Producer prices came in hotter than expected in November. This came on the heels of a CPI report showing price inflation is sticky.

With inflation worries mounting, investors sold gold.

Wait.

People sold an inflation hedge with increasing signs of inflation?

Yes. You read that correctly.

We’ve returned to a market dynamic that dominated 2023. Investors worried about sticky inflation are dumping gold, an asset that has traditionally served as a hedge against price inflation.

Is that a mistake?

I think it is, and I’ll explain why.

The reason people keep dumping gold is simple. Mainstream investors think the Federal Reserve might cut interest rates more slowly than anticipated. Since gold is a non-yielding asset and tends to face headwinds in a higher interest rate environment, they are spurning the yellow metal.

On the surface, this strategy makes sense, at least as a short-term play. But these mainstream investors are missing the bigger picture – specifically two important factors.

- Inflation isn’t likely going anywhere anytime soon.

- The Fed is going to keep cutting.

The Inflation Problem

Producer prices rose 3 percent on an annual basis in November. That was up from a 2.4 percent increase in October, and it was the highest year-on-year increase since February 2023.

On a monthly basis, PPI was up 0.4 percent, compared to 0.2 percent in October.

Surging producer prices are particularly worrisome because they are generally leading indicators for consumer price inflation.

PPI calculates the prices producers pay for their production inputs. At least some of these price increases will pass along to consumers in the future, driving CPI higher.

And the CPI data is already worrisome. Core CPI, stripping out more volatile energy and food prices, has been mired around 3 percent for months.

