This is our last Scoop of the year. The Forecast 2025 version. With luck, we will return on Jan 6.

Forecasting is a mug’s game. The forecaster gets mugged. So we forecast with trepidation.

Our two words for 2025 are chaos and volatility. The election of Donald Trump is sure to bring some chaotic times to the markets mostly because you don’t know what he is going to do. He threatens but then sometimes doesn’t follow through. The Mexican Wall always stands out. The vast majority of the 458 miles were built where walls already existed even as they were drooping. The border is 1,954 miles long. Mexico paid for none of it. Appropriations were taken from other departments (mainly Defense), which sparked a government shutdown and numerous lawsuits.

The threats this time center on tariffs and deportations. Both are negative to the economy and potentially also to the global economy. We are entering 2025 with an overvalued stock market. Some believe it is a bubble. Our age has been characterized by excesses, inequality and polarization. We thought of the 1920 which was followed by a stock market crash and the Great Depression. Yes, there were tariffs and deportations back then along with inequality, poverty, and polarization. The stock market of the 1920s is considered one of the most famous bubbles of all time. It rose 478% from 1921 to 1929 The current market has seen the DJI rise 577% 2from 009 to the present.

We also look at where the cycles are. Too many cycles are all coming together in the upcoming period to 2030. Not a good sign. Negative signs were seen this past week when 6 of the MAG7 stocks made all-time highs leading the NASDAQ barely to an all-time high. But the S&P 500 and the DJI both finished the week in the red. A divergence? Bitcoin has also been in a bubble as well and should run into resistance here near $100,000. It’s up an astounding 20,178% from humble beginnings in 2014/2015.

This coming week is the FOMC on Wed Dec 18. It is widely expected we will see a 25 bp rate cut. But there are some signs it could be 50 bp. Also, watch for PCE prices out on Dec 20.

Gold is still showing signs of being a winner in 2025 despite recent weakness. Lundin Gold Inc., for example, reported record high cash flow, record revenues, record EBITDA, pays a dividend, and is held in the Enriched Capital Conservative Growth Strategy.* Oil is also showing signs of waking up particularly if Mid-East wars escalate.

We show our table of markets and trends at the end.

Remember “If Santa Claus should fail to call, bears may come to Broad and Wall.”

The best to everyone for the holidays and into 2025. See you next year.

DC

* Reference to the Enriched Capital Conservative Growth Strategy and its investments, celebrating a 6-year history of strong growth, is added by Margaret Samuel, President, CEO, and Portfolio Manager of Enriched Investing Incorporated, who can be reached at 416-203-3028 or [email protected]

“Those who have knowledge don’t predict. Those who predict don’t have knowledge.”

—Lao Tzu, Chinese philosopher, and author of Tao Te Ching, 2nd century BCE, which is the foundation for Taoism, known as an Old Master; b. 6th century BCE–5th century BCE

“Forecasts create the mirage that the future is knowable.”

—Peter L. Bernstein, American financial historian, economist, educator, CEO Bernstein-McCauley Inc., later Peter L. Bernstein Inc., editor Journal of Portfolio Management, research staff for Federal Reserve of New York; 1919–2009

“Millionaires don’t use astrology, billionaires do”

—attributed to J.P. Morgan, American financier, and investment banker, who dominated Wall Street through the Gilded Age from the late 1870s to late 1890s and the Progressive Era from the late 1890s to 1920s, banking firm J.P. Morgan & Co., today J.P. Morgan Chase & Co; 1837–1913

Forecast 2025

Is our period an age of excess, epitomized by a man purchasing a supposed piece of art of a banana taped to the wall for US$6.2 million, then eating it? We’ve had other financial crazes as well. The ones that come to mind are Non-Fungible Tokens (NFTs), meme stocks (i.e. GameStop), and, yes, cryptos (Bitcoin). Financial advice came from TikTok, Instagram, Facebook, X (formerly Twitter), and Snapchat. Using your broker or your bank? Meh.

The 1920s were an age of excess as well. Known as the Jazz Age and the age of prohibition and flappers, there was conspicuous consumption. It was also an age of culture wars around immigration, race, alcohol, sexual morality, and gender politics. And it was also a technological age with advances in film, telephones, radio, and automobiles. There was also a housing boom as the suburbs grew. And there were divides between urban and rural and even paramilitary terror groups like the Ku Klux Klan. And, lest we forget, there were wars: civil wars in Russia and China, wars between Poland, Russia, and Ukraine, turmoil in the Middle East, the Turkish War of Independence, rebellions in Iraq, and more. And dare we mention that there was extreme inequality as well. 5% of the population earned a third of the income. 60% lived in poverty. But the stock market roared, thanks to easy money.

