Is the U.S., and by extension the rest of the world, headed for a monumental collapse? After all empires come and go, and the list is long of collapsed empires over the centuries – Greece, Rome, Byzantine, Spain, France, Great Britain, USSR, plus others all exhibited similar characteristics before their collapse. For some, it resulted in a diminished role in the world. For others, it ended in revolution or civil war and the rise of an autocracy. We have a look at some of these characteristics and how we are marching towards our own demise, a process that can only be stopped by major reform, or it will end in revolution or civil war, as it has before.

The Fed cut interest rates as expected this past week. We look at the fallout of the rate cut as our chart of the week. The Fed expressed some reservations as to whether a rate cut could occur at the December FOMC.

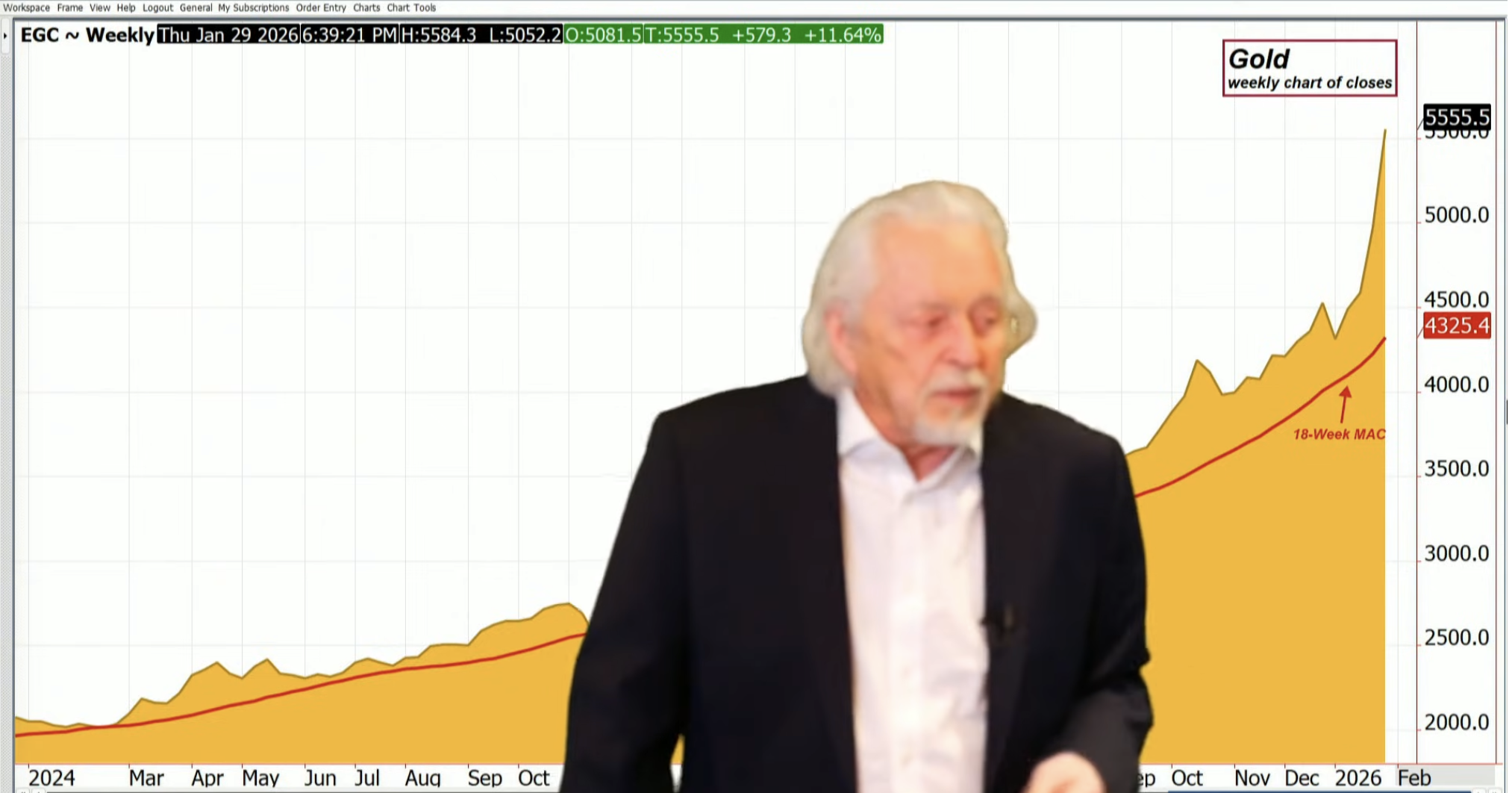

Once again, the stock market rose to new all-time highs, led as usual the MAG7. It’s a bubble that seems to have no end. But a rising stock market masks deterioration in the broader economy. Gold continued its recent wobble. It was overdue, and it raised our expectations of a low in the November/December period. If correct, this pullback should be a buying opportunity. Oil prices pulled back after jumping the previous week. The energy infrastructure and waste management company, Secure Waste Infrastructure Corp., recently reported increased EBITDA, pays a dividend, and is held in the Enriched Capital Conservative Growth Strategy.* Oil stocks remain compelling as we move into a positive seasonal period.

