A shortened report this past week. Next week we are away up north with no internet unless we can find a hotspot with my mobile. Odds favour no report.

Noteworthy this week was Trump’s 35% tariffs against Canada, with CUSMA goods exempt. Effective Aug 1, but will the TACO man flip again? A host of other countries are also set to see their tariffs rise.

Markets once again made new all-time highs (S&P 500, NASDAQ, TSX) but promptly turned around and closed mildly lower. Is it a top? We can’t tell until we break support points, but given the background news of tariffs and Trump upping his war with Fed Chair Jerome Powell, a top is a real possibility.

Gold and the precious metals also rose on the week, with silver, platinum, and palladium all making 52-week highs. Copper made all-time highs. The commodities super cycle looks to be on. The gold stocks were also higher, and positive signs continue to form in the junior exploration junior mining market. Sprott Inc., for example, a global asset manager focused on precious metals and critical materials investments, reported increased net income, decreased interest expense, pays a dividend, and is held in the Enriched Capital Conservative Growth Strategy.* The TSX Metals & Mining (TGM) made all-time highs. Leading the metals group up? The fact that four of our metals made new highs suggests to us that gold and the gold stocks can’t be too far behind.

We labeled one of our charts the chart of the week (page 7). We note that the US$ Index is at the bottom of a down channel and appears to want to break under it. Instead, the US$ Index was up on the week and appears poised to move higher. Gold and the US$ Index rising together have happened before.

We’ll be back the week after, but key into this week appears to be the potential for stock markets to top and gold and precious metals to go higher. But will the TACO man flip again? The TACO man wants lower interest rates and a higher stock market. But his actions are mostly against both. Always use stops and be wary of breakdown points.

The weather should be cooler up north, and the lakes are cold. Admittedly, we hope to have a great week. For everyone else, have a great week.

DC

* Reference to the Enriched Capital Conservative Growth Strategy and its investments, celebrating a 7 ½ -year history of strong growth, is added by Margaret Samuel, President, CEO, and Portfolio Manager of Enriched Investing Incorporated, who can be reached at 416-203-3028 or [email protected]

“The Fed is very smart, but it doesn’t run the markets. In the end, the markets will run the Fed. The markets are bigger than any man or group of men. The markets can even break a president.”

—Richard Russell, American finance writer best known for his Dow Theory Letters, 1924–2015

“The possession of gold has ruined fewer men than the lack of it.”

—Thomas Baily Aldrich, American writer, poet, critic, editor, long known as editor for the Atlantic Monthly, wrote a semi-autobiographical book, The Story of Bad Boy (1870); 1836–1907

“Don’t worry about people stealing your ideas. If the ideas are any good, you’ll have to ram them down people’s throats.”

—Howard H. Aitken, American physicist, pioneer in computing, original designer behind IBM’s Harvard Mark I, the world’s first programmable computer; 1900–1973