If that all sounds familiar, we need only look at today. Instead of the Ku Klux Klan (although they are still around), we have paramilitary groups like the Proud Boys and the Oath Keepers, plus others. You could transpose the issues and divisions in the 1920s to today and not be too far off. We even have a technological age with AI, 5G networks, electric vehicles, wearable technology, cloud computing, and more. We’ve also had

our own housing boom as house prices soared. Inequality is not much different as the top 5% still earn a third of the income. Thanks to income supplements it is estimated that 13% live in poverty while another 15% live just above the poverty line. Irrespective the stock market has roared thanks to easy money.

Herbert Hoover, a businessman, was elected president in 1928 and his cabinet was stuffed with millionaires. Most notable was Andrew Mellon, scion of the wealthy Mellon family, investment banker, and businessman, who was Secretary of the Treasury. You might consider him to be the Elon Musk of the day, except he wasn’t the wealthiest. That title belonged to John D. Rockefeller. Then in 1929 came the stock market crash and the Great Depression was underway. Do we mention that tariff wars began with the Smoot-Hawley Tariff Act of 1930?

Donald Trump, a businessman, was elected president in 2024 and his cabinet is stuffed with billionaires. Appointed to a prominent position is Elon Musk, the world’s richest man and businessman as head of the Department of Government Efficiency (DOGE). No, we haven’t had a stock market crash—at least not yet. But tariffs are threatened. 25% tariffs may be imposed on Canada and Mexico, maybe up to 100% on China, and 100% tariffs on the BRICS nations if they threaten the U.S. dollar by trying to create a BRICS currency. Threaten the BRICS over the U.S. dollar but push Bitcoin to replace the U.S. dollar?

Mass deportations were popular in the 1930s, where in the U.S. hundreds of thousands of Mexican Americans were deported. Canada deported immigrants as well. The perception was they were taking American and Canadian jobs during a period of high unemployment. As a result, immigration collapsed. Trump has threatened to deport 11 million illegal immigrants and, as well, end birthright citizenship, meaning those born in the U.S. from illegal immigrants. None of this has been tested in court, nor have the logistics as to how this will actually work been tested.

The Fed forced down interest rates in the 1930s, but long rates rose. Deflation set in as they contracted the money supply. Some governments tried to cut expenses, notably here in Canada. That, like tariffs, exacerbated the Great Depression. Trump’s creation of the Department of Government Efficiency (DOGE) under mega-billionaires Elon Musk and Vivek Ramaswamy is seeking to cut $2 trillion from the U.S.’s $7.3 trillion budget expenditures. Given that Social Security, Medicare, Medicaid, interest on the debt, and defense make up almost 73% of that total, cutting $2 trillion would devastate not just the budget but the U.S.

They say a recession is when unemployment hits 10%. In a depression, it hits 25%. Curiously, the Great Recession of 2007–2009 topped out at 10% unemployment (U3) while the pandemic recession of 2020 was brief as unemployment topped out at 14.7%. The Great Depression peaked at 24.9% unemployment.

We’re not suggesting that the coming period is going to be another Great Depression. But we are expecting the coming period to be filled with chaos and volatility. We are not even going to argue as to whether the stock market, which has already been rising sharply, doesn’t melt up even further. Answer—it could. But when this run-up is done, the fall could be swift. What goes up fast comes down even faster.

This year we seem to be on pace for a possible gain for the S&P 500 of 30%. Since 1833 we have had nine years where the Dow Jones Industrials (DJI) gained 30% or more. We don’t have the S&P 500 figures. The last time was 1995. The biggest yearly gain for the DJI was 1915 when it leaped 81.7%. Of those nine years where the DJI had gains of 30% or more, six of them occurred in years ending in five.

Years ending in five have been the best years for the DJI where there have been 15 up years and only 4 down years since 1835. However, two of those down years are most recently 2005 and 2015. The drops were small with 2005 down 0.6% and 2015 down 2.2%. The other two down years were 1865 and 1875. (See our chart on the 10-year stock market cycle). The 10-year cycle suggests that the odds favour an up year in 2025.