It’s November, and there is a chill in the air. Must mean winter is coming.

Have a great week!

DC

* Reference to the Enriched Capital Conservative Growth Strategy and its investments, celebrating a 7 ½ -year history of strong growth, is added by Margaret Samuel, President, CEO, and Portfolio Manager of Enriched Investing Incorporated, who can be reached at 416-203-3028 or [email protected]

“The four most dangerous words in investing are, it’s different this time.”

—Sir John Templeton, American-born British investor, banker, fund manager, and philanthropist, founder of The Templeton Growth Fund, 1954, pioneer of emerging market investing; 1912–2008

“The conventional view serves to protect us from the painful job of thinking.”

—John Kenneth Galbraith, Canadian-American economist, diplomat, public official, and intellectual, author of The New Industrialist State (1967) and many others, U.S. Ambassador to India 1961–1963, Deputy Director of the Office of Price Administration (OAP) during World War II; 1908–2006

“Gold is the money of kings, silver is the money of gentlemen, barter is the money of peasants – but debt is the money of slaves.”

—Norm Franz, American biblical economist, author of Money & Wealth in the New Millennium: A Prophetic Guide to the New World Economic Order (2002), connector of the Bible and the economy; 1934–2024

Sir John Templeton’s words were always prophetic. Economists Carmen Reinhart and Kenneth Rogoff used the words for the title of their book, This Time is Different: Eight Centuries of Financial Folly (2009). Their book covered 66 countries across five continents and eight centuries. The book is a comprehensive look at financial crisis – including government defaults, banking panics, inflationary spikes from medieval currency debasement to the subprime disaster and financial crisis of 2008. The book might be a slog for many, but it remains one of the best empirical investigations of financial crisis ever published, according to Niall Ferguson, British-American historian and author of The Ascent of Money (2009) and many others.

Documenting the history of how empires rise and fall and how societies collapse has been studied by many. Books that come to mind include Collapse: How Societies Choose to Fail or Succeed (2005) by Jared Diamond and Failed States: The Abuse of Power and the Assault on Democracy (2006) by Noam Chomsky. But these are just two amongst many. One common thread is the ability to analyze the past in order to predict the future. But few pay attention to the past, with the result that the past repeats itself over and over again, and there is nothing we can do about it. It is a process leading to collapse, and few see it until it is staring us in the face.

So where are we today? It may surprise some that we appear to be well on our way to another collapse. It’s like the quote from Ernest Hemingway’s novel The Sun Also Rises (1926): “How does one go bankrupt? Two ways. Gradually, then suddenly.” There are common themes that play out that inevitably lead us to collapse, such as these, which we have gleaned from a number of sources:

- Inequality

- Military overextension

- Currency debasement and collapse

- Spiralling debt and fiscal crises

- Erosion of democracy and polarization

- Social decay

- Loss of productive capacity

- Sudden implosion

Today, we are seeing all of these things. Except we haven’t hit number 8 yet. It is impossible here to go into each one in detail, so we’ll give a brief description of each:

- Inequality. Of the G7 countries, the U.S. has the highest inequality for both income and wealth. Most inequality measurements note income inequality both before and after tax, but there are also measurements of wealth inequality. Today, the U.S. has greater inequality than in either the Gilded Age or the Roaring Twenties. Notably, both those eras ended in a stock market crash and an economic depression.

The Gini Coefficient is the most frequently used measurement. It has a range from 0 to 1, with 0 signifying absolute equality and 1 absolute inequality (one person has all the income/wealth). No one country has an absolute Gini. According to more recent numbers, the U.S. has a Gini Coefficient of 0.48 for income before tax, but it falls to around 0.39–0.41 after tax due to income redistribution policies. The remaining G7 countries have an income Gini over 0.4 but below the U.S. After tax, their Gini falls much further due to stronger income redistribution programs.

As to the wealth Gini, the U.S. has a Gini of 0.8–0.9, as 1% holds about one-third of the wealth while the bottom 50% has a tiny fraction of less than 1%. Noteworthy is Elon Musk with a net worth of $500.1 billion on Forbes’ real-time billionaire list (www.forbes.com/real-time-billionaires/#5c2c14e03d78). If Elon were a country, that would make him the 31st largest country in the world by GDP, behind Austria but ahead of Norway (www.statisticstimes.com/economy/projected-world-gdp-ranking.php).

- Military overextension. The U.S. has some 166 thousand troops stationed in 178 countries outside the U.S. By comparison, Great Britain at the height of its imperialism was stationed in only about 80 countries. Rome had military in roughly 40 modern countries today. The cost of military extension is extremely expensive. Officially, the U.S. defense budget is around $922 billion, more than the next 10 countries combined. In reality, its defense expenditures are most likely well past $1 trillion. Military overextension drained the treasuries of both Great Britain and Rome, helping to lead them to their eventual demise.

