“Collections”, “collecting”, “rarity”, “numismatics” – all can be intimidating words for the average gold investor. Instant non-starters. Which makes sense. Often these words are used in conjunction with vastly overpriced products, nuanced and subjective complexities that are difficult to define, value and understand, exorbitant buy/sell spreads, and poor investment fundamentals.

A veritable mine-field.

But what if it could be different? What if building investment collections of $20 St. Gaudens could actually be made transparent? What if date and grade varieties of $20 gold pieces could be proven to have strong potential as long-term investments? What if this market is easier to understand than it’s made out to be?

The reality is… it is.

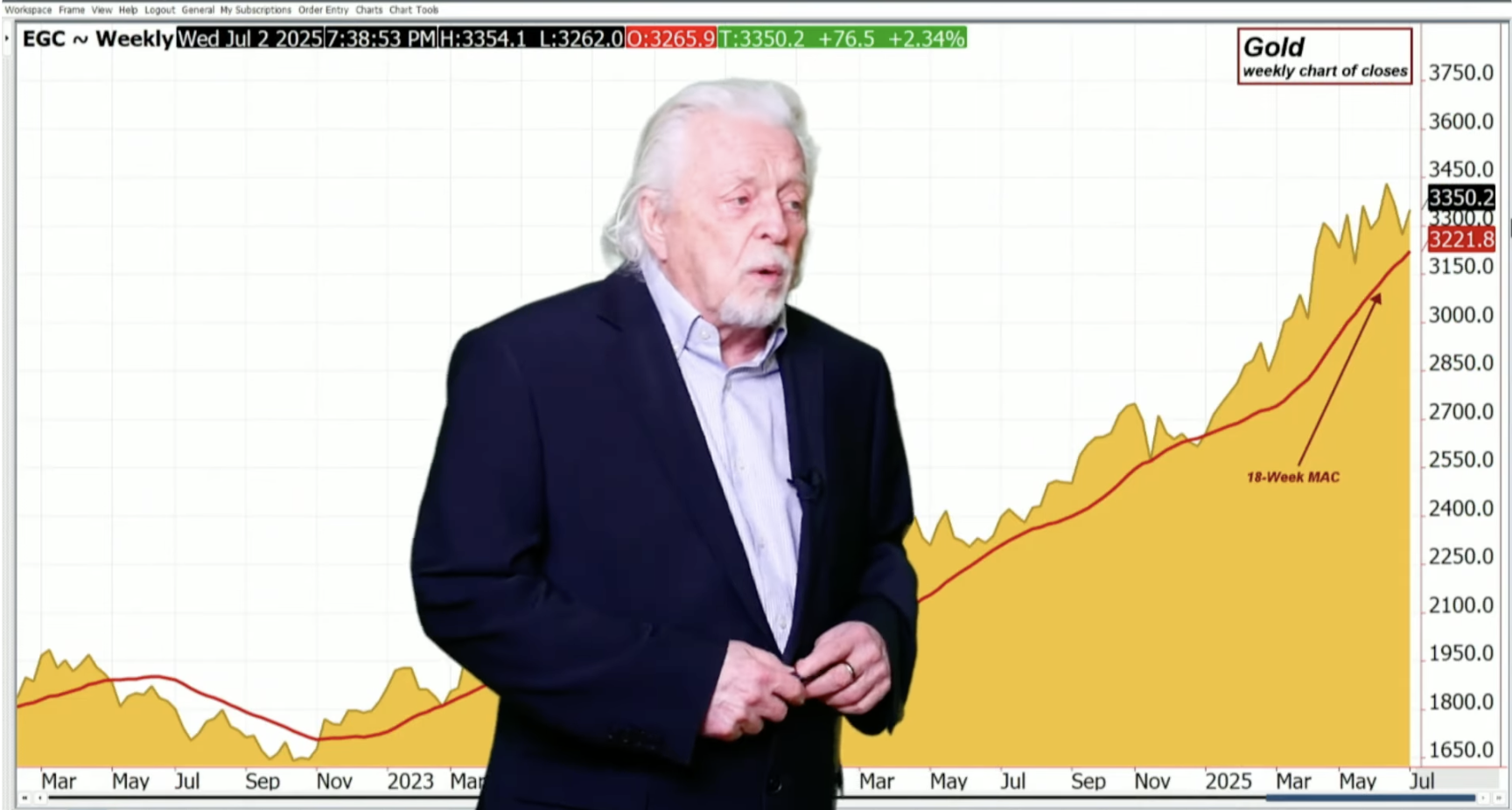

Although, it is worth noting that it is this very same shared trepidation among investors that has seen this area of the market go almost completely ignored in recent years. And, in a sort of self-fulfilling prophecy, this generalized and broadly shared disinterest has manifested in a multi-year absence of meaningful demand, which has now evolved into a notably undervalued opportunity this article seeks to highlight (and resolve to the benefit our clients and readers).

This article will specifically explore how investment collections in $20 St. Gaudens are arguably one of the most undervalued areas of the entire gold market, if not the most undervalued. It will seek to debunk myths and preconceived notions that all collectors coins are by default overpriced, expensive and inaccessible. In fact, it will illuminate the exact opposite – how positions with substantial additional rarity and diversity can – for the time being and under current market conditions – be built for minimal to no additional premium to common alternatives, and with relative overall ease.