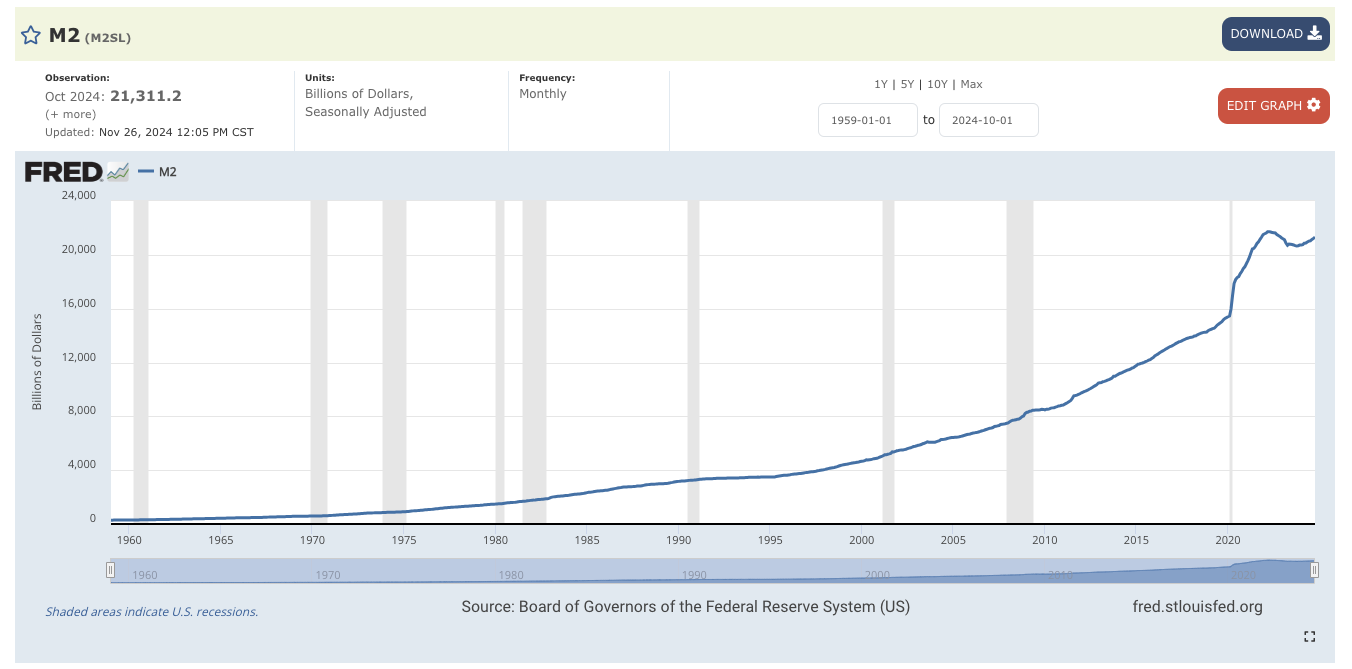

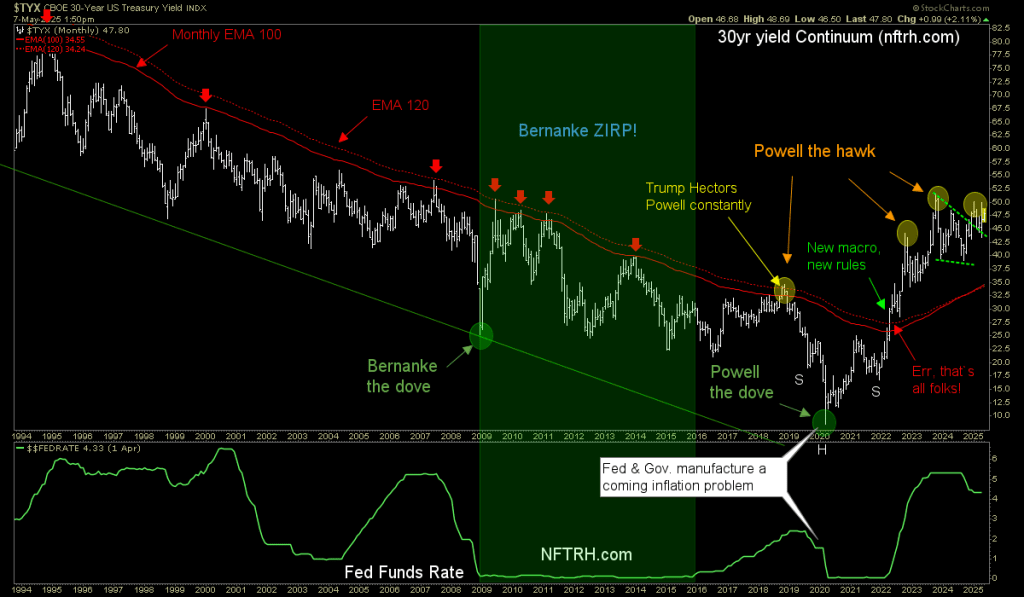

Some people might find this surprising given the Fed’s aggressive interest rate increases and balance sheet reduction. But as I’ve pointed out over and over, the Fed’s inflation fight was wimpy compared to the inflation creation during the COVID era. On top of that, the Fed never unwound the inflation it created in the decade following the 2008 financial crisis. The Fed didn’t do enough to address inflation, to begin with, and then it surrendered to inflation last summer when it announced plans to slow balance sheet reduction.

Simply put, raising rates to 5.5 percent coupled with a modest decrease in the balance sheet was never going to unwind the inflationary impact of nearly $9 trillion in money creation and well over a decade of artificially low interest rates. Remember that Paul Volker had to jack rates up to 20 percent to slay the inflation dragon of the 1970s. Powell and Company essentially shot some BBs at inflation and called it a day.

That’s why I’m convinced that inflation isn’t going anywhere. They did just enough to create an illusion of victory, but the inflation monster is still hiding under the bed.

The Fed Will Keep Cutting Interest Rates

Even with price inflation well above the 2 percent target, the Fed is loosening monetary policy. It started with a super-sized rate cut in September and then trimmed another 25 basis points in November. Virtually everybody expects the central bank to cut again at the December meeting.

We’re already seeing the effects. The money supply began increasing earlier this year. That signals the central bank is once again inflating.

So, why is the Fed easing monetary policy when it’s clear price inflation is alive and well?

Because while they will never say so out loud, the central bankers at the Fed know that this debt-riddled bubble economy can’t function in a higher interest rate environment. The economy is addicted to easy money (inflation), and the pusher is giving the addict more drugs to keep it from going into withdrawal.

Just consider the national debt. It eclipsed $36 trillion last month. The interest expense during fiscal 2024 was over $1 trillion. This is just one example of how higher interest rates are putting a stranglehold on the economy.

The federal government isn’t the only one struggling with debt. Corporate debt is at record levels. Consumer debt is at record levels. Everybody is levered to the hilt.

This economy is built on debt, and the foundation will crumble if interest rates remain even modestly high.

So, the Federal Reserve is walking a tightrope. It’s trying to keep inflation under control without causing a major economic crisis.

Odds are this balancing act will end in disaster.

When the economy visibly cracks, the Fed will be forced to get even more aggressive in loosening monetary policy. If history is any indication, it will cut rates to zero again, and it will launch quantitative easing (QE).

You think inflation is bad now? Just wait until the central bank revs up the money printing press again.

In my view, the most likely scenario is stagflation – a crashing economy in the midst of rapidly rising prices.

A lot of people believe everything is fine. After all, the Fed started raising interest rates over a year ago, and nothing bad has happened. And now the central bank is cutting rates. According to most mainstream analysts, we’re gliding to a soft landing.

But don’t forget that the Fed was cutting rates in 2007. Everybody swore everything was fine.

And then it wasn’t.

I’ve been saying for months that this looks a lot like 2007 2.0. Now, some people in the mainstream are starting to pick up on the similarities. Golden Coast Consultants chief market strategist Gregory Crennon recently noted that in December 2007, “the stock market was near or at its highs as the economy was still growing, the Fed decided to cut rates by a 1/4 % to 4.25% while stating inflation was still a concern.”

As the saying goes, things tend to happen slowly and then all at once.

The bottom line is savvy investors might want to think twice about dumping their gold along with the masses. In fact, you might want to consider these dips as buying opportunities.

Read the full article here

Leave a Reply