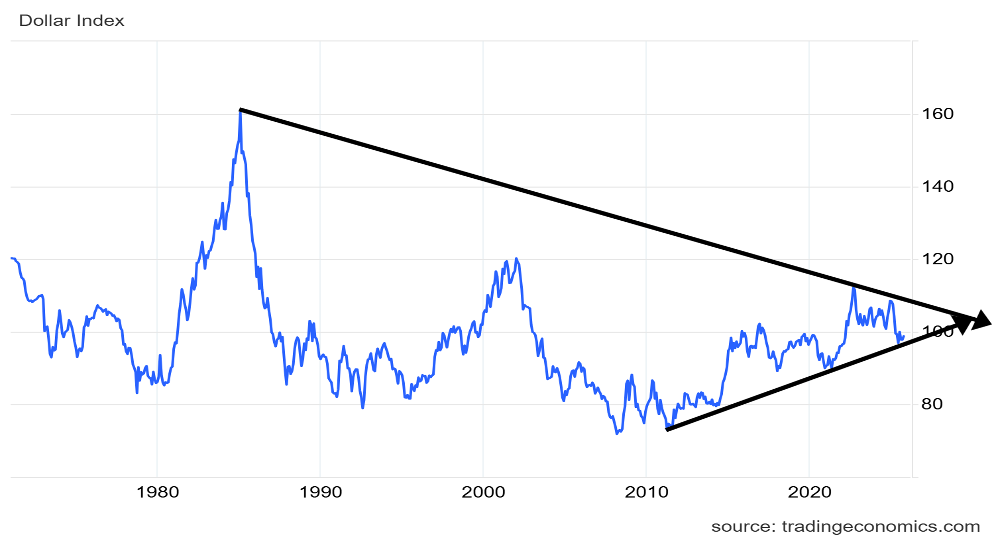

- Currency debasement and collapse. Since the U.S. took the world off the gold standard in August 1971, the US$ Index (or its equivalent) has fallen about 40%. In terms of purchasing power of gold, the U.S. dollar’s purchasing power has fallen roughly 99%. Currency debasement is not unusual. The Roman silver denarii started as pure silver. Starting with Nero in 64AD, the amount of silver was continuously debased until by the end of the 3rd century, there was hardly any silver left. Britain constantly devalued its pound. More recently, in 1957, one pound = US$2.79. Today, one pound = US$1.31, a decline of 53%.

Then there is BRICS (Brazil, Russia, India, China, South Africa) and its attempts to derail the U.S. dollar as the world’s reserve currency. BRICS, led by China and Russia, trades in yuan and rubles.

Saudi Arabia is poised to accept the yuan for oil. A number of countries have engaged in de-dollarization, reducing the use of and dependence on the U.S. dollar, including a number of Eurasian countries known as the “stans,” plus some in Africa.

BRICS nations’ central banks have been accumulating gold at a record pace, over 1,000 tonnes annually, in order to shore up their currencies and lessen the need for U.S. dollar reserves. The BRICS nations, already at 10 members, are looking to expand further. Financial hubs dealing in yuan are expanding. The yuan’s share of global reserves is growing, as is its share of world trade. That said, the U.S. dollar remains the reserve currency with over 70% of global FX trading and use in trade. However, its share of FX reserves in central banks has fallen under 60%. BRICS is building alternatives to the SWIFT payment system, the IMF (International Monetary Fund), the World Bank, and the International Development Bank (IDB) in order to get out from under U.S. global hegemony. Nonetheless, there is no sign that the U.S. is about to lose its reserve currency status. The U.S. dollar may be falling, but the process takes decades.

