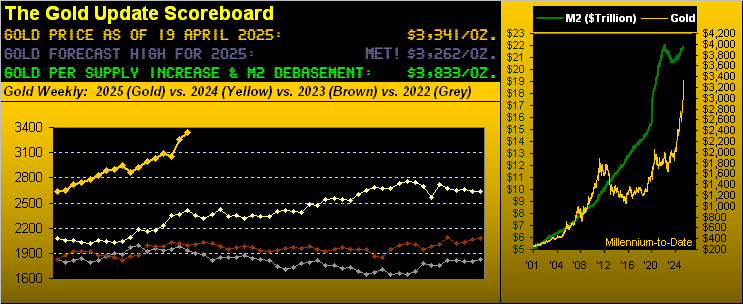

Gold is up 25% year to date, and what a year it’s been so far.

Donald Trump has boldly imposed a new era of US economic policy dominated by tariffs, trade wars, and threats to the sovereignty of nations it has long considered allies (Canada, Denmark, Panama), as the second-term president aims to rewrite the rules of international trade mostly by disregarding them as he pursues an America-first agenda.

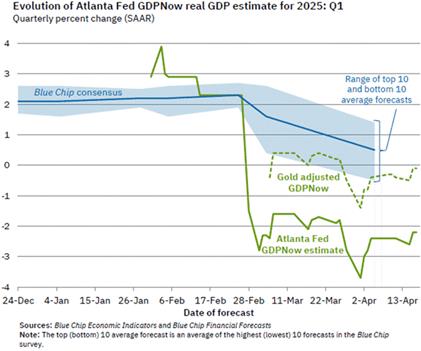

Global stock markets hate the uncertainty of Trump’s on-again, off-again tariffs, with many economists seeing the tariffs bringing a fresh wave of inflation to already-struggling consumers worldwide, but especially in the States where import duties have been threatened on at least 80 countries, with a minimum 10% tariff currently in place.

Trillions of dollars have been wiped off US stock indexes, with the S&P 500 down 10% year to date, the Dow falling 6.4%, and the Nasdaq plunging 15.4%, as of this writing.

If the tariffs continue, global growth is projected to stall, which could mean higher unemployment, lower corporate earnings, and the recession many expected with double-digit inflation but never came.

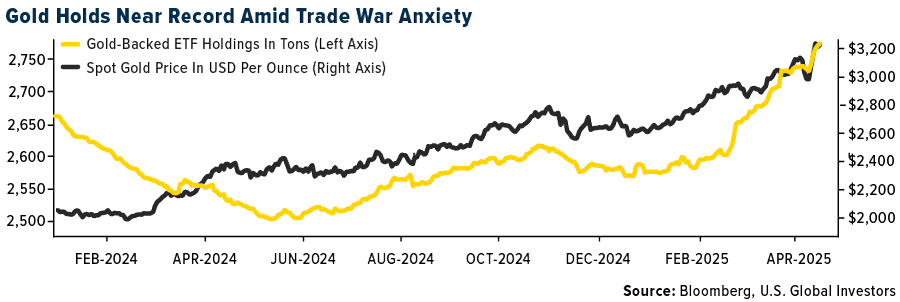

It is indeed a magical time for gold. The precious metal has powered higher on safe-haven demand, as investors flee stocks and bonds in favor of hard assets. It’s also benefited from a lower dollar. The almighty buck started the year at 108.49 against a basket of currencies but has fallen 9% to 99.47 — the lowest it’s been since the darkest days of the pandemic in April, 2020.

Remarkably, safe-haven demand for gold is currently stronger than real interest rates. Gold tends to do well when real interest rates (the 10-year Treasury rate minus inflation) are negative, but due to the collapse in bond prices and the rise in bond yields (the two move in opposite directions), real interest rates are currently positive at 1.99%.

US inflation is down from 3% in January to 2.4% in March, but that could be because the tariffs haven’t yet taken effect. We are currently still in a 90-day pause..