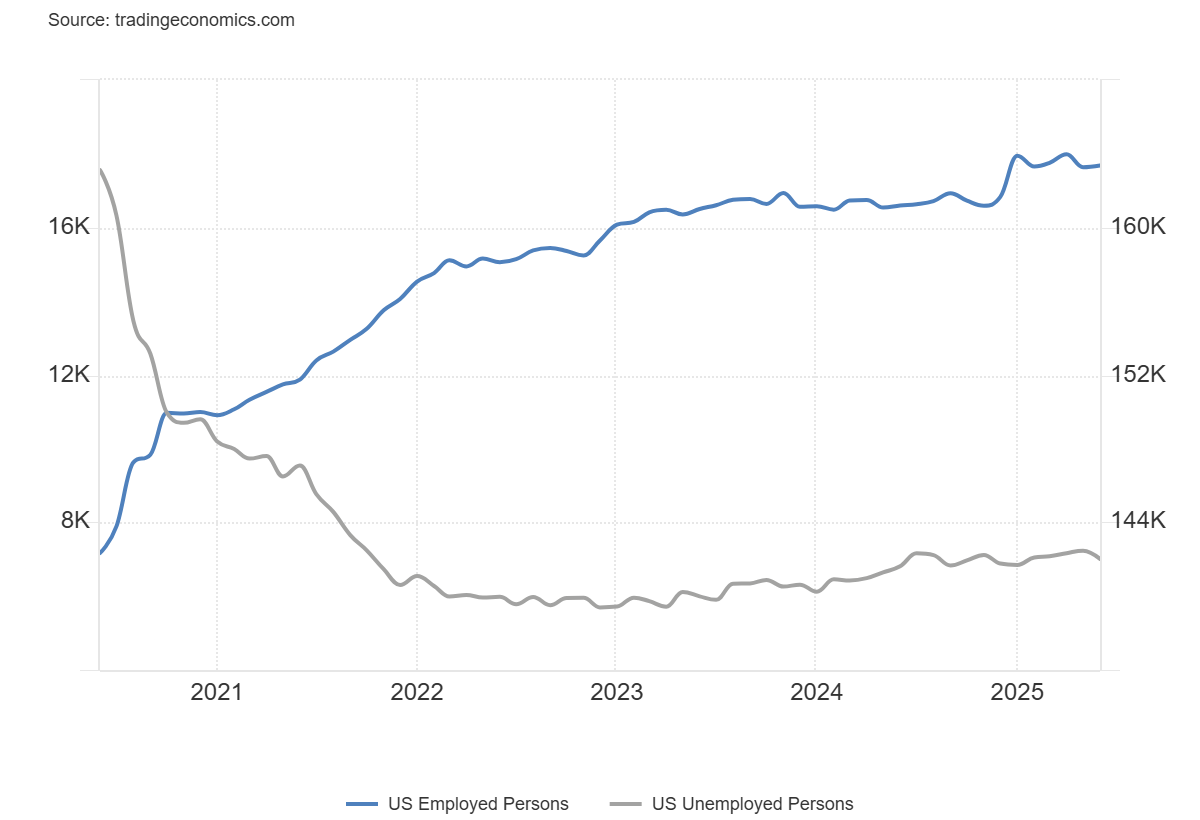

Canada Jobs Report

Canada Employment Rate vs. Unemployment Rate 2020–2025

Source: www.tradingeconomics.com, www.statcan.gc.ca

Gangbusters. That’s about all we can say about the June jobs report for Canada. But is it really?

Canada added 83,100 jobs in June, far outstripping the expectation of zero (0) growth and an 8,800 gain in May. The unemployment rate fell to 6.9% from 7.0%, definitely below the expected 7.1%. Even the R8 unemployment rate (plus discouraged searchers, waiting group, portion of involuntary part-timers), the highest reported by Statistics Canada, fell to 8.6% from 9.1%. Of the job growth numbers, 13,500 were full-time vs. 57,700 in May, while part-time jumped sharply, up 69,500 vs. down 48,800 in May. The part-time growth effectively offsets the May report. This is possibly due to shifting periods or a catch-up? The huge jump in part-time employment, however, is a cautionary sign. Irrespective of this, “it’s tariffs, what tariffs?” The biggest gains were in wholesale and retail trade, along with health care and social assistance. The provinces with the big gains were Alberta, Quebec, and Ontario, while the Maritimes saw small losses.

Wage growth slowed to a year-over-year (y-o-y) gain of 3.2%, below the 3.5% the previous month, while the participation rate rose to 65.4% from 65.3%. The employment population ratio was 60.9% vs. 60.8%, reflecting more people working. All this points to is that the economy is not dead yet. The Canadian economy grew by 2.3% in Q1. That’s interesting, as the U.S. economy grew by 2.0% in Q1 (annualized). Canada outpacing the U.S.? Despite all the issues of Trump’s attacks on Canada and the rest of the world? First quarter growth may have been a little skewed by manufacturers, businesses, and consumers wanting to get ahead of tariffs by buying early and stockpiling.

This is the last jobs report before the next meeting of the Bank of Canada (BofC) on July 30. We suspect that the BofC will hold interest rates firm because of this better-than-expected report. While layoffs in some companies are being reported, other companies are hiring. With layoffs as well, people are not counted as unemployed until their severance runs out. Both the number of people employed and unemployed rose last month: employed +7,400, unemployed +39,300.

This is the biggest gain in six months. All this was reported before the potentially negative effects of Trump’s 50% tariff on copper and 35% against Canada. Grant you, it’s the TACO man talking (“Trump Always Chickens Out”), so what is said today can change tomorrow. We are supposed to have a trade deal by July 21. We confess, we’ll be surprised if it happens. Nonetheless, there has been negative fallout from tariffs, in particular those impacting Ontario, the manufacturing heartland of Canada. Windsor, for example, has an unemployment rate of 11.2% vs. 6.9% for Canada.