US$ Index 1971–2025

Source: www.tradingeconomics.com,

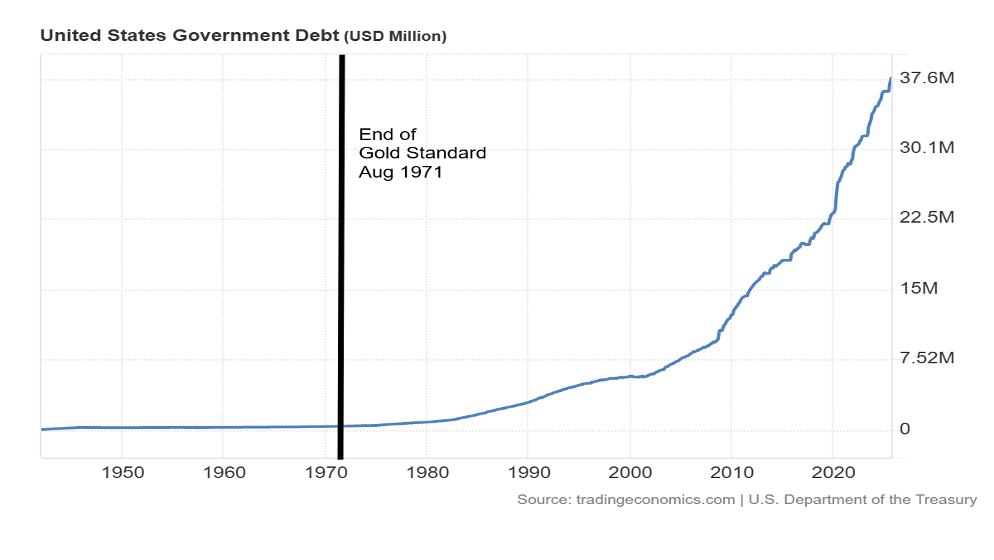

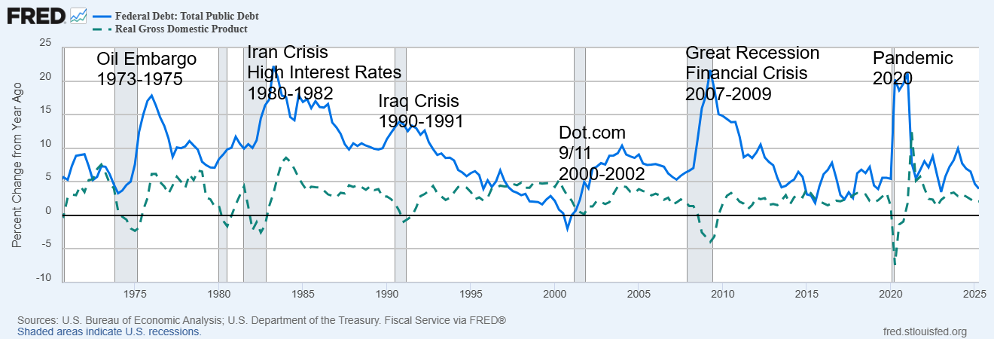

- Spiralling debt and fiscal crises. In August 1971, when Nixon took the world off the gold standard, U.S. debt totalled $412.3 billion. It took almost 200 years to get there. Since then, U.S. debt and global debt have exploded. Today, U.S. federal debt stands at $38 trillion, including $1.8 trillion alone since the end of Q2-2025. In other words, the U.S. adds more debt in a month than it took to build up after 200 years. Since 1971 the U.S. has had seven recessions: the 1974–1975 oil embargo; the 1980, then 1981–1982 recessions, sparked by the Iranian oil crisis and the tightening by the Fed to bring down high inflation; the early 1990s recession, sparked by the savings and loan crisis, the earlier stock market crash of 1987 and a spike in oil prices due to the Iraq war; the 2000–2002 recession and crisis, sparked by the collapse of the dot.com bubble and the September 11, 2001 (9/11) attacks; the Great Recession and financial crisis, sparked by the collapse of the sub-prime mortgage market that built up during the housing bubble; and the COVID recession, sparked by the pandemic. Starting from the 1987 stock market crash, the Federal Reserve’s route to prevent a financial crisis and depression has been to flood the system with liquidity (quantitative easing or QE) and lower interest rates sharply, particularly during the Great Recession and pandemic.

The result is that it takes more and more debt to purchase that $1 of GDP following each crisis. Are they running out of bullets? In 1971, the U.S. debt-to-GDP ratio was 36.6%. Today it is 124.3% and rising.

U.S. Debt 1942–2025

Source: www.tradingeconomics.com, www.home.treasury.gov

Total Debt, Real GDP Annual % Change 1970–2025

Source: www.stlouisfed.org

Almost consistently since 1970, U.S. federal debt growth has outpaced real GDP growth. It’s an unsustainable pace. It takes more and more debt to bail out the economy and purchase an additional $1 of GDP. The question is, when does a systemic debt crisis hit? The only way out is growth. Instead, they are headed in the opposite direction.

- Erosion of democracy and polarization. The U.S. has always had a level of polarization. After all, they fought a civil war over it (1861–1865). But the current polarization really started to get underway in the 1990s, accelerating after the 2000s and intensifying since 2016 and the first election of Donald Trump. Polarization centers around media, cultural identity, and institutions. Since the 2000s, there has been a steady erosion of democracy in the U.S., starting with the Supreme Court and the 2000 Bush/Gore election, the “hanging chads.” Adding to it were the events of 9/11, expanding executive power and surveillance, and the start of gerrymandering to give one party an advantage over the other. The erosion continued into the 2010s and culminated in the January 6, 2021, attack on the Capitol to prevent the certification of the 2020 election. Since the election of Donald Trump in 2024, the U.S. is undergoing a serious erosion in democracy as institutions are attacked – i.e., media, universities, science – plus attempts to influence elections and even hints that the 2026 midterms may never happen. The deportation program is seeing people snatched off the street, including women and children, and deported with no due process in law, some to countries with which they have no connection. Troops have been sent into Democratic cities to quell what they say is rampant crime, sparking confrontations on the street by residents against ICE and the DHS. The Economist lists the U.S. as a “flawed democracy.” In 2024, the last year The Economist published a democracy report, only 25 countries out of 167, or 15% were listed as full democracies.

