US Treasury yields rose on Tuesday following the release of June inflation figures that showed the Consumer Price Index (CPI) rose 0.3%, month over month, bringing the annual inflation rate to 2.7%.

The so-called core CPI, which excludes food and fuel, added 0.2% on the month for a 12-month increase of 2.9%.

The higher inflation prints all but dash hopes that the Federal Reserve will cut interest rates at its meeting later this month.

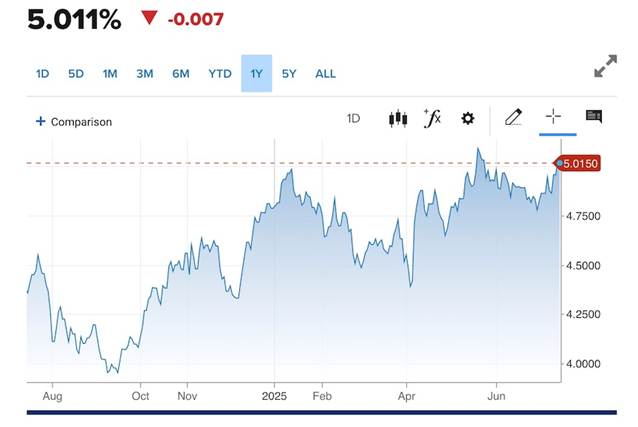

This led bond traders to push for higher yields on short- and long-dated Treasuries. The 10-year Treasury yield rose 6 basis points to 4.485%, while the 30-year yield jumped more than 4 basis points to 5.015%. The 2-year note yield advanced nearly 6 basis points to 3.954%. (CNBC)

Taking a look at the 10-year and the 30-year charts, yields have climbed from their one-year lows on Sept. 16, 2024, but are nowhere near all-time record-highs set 44 years ago. In June of 1981, during the depths of the recession, the 10-year reached 15.82%, and the 30-year hit 15.19% in September 1981.

The global bond market is significantly larger than the global stock market, with a total value exceeding $140 trillion. The US bond market alone is valued at over $51 trillion, making it the largest in the world. (AI Overview)

This is why investors, large and small, watch US Treasury yields closely to see what they are signaling for the economy going forward.

The higher the yields on long-term Treasuries, the more confidence investors have in the economic outlook. But high long-term yields can also be a sign of rising inflation expectations. Investors require higher interest rates to tie up their money for up to 30 years, as the risk of inflation is greater.

Lower yields generally indicate reduced interest rates for government debt and can signal weakening economic growth expectations or lower inflation expectations. During periods of quantitative easing, when the Fed lowers rates and buys up bonds and other securities to shore up a weakening financial system, Treasury yields fall and bond prices rise.

When yields fall, it means investors are willing to accept lower returns on their investments in Treasuries, often because they are seeking safe-haven assets (bonds) during periods of economic uncertainty.

Bond prices and yields have an inverse relationship. When yields go up, prices drop, signaling a lower demand for Treasuries. If the Fed increases interest rates, yields generally rise.

There is a group of powerful investors that not only watches US Treasury yields closely, but they also take an active part in influencing the bond market, especially if they don’t like the economic policies of the administration.

Bond vigilantes are investors who sell government bonds in response to fiscal policies they view as inflationary or irresponsible, driving up borrowing costs for the government. — Investopedia definition

The term was coined by economist Ed Yardeni in the 1980s.

Historical examples of bond vigilantism occurred in the early 1980s, during the Clinton administration of the ‘90s, in the early Obama years, and most recently, following Donald Trump’s election victory in 2024, when US Treasury yields jumped from 4.29% to 4.42% in a single day — the big move attributed to concerns about spending and tax cuts under the new administration. (Investopedia)

“The perceived power of bond vigilantes was famously illustrated in the early 1990s, when U.S. yields jumped as investors dumped Treasuries amid fears about federal deficits in what became known as the Great Bond Massacre.” — Fortune

10-year U.S. Treasury yields rose to more than 8% from 5.2%, spooking the administration and prompting deficit-reducing measures. By 1998, yields had fallen to around 4%.

Topping all of these examples in terms of the drama it caused was the UK gilt crisis of 2022. After new Prime Minister Liz Truss announced a mini budget that made unfunded tax cuts and raised the amount borrowed, all hell broke loose in London’s financial district. The British pound sterling fell to a record low against the dollar, and borrowing costs surged one percentage point. Truss was abruptly forced to resign.

JP Morgan provides a more nuanced view of what happened:

In less than three days in September 2022, 30-year U.K. Gilt yields rose more than 1.60 percent. For U.K. Defined Benefit (DB) pension schemes that typically manage their liquidity based on a scenario of bond yields rising by one percent over a period of a week or more, the size and unprecedented speed of this increase created a perfect storm. They had to quickly generate appropriate collateral to meet sizable margin calls on interest rate swap and FX forward positions.