Overall, a good report. But the huge jump in part-time is illusory, as that gain can also be the first to disappear.

Updates

S&P 500

Source: www.stockcharts.com

Has the U.S. stock market topped? Once again, the S&P 500 (SPX), along with the NASDAQ, has made all-time highs. But, once again, neither the Dow Jones Industrials (DJI) nor the Dow Jones Transportation (DJT) has made all-time highs. In Canada, the TSX Composite did make new highs. This only becomes a significant divergence if the market were to turn down and give us a sell signal or confirm a top. Interestingly, Bitcoin also made a new all-time high was Bitcoin. A breakout? Or a hook? The crypto market is bubbly with calls for $150,000, $200,000 Bitcoin. But what is Bitcoin used for? Well, not much.

It is not difficult to see that the SPX briefly went above the trendline connecting the earlier tops. However, follow-through has not been seen. Will we see it? Even further highs remain possible. On the other hand, the NASDAQ has cracked its upper trend line. Interestingly enough, while that trendline connecting the tops for the SPX was a rising trendline, the same trendline for the NASDAQ connected declining tops. Another divergence? We have golden crosses for both the SPX and NASDAQ, another buy signal. But not yet for the DJI, although it is getting close. DJT? Not a chance.

The rise in the markets since the “Liberation Day” low in April has been almost straight up. A V recovery. We are now overbought by a number of measurements, but so far, the market has not cracked. Volume has tailed off. The VIX volatility indicator is at 16, which we consider mildly complacent. The CNN Fear & Greed Index is registering Extreme Greed. Nvidia has been the hero, the first $4 trillion company, making Nvidia the fifth largest country in the world, behind Japan but ahead of the U.K. (market cap vs. GDP).

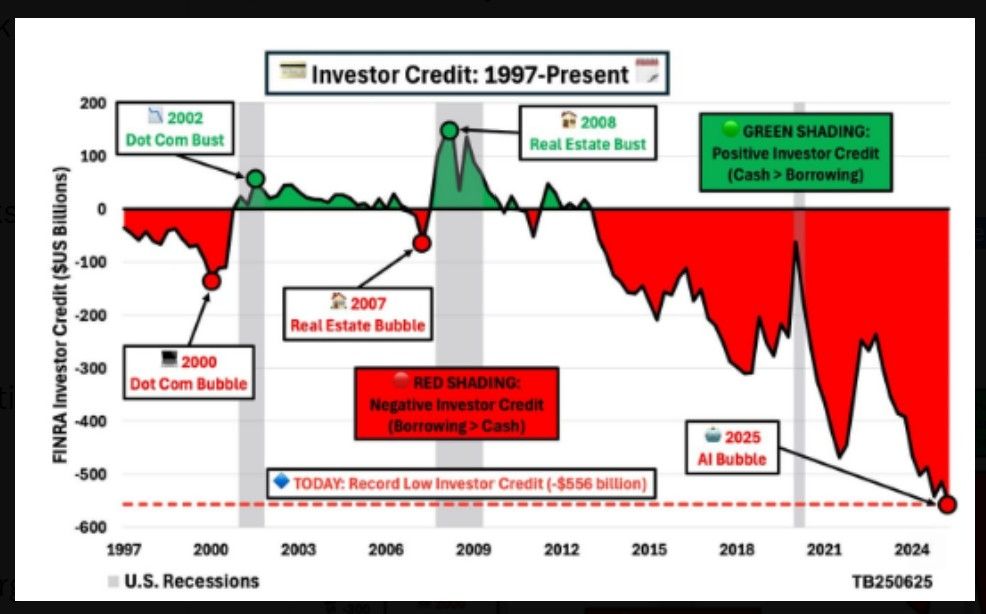

Things have been generally rosy for the stock market. Lots of money around, it seems. The economy has been “Goldilocks” despite the tariff wars, but that could change now that President Trump is once again slapping tariffs on a host of countries. So far, the response has been somewhat muted, but that could change. There remain funds on the sidelines that could be employed in the market. Interestingly, there is evidence that the public is piling into the stock market. The chart below shows the huge uptick in margin buying by the public. It far outpaces what was seen during the dot.com and real estate bubbles. It’s AI mania. The public always gets in at the top and sells at the bottom.