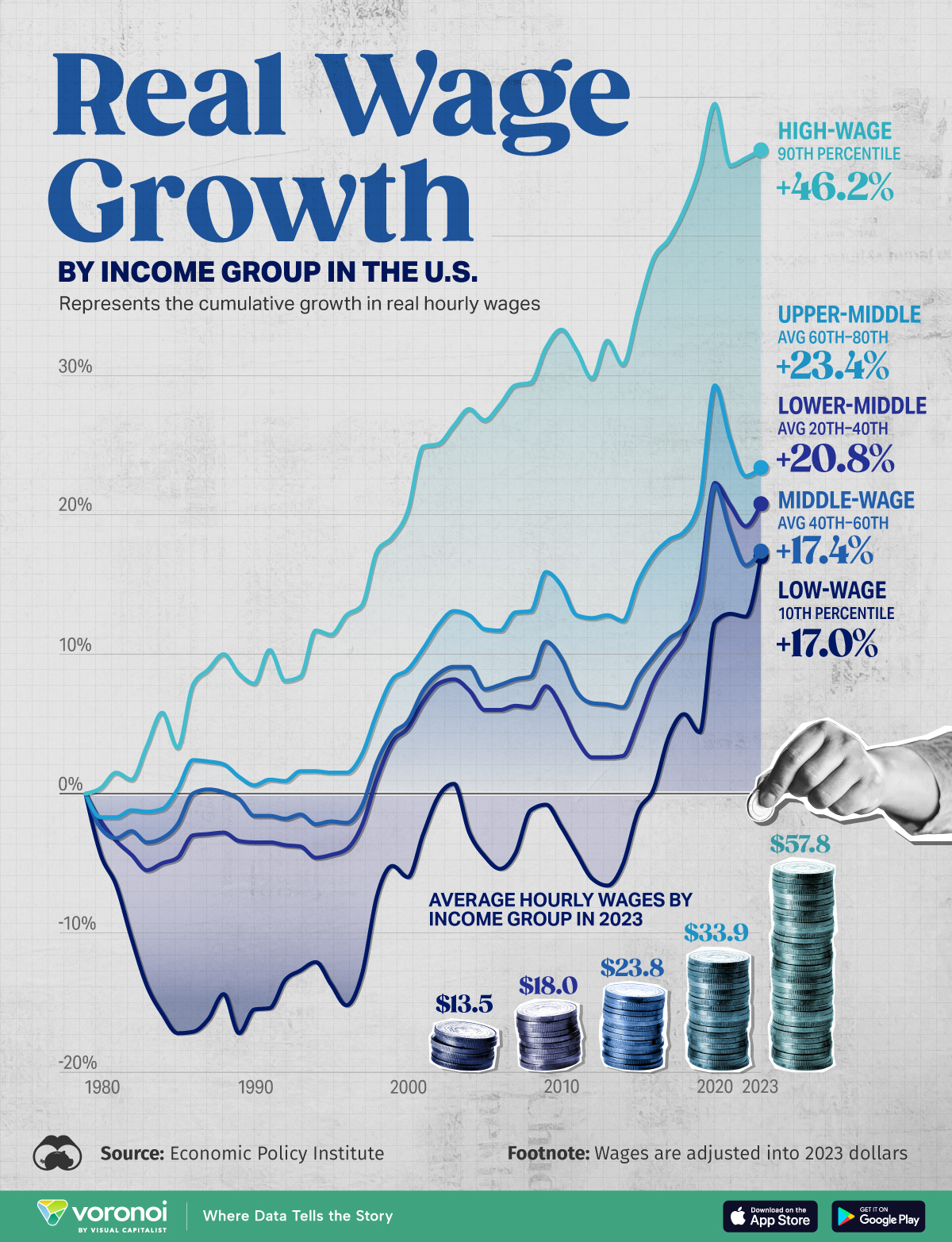

- Social decay. This manifests itself in many ways with the rise in abusiveness on the internet (social media) and polarization, a rise in loneliness due to single-person households, homelessness, drug overdoses, declining civic trust, declining marriage rates and rise of single-parent families, a rise in suicide rates, a rise in teen mental health issues, and a decline in memberships with civic organizations (i.e., church, voter turnout, clubs). We should add the decline of the middle class to the list. The collapse of the manufacturing sector, as it was offshored, led to hundreds of thousands of layoffs. These well-paying jobs were never recovered. Add in inflation, the bubble market in housing, stagnating wages, and many who would once have been considered middle class are just surviving.

Source: www.visualcapital.com

The chart above may be a couple of years old, but the concept is the same, as wages of the top 10% have grown 2.5 times faster than the bottom 60%. This has also contributed to growing income and wealth inequality. Today, the top 1% have an average of $19.6 million vs. the bottom 50% with an average wealth of $34.3. There are 23.8 million millionaires in the U.S., but 41.7 million collect food stamps. All this has contributed to social decay, particularly in the U.S.

