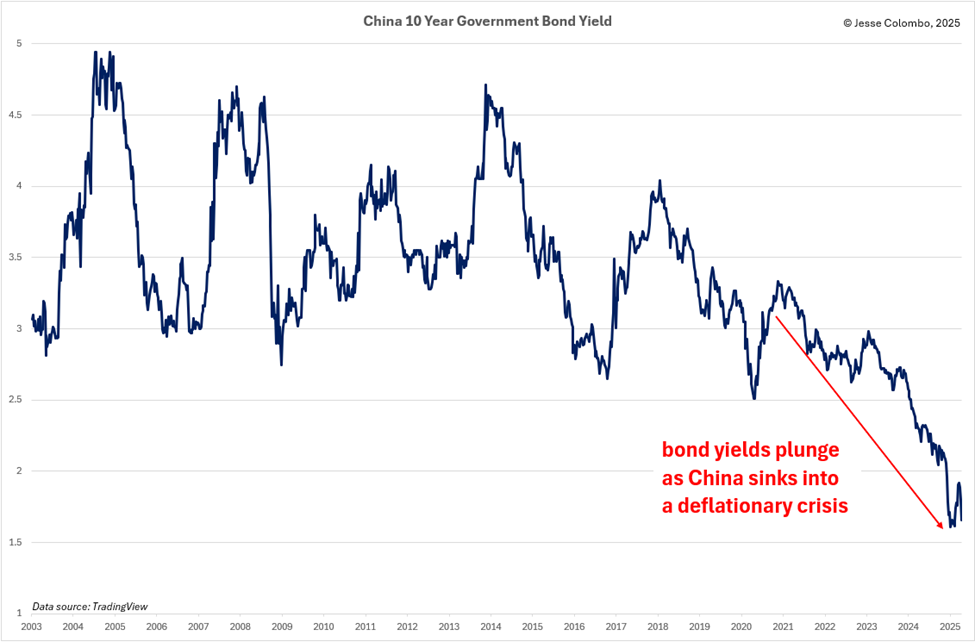

Meanwhile, government bond yields have collapsed to record lows, signaling a deepening deflationary spiral. In low-interest-rate environments like China’s, gold— which generates no yield—becomes more attractive as the opportunity cost of holding it diminishes. Additionally, China is likely to respond with a massive stimulus “bazooka” to combat deflation, which should provide a powerful tailwind for gold, silver, and other commodities.

Another likely reason why gold has entered a parabolic phase in the past week is an unusual and troubling development: U.S. Treasury bonds and notes—normally considered safe-haven assets that rise during market corrections—have been falling alongside stocks. There are several theories for this breakdown, including the possibility that China and other major holders of U.S. government debt are dumping Treasuries in retaliation against the Trump administration’s aggressive tariffs.

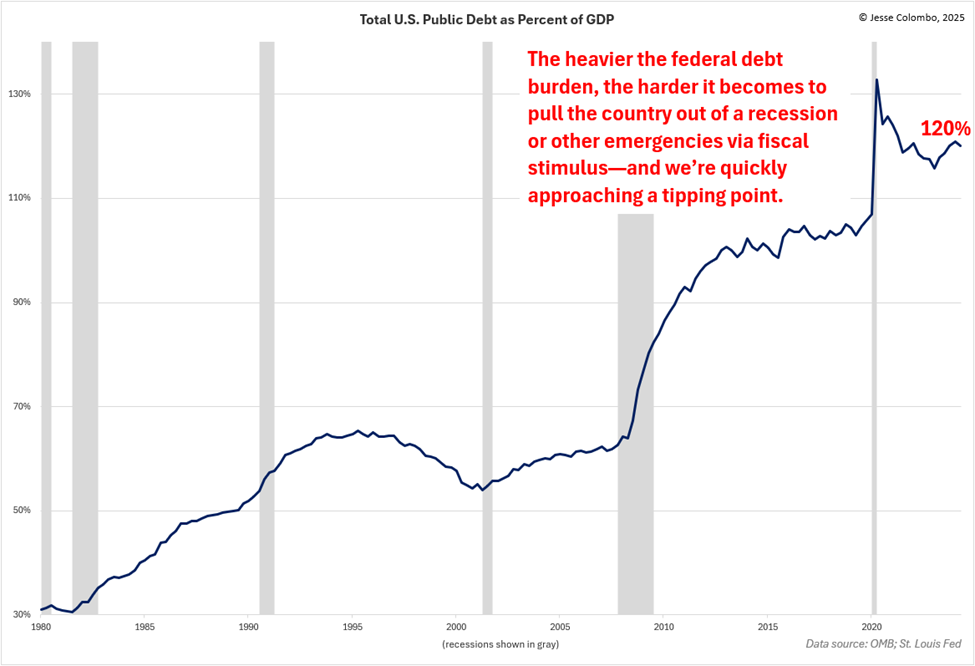

With the safe-haven status of Treasuries increasingly in doubt, gold is looking far more attractive by comparison—helping to drive a surge in investor demand. In my view, this rotation into gold is a far wiser move than investing in the debt of the dangerously overleveraged U.S. government, as I’ll explain next.