Source: www.barchart.com, www.syzgroup.com

Given the tariff wars, there is a risk that foreigners decide to take their money out of the U.S. (bonds and stocks) in response to Trump’s tariffs. Foreigners are piling into U.S. bonds and equities. Foreign holders of U.S. treasuries make up 33% of the public treasury market, while they also make up 27% of the corporate bond market. As well, they make up some 18–20% of the U.S. equity market. It wouldn’t take much of a withdrawal to suddenly spark a concern (panic?) to get out of U.S. securities. The falling U.S. dollar is not helping.

The economy is a Goldilocks economy with lower inflation, even as it is still above the Fed’s 2% target, a labour market that continues to show life, earnings that remain off their highs but still elevated, and economic growth that is still positive on an annualized basis. On a quarterly basis, Q1 was negative 0.5%. The PE for the SPX is near 30, which is high. The Schiller PE ratio is even higher at 38. Previously, the market has topped out with PEs that high. Add in tariff uncertainty, and we could be setting up conditions for a top. The market looks at earnings, not the latest tariff war between the U.S. and Myanmar. So far, the announcement of a new round of tariffs hasn’t moved the market until they announced steep tariffs on Canada. The TACO man could once again change his mind. He wants tariffs, but he also doesn’t want the market to fall. The uncertainty of what Trump may or may not do has most companies sitting on their hands.

As of now, we wouldn’t consider that the SPX has topped until we drop under 5,900. Under 5,750, it has topped for sure. Warning bells are ringing everywhere. This is not the time to be buying.

Lest we forget, there is still the question of a huge $37 trillion debt, the $3 trillion annual deficit, and the ongoing fight between Trump and Fed Chair Jerome Powell. We don’t know how this will end, as the only thing certain is that Powell’s term is up in 2026. Powell mostly ignores what Trump says, but the threats against the Fed Chair are rising. Anything that overthrows Powell will not be well received by markets, as we suspect bond yields will rise, gold will rise, but stocks will fall, and the US$ Index will fall. A dangerous game they are playing.

Not helping the debt and deficits this past week was the fact that bond yields, as represented by the U.S. 10-year treasury note, jumped to 4.42% up 1.6%. The Canadian 10-year Government of Canada bond (CGB) was also up, gaining 4.4% to 4.50%. Rising bond yields are not good when one has $37 trillion in debt. Hence, another highlight for the president/Fed Chair fight.

Chart of the Week

Source: www.stockcharts.com

Is the US$ Index poised to break down or poised to rebound? This longer-term chart of the US$ Index of the past 20 years shows that the US$ Index is either breaking down under that trendline or it’s poised to stage a big rebound. A move now back over 98 and especially over 99 could signal that a low is in. Over 100, we could rise further to 101. If the US$ Index rebounds, it could have a negative impact on gold. Only a further drop under the recent low of 96.38 could suggest we are continuing our downward trend.

The chart on the next page shows the US$ Index broke below a trendline, then reversed back up. No, it is not yet giving us a buy signal, but it is beginning to look like a false breakdown. A rising US$ Index could be negative for gold. As one can note from the daily chart of the US$ Index on the next page, we are approaching a breakout of that downtrend line. One positive we have noted of late is that there have been days when gold rose despite the US$ Index also rising. Helping gold is its safe haven status and ongoing demand from central banks. Also, gold is a hedge against the volatility being seen in markets. Gold is also responding positively to the hiking of the debt limit and growing systemic risk in the banking sector, particularly if loan losses continue to rise and the risk of a sovereign debt crisis also rises. We note that, during COVID and the start of the Russia/Ukraine war, gold and the US$ Index both rose together.

Source: www.stockcharts.com

Gold

Source: www.stockcharts.com

Gold continues to tantalize us as to whether it will break higher or continue in its current corrective period. The pattern is appearing as a symmetrical triangle with the potential for a five-point reversal pattern that should propel us higher. Symmetrical triangles can be both continuation patterns and topping patterns. Which one is this? We lean towards a continuation pattern but are wary of a topping pattern.

The pattern can be ambiguous, and if we were to break down under $3,250 and especially under $3,200, we could see a larger drop towards $3,000, even $2,900. New highs will help, as well as new highs for silver. On Friday, July 11, 2025, silver did jump to new 52-week highs over $38. Is silver leading? The key now going forward is that gold also jumps over $3,500, and the gold stocks indices (HUI, TGD) also make new highs.