10-Year Stock Market Cycle

Annual % Change in the Dow Jones Industrials Average*

Year of Decade

|

Decades |

1st |

2nd |

3rd |

4th |

5th |

6th |

7th |

8th |

9th |

10th |

|

1831–40 |

|

|

-0.9 |

13.0 |

3.1 |

-11.7 |

-11.5 |

1.6 |

-12.3 |

5.5 |

|

1841–50 |

-13.3 |

-18.1 |

45.0 |

15.5 |

8.1 |

-14.5 |

1.2 |

-3.6 |

– |

18.7 |

|

1851–60 |

-3.2 |

19.6 |

-12.7 |

-30.2 |

1.5 |

4.4 |

-31.0 |

14.3 |

-10.7 |

14.0 |

|

1861–70 |

-1.8 |

55.4 |

38.0 |

6.4 |

-8.5 |

3.6 |

1.6 |

10.8 |

1.7 |

5.6 |

|

1871–80 |

7.3 |

6.8 |

-12.7 |

2.8 |

-4.1 |

-17.9 |

-9.4 |

6.1 |

43.0 |

18.7 |

|

1881–90 |

3.0 |

-2.9 |

-6.5 |

-18.8 |

20.1 |

12.4 |

-8.4 |

4.8 |

5.5 |

-14.1 |

|

1891–00 |

17.6 |

-6.6 |

-24.6 |

-0.6 |

2.3 |

-1.7 |

21.3 |

22.5 |

9.2 |

7.0 |

|

1901–10 |

-8.7 |

-0.4 |

-23.6 |

41.7 |

38.2 |

-1.9 |

-37.7 |

46.6 |

15.0 |

-17.9 |

|

1911–20 |

0.4 |

7.6 |

-10.3 |

-5.4 |

81.7 |

-4.2 |

-21.7 |

10.5 |

30.5 |

-32.9 |

|

1921–30 |

12.7 |

21.7 |

-3.3 |

26.2 |

30.0 |

0.3 |

28.8 |

48.2 |

-17.2 |

-33.8 |

|

1931–40 |

-52.7 |

-23.1 |

66.7 |

4.1 |

38.5 |

24.8 |

-32.8 |

28.1 |

-2.9 |

-12.7 |

|

1941–50 |

-15.4 |

7.6 |

13.8 |

12.1 |

26.6 |

-8.1 |

2.2 |

-2.1 |

12.9 |

17.6 |

|

1951–60 |

14.4 |

8.4 |

-3.8 |

44.0 |

20.8 |

2.3 |

-12.8 |

34.0 |

16.4 |

-9.3 |

|

1961–70 |

18.7 |

-10.8 |

17.0 |

14.6 |

10.9 |

-18.9 |

15.2 |

4.3 |

-15.2 |

4.8 |

|

1971–80 |

6.1 |

14.6 |

-16.6 |

-27.6 |

38.3 |

17.9 |

-17.3 |

-3.1 |

4.2 |

14.9 |

|

1981–90 |

-9.2 |

19.6 |

20.3 |

-3.7 |

27.7 |

22.6 |

2.3 |

11.8 |

27.0 |

-4.3 |

|

1991–00 |

20.3 |

4.2 |

13.7 |

2.1 |

33.5 |

26.0 |

22.6 |

16.1 |

25.2 |

-6.2 |

|

2001–10 |

-7.1 |

-16.8 |

25.3 |

3.1 |

-0.6 |

16.3 |

6.4 |

-33.8 |

18.8 |

11.0 |

|

2011–20 |

5.5 |

7.3 |

26.5 |

7.5 |

-2.2 |

13.4 |

25.1 |

-5.6 |

22.3 |

7.2 |

|

2021–30 |

18.7 |

-8.8 |

13.7 |

16.3* |

|

|

|

|

|

|

|

|

11 up 8 dn |

11 up 8 dn |

10 up 10 dn |

14 up 6 dn |

15 up 4 dn |

11 up 8 dn |

10 up 9 dn |

14 up 5 dn |

13 up 5 dn 1 flat |

11 up 8 dn |

Source: www.stocktradersalmanac.com

* To date

2025 is also a post-election year. According to the Presidential Election Stock Market Cycle, the post-election year is the worst performer of the four years. 1937 under Franklin Roosevelt stands out as the worst post-election year down 32.8%. But over the past ten years, the record has been eight up years and only two down years.

The best performer of the year of major indices has been the NASDAQ up 32.7%. Gold has outperformed the others up 29.2%. Silver is up 28.8% to date. The S&P 500 has gained 26.9% to date. The TSX Gold Index (TGD) up 25.3% has outperformed the Gold Bugs Index (HUI) up 22.4%. The TGD outperformed the TSX by 20.6% thus far in 2024.

Source: www.stockcharts.com

We are living in a world of chaos: wars, culture wars, deep divisions, rising fascism, increasing intensity, and rising costs of storms including wildfires, floods, and hurricanes. The latter is due to climate change, where we are coming off the hottest decade and year on record. Climate change is causing storms to become more intense and costly due to rising sea temperatures which provide more energy to fuel storms, leading to stronger winds, heavier rainfall, and increased storm surges, resulting in greater damage to coastal areas and infrastructure; this trend is reflected in a significant increase in the economic cost of weather-related disasters globally.

