The once-red-hot U.S. labor market is cooling at the edges. The Bureau of Labor Statistics’ latest Job Openings and Labor Turnover Survey (JOLTS), released July 29, shows total openings falling to 7.4 million in June—a 4.4 percent openings rate. Hiring was flat at 5.2 million, while total separations came in slightly lower at 5.1 million. The so-called “quits rate,” widely viewed as a gauge of worker confidence, held at 2.0 percent.

June’s soft underbelly was most visible in consumer-facing industries. Accommodation and food services alone shed 308,000 openings, health care lost 244,000, and finance and insurance trimmed 142,000. On the upside, retail trade added 190,000 vacancies, perhaps anticipating back-to-school spending, while the information sector posted a 67,000 gain. Hiring, however, failed to keep pace: arts, entertainment, and recreation reported 42,000 fewer hires, undercutting hopes for a robust summer season. Drilling into separations, professional and business services saw 114,000 fewer quits—evidence that workers are becoming less willing to risk job-hopping for higher wages.

Revisions to May’s data further cooled the narrative. The BLS trimmed prior estimates by 57,000 openings, 38,000 hires, and 29,000 separations; layoffs for May were revised up by 10,000. Such downward adjustments suggest the labor market may have been softer for longer than headline figures implied—a reminder that policymaking by rear-view mirror can be perilous. Mining and logging was one of the few industries to buck the layoff trend, adding 5,000 dismissals in June, while state-and-local government education recorded 39,000 fewer separations, reflecting the sector’s traditional employment stability.

Size didn’t matter much: establishments with fewer than ten employees and those with more than 5,000 saw little change in openings, hires, or separations. The hiring rate for the entire economy stayed stuck at 3.3 percent—comfortably below the 2019 average of 3.8 percent that prevailed before pandemic-era stimulus flooded the system. With the next JOLTS release slated for September 3, analysts will watch whether July’s numbers validate a slowdown or simply mark a summer lull.

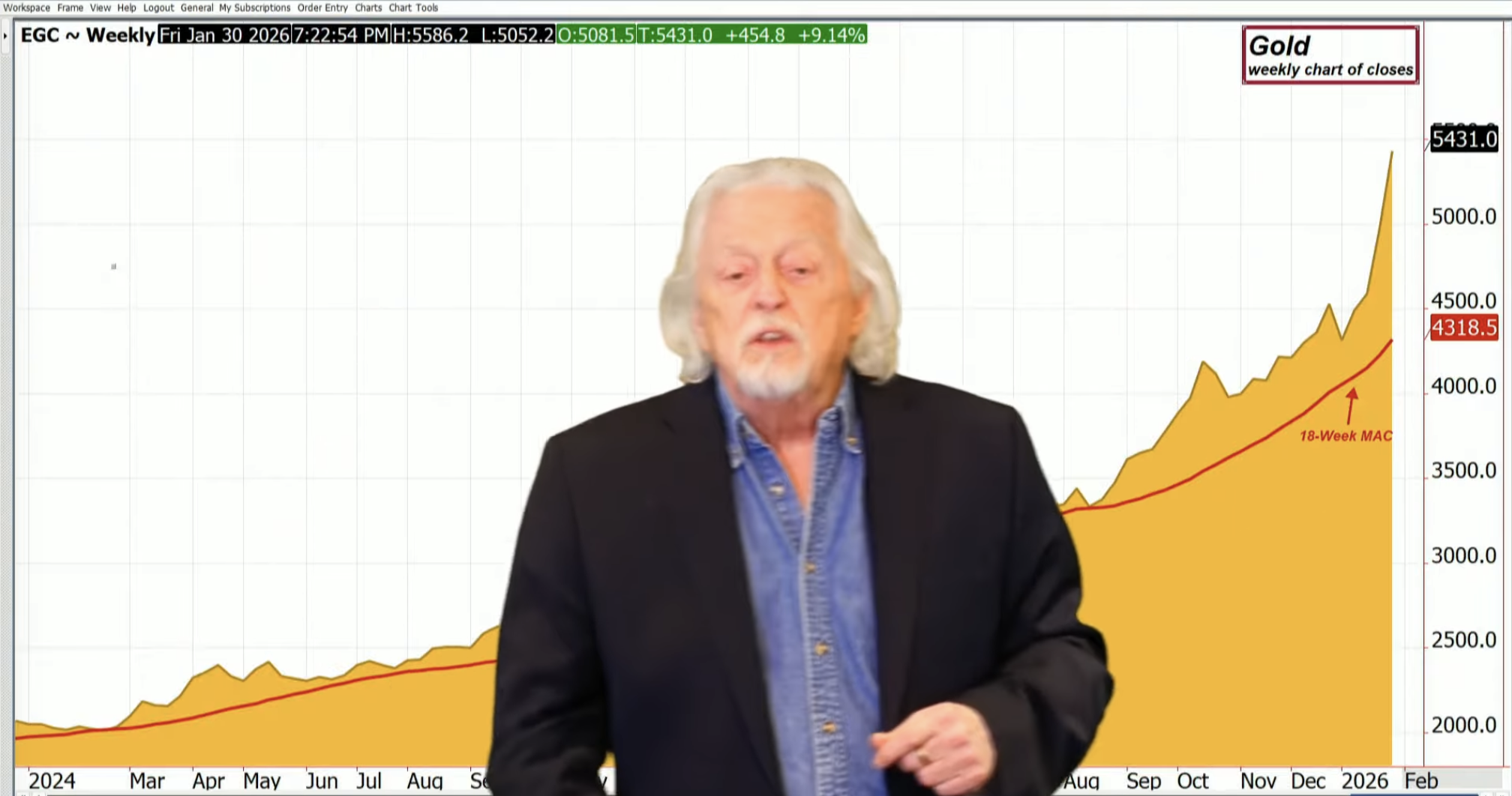

Meanwhile, bullion’s relentless rise is rattling desks from Wall Street to Washington. A record-high spot price north of $3,300 suggests investors are hedging against both lingering inflation and the prospect that softer labor data will pressure the Federal Reserve toward renewed monetary accommodation. Historically, a widening gap between real-world price signals and official reassurance has boded ill for currency purchasing power. If gold’s surge is the canary, the labor market might not be the only thing losing altitude.

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Read the full article here

Leave a Reply