We are in a weak period for gold (and the precious metals), but hold to the potential for a July low. However, sometimes these periods also last into August, even early September, before we see the rally into October/November. All this has put us on short-term cautious alert, but we remain long-term bullish. Note that in 2024, we also had a consolidation period that lasted into August, then we rallied into October/November before another decline into December. Silver making new highs is encouraging. Now it needs to hold it.

RSIs for both gold and silver are fairly neutral here, adding to the uncertainty. The gold stocks also appear to be forming a symmetrical triangle. The TSX Gold Index (TGD) needs to break out over 520 to confirm higher. A breakdown under 480 and especially 470 spells trouble with potential downside targets to 400. The TGD is showing what may be an ascending triangle which is bullish. But we need to break the new highs to confirm that. Incidentally, the TSX Metals & Mining Index (TGM) made all-time highs this past week. An omen for gold?

Gold was our number one pick for 2025, and so far, it has not disappointed. Percentage-wise, gold is up in 2025, along with silver. The indices are also performing very well, with the HUI up percentage-wise, and the TGD is also up. As well, we are seeing buying in the junior miners that primarily trade on the TSX Venture Exchange (CDNX).

Other metals have been moving up as copper, platinum, and palladium all made new highs this past week, while copper made all-time highs. The CDNX has also been making new 52-week highs. The best part about the gold market is that, despite the new highs and the strong performance to date, we are seeing few signs of frothiness that could signal a potential top. Gold, along with silver and the precious metals, remains under-owned and under-appreciated, particularly in North America. As a friend who watches U.S. channels such as CNBC and Fox notes, they rarely ever mention gold. AI rules.

Copyright David Chapman 2025

Markets & Trends

|

|

|

|

% Gains (Losses) Trends

|

|

||||

|

|

Close

Dec 31/24

|

Close

Jul 11/25

|

Week

|

YTD

|

Daily (Short Term)

|

Weekly (Intermediate)

|

Monthly (Long Term)

|

|

|

ne

|

|

|

|

|

|

|

|

|

|

S&P 500

|

5,881.63

|

6,259.75 (new highs) *

|

(0.3)%

|

6.4%

|

up

|

up

|

up

|

|

|

Dow Jones Industrials

|

42,544.22

|

44,371.51

|

(1.0)%

|

4.3%

|

up

|

up

|

up

|

|

|

Dow Jones Transport

|

16,030.66

|

16,208.86

|

1.0%

|

2.0%

|

up

|

neutral

|

up

|

|

|

NASDAQ

|

19,310.79

|

20,585.53 (new highs) *

|

(0.1)%

|

6.6%

|

up

|

up

|

up

|

|

|

S&P/TSX Composite

|

24,796.40

|

27,023.25 (new highs) *

|

(0.1)%

|

9.3%

|

up

|

up

|

up

|

|

|

S&P/TSX Venture (CDNX)

|

597.87

|

784.42 (new highs)

|

3.9%

|

31.2%

|

up

|

up

|

up

|

|

|

S&P 600 (small)

|

1,408.17

|

1,376.56

|

(0.3)%

|

(2.2)%

|

up

|

neutral

|

up

|

|

|

MSCI World

|

2,304.50

|

2,705.41 (new highs) *

|

0.2%

|

17.4%

|

up

|

up

|

up

|

|

|

Bitcoin

|

93,467.13

|

118,053.56 (new highs) *

|

9.6%

|

26.3%

|

up

|

up

|

up

|

|

|

|

|

|

|

|

|

|

|

|

|

Gold Mining Stock Indices

|

|

|

|

|

|

|

|

|

|

Gold Bugs Index (HUI)

|

275.58

|

430.35

|

0.8%

|

56.2%

|

up

|

up

|

up

|

|

|

TSX Gold Index (TGD)