Nonetheless, climate change is contentious and is a part of the deep divisions that exist in society today. Climate change deniers (primarily in the U.S. and even Canada) are also gaining political power as they call climate change a hoax, even though the vast majority of scientists say otherwise and other countries treat it seriously. What this means going forward and how we deal with the effects of climate change is unknown. However, the effects of climate change are expected to become more intense as we move forward.

So, what to expect in 2025? One of the key themes of 2025 will involve Donald Trump. Never in history has the U.S. elected a 34-times convicted felon who is under indictment for other crimes, including the January 6, 2021, insurrection, even as that one has now been pulled. Trump is a disrupter and not necessarily for the better. What will be the market reaction to tariffs? In the 1930s, trade wars broke out exacerbating the Great Depression. Already there has been growing instability in U.S. relations with China, Russia, Europe, and the BRICS.

nations. There is also growing instability with the U.S.’s two main trading partners Canada and Mexico. A return of Trump to power could have profound impacts on international trade and relations, geopolitics, and the global economy. Given Trump’s transactional approach to everything, his opening salvo may be just a negotiating tactic or a bluff. Irrespective, his statements are being treated seriously.

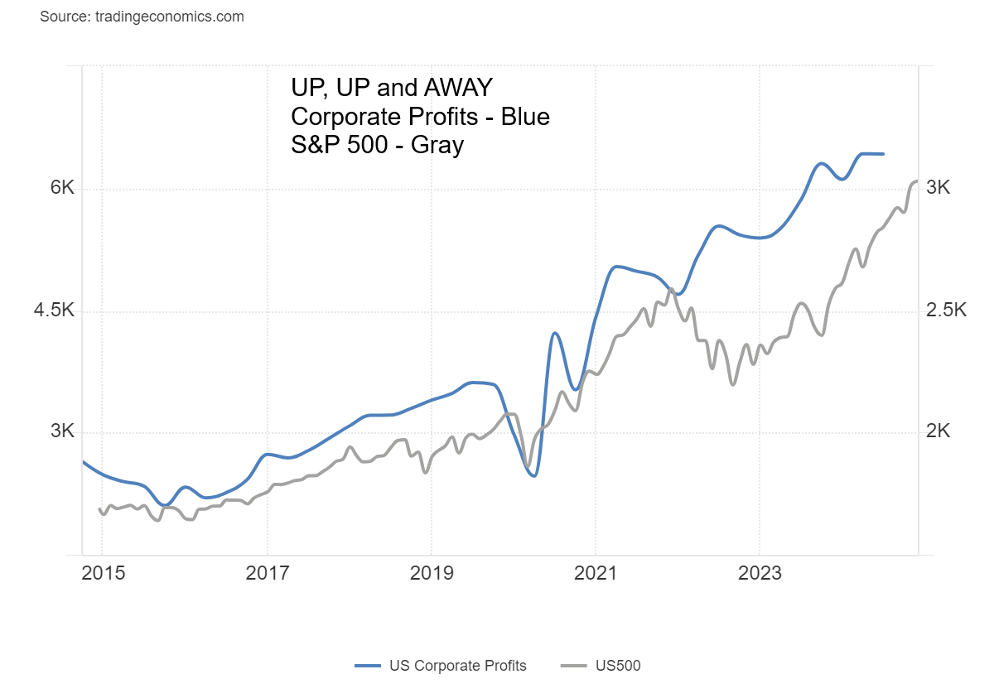

A second key theme involves Big Tech. Big Tech has dominated the markets for the past decade, with the FAANGs and the MAG7 (Nvidia, Amazon, Apple, Google, Meta, Microsoft, and Tesla). The tech world is dominated by one man: Elon Musk, currently listed on Forbes’ real-time billionaires list with a net worth of an astounding $439.4 billion. If Musk were a country, he’d now rank 35th just under Bangladesh. Apple is listed as the largest company in the world with a market cap of $5.3 trillion. That would make Apple the third largest economy in the world, behind only the U.S. and China. With that kind of size, it buys influence. With Musk now entrenched in the Trump government, what does it mean for the tech world and the U.S.? Corporate profits have been rising for years.

With corporate profits rising largely in conjunction with the stock market, it is not unreasonable to think that the stock market could keep on rising in a melt-up. Proposed tax cuts could accelerate the process (and the profits). We know that this market is grossly overvalued. However, with the Fed cutting rates, that could help the stock market continue its record run. But will it? Into 2025 it could, but we continue to believe that cycles do work, and we have consistently cited a few of them coinciding over the next few years. These cycles could get underway in 2025, given our thoughts of chaos and volatility.