- Loss of productive capacity. After World War I, the U.S. led the world in GDP, with a huge share of global manufacturing, rising real wages, a positive trade balance, and high-capacity utilization. Starting in the 1970s with the Arab oil embargo, things began to slide. As well, global competition from Germany, Japan, and East Asia began to challenge the U.S. at a number of levels. As a result, over time, manufacturing jobs disappeared, outsourced to Asia, Mexico, etc., capacity utilization, once over 90%, fell under 80%, and labour productivity growth slowed considerably. The U.S. outsourced its manufacturing to other countries, keeping the high-end stuff like marketing and finance – the Platform Economy. That resulted in growing wage gaps and major growth areas going into finance and real estate. The trade deficit rose sharply as the U.S. imported everything. Manufacturing as a share of GDP was 16% in 1997 and by 2007 had fallen to 11%. Manufacturing jobs have fallen 26% since 2000, and the U.S. workforce is lower today by about one million than in 2000, despite a sharp rise in population.

The U.S. is trying to rebuild productive capacity behind a wall of tariffs. Offshoring has gone on for years. It has hollowed out the middle class and middle-class jobs. Manufacturing doesn’t come back overnight and could take years to rebuild. There is a shortage of skilled labour, domestic supply chains are frayed, and there are limitations on permits and energy. Wall Street’s focus is on finance, not factories. Wall Street’s focus on earnings is not conducive to long-term industrial investment.

- Sudden implosion. “How does one go bankrupt? Two ways. Gradually, then suddenly.” We are still on the gradual part, but the implosion is getting closer in the form of another financial crisis. The capacity of the U.S. and the world to deal with another one on the scale of the 2008 financial crisis or worse is severely limited and constrained.

Against this backdrop, it seems incredible that the U.S. stock market keeps going up to record highs. If the stock market is the measurement for the success of the U.S., then it is being delivered in spades. Who cares about all the other problems? Billionaires get richer. The rest of the economy is in a slow collapse. Corporate earnings, an ongoing love affair with high-tech and AI, and an economy rolling over but not yet in a recession, are all contributing to the record move. It seems like a “what, me worry?” market. Obviously not.

Interest rates may be higher today, but in real terms, they are not so high that this sparks problems. Years of QE flooded the markets with oodles of liquidity. The money poured into the stock market. Financialization became “the thing.” Buy equities – who needs factories? A rising market fuels corporate buybacks, thus fueling the stock market even further. The rise in the stock market is primarily driven by a handful of stocks led by the MAG7, which now make up some 35% of the S&P 500 market cap. Troubles elsewhere in the world spark the movement of international flows into the U.S. as a safe haven. Cheap leverage obtainable by cheap money, the offshoring of production (cheap labour), and automation using emerging technologies (AI) are driving markets higher.

There are cracks. Market valuations are extremely high; we have narrow leadership (MAG7) and high PEs (price-to-earnings), with other measurements at or near record highs, signaling potential trouble ahead. Cracks are appearing in the commercial real estate market with empty office buildings, and subprime auto lenders are teetering. That could spark a financial crisis. Households are stretched, with credit card delinquencies rising along with mortgage defaults. Banks are upping their reserves for loan losses. Unemployment is rising, even as we are in the dark about where it is due to the shutdown of the U.S. government and the Bureau of Labor Statistics (BLS), which provides the data. That leaves everyone in the dark, especially the Fed.

The recent collapse of gold prices (down almost 11% from the highs), with silver and the gold stocks down even more, has raised some questions about what is going on. The current decline is the steepest so far for 2025. Gold is the safe haven. Is this just normal profit-taking following a huge run-up, or is something else going on? Some are speculating that the fall in gold prices reflects the potential for a liquidity crisis. As a result, we see selling to raise cash in the event of a possible crisis.

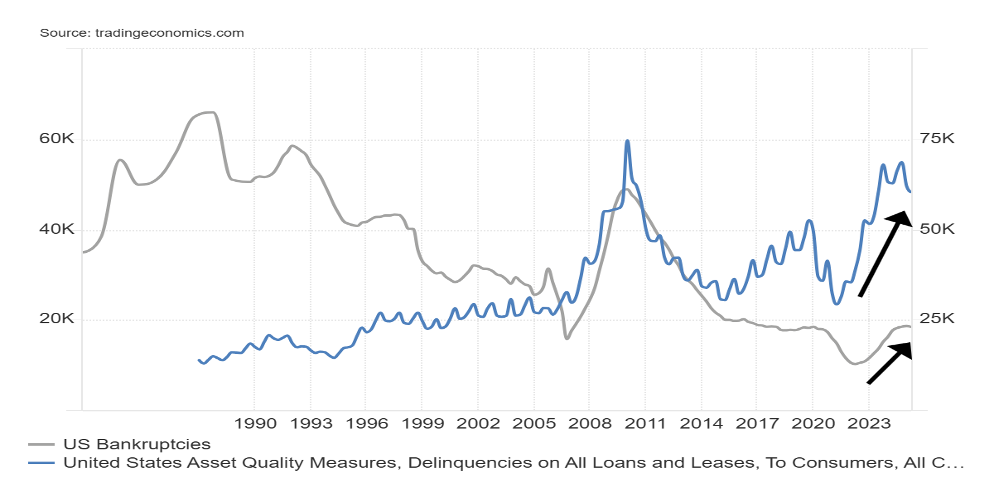

Company bankruptcies have been rising. No, they are not yet at levels seen during the savings and loan crisis of the late 1980s or the global financial crisis of 2007–2009. But is it the canary in the coal mine? Or as JP Morgan Chase CEO Jamie Dimon noted, if there is one cockroach, there are probably more.