|

336.87

|

503.70

|

0.1%

|

49.5%

|

up

|

up

|

up

|

|

|

|

|

|

|

|

|

|

|

|

|

%

|

|

|

|

|

|

|

|

|

|

U.S. 10-Year Treasury Bond yield

|

4.58%

|

4.42%

|

1.6%

|

(3.5)%

|

|

|

|

|

|

Cdn. 10-Year Bond CGB yield

|

3.25%

|

3.50%

|

4.2%

|

7.7%

|

|

|

|

|

|

Recession Watch Spreads

|

|

|

|

|

|

|

|

|

|

U.S. 2-year 10-year Treasury spread

|

0.33%

|

0.52%

|

13.0%

|

57.6%

|

|

|

|

|

|

Cdn 2-year 10-year CGB spread

|

0.30%

|

0.76%

|

10.1%

|

153.3%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Currencies

|

|

|

|

|

|

|

|

|

|

US$ Index

|

108.44

|

97.88

|

0.9%

|

(9.8)%

|

down

|

down

|

down

|

|

|

Canadian $

|

69.49

|

0.7309

|

(0.9)%

|

5.2%

|

up

|

up

|

neutral

|

|

|

Euro

|

103.54

|

116.87

|

(0.6)%

|

12.9%

|

up

|

up

|

up

|

|

|

Swiss Franc

|

110.16

|

125.47

|

(0.2)%

|

13.9%

|

up

|

up

|

up

|

|

|

British Pound

|

125.11

|

134.95

|

(1.1)%

|

7.9%

|

up

|

up

|

up

|

|

|

Japanese Yen

|

63.57

|

67.85

|

(1.6)%

|

6.7%

|

up

|

up

|

neutral

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Precious Metals

|

|

|

|

|

|

|

|

|

|

Gold

|

2,641.00

|

3,356.22

|

0.9%

|

27.1%

|

up

|

up

|

up

|

|

|

Silver

|

29.24

|

38.47 (new highs)

|

4.4%

|

31.6%

|

up

|

up

|

up

|

|

|

Platinum

|

910.50

|

1,455.70 (new highs)

|

5.9%

|

55.9%

|

up

|

up

|

up

|

|

|

|

|

|

|

|

|

|

|

|

|

Base Metals

|

|

|

|

|

|

|

|

|

|

Palladium

|

909.80

|

1,285.00 (new highs)

|

11.7%

|

41.2%

|

up

|

up

|

down

|

|

|

Copper

|

4.03

|

5.54 (new highs) *

|

8.6%

|

37.5%

|

up

|

up

|

up

|

|

|

|

|

|

|

|

|

|

|

|

|

Energy

|

|

|

|

|

|

|

|

|

|

WTI Oil

|

71.72

|

68.78

|

2.9%

|

(4.1)%

|

up

|

neutral

|

down

|

|

|

Nat Gas

|

3.63

|

3.36

|

(2.6)%

|

(7.4)%

|

down

|

neutral

|

neutral

|

|

Source: www.stockcharts.com

* New All-Time Highs

Note: For an explanation of the trends, see the glossary at the end of this article.

New highs/lows refer to new 52-week highs/lows and, in some cases, all-time highs.

GLOSSARY

Trends

Daily – Short-term trend (For swing traders)

Weekly – Intermediate-term trend (For long-term trend followers)

Monthly – Long-term secular trend (For long-term trend followers)

Up – The trend is up.

Down – The trend is down

Neutral – Indicators are mostly neutral. A trend change might be in the offing.

Weak – The trend is still up or down but it is weakening. It is also a sign that the trend might change.

Topping – Indicators are suggesting that while the trend remains up there are considerable signs that suggest that the market is topping.

Bottoming – Indicators are suggesting that while the trend is down there are considerable signs that suggest that the market is bottoming.

Disclaimer

David Chapman is not a registered advisory service and is not an exempt market dealer (EMD) nor a licensed financial advisor. He does not and cannot give individualised market advice. David Chapman has worked in the financial industry for over 40 years including large financial corporations, banks, and investment dealers. The information in this newsletter is intended only for informational and educational purposes. It should not be construed as an offer, a solicitation of an offer or sale of any security. Every effort is made to provide accurate and complete information. However, we cannot guarantee that there will be no errors. We make no claims, promises or guarantees about the accuracy, completeness, or adequacy of the contents of this commentary and expressly disclaim liability for errors and omissions in the contents of this commentary. David Chapman will always use his best efforts to ensure the accuracy and timeliness of all information. The reader assumes all risk when trading in securities and David Chapman advises consulting a licensed professional financial advisor or portfolio manager such as Enriched Investing Incorporated before proceeding with any trade or idea presented in this newsletter. David Chapman may own shares in companies mentioned in this newsletter. Before making an investment, prospective investors should review each security’s offering documents which summarize the objectives, fees, expenses and associated risks. David Chapman shares his ideas and opinions for informational and educational purposes only and expects the reader to perform due diligence before considering a position in any security. That includes consulting with your own licensed professional financial advisor such as Enriched Investing Incorporated. Performance is not guaranteed, values change frequently, and past performance may not be repeated.

Read the full article here

Leave a Reply