Source: www.tradingeconomics.com, www.bea.gov,

We know the last 72-year cycle (Merriman www.mmacycles.com) last bottomed in 2009, given it was 77 years from the 1932 stock market low. 2002 was 70 years, so it is possible it was a double bottom. But for our purposes, we’ll use 2009 as our low. Merriman has also cited the possibility of a 90-year cycle. If correct, it centers around 2022 but could in theory range from 2007 to 2037. We’re well past 2007, so the cycle low is still to come. It is highly unlikely that 2009 was both the 72-year and 90-year cycle low. We expect that we are currently embarking on a new 72-year cycle. As to the 90-year cycle, it has had only two observations since the late 18th century. The first was in 1843, then roughly 90 years later in 1932. Both were major economic depressions, the former known as the Hungry Forties and the latter as the Great Depression.

The 72-year cycle breaks down into four 18-year cycles. From 2009 that makes the center of the next 18-year cycle low in 2027 with a range of 15–21 years or 2024 to 2030. The 18-year cycle breaks down into three 6-year cycles with a range of 5–7 years. On that basis, we saw a cycle low in 2015–2016 and then again in 2022. The next one is due 2027–2029. Finally, they also talk of a 4-year cycle with a range of 3–5 years. We did see a low in late 2011 which would be short from the early 2009 low, then a low in 2015/2016 followed by a low in 2020. The next one is due from 2023 to 2025. The one following would be in 2028–2030.

As you can see, all these cycles, 90, 18, 6, and 4 are collecting and overlapping in the upcoming period. The odds then favour the upcoming period, given that everything going on behind could be volatile and we see a significant stock market low, if not in 2025, then sometime later in the decade.

Source: www.stockcharts.com

What about gold? Gold does not have the free trading history that the stock market has; therefore, a history of cycles is still developing. Here Merriman emphasizes what he sees as a 7.83-year cycle. From that important low in 1976 we did see important lows in 1985, 1993, 2001, 2008, and 2015. Following the 2015 low, the next 7.83-year cycle low would be due in 2023. We had what has proven to be an important low in November 2022. Could that have been our 7.83-year cycle low? The range would be 7–9 years. If that’s correct, then we know we are in the up phase of the current 7.83-year cycle. That cycle breaks down into three 31.3-month cycles or two 47-month cycles. If it is the 31.3-month cycle, it is due in 2025 centered around June. That suggests to us that the next peak, whenever that comes, could be our temporary top. Once the next 31.3-month cycle low is determined, we should embark on the next upmove. We continue to have targets up to $3,600.

Overall, our expectations for gold in 2025 are positive, but it will not be a straight-up move. The 10-year cycle for gold is not much help as we have yet to find any consistency. The record is three up and two down with the two down years coming in 1975 and 2015. We remain concerned that silver continues to lag as do the gold stocks, as represented by the Gold Bugs Index (HUI) and the TSX Gold Index (TGD). Silver is currently down about 36% from its all-time high. The HUI remains down over 50% from its all-time high and the TGD is still down around 18% from its all-time high.

We mustn’t ignore junior mining stocks including the junior gold mining stocks. The TSX Venture Exchange (CDNX) which is made up of roughly 50% junior mining companies remains down an astounding 82% from its all-time high seen in 2007. The CDNX is even down 45% from its 2021 high. Junior miners are unloved and under-owned at least by anybody who is not an insider or billionaire Eric Sprott. The current period reminds us of the late 1990s when tech was all the rage and junior mining stocks were unloved and under-owned. By 2000 the rebound was underway and the next seven years saw the CDNX rise 433% from its humble beginnings in 1999. We thought at the time that they would become the next big thing when we witnessed junior miners turning into tech companies. As we know, tech crashed while commodities and commodity stocks rose.