For context, the intraday range of 127 bps on the 30-year Gilt in just one day exceeded the annual range for 30-year Gilts in all but four of the last 27 years. The magnitude of this market move went well beyond the contingency plans that most schemes had in place. Not only were they asked to post very large margin calls in value terms for both cleared and non-cleared trades, but also the Gilts, which they had planned to post as collateral for their non-cleared trades, were significantly declining in value.

A lesser bond crisis hit Britain on Jan. 10, 2025, when a gilt selloff caused pension cash calls and the 30-year UK government bond hit a 26-year high.

It is widely believed that a crash in the US bond markets was behind Donald Trump’s sudden 90-day reprieve in imposing so-called “reciprocal tariffs” he announced on “Liberation Day”, April 2nd.

The bond vigilantes’ dislike of the tariffs had resulted in a mass Treasury sell-off, including by China and Japan, the two nations holding the most Treasury bonds.

On April 11, Focus Wealth Management published a piece titled, ‘Return of the bond vigilantes and the spectre of an American face-off’.

Referencing January’s 5% spike in the UK 30-year gilt, and a more muted version that played out in Germany after Chancellor Merz proposed big defense and infrastructure spending beyond typical debt limits, the authors ask, what if bond vigilantes come for the US?

The odds are greater, they argue, for three reasons:

First, America’s fiscal position has long been poor, and it’s gotten worse.

Second, many of Trump’s policies — including sweeping tariffs, floating a debt restructuring, and the [passed] tax legislation, which could add US$1 trillion to US$2 trillion to the federal deficit over the next decade — look likely to worsen the fiscal outlook and/or rattle bond investors.

Third, bond markets have been acting odd lately. With all the uncertainty and volatility in stocks, this should be a clear “safe haven” moment. Instead, U.S. Treasuries are selling off.

All this is raising the odds of something unwanted: a bond vigilante showdown…

A nasty clash would resemble the British experience, but with U.S. leadership refusing to back down. This would be the “let them eat cake” moment: yields would spike, the administration would inadequately respond, bondholders would lose even more confidence, yields would spike further, the dollar would fall, thereby spooking everyone now actively paying attention, and a full-blown crisis would eventually be on everyone’s hands.

Reuters notes that, according to academic theory, investors typically lend to sovereign borrowers (like the US) when the country has institutions in place that protect against the threat of expropriation.

The article question why the Trump administration’s disrespect for such institutions, and the challenges on key constraining mechanisms on the executive, including confrontations with judges, legislators and the central bank, and even provision of the Constitution itself, not to mention the numerous international agreements the administration has pulled out of, hasn’t inspired more bond vigilantism and led rates higher than they are currently.

Certainly, there have been signs of discontent among bond investors, including after Trump’s Liberation Day tariff announcement, and following Trump’s musings that Fed Chair Jerome Powell’s termination “cannot come fast enough.”

In both cases, the bond market moves were notable but not earth-shattering. They did appear to have the desired effect, as the administration responded by either softening its language or postponing controversial policies, and these pivots led to market recoveries. But given the stakes, jumps of less than 75 basis points in the 10-year Treasury yield seem rather contained.

Why would this be? Reuters offers three possible explanations:

First, the theory about the link between institutional strength and borrowing costs could be wrong. Things like the rule of law and central bank independence are nice to have, but ultimately, bondholders care about one thing: getting paid.

And the risk of a U.S. default remains low. While investors have been getting antsy about the potential for Trump’s One Big Beautiful Bill to add around $3.3 trillion to the deficit over the next decade, according to the Congressional Budget Office, the dollar remains the world’s reserve currency, so the U.S. has more room for fiscal profligacy than most.

Indeed, U.S. Treasuries’ long-held role as the global risk-free asset may be why yield spikes have been contained. The $28 trillion U.S. Treasury market remains a key pillar of the global financial architecture, and there is no ready substitute with the same size, liquidity, and depth.

So, it’s understandable why investors are loath to flee. No one wants to pull the alarm if there is a significant risk that doing so will cause a part of the building to fall on one’s head.

However, this doesn’t mean that the bond vigilantes have gone away, just that they are biding their time.

Trump signed his Big Beautiful Bill into law on July 4th. According to the Tax Foundation, the legislation, which includes extending the 2017 tax cuts that were expiring, will decrease federal tax revenue by $5 trillion from 2025 through 2034.

In March, Project Syndicate asked a series of financial experts whether the bond vigilantes would become a persistent issue for major economies.

Desmond Lachman, a senior fellow at the American Enterprise Institute, said: According to the Committee for a Responsible Federal Budget, Trump’s tax-cut proposals would add $7.75 trillion to the US national debt over the next decade, pushing the debt-to-GDP ratio above 140% by 2034. If implemented, such massive tax cuts are bound to raise serious questions about the sustainability of US public finances, and that in turn would constitute an open invitation for the bond vigilantes to return in full force.