U.S. Bankruptcies (companies only) 1980–2025, Delinquencies of Loans/Leases to Consumers 1988-2025

Source: www.tradingeconomics.com, www.uscourts.gov/topics/administrative-office-us-courts, www.federalreserve.gov

The chart above shows that delinquencies on loans/leases to commercial banks have reached levels seen at the time of the global financial crisis of 2008. And we are not yet in a recession. Commercial bankruptcies are rising, but not yet at levels seen during the global financial crisis of 2008 and the savings and loans crisis of the late 1980s.

Source: www.stockcharts.com

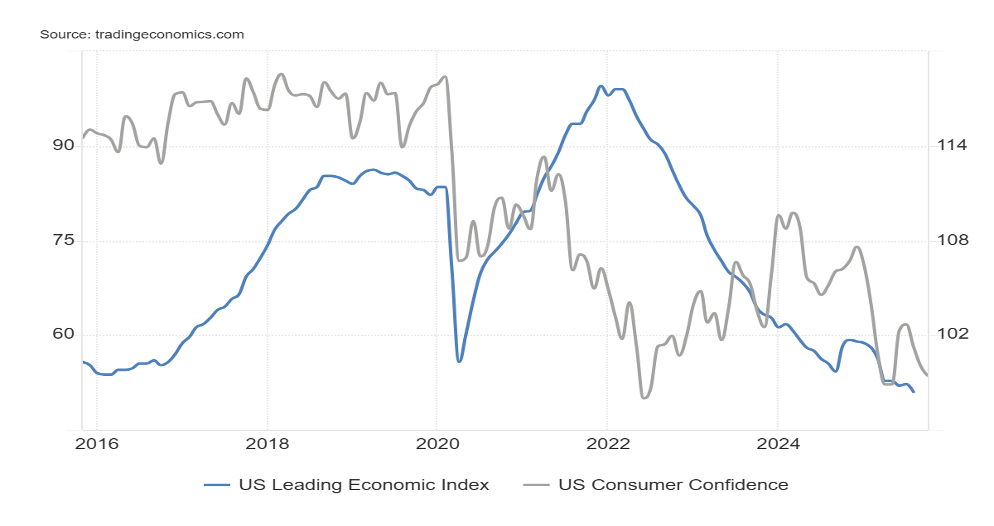

Bankruptcies are rising, delinquencies are rising, consumer confidence is falling, leading indicators are falling, inequality is growing (the rich get richer, while everyone else gets poorer), social decay is highly visible, democracy is teetering, and debt keeps on rising – but the stock market doesn’t care. Not yet, anyway.

As the chart shows, the U.S. Leading Economic Index (LEI) has been falling steadily since 2022, while consumer confidence is down around where it was during the 2008 financial crisis and the early 1980s recession.