10-Year Gold Cycle

Annual % Change in Gold

Year of Decade

|

Decades |

1st |

2nd |

3rd |

4th |

5th |

6th |

7th |

8th |

9th |

10th |

|

1961–70 |

|

|

|

|

|

|

-0.5 |

10.7 |

6.2 |

-8.9 |

|

1971–80 |

16.5 |

48.9 |

75.6 |

60.6 |

-23.3 |

-3.8 |

23.4 |

36.5 |

134.8 |

10.9 |

|

1981–90 |

-32.5 |

12.7 |

-14.4 |

-20.0 |

6.9 |

23.1 |

20.1 |

-15.7 |

-1.8 |

-1.6 |

|

1991–00 |

-10.6 |

-5.9 |

17.6 |

-1.9 |

1.0 |

-4.9 |

-21.5 |

-0.2 |

0.1 |

-6.0 |

|

2001–10 |

2.6 |

24.8 |

flat |

25.6 |

18.2 |

22.8 |

31.4 |

5.8 |

23.9 |

29.8 |

|

2011–20 |

10.2 |

7.0 |

-28.2 |

-1.5 |

-10.4 |

8.6 |

13.7 |

-2.1 |

18.9 |

24.4 |

|

2021–30 |

-3.5 |

-0.1 |

13.5 |

29.2* |

|

|

|

|

|

|

|

|

3 up 3 dn |

4 up 2 dn |

4 up 2 dn |

3 up 3 dn |

3 up 2 dn |

3 up 2 dn |

4 up 2 dn |

3 up 3 dn |

5 up 1 dn |

3 up 3 dn |

Source: www.stockcharts.com

* To date

Source: www.stockcharts.com

Gold has a history of inversely trading with the US$ Index: if the US$ Index rises, gold weakens, and vice versa. Equities tend to be undervalued when the US$ Index is low and overvalued when the US$ Index is high. What’s intriguing here is that since the start of the US$ Index in the 1970s it has had three peaks: one coinciding with the Plaza Accord of 1985, designed to bring down the value of the U.S. dollar, the second at the peak of the tech/dot.com bubble, then triggered lower by the events of 9/11, and the most recent high coinciding with a

potential peak of the MAG7 bubble. Each subsequent high has been lower. What this chart suggests is that the odds favour the next move for the US$ Index going down. That in turn would be positive for gold.

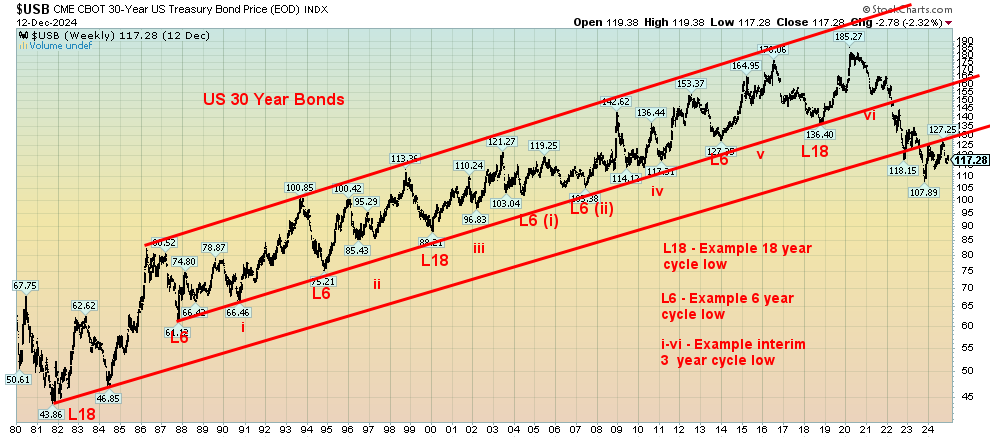

U.S. 30-year bonds 1980–2024

Source: www.stockcharts.com

This is our best picture of bond prices over a 40-year + period. We have delineated for them 18-year and 6-year cycle lows. They are consistent. Given the last 18-year cycle low was in 2018, the odds seem to favour that the low seen in 2023 was our 6-year cycle low (range 5–7 years). While there is a strong possibility the 6-year low is in, we don’t believe bonds will see much upward movement in the next up phase. The 30-year is constrained by the line up from the 1981 low currently near 130 and further resistance up to 135. The next three-year cycle low would be due in 2026. That suggests we should see some upward movement in price (yields move inversely to price down) in 2025. Our expectations are topped by the resistance zones above. We’d have to get through 140 to suggest a test up to 160.

