The purpose of this Precious Metals sector update is to make two points clear in as short order as possible. The first is to explain why gold’s current powerful uptrend, which began less than a year ago, has much further to run. The second is to demonstrate that silver’s corresponding powerful uptrend has barely begun yet and that therefore silver and silver investments are outstandingly attractive now with almost everything to go for and also to point out that the related imminent powerful uptrend in Precious Metals stocks has not even started yet, but is about to.

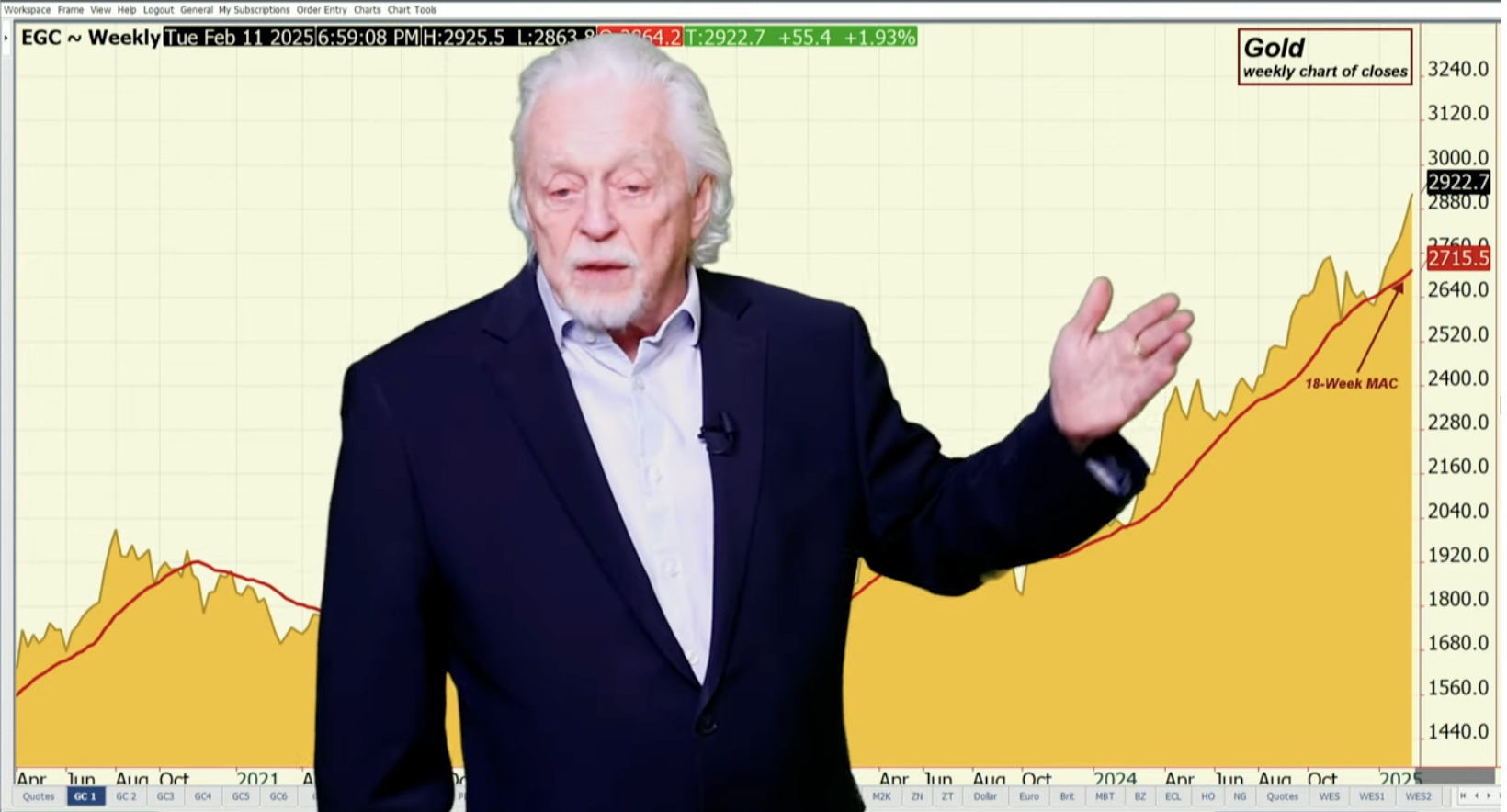

With regards to the first point, consider the following long-term arithmetic gold chart going back to the start of this millennium, i.e. to the start of the year 2000. It looks like gold has risen quite a lot over the past year, doesn’t it?…

Now look at a chart for the same time period on a log scale – see the difference. Compared to the Great 2000’s bull market in proportional terms, i.e. in percentage terms, gold has hardly risen at all over the past year. This means that this major uptrend is still in its early stages and has much, much further to go, hardly surprising considering that under a year ago it broke out of a massive 12-year-long consolidation pattern and it’s even less surprising when you also consider that with currencies collapsing due to Central Bank profligacy, we are headed in the direction of hyperinflation, which of course also means that the uptrend could accelerate dramatically to the upside.

