Peter appears on Triangle Investor Interviews to unpack the recent surge in precious metals and what it reveals about confidence in the U.S. dollar. He ties gold’s rapid advance to failures in fiscal and monetary policy, and he raises questions about the future of both tokenized assets and Bitcoin compared with real, physical bullion.

He starts by pointing to the dramatic price action in the metals and what that signals about public trust in policy makers and the Fed itself:

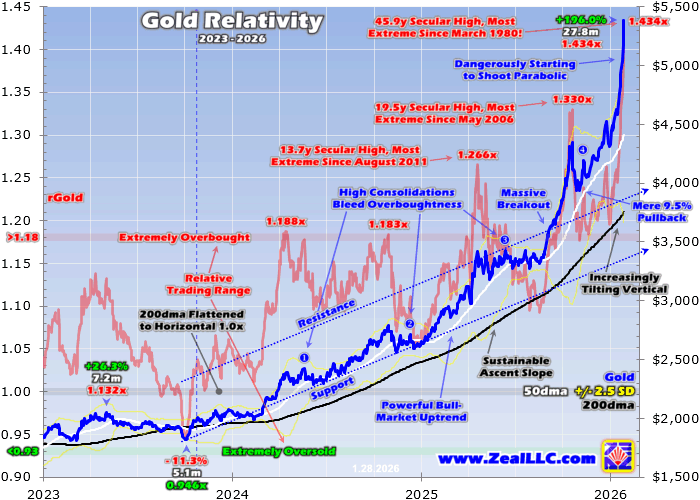

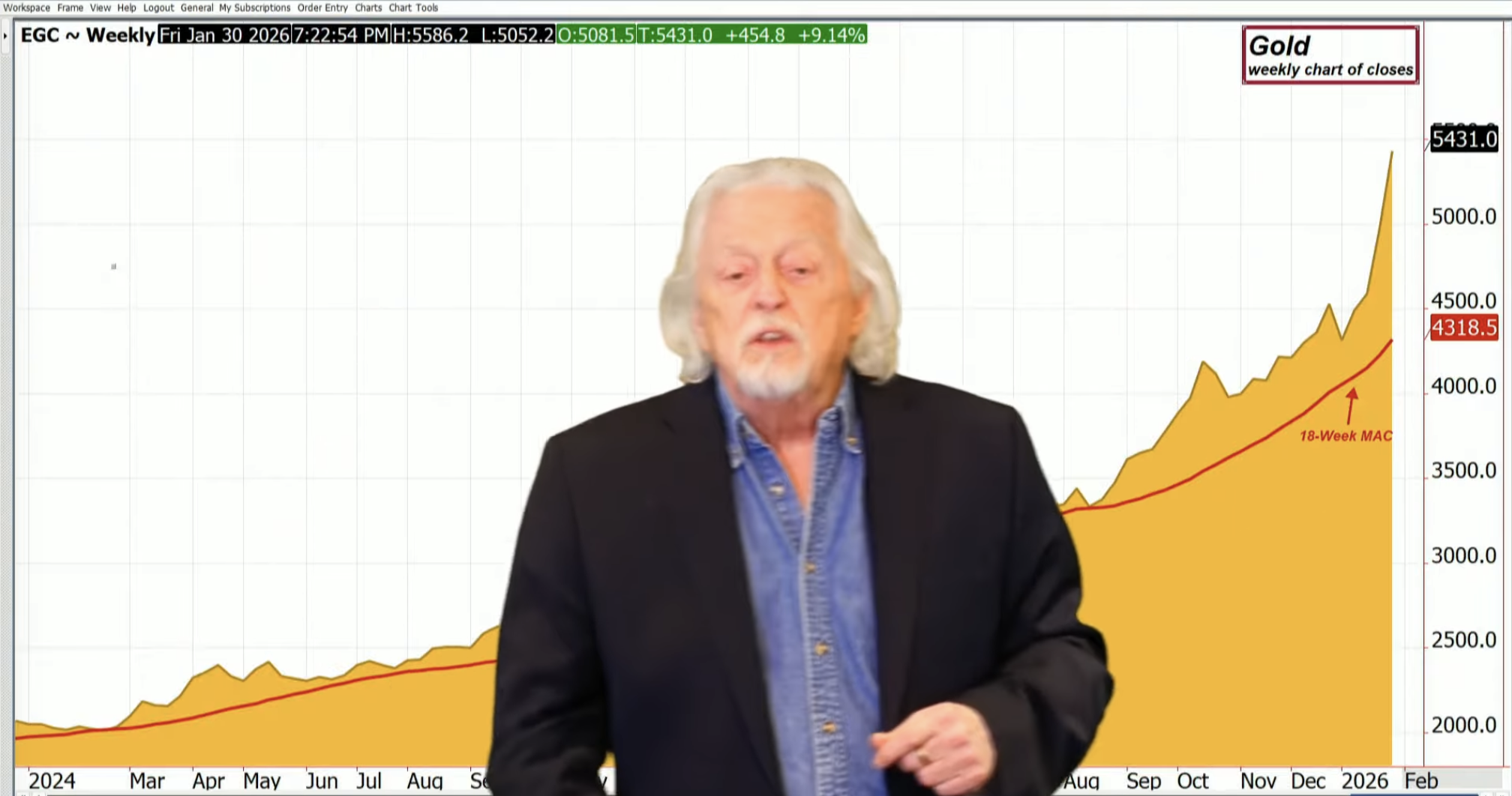

You’re seeing gold now is, you know, $150 away from $4,000 an ounce. I mean, that is a very significant move that we’ve seen in the price of gold in a short period of time. And silver, yeah, it’s back above $47, very close to its double top at 50. But I think that silver is going to go a lot higher than 50. But I think the move in gold is a lot more significant because I think it really indicates a complete loss of confidence in the United States in its fiscal policy, in its monetary policy, in the independence of the Fed.

He spends a moment separating useful digital tools from the actual asset that central banks prize, arguing that tokenized representations aren’t the same as ownership of vaulted metal:

Well, to the extent that central banks hold gold, I don’t think they’re going to hold tokenized gold. They’re going to hold actual gold that they have in their vaults. But I do think that tokenization could be helpful as far as enabling individuals and institutions to more easily transact with each other in gold. If I have a gold token that can move along a blockchain, then it’s very easy for me to transfer ownership of my gold. I don’t have to ship you the gold.

On Bitcoin, Peter pushes back on the common measure of success against fiat currencies and insists on comparing crypto to gold if it claims to be a digital substitute. By that yardstick, Bitcoin has lost ground:

In fact, if you look at where gold was at its peak in 2021, four years ago, late 2021, Bitcoin was worth more than it is today in terms of gold by about maybe 18%. So that’s a pretty significant decline in the real value of Bitcoin measured against gold because Bitcoin is marketed as a digital version of gold. So I think if you want to see how Bitcoin is doing, it’s best to measure it against gold versus measuring it against the dollar or any other fiat currency because it’s supposedly not a fiat currency. It’s being marketed as a digital alternative to gold. So gold is probably the best way to measure it. And it’s down considerably over four years.