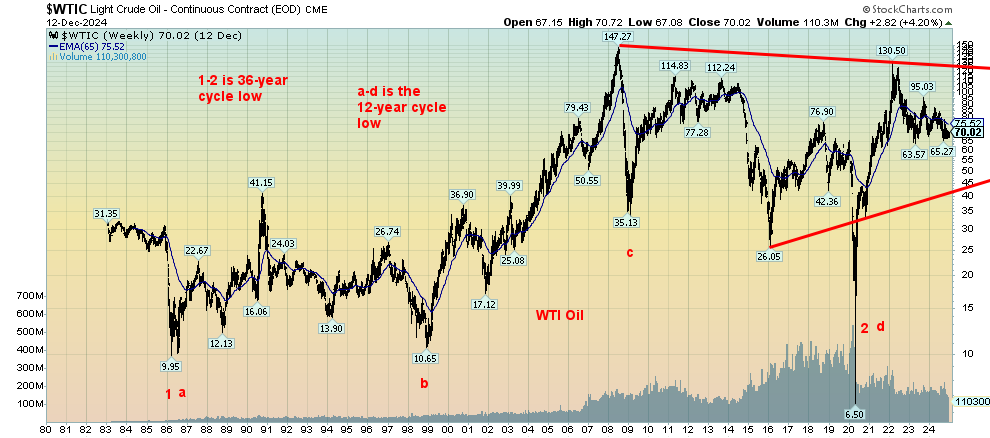

According to Merriman, oil cycles are a little different. As with gold, there is a lack of history, mostly because oil prices never really started showing periods of strong ups and downs until the onset of the Arab oil embargo in 1973. After that initial burst, which topped with the Iranian hostage crisis in 1980, oil has had some cycles that appear to have become noticeable. The long one is a 36-year cycle which bottomed in 1986, then again with the 2020 pandemic low (34 years). The 36-year cycle breaks down into either two 18-year cycles or, as appears to be the case, three 12-year cycles. After the 1986 low came the low in 1998 (12 years), 2009 (11 years), and 2020 (11 years).

WTI Oil 1982–2024

Source: www.stockcharts.com

If that’s correct, then the next 36-year cycle low is not due until well into the future in 2056 and the next 12-year low is due around 1932. The interim short-term cycle appears to be either four 3-year cycle lows or three 4-year cycle lows. If that’s correct, the 3-year cycle appears to work and there was a low in 2023. The next one is due in 2026. But oil is still struggling to rise here. There is plentiful oil around and demand remains soft, so the only major catalyst is geopolitical concerns. The war that would involve Iran and the Straits of Hormuz would be the catalyst.

2025 is shaping up to be dominated by Trump. He was recently noted as Time’s Person of the Year. It’s his second time. Time’s Person of the Year is someone who has dominated the news over the past year. We note that both Hitler and Stalin were also Time’s Person of the Year on two occasions. “The Grifter”, as he is sometimes known, could bring us two devastating events. The first is tariffs. If they are implemented, they could have huge negative impacts on both the U.S. and world trade. The second is the threat to deport illegal immigrants and, through the DOGE, downsize the government. Both would also have negative impacts on the economy. All this points to what we have said: 2025 could be a year of chaos and volatility.