Investment Collections of $20 St. Gaudens Gold Coins

The $20 St. Gaudens gold coins were minted from 1907 to 1933. During his second term, president Theodore Roosevelt sought to ‘beautify American coinage’, and commissioned famed sculptor and artist Augustus St. Gaudens to redesign American gold coins. The design change took effect in 1907, and featured a striding Lady Liberty on the coin’s obverse, carrying a torch in one hand and an olive branch in the other, and a flying eagle amidst a rising sun on the reverse. Initially, coins were produced with a ‘High Relief’ design which gave the coin a sculpted look. But the minting process of such coins proved laborious and were abandoned after just 11,250 coins were struck, in favor a lower relief design that could be more easily mass produced. In the first two years of production (1907-08), the coins did not include the motto ‘In God We Trust’, as Roosevelt feared the coins would be used for ‘ungodly’ acts such as gambling and crime. But after public outcry, the motto was added back onto coins in late 1908, and for the remainder of the series was present on the reverse of the coins.

The $20 St. Gaudens were minted in Philadelphia, Denver and San Francisco. Production was suspended from 1917-1919 during World War I, and then discontinued completely in 1933. In total, counting the two High Relief types, 53 different dates, types, and mint-marks (Denver ‘D’ or San Francisco ’S’), were minted during the 26-year production of $20 St. Gaudens. In other words, a fully ‘complete’ set would contain 53 total coins. To be sure, fully completing a $20 St. Gaudens set is quite the (expensive) task, with numerous coins fetching six figures each and the extremely rare 1927-D a multi-million dollar coin in itself.

But that is not the subject of this article.

This article centers around accessible, affordable scarcity – increased rarity at little to no extra cost to common dated coinage.

Enter ‘The 30’…

In the St. Gaudens series, there are a handful of ‘common dated’ coins, specifically comprised of coins minted in Philadelphia either in 1908 (coins without the motto In God We Trust) and then from 1922-1928. Of these, the 1908, 1924, and 1927 are by far the most common and the 1922, 1923, 1925,1926 and 1928 are all slightly scarcer, but still generally considered ‘common’ as well, especially in lower grades. As such, any time an investor purchases graded $20 St. Gaudens without the date specified, it will be likely be one of these dates.

What surprises many investors, and the focus of this article, is that past these 8 ‘common dated coins’, there are 22 ’better dated’ and far scarcer coins that are all reasonably accessible and can be obtained in Mint State 63 for comparable per coin prices to common dated MS65 $20 St. Gaudens. In fact, several can actually be acquired for less per coin. Combine the two groups, and you have ‘The 30’.

“I’m confused. How is a lower grade coin a better value?”

Consider the following chart – listed are the twenty-two scarcer, ‘better-dated’ coins from ‘The 30’ compared with the three most common dated coins. Listed beside each date is the number of coins that have achieved the grade MS63 according to PCGS (Professional Coin Grading Service) along with the total number of coins ‘better’ – those that have achieved higher grades. What you will quickly see is that each of these 22 ‘better dated’ coins are actually far far scarcer in MS63 than the common dated coins are in MS65.

Now, take a look at the three most common dates in higher grade MS65, populations of each in grade, as well as total known better:

For each of the twenty-two coins listed in the first section, the population in grade is a mere fraction of that of the common dated coins, despite being in a lower grade. To emphasize, not a single one of these better-dated coins has 10,000 coins in grade, and many have closer to only 1,000. And equally important and influential to value, the total known population of coins in higher grades is roughly equal to and/or significantly less than that of the common-dated coins, despite so many more numerical levels possible higher moving from MS63 than from MS65.

This is what is referred to as ‘conditional rarity’ – rarity derived from the quality of the coin compared to other coins of the same date.

Speaking overall, far fewer of the better dated coins listed were minted to begin with, and even fewer survived into the modern era in high grade. So lower grade specimens of better dated coins are, in fact, much scarcer than higher grade specimens of common dated coins.

“So they must be much more expensive then, right?”

Again, and perhaps most important point of this article – accumulating these twenty-two better dated coins in MS63 is, at this time, cost comparable to accumulating twenty-two common-dated MS65 $20 St. Gaudens.

“What are your clients are doing?”

Over the past year, we have shed light on this undervalued area of the market privately with our clients. These are a few examples of how our clients have responded.

“The 30”

The most popular position our clients are taking is to purchase ‘The 30’: the twenty-two coins listed above in MS63 added to the 8 common dates (1908 N/M and 1922-28 in MS64 and MS65). In so doing, they build a portfolio position of 30 different dates and mint marks, all in grade MS63 and higher, and all for a comparable total cost to buying the same number of common coins in MS65. As of the writing of this article, this position can be acquired for less than an average of $3500 per coin and ~$100,000 total investment. Some choose to knock this out very quickly, while other clients chip away at this 3-5 coins at a time, with the long term acquisition goal in mind of ultimately completing ‘The 30’ over the course of several years.

Added note on total cost of accumulation: Consider that a purchase of 30 raw ungraded common $20 gold pieces would cost roughly $90,000 in itself at this time. Our clients have grown increasingly enthusiastic with the notion that a position like this can be accomplished for a mere 10% more than what amounts to an historical bullion position. It is also worth noting that just a few years ago, raw ungraded $20 St. Gaudens would have commanded similar percentage premiums as the better dated coins do today.

As an alternative strategy, many clients are also acquiring dates of their preference, with a focus on mint-marked dates, better dates, simple/shorter date runs and other similar strategies. Perhaps only acquiring 5-10 different dates as their budget allows, for example. We also have clients that have completed ‘5 of each’ and ’10 of each’ positions of better dates varieties, and are foregoing common date positions altogether as long as this undervalued condition persists.

Final Thought

Whether it’s ‘The 30’, or a pick and choose strategy surrounding better dated coins – all present a compelling opportunity to add historical significance and investment potential to a gold portfolio at an opportune time, under opportune market conditions. And perhaps, now armed with a greater understanding, words such as ‘numismatic’ and ‘rarity’ move from intimidating and risky, to inviting and intriguing, and the idea of building a ‘collection’ – whatever that looks like to you – can now be viewed as the generational opportunity it currently is.

Read the full article here

Leave a Reply