Gold’s meteoric rise last year (+31%) was predominantly due to central bank buying, as emerging economies, fearful that what happened to Russia when it had its foreign exchange reserves confiscated after invading Ukraine, could happen to them, backed up the truck for gold.

According to the latest numbers from the World Gold Council, central banks added 1,045 tonnes to global gold reserves in 2024 — extending their buying streak to 15 consecutive years.

Source: World Gold Council

Source: World Gold Council

2024 was also the third consecutive year in which gold demand surpassed 1,000 tonnes, far exceeding the 473-tonne average between 2010 and 2021.

Similar to the preceding 14 years, gold buying in 2024 was driven by emerging market banks, led by Poland, which purchased 90 tonnes. Other significant purchasers included the Czech National Bank, the Central Bank of Hungary, the Central Bank of Turkey, the Reserve Bank of India, and China, which bought 44 tonnes. At the end of 2024, the PBoC reported holding 2,280t of gold, accounting for 5% of its total international reserves.

As the chart below shows, the United States held the most gold at 8,133 tonnes, followed by Germany, Italy, France, Russia, and China.

What’s next for the gold price? Will it continue to push higher as Trump sows division and market fear? Safe-haven demand will certainly be a factor, but some are pointing to a little-known change in the banking system as being the next catalyst for gold.

More than that, the change to banking rules ostensibly to better insulate banks from economic crises, could represent the next step in the process of de-dollarization, as the banking world moves in a direction that makes gold the center of a new monetary system.

What is Basel III?

After the financial crisis, new banking rules known as Basel I, II and III came into effect. The regulations were created by the Basel Committee on Banking Supervision (BCBS), an offshoot of the Bank for International Settlements (BIS).

The regulations require banks to maintain proper leverage ratios and to meet certain minimal capital requirements. Tier 1 capital assets, such as cash and sovereign bonds (like US Treasuries), are considered the core measure of a bank’s financial strength from a regulator’s point of view.

Under the old Basel I and II rules, gold was rated a Tier 3 capital asset. Banks traditionally discounted a bank’s gold holdings by 50% of the market value. With gold’s value cut in half, banks had little incentive to hold gold as an asset.

As of April 1, 2019, gold bullion is a Tier 1 capital asset. Also, and this is important, under Basel III a bank’s Tier 1 capital assets must rise from the current 4% of total assets to 6%.

Because gold is now a Tier 1 capital asset, banks can operate with far less capital than when gold was classified as Tier 3. Then, banks had to hold extra capital on their books against gold holdings.

Sprout-less gold now Tier 1 capital

First announced in 2017, the Basel III rules apply to banks operating in the US, the European Union and Switzerland. Basel III was supposed to apply to UK banks as of Jan. 1, 2022, but according to the Bank of England, implementation has been delayed until Jan. 1, 2027.

Under the new regulations, allocated (physical) gold will be considered a Tier 1 asset and will continue to have zero risk weighting. Conversely, banks’ unallocated gold will be considered a Tier 3 asset. Unallocated gold refers to so-called “paper gold” like gold ETFs and gold futures.

In plainer English, Basel III requires the banks hold more high-quality assets to prevent liquidity crisis, reduce risky lending practices, and ensure the banks are more prepared for any kind of financial shock.

Key features of Tier III include:

- Increased capital requirements: Banks are required to hold higher levels of capital to absorb potential losses and increase their resilience to financial shocks.

- Leverage ratio: Basel III also introduced a non-risk-based leverage ratio to limit the degree to which banks can fund their activities with borrowed money.

- Liquidity requirements: Two liquidity standards are outlined in Basel III: the Liquidity Coverage Ratio (LCR) and Net Stable Funding Ratio (NSFR).

- Counterparty credit risk: There are also measures to mitigate counterparty credit risk in derivative transactions.

Read more here

Central bank gold buying, particularly in Tier 1 assets, is significantly impacting the gold market, driving up the price and contributing to the overall demand for gold.