Copyright David Chapman 2024

Markets & Trends

|

|

|

|

% Gains (Losses) Trends |

|

||||

|

|

Close Dec 31/23 |

Close Dec 13, 2024 |

Week |

YTD |

Daily (Short Term) |

Weekly (Intermediate) |

Monthly (Long Term) |

|

|

Stock Market Indices |

|

|

|

|

|

|

|

|

|

S&P 500 |

4,769.83 |

6,051.09 |

(0.6)% |

26.9% |

up |

up |

up |

|

|

Dow Jones Industrials |

37,689.54 |

43,828.06 |

(1.9)% |

16.3% |

up |

up |

up |

|

|

Dow Jones Transport |

15,898.85 |

16,711.43 |

(1.0)% |

5.1% |

up |

up |

up |

|

|

NASDAQ |

15,011.35 |

19,926.72 (new highs)* |

0.3% |

32.7% |

up |

up |

up |

|

|

S&P/TSX Composite |

20,958.54 |

25,274.30 (new highs)* |

(1.6)% |

20.6% |

up |

up |

up |

|

|

S&P/TSX Venture (CDNX) |

552.90 |

607.84 |

(0.4)% |

9.9% |

neutral |

up |

down (weak) |

|

|

S&P 600 (small) |

1,318.26 |

1,488.63 |

(1.5)% |

12.9% |

up |

up |

up |

|

|

MSCI World |

2,260.96 |

2,373.63 |

(1.4)% |

5.0% |

neutral |

neutral |

up (weak) |

|

|

Bitcoin |

41,987.29 |

101,544.10 |

0.2% |

141.8% |

up |

up |

up |

|

|

|

|

|

|

|

|

|

|

|

|

Gold Mining Stock Indices |

|

|

|

|

|

|

|

|

|

Gold Bugs Index (HUI) |

243.31 |

297.79 |

0.5% |

22.4% |

down |

up |

up |

|

|

TSX Gold Index (TGD) |

284.56 |

356.53 |

0.3% |

25.3% |

down (weak) |

up |

up |

|

|

|

|

|

|

|

|

|

|

|

|

% |

|

|

|

|

|

|

|

|

|

U.S. 10-Year Treasury Bond yield |

3.87% |

4.40% |

5.5% |

13.7% |

|

|

|

|

|

Cdn. 10-Year Bond CGB yield |

3.11% |

3.20% |

6.7% |

3.0% |

|

|

|

|

|

Recession Watch Spreads |

|

|

|

|

|

|

|

|

|

U.S. 2-year 10-year Treasury spread |

(0.38)% |

0.15 |

150.0% |

139.5% |

|

|

|

|

|

Cdn 2-year 10-year CGB spread |

(0.78)% |

0.16% |

77.8% |

120.5% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Currencies |

|

|

|

|

|

|

|

|

|

US$ Index |

101.03 |

106.98 |

0.9% |

5.9% |

up |

up |

up |

|

|

Canadian $ |

75.60 |

70.26 (new lows) |

(0.6)% |

(7.1)% |

down |

down |

down |

|

|

Euro |

110.36 |

105.00 |

(0.6)% |

(4.9)% |

down |

down |

down |

|

|

Swiss Franc |

118.84 |

112.03 |

(1.6)% |

(5.7)% |

down |

neutral |

up |

|

|

British Pound |

127.31 |

126.21 |

(0.9)% |

(0.9)% |

down |

down (weak) |

neutral |

|

|

Japanese Yen |

70.91 |

65.09 |

(2.4)% |

(8.2)% |

down (weak) |

neutral |

down |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Precious Metals |

|

|

|

|

|

|

|

|

|

Gold |

2,071.80 |

2,675.80 |

0.6% |

29.2% |

neutral |

up |

up |

|

|

Silver |

24.09 |

31.03 |

(1.8)% |

28.8% |

down |

up |

up |

|

|

Platinum |

1,023.20 |

924.30 |

(1.0)% |

(9.7)% |

down |

down |

down (weak) |

|

|

|

|

|

|

|

|

|

|

|

|

Base Metals |

|

|

|

|

|

|

|

|

|

Palladium |

1,140.20 |

961.70 |

(0.4)% |

(15.7)% |

down |

neutral |

down |

|

|

Copper |

3.89 |

4.20 |

flat |

8.0% |

down (weak) |

down (weak) |

up (weak) |

|

|

|

|

|

|

|

|

|

|

|

|

Energy |

|

|

|

|

|

|

|

|

|

WTI Oil |

71.70 |

71.29 |

6.1% |

(0.7)% |

up |

down |

down |

|

|

Nat Gas |

2.56 |

3.28 |

6.5% |

28.1% |

up |

up |

down (weak) |

|

Source: www.stockcharts.com

* New All-Time Highs

Note: For an explanation of the trends, see the glossary at the end of this article.

New highs/lows refer to new 52-week highs/lows and, in some cases, all-time highs.

GLOSSARY

Trends

Daily – Short-term trend (For swing traders)

Weekly – Intermediate-term trend (For long-term trend followers)

Monthly – Long-term secular trend (For long-term trend followers)

Up – The trend is up.

Down – The trend is down

Neutral – Indicators are mostly neutral. A trend change might be in the offing.

Weak – The trend is still up or down but it is weakening. It is also a sign that the trend might change.

Topping – Indicators are suggesting that while the trend remains up there are considerable signs that suggest that the market is topping.

Bottoming – Indicators are suggesting that while the trend is down there are considerable signs that suggest that the market is bottoming.

Disclaimer

David Chapman is not a registered advisory service and is not an exempt market dealer (EMD) nor a licensed financial advisor. He does not and cannot give individualised market advice. David Chapman has worked in the financial industry for over 40 years including large financial corporations, banks, and investment dealers. The information in this newsletter is intended only for informational and educational purposes. It should not be construed as an offer, a solicitation of an offer or sale of any security. Every effort is made to provide accurate and complete information. However, we cannot guarantee that there will be no errors. We make no claims, promises or guarantees about the accuracy, completeness, or adequacy of the contents of this commentary and expressly disclaim liability for errors and omissions in the contents of this commentary. David Chapman will always use his best efforts to ensure the accuracy and timeliness of all information. The reader assumes all risk when trading in securities and David Chapman advises consulting a licensed professional financial advisor or portfolio manager such as Enriched Investing Incorporated before proceeding with any trade or idea presented in this newsletter. David Chapman may own shares in companies mentioned in this newsletter. Before making an investment, prospective investors should review each security’s offering documents which summarize the objectives, fees, expenses and associated risks. David Chapman shares his ideas and opinions for informational and educational purposes only and expects the reader to perform due diligence before considering a position in any security. That includes consulting with your own licensed professional financial advisor such as Enriched Investing Incorporated. Performance is not guaranteed, values change frequently, and past performance may not be repeated.

Read the full article here

Leave a Reply