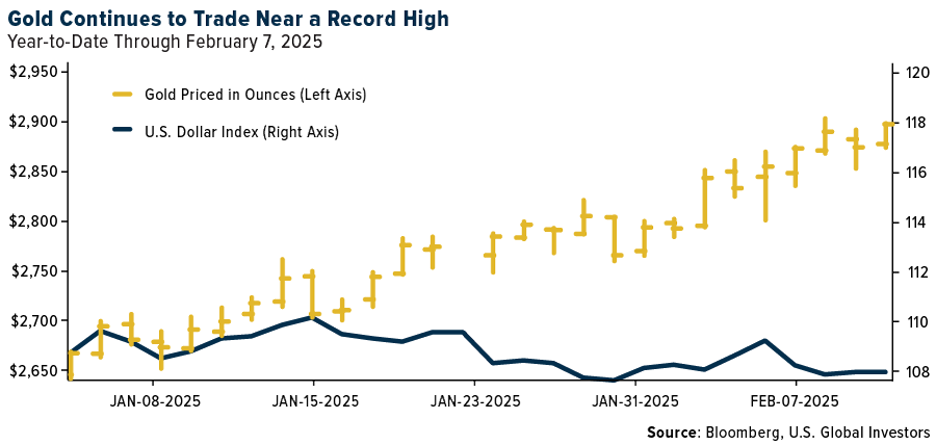

Now to the second point. We see on gold’s 6-year chart that, having broken out of the massive 12-year Cup & Handle consolidation pattern under a year ago, gold is now forging ahead within a powerful uptrend and we also see that it found support at the lower rail of this channel at the end of last year which launched it into the current upleg.