According to the World Gold Council, central banks bought gold in 2019 as a direct result of the reclassification of gold as a Tier 1 asset under Basel III.

Many central banks and financial regulators have implemented Basel III, either fully or partially. Key examples include the Eastern Caribbean Central Bank (ECB), the Office of the Superintendent of Financial Institutions (OSFI) in Canada, and the Bank for International Settlements, headquartered in Switzerland.

There have also been notable increases in gold reserves from the central banks of China, India and Poland, among others, with the trend attributable to Basel III regulations.

Central banks clearly see the value of holding gold over paper assets; after 2008, mortgage-backed securities (MBS) lost most of their value and they have also suffered massive value destruction by holding sovereign debt such as Greek bonds that became nearly worthless during the Greek debt crisis in 2015.

Perhaps almost a doubling of gold bullion purchases in 2018 over 2017 indicates that central banks believe gold is a better Tier I asset than government debt and MBS? There is also that 2% increase in total assets to 6%, which now needs to be filled, likely by gold.

Basel III and the US

The implementation of Basel III across the global banking system has been ongoing since 2019, but the United States has not yet moved to it.

This, however, is about to change. As of July 1, 2025, the US will adopt gold as a Tier 1 asset under Basel III regulations — thus aligning US bank capital rules with global standards. The reforms will impact larger banks, those with $100 billion or more in assets, more significantly.

According to Stansberry Research,

Simply put, banks will no longer have to hold extra capital to support their gold holdings. And banks will be able to have gold on their books at 100% of the market value…

The Basel III regulation change will only increase the institutional demand for gold… which will continue to drive the gold bull market that’s underway.

All that is true, but let’s dive a little deeper into why the US has waited six years to implement Basel III, and what it could actually mean.

First we need to define a new term: Basel III Endgame. This refers to the final set of rules from the Basel Committee on Banking Supervision (BCBS) that aims to strengthen bank capital requirements by requiring banks to hold more capital against credit, operational and market risks.

In the US, the phased-in approach starts on July 1, with full compliance expected by July 1, 2028. This means that the changes impacting banks particularly those with $100 billion or more in assets will be introduced gradually over three years.

Global monetary reset

To the question of why the United States delayed Basel III until this year. There is no obvious answer but two theories are plausible.

First, the US understands that the sooner Basel III goes into effect, the sooner the dollar will lose its standing as the world’s reserve currency. This is obviously something the US government fears and wants to avoid at all costs. If Basel III forces banks to treat gold as a Tier 1 asset — the same as cash and Treasuries — it could disrupt a dollar-denominated world where confidence is based on debt, derivatives and fiat-backed assets. “The US has a lot to lose as gold’s role expands because it threatens dollar supremacy,” states a video on the topic.

The other theory is that the US is buying time to get a “Plan B” in place. Many are pointing to a recent comment by US Treasury Secretary Scott Bessent, who said “within the next 12 months we’re going to monetize the asset side of the US balance sheet”. Could Bessent have been referring to anything other than gold?

Regardless of the cause of the US delay, one thing is for sure: the rest of the world is moving forward towards gold especially BRICS nations; they are preparing for the transition. We saw this in the aforementioned central bank gold-buying numbers cited by the World Gold Council.

Also, could there be any coincidence in the fact that the final stages of preparing for the Basel III Endgame started on Jan. 1, 2023? Since then, the spot gold price has jumped over 60%.

I previously alluded to Basel III being more than it appears to be, i.e., a mundane change to the banking system. The narrator in the video by ITM Trading asks the question: “Is Basel III just about stabilizing banks? Or is this laying the foundation for a massive monetary reset, one that puts gold at the center of the system?”

She also asks rhetorically whether this elite group of regulators, the BIS, really didn’t realize the banks were overleveraged until after 2008? Clearly not, meaning that “these [Basel III] changes might not be about preventing the next crisis; they are about preparing for the next crisis.”