A final reason for the bond vigilantes to act would be if Fed Chairman Powell were fired ahead of the expiration of his term. Trump would ensure that Powell’s replacement conforms to his wish to reduce interest rates — something Powell and his board have refused to do.

According to New Capital, the firing would likely prompt a violent reaction against US assets, encouraging money to flee abroad.

Waning confidence in the Fed’s resolve to curb inflation could lead bondholders to demand an increased risk premium to hold Treasuries, pushing up medium-to-long dated bond yields…

As short-term rates would be expected to be cut aggressively under a new Trump-appointed leadership, the US yield curve would steepen dramatically, although that would not necessarily signal an improved growth outlook. Any attempt by the Fed under the new chair to limit the surge in yields, for instance by restarting quantitative easing, would likely be met with even stronger selling flows by private and international investors.

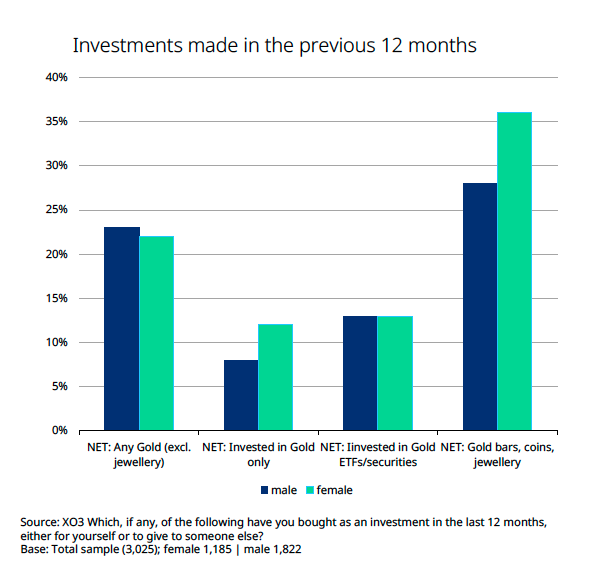

The US dollar would also be negatively impacted. Its role as the world’s reserve currency rests on trust in US institutions. A politicised Fed would erode that trust. Foreign holders of US dollars will seek to diversify into other currencies and gold. The sell-off in US government bonds would be mirrored by a sharp fall in the US dollar, compounding a trend that has already emerged after Trump’s tariff announcements. In an adverse feedback loop, a weaker US dollar would eventually raise the price of imported goods, stoke inflation and inflation expectations, and push bond yields higher.

Stocks would inevitably be caught up in the financial maelstrom:

Equity markets would not be spared by the shock. Volatility would spike as investors price in the implications of a central bank subject to the will of the President. An increased equity risk premium would depress US share prices and negatively affect their expected returns relative to other markets.”

Conclusion

The bond vigilantes are real, and they wield enormous power. The global bond market is significantly larger than the global stock market, with a total value exceeding $140 trillion.

When Britain’s neophyte Prime Minister Liz Truss published a mini budget that made unfunded tax cuts and raised the amount borrowed, the bond vigilantes sold UK gilts en masse, sank the pound, and forced Truss to resign.

Could the same thing happen in the US? Quite possibly, if the United States continues to rack up debt and reduce revenues through tax cuts.

Indeed, a US bond market crash seems inevitable, especially as inflation rises amid Trump’s inflationary tariffs on imports, leading to a standoff between Trump and Powell over interest rates.

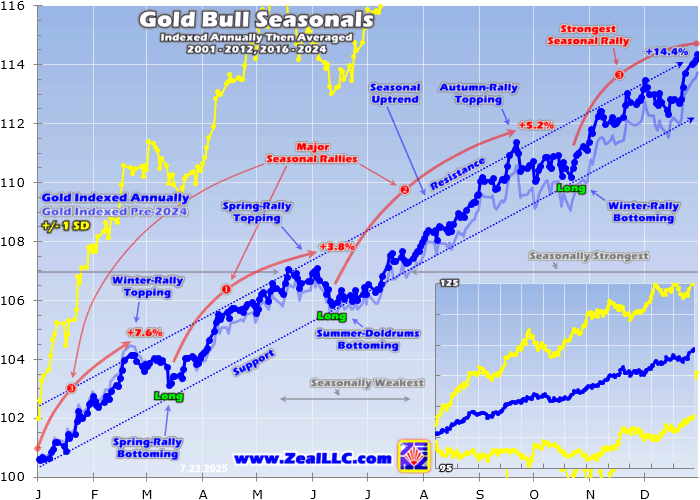

If it does, the last safe havens standing are commodities and precious metals.

Read the full article here

Leave a Reply