On Friday’s episode of The Peter Schiff Show, Peter dissects a strange Friday in which the headline non-farm payrolls report never arrived because of the government shutdown. He links the missing data to an alarming private-payroll print, explains why the stock market is celebrating weakness for the wrong reasons, and reminds listeners that gold — not a paper dollar — reveals the real erosion of purchasing power. He also calls out the coercive nature of regulatory threats that force companies into “voluntary” actions to avoid penalties.

He opens by pointing out the absurdity of a shutdown that doesn’t actually shut enough of the state, and the practical consequence: no official jobs number to force a conversation about the economy’s health:

So normally on the first Friday of a month, I would be talking about the non-farm payroll report, the jobs report. But I can’t talk about it because it wasn’t released. And the reason it wasn’t released, as I guess there’s nobody who showed up to work at the Bureau of Labor Statistics because of the government shutdown. Now you know, the main problem with the government shutdown is that they don’t shut enough of the government down.

He then contrasts the missing government numbers with the private payrolls service ADP, which shows a far weaker picture than the market or the administration would like. Peter uses this to argue that the economy may be deteriorating even before policymakers react:

So the expectation was for 50,000 jobs– pretty low bar. But not only did they not meet that bar, they were well beneath it because we actually lost 32,000 jobs, according to ADP, in September and worse. They went back to the prior month, which was originally reported as plus 54,000 jobs, and they revised that to a minus 3000. So that’s back to back negative numbers for ADP. Now the expectation for the government number was 50,000.

He notes how the missing official report serves the administration by sparing an awkward headline, and he explains why markets often interpret bad economic news as good: it increases the odds of easier monetary policy, which inflates asset prices even as it masks economic weakness:

So the Trump administration was spared the embarrassment of a horrible non-farm payroll report. Now, the market rallied anyway today. I don’t know what they would have done. It probably would have rallied because bad news is good news, right? Because it means we get bigger rate cuts. In fact, the Dow Jones closed at a new record high today above 47,000.

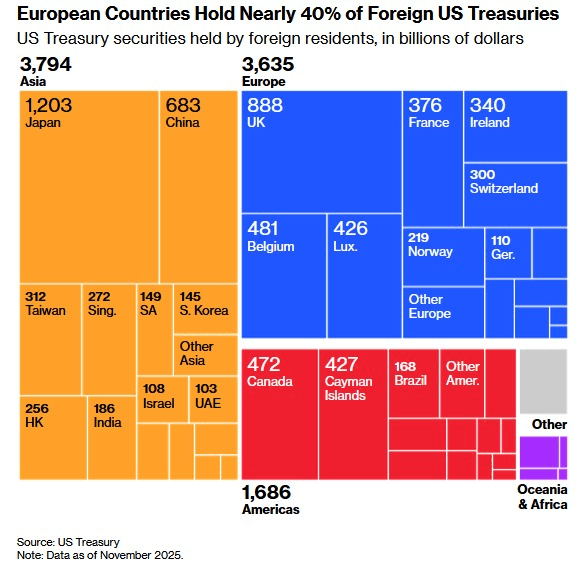

From an Austrian viewpoint, Peter reminds listeners that nominal stock indexes tell you nothing about real wealth when the currency itself is losing value. He urges people to look at gold as the true test of monetary reality, since the paper dollar is a government IOU, not real money:

See, that’s what the government wants you to believe, right? That’s part of the delusion of the drug of inflation, right? It’s not just a tax, it’s a drug. Look at the price of gold because that’s how you tell what’s real, right? What’s fake is the US dollar price because the dollar is just a piece of paper.

Peter then translates the stock market’s nominal gains into a gold-denominated context, showing how paper gains can be an illusion when compared to sound money. He highlights that the Dow’s apparent strength masks substantial losses in purchasing power measured in gold:

The Dow is worth 12 ounces of gold right now. It was worth, I think, 17 ounces of gold at the end of last year. So we’re down about 27% again. Yeah, 27% on the year, 27% priced in gold. If you go back two full years from the end of Q3, 2023 to the end of Q3, 2025, those two years, the price of gold actually doubled over those two years.

Finally, Peter turns to a specific example of how government power distorts markets: when regulators threaten tariffs or penalties, corporations “volunteer” to change behavior, but only after being coerced. He frames the Pfizer case as illustrative of how a supposed voluntary concession is actually compelled by a regulatory stick:

Now, since Pfizer has voluntarily agreed to these price reductions, it is exempt from those tariffs, at least for the next three years, right? Now, that doesn’t sound voluntary to me. The government says, we are going to hit you with this huge tax unless you agree to do this other thing. And you may not have done this other thing of your own volition. But if you do this other thing, then we’re not going to punish you with something even worse.

For Peter’s coverage of last week’s precious metals price surge, check out the latest Friday Gold Wrap!

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Read the full article here

Leave a Reply