In other words, central banks are stockpiling gold to be prepared for when the fiat currency system eventually breaks down.

Another important point about Basel III is how it treats allocated/ physical gold versus unallocated/ paper gold.

In the past, if gold prices went up, it didn’t really impact central banks because gold was Tier 3. By making gold a Tier 1 asset, Basel III is forcing a shift away from paper gold, towards physical gold. Moreover, a rise in the gold price will hugely benefit central banks because it increases the value of their reserves, far more than previously.

Physical gold will be at the center of the new financial system because of something called the Net Stable Funding Ratio, or NSFR. The NSFR essentially makes it harder to suppress real gold values with paper gold contracts. As the narrator in the video explains,

The spot price of gold that you read about in the news is actually much lower than it should be if true supply and demand were in charge, essentially the COMEX and the LBMA. They operate on a fractional reserve system the same way banks do. Think about your deposit in a bank. They don’t keep 100% of that deposit, they keep a small fraction but there is an illusion that they have 100% of the deposits in their holdings. The same thing happens in the gold market, they make multiple paper claims — gold ETFs, gold futures contracts on the same piece of physical gold — meaning that they are able to artificially suppress the price of gold by creating all this paper when in reality the amount of physical gold they have is far less. Last year alone the LME did trillions of dollars in paper gold trade on unallocated metals, so even as true demand for gold rose, the price didn’t accurately reflect that because they suppressed it with the amount of paper trades that were going on.

But Basel III is changing the game. Under the new rules banks must hold physical gold; there can no longer be this huge reliance on unallocated contracts. The system is crumbling in live time.

She references what happened earlier this year, when a surge in gold shipments to the US, essentially frontloading gold to the COMEX ahead of the expected Trump tariffs on metals, led to a shortage of bullion in London.

“People can’t get their hands on gold because so much has been shipped to New York, and the rest is stuck in the queue,” one industry executive told the Financial Times. “Liquidity in the London market has been diminished.”

“The veil is being lifted on this system that has been suppressing gold prices and everyone is starting to wake up and realize it,” states the ITM Trading video. “At the same time central banks are buying gold in record numbers especially over the last three years. Why? because they know what’s coming.”

Could this be the reason the Department of Government Efficiency (DOGE) plans to audit Fort Knox’s 147.3 million ounces of gold, representing roughly 59% of the Treasury’s gold supply with a market value of $431 billion based on $2,930 gold?

Conclusion

Central banks are buying gold because of protection against currency instability, as global debt reaches unsustainable levels. When trust in fiat currencies is shattered it is gold that will act as a true hedge against inflation and a safeguard against devaluation.

The second reason they are purchasing gold is because there is a global shift toward a multi-polar currency or neutral settlement currency as China, Russia and the BRICS-alliance countries work together to move away from the dollar, which the United States has weaponized against them. Gold is neutral, it is not affiliated with any country, it transcends politics and acts as universal true money.

Most importantly, central banks are buying gold because they are preparing for a new gold-backed monetary system once reasons one and two come to fruition. As ITM Trading reminds us,

“When the fiat system that we know today collapses, these banks are going to be leaning on their hard assets. They’re going to need gold as a way to set themselves up in the new system because every major monetary shift in history has had gold at the heart of it and this time will be no different.”

As for what this means for retail investors, the answer is simple — buy gold because demand will surely exceed the supply and move the price even higher than it is now. Also, having gold will be the most effective form of wealth protection when paper money becomes worthless.

“If central banks are stockpiling gold it is for a reason, and if they are preparing for a reset then we should be too. The gold supply squeeze is going to be real as banks and institutions move towards physical gold. What was considered expensive today will be considered cheap tomorrow. And lastly, the wealth transfer is happening now. Those who see what’s really going on and prepare today will be in a position of power when the final stages of the reset come into play.”

Richard (Rick) Mills

aheadoftheherd.com

Read the full article here

Leave a Reply