U.S. Leading Economic Index (LEI), U.S. Consumer Confidence 2015–2025

Source: www.tradingeconomics.com, www.umich.edu, www.conference-board.org

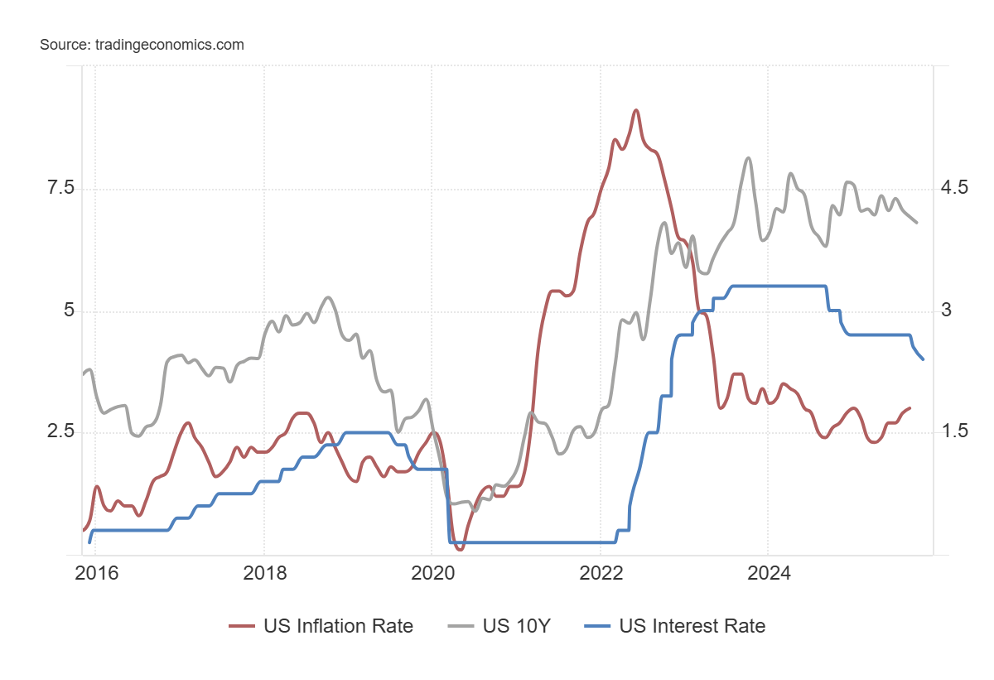

Chart of the Week

Source: www.tradingeconomics.com, www.federalreserve.gov, www.bls.gov

To nobody’s surprise, the Federal Reserve lowered the key Fed rate by 25bp at the recent FOMC meeting on October 29. The rate now stands at 3.75%–4.00%. The move followed the earlier lowering in September 2025. Canada’s Bank of Canada (BofC) also lowered its key bank rate to 2.25%, also lower by 25bp. In the U.S., the latest inflation rate was 3.00% and the 10-year U.S. Treasury note yield is 4.10% and rising.

What may have surprised everyone is that both the Fed (Jerome Powell) and the BofC (Tiff Macklem) noted that a December rate cut is not a foregone conclusion. Powell cited uncertainty surrounding trade and the lack of data, given the government shutdown. Macklem cited trade uncertainties. Notably, the FOMC was not all in agreement, and by lowering the rate only 25bp, it drew the ire of President Trump, who wants sharply lower rates. Once again, it raises the spectre of a Powell firing, even though Trump can’t do it and Powell’s term ends next May anyway.

Powell cited the lack of data as a serious concern. Powell did cite uncertainty in the jobs market, primarily as a result of Trump’s immigration crackdown. Add to that the recent sharp rise in announcements of layoffs.

Because of the government shutdown, at least 670 thousand federal workers will not get paid. The real number could be a lot higher, given that there are at least 2 million federal employees. Thousands more are deemed essential, and they won’t be paid either, nor will the military. Essential workers include air traffic controllers, who are already in chaos. There has been a sharp rise in essential workers phoning in sick. Against that, they are being threatened with firing. Chaos and uncertainty reign.

But it goes beyond government workers, including military, not being paid, as it is also negatively impacting food stamps that are about to expire, rising costs for health care, and cuts to Medicaid. Courts have ordered the reinstatement of food stamps on the program known as SNAP. Combine all that with mass layoffs of a number of firms, and the odds of an economic disaster rise. Against all that, Trump tears down the White House’s east wing to build a ballroom monument.

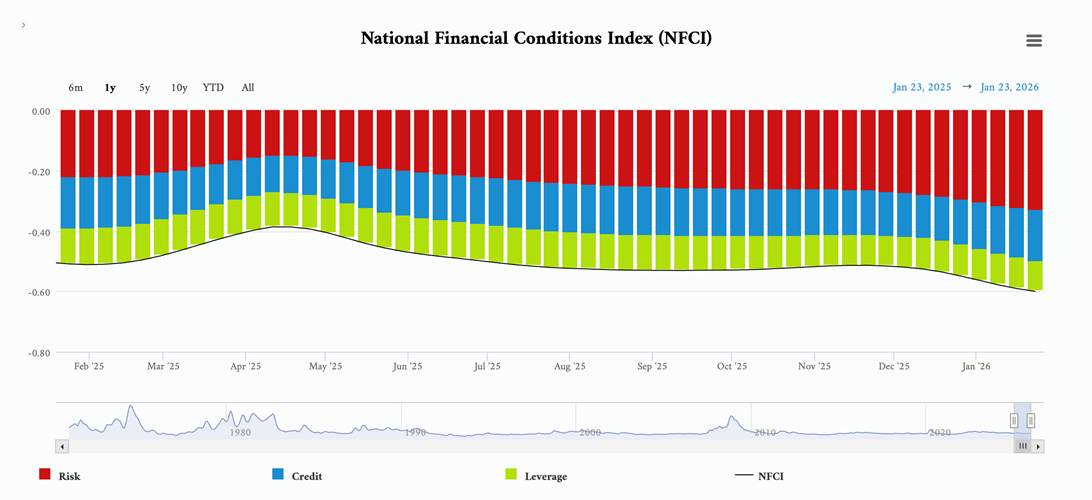

As well, we note that bank credit is tightening, and in response, the Fed is easing up on any further quantitative tightening (QT), which could lead to a rise in money supply and increase liquidity.

The stock market wobbled, bond yields ticked higher, gold wavered but rebounded, and the US$ Index rose. There is a disconnect between a darkening economic situation and declining consumer sentiment, but a rising stock market and creation of ballroom monuments.

Markets & Trends

Read the full article here

Leave a Reply