International gold prices are set by the London Bullion Market Association twice daily through the LBMA Gold Price auction, establishing a global benchmark that ripples across markets in New York, Shanghai, Dubai, and beyond. As of November 2025, gold trades near $4,000 per troy ounce internationally, reflecting record central bank purchases, persistent inflation concerns, and strong demand from Asia and the Middle East. Understanding how international gold pricing works helps investors navigate currency fluctuations, regional premiums, and global supply-demand dynamics that ultimately determine what you pay for gold.

USAGOLD has tracked international gold markets since 1973, helping investors understand global price dynamics and their portfolio implications. New to gold investing? Start with our First Time Investor Q&A before diving into international market analysis. For investors concerned about Federal Reserve policy’s impact on dollar-denominated gold prices, our Federal Reserve gold price analysis explains the key relationships.

How International Gold Pricing Works

Gold trades globally 24 hours a day across multiple financial centers, but certain markets and mechanisms establish benchmark prices that other markets reference.

The LBMA Gold Price serves as the international benchmark. The London Bullion Market Association facilitates two electronic auctions daily at 10:30 AM and 3:00 PM London time. Major banks and dealers submit buy and sell orders, and the auction determines a clearing price where supply equals demand. This twice-daily price becomes the reference point for physical gold contracts, mining company hedging, and central bank transactions worldwide.

The LBMA Gold Price replaced the London Gold Fix in 2015 but serves the same essential function: establishing a transparent, widely accepted international benchmark. The process uses an electronic auction platform operated by ICE Benchmark Administration rather than the old telephone-based fixing system.

Spot price vs. futures price: The spot price represents immediate delivery of physical gold. Futures prices reflect contracts for delivery at specified future dates. These prices differ slightly based on storage costs, interest rates, and time until delivery. Most price quotes you see reference the spot price or the nearest futures contract.

24-hour global trading: When London closes, New York trading is in full swing. When New York winds down, Asian markets in Sydney, Hong Kong, Shanghai, and Singapore are opening. This continuous trading means gold prices move constantly, responding to news and economic data from around the world.

Major trading centers include:

- London: The largest physical gold market and source of the LBMA benchmark price

- New York: Home to COMEX gold futures, the world’s largest gold futures exchange

- Shanghai: The Shanghai Gold Exchange handles massive physical gold volume, particularly for Chinese domestic demand

- Dubai: A major physical gold trading hub serving Middle Eastern and South Asian markets

- Zurich and Singapore: Important centers for gold storage, trading, and refining

Why the London price matters most: London’s central position in global finance, its historical role in gold trading dating back centuries, and the participation of all major banks and dealers in the LBMA auction make London the price discovery mechanism for international gold. When someone asks “what’s the gold price today,” they’re almost always referencing the London spot price.

Currency considerations: Gold trades internationally in U.S. dollars. A Canadian wants to buy gold, they check the dollar price and convert using the USD/CAD exchange rate. This creates a connection between dollar strength and international gold demand. When the dollar strengthens against other currencies, gold becomes more expensive in local currency terms, potentially reducing demand. When the dollar weakens, gold becomes cheaper for foreign buyers, potentially increasing demand.

Regional variations from the benchmark: While the LBMA price serves as the international benchmark, actual transaction prices vary by location due to:

- Transportation costs from London or major storage hubs

- Local taxes and import duties

- Local supply and demand imbalances

- Currency exchange spreads

- Dealer markups specific to each market

These variations typically amount to small percentages of the base price, but they can widen during periods of extreme demand or supply disruption.

Current International Gold Price (November 2025)

Gold trades near $4,000 per troy ounce as of November 2025, marking new all-time highs and reflecting the culmination of multiple bullish factors converging over the past two years.

Recent price trajectory:

Gold started 2024 around $2,050 per ounce. By year-end 2024, prices had pushed above $3,000 for the first time. The rally accelerated in 2025, with gold breaking $3,500 in spring and approaching $4,000 by fall.

This represents roughly a 95% gain from the $2,050 starting point in early 2024 to the $4,000 level in November 2025. The pace of appreciation has been remarkable even by gold’s historical standards.

Key drivers of 2024-2025 rally:

Record central bank buying: Central banks globally purchased over 1,000 tonnes of gold in both 2022 and 2023, the highest levels in decades. This buying continued through 2024 and 2025, creating sustained physical demand from the official sector. China, Russia, Poland, Singapore, and numerous emerging market central banks aggressively added gold to reserves.

Persistent inflation concerns: Despite Federal Reserve rate hikes and tight monetary policy, inflation proved stickier than expected. Core inflation readings remaining above 3% through much of 2024 and early 2025 kept investors worried about purchasing power erosion. Gold’s traditional role as an inflation hedge drove continued investment demand.

Geopolitical tensions: Multiple regional conflicts, trade tensions, and great power competition created an environment of elevated uncertainty. Investors typically allocate more to gold during such periods as insurance against unexpected escalations or disruptions.

Currency debasement fears: Massive government deficits in major economies, combined with political dysfunction limiting fiscal reform prospects, raised concerns about long-term currency stability. Gold benefited as an asset not dependent on any government’s fiscal discipline.

Asian demand strength: Physical gold demand from India, China, and other Asian markets remained robust through 2024-2025. Cultural affinity for gold combined with rising incomes in Asia created powerful structural demand supporting prices.

Supply constraints: Gold mining production has been relatively flat for several years. Bringing new mines online takes a decade or more, meaning supply cannot quickly respond to higher prices. This supply inelasticity supports price gains when demand increases.

Price performance by currency:

While gold hit $4,000 in dollar terms, its performance varied when measured in other currencies:

Euro: Gold rose from roughly €1,850 per ounce in early 2024 to approximately €3,700 in November 2025, a 100% gain. The euro weakened modestly against the dollar during this period, amplifying gold’s gains for European holders.

Japanese Yen: Gold surged from about ¥290,000 per ounce to over ¥600,000, more than doubling. The yen’s significant weakness against the dollar through 2024-2025 meant Japanese investors saw even larger gold gains than U.S. investors in local currency terms.

British Pound: Gold climbed from approximately £1,650 per ounce to £3,200, a 94% gain similar to the dollar performance.

Chinese Yuan: Gold rose from roughly ¥14,500 per ounce to ¥28,500, nearly doubling in yuan terms as well.

Indian Rupee: Gold increased from about ₹170,000 per ounce to ₹335,000, a 97% gain.

These currency-specific returns highlight why gold appeals globally. Regardless of which currency you earned or saved in, gold provided substantial gains measured in your local unit of account.

Why Gold Prices Differ by Country

Walk into a gold dealer in New York, London, Dubai, and Mumbai, and you’ll find different prices for the same gold coin despite a single international benchmark price. These variations stem from multiple factors affecting local gold markets.

Import duties and taxes: Governments impose different tax regimes on gold imports and sales. India charges a 15% import duty on gold plus 3% GST, adding 18% to the international price before dealer markups. Turkey periodically adjusts its gold import taxes. Some Middle Eastern countries charge minimal or no import duties, making gold cheaper there than in high-tax jurisdictions.

These tax differences can create price variations of 10% to 20% or more between countries. An ounce of gold costing $4,000 in a zero-tax jurisdiction might effectively cost $4,720 in a country with 18% total taxation.

Currency exchange rates and spreads: Converting from dollars to local currency involves exchange rate risk and bid-ask spreads charged by currency dealers. In countries with volatile currencies or capital controls, these spreads can be substantial.

Argentina, Turkey, and other countries with unstable currencies often see wider spreads between the international dollar price and local currency prices due to currency risk premiums and official vs. parallel exchange rates.

Local supply and demand imbalances: When local demand surges or supply tightens, prices can rise above international levels. During India’s wedding season (October through December), gold demand spikes, sometimes creating premiums above international prices. When supply chains were disrupted during COVID-19, some markets faced physical shortages driving local premiums higher.

Conversely, when a region has weak demand or excess supply, local prices might trade slightly below international benchmarks to attract buyers.

Transportation and insurance costs: Moving gold from major storage hubs like London, New York, or Zurich to smaller markets involves shipping, insurance, and security costs. These logistics expenses add to the final price consumers pay.

A dealer in New Zealand or South Africa incurs higher transportation costs than a dealer in London or New York, which translates to slightly higher prices for customers in those regions.

Dealer markups and local competition: Competitive dealer markets with thin margins keep prices closer to international benchmarks. Markets with fewer dealers or higher operating costs see larger markups.

Online dealers often offer prices closer to international benchmarks because they compete globally. Local physical dealers in cities with high real estate and labor costs may charge higher premiums to cover overhead.

Form of gold matters: Gold bars typically trade closer to spot prices with smaller premiums than gold coins. Collectible coins carry much higher premiums based on numismatic value. Small gold jewelry carries the highest premiums due to fabrication costs.

A 1 kg gold bar in London might trade at 1% over spot. The same quantity in small coins could carry 5% premiums. As jewelry, it might cost 30% or more above gold content value.

Refining standards: Different regions prefer different refining standards. Western markets strongly prefer LBMA Good Delivery bars from approved refiners. Asian markets, particularly China, often prefer China Gold Association certified bars. Getting gold refined to local standards adds costs if the gold wasn’t originally refined to those specifications.

Capital controls: Countries with capital controls make it harder to import gold or repatriate gold when selling. These restrictions create risk premiums and wider spreads between international prices and local prices.

China’s capital controls mean gold prices on the Shanghai Gold Exchange sometimes diverge from London prices, particularly during periods when authorities are managing currency flows.

Top Gold Producing Countries and Market Impact

Gold mining production influences supply available to meet global demand, though mining represents only part of total supply when you include recycled gold and central bank sales.

Top gold producing countries (2024-2025 estimates):

China: 370 tonnes annually. China has been the world’s largest gold producer since 2007. However, China consumes far more gold than it produces domestically, making it a major net importer. Chinese production stays within China, rarely reaching international markets.

Australia: 320 tonnes annually. A major gold exporter with large-scale mining operations in Western Australia and other regions. Australian production feeds global markets, particularly Asian refineries.

Russia: 300 tonnes annually. Russian gold production has increased steadily over the past decade. Western sanctions following geopolitical conflicts have redirected Russian gold toward Asian markets, particularly China and India, rather than London and New York.

United States: 180 tonnes annually. Nevada hosts major gold deposits and mining operations. U.S. production serves both domestic and international markets.

Canada: 170 tonnes annually. A major gold producer with mines across multiple provinces. Canadian gold often goes to U.S. and European refineries.

Peru: 140 tonnes annually. South America’s largest gold producer. Peruvian gold typically gets refined in Switzerland before entering international markets.

Ghana: 135 tonnes annually. Africa’s top gold producer. Ghanaian gold production has grown steadily with investment from international mining companies.

South Africa: 100 tonnes annually. Once the world’s largest gold producer by far, South African