He takes a practical view on silver’s prospects and who will actually adopt it. Silver’s physical bulk matters for big institutions, while retail demand could drive higher prices:

Yeah, I don’t know that the central banks are going to get into silver. Just it’s pretty bulky, you know, but I think the retail public will. I mean, they say silver is the poor man’s gold. This whole rally has really been powered by central banks. But when it broadens and you do have more of a retail component, you know, I have a gold company Shift Gold and our sales have been pretty lackluster over the last couple of years, despite this record rise in the price of gold.

Peter is blunt about why the dollar’s reserve role is under threat—policy choices that allow the U.S. to freeze other countries’ dollar access change how prudent nations view holding dollars:

Well, I think the dollar is in the process of losing that status now. That’s what we’re witnessing. And, you know, it’s a consequence of the policies that we’ve pursued. I mean, particularly the Joe Biden sanctions against Russia. That really highlighted the risk to other countries of holding dollars as their primary reserve, because it could be yanked out from under them at the whim of an American president.

He closes by reminding listeners that most Americans will not notice exchange-rate moves until they hit their wallets, and that a weaker dollar compounded by tariffs will raise domestic prices for goods we import:

But the average American isn’t paying attention to how many euros or how many yen he can buy with his dollar. I mean, unless he’s planning a vacation in Europe, he doesn’t really pay attention. But the exchange rate of the dollar determines what we pay for our imports. And if the dollar really tanks, then everything is going to cost a lot more. That’s on top of the tariffs that we’re paying now because of Trump.

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Read the full article here

Leave a Reply