Not only is the total value of U.S. federal government debt—now just shy of $37 trillion—hitting all-time highs, but it’s also approaching record levels relative to the size of the economy, as measured by GDP. This means the U.S. debt burden is historically extreme, raising the very real and rapidly growing risk of a sovereign debt crisis.

In this context, it’s entirely understandable that foreign holders of U.S. debt would want to diversify away from Treasuries and into gold—a time-tested safe haven and the world’s most enduring store of value for over 6,000 years. This is a major driver of China’s growing appetite for gold.

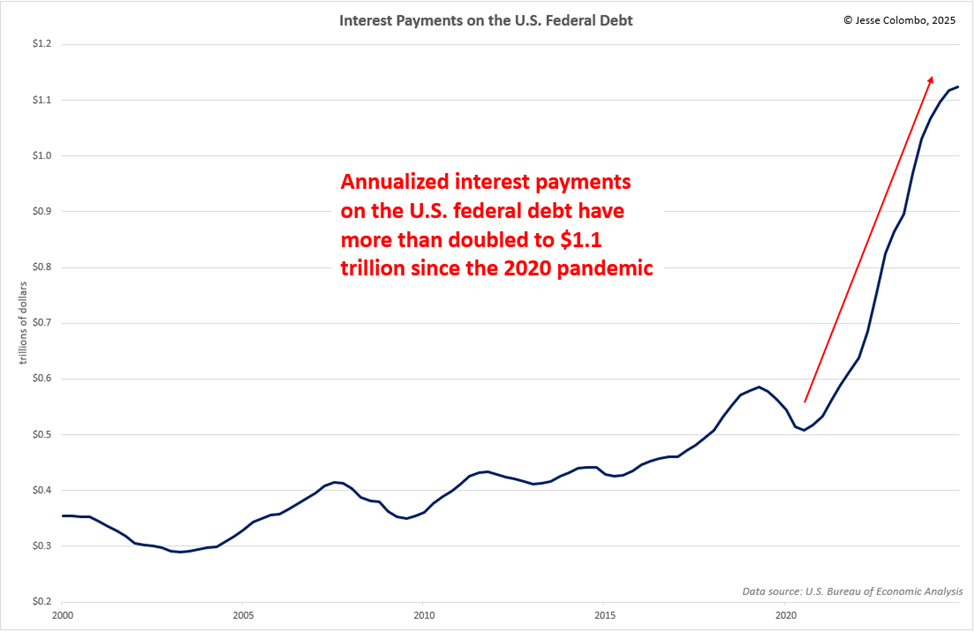

To make matters worse, since the 2020 pandemic, the combination of surging national debt and rising interest rates has more than doubled America’s annual interest payments to over $1.1 trillion. That staggering figure now exceeds federal spending on defense, income security, health, veterans’ benefits, and even Medicare—making interest the second-largest expense for the U.S. government, behind only Social Security, which costs roughly $1.5 trillion per year.

To summarize, there are numerous signs confirming that the Chinese gold mania I began warning about late last year is now fully underway—and it’s playing a major role in driving gold beyond $3,000 and into a much more aggressive, parabolic phase. This rally is characterized by heavy trading volume and broad participation in Shanghai Futures Exchange gold futures, which suggests the bull market still has plenty of fuel left in the tank.

On top of that, China’s central bank remains a relentless gold accumulator, and now, with insurance companies newly permitted to invest in gold, even more institutional capital is flowing into the metal. Who knows how many other Chinese corporations will jump into the frenzy next? In my view, China should be applauded for embracing and celebrating gold as it has—and the West has a lot to learn. One way or another, it will be forced to catch up.

Disclaimer: the information provided in The Bubble Bubble Report and related content is for informational and educational purposes only and should not be construed as investment, financial, or trading advice. Nothing in this publication constitutes a recommendation, solicitation, or offer to buy or sell any securities, commodities, or financial instruments.

All investments carry risk, and past performance is not indicative of future results. Readers should conduct their own research and consult with a qualified financial advisor before making any investment decisions. The author and publisher disclaim any liability for financial losses or damages incurred as a result of reliance on the information provided.

Read the full article here

Leave a Reply