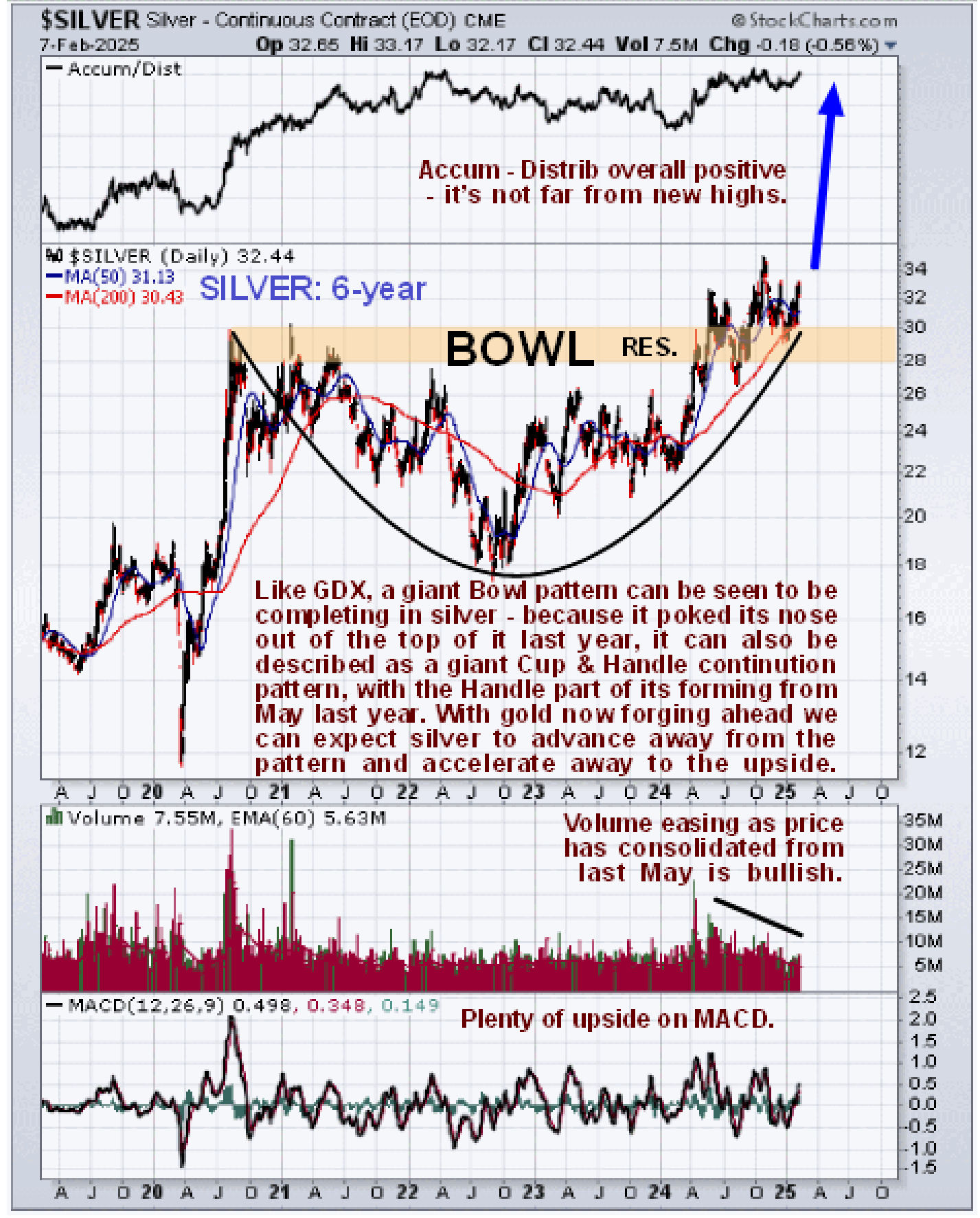

But what about silver? While gold has been romping ahead over the past year, silver has been “dragging its feet” and has scarcely gotten above its 2020 and 2021 highs, as we can see on its latest 6-year chart below. However, this is not a cause for concern for silver investors because, as we can see on the chart, it has just poked its nose out of the top of a big bullish Bowl pattern that has built out since mid-2020 that promises to slingshot silver initially to resistance at its 2011 highs at $50 and in any case it is perfectly normal for gold to take the lead during the early stages of a sector advance. We should also be cognizant of the fact that the sideways pattern that has formed in silver over the past 8 months or so with it perched just above the boundary of the Bowl may constitute the “Handle” of a big Cup & Handle consolidation pattern that has formed since mid-2020.

As for Precious Metals stocks, we know that they have been seriously underperforming gold for the past year, but again, we see on the 6-year chart for GDX that it is in the latest stages of a big Cup & Handle consolidation pattern that is remarkably similar to the one that has formed in silver over the same period, but in the case of GDX, it has yet to break out of it. The importance of this cannot be overstated – it means that with regards to Precious Metals stocks there is everything to go for once GDX breaks out the top of this big Bowl pattern it can be expected to slingshot higher resulting in spectacular gains in many PM stocks, especially in large and mid-cap stock in the early stages in the early stages of the runup.

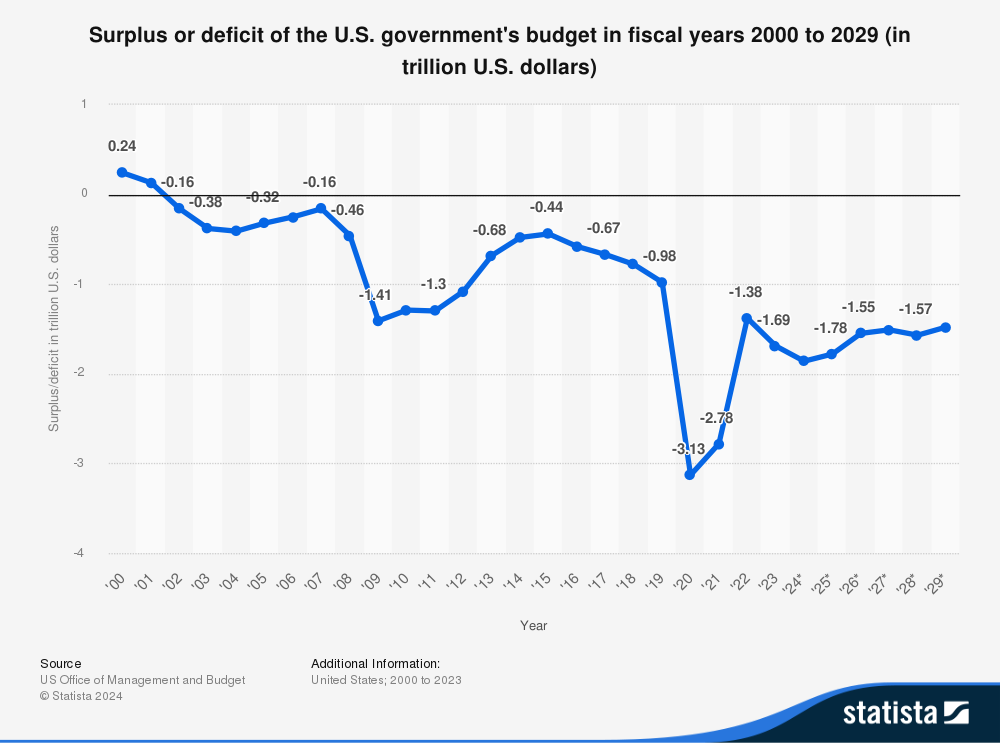

What about the argument and the fear that the stock market is going to crash and take down the PM sector with it? This is an argument that keeps replaying like one of those old 78 rpm records that are set to replay endlessly. It doesn’t look like it’s going to happen. Here’s why – roughly 90% of the stock market is now owned by the wealthiest 1 to 2% of the population who have the most political power and ability to exert influence. The system is therefore organized to protect their interests and the way it works is that the Fed creates new money in ever-increasing amounts to backstop the increasingly fragile debt market to stop it imploding and in this manner protect the stock market. The new money eventually feeds through into higher inflation so that the middle and lower classes end up footing the bill for it all. This is why we are headed for hyperinflation because the perpetuation of the current system best serves the interests of the ruling class for as long as possible.

The late December bottom in the Precious Metals sector was called exactly almost to the day in the article ROLL UP, ROLL UP FOLKS FOR THE GREAT END OF YEAR PRECIOUS METALS STOCKS CLEARANCE SALE.

Read the full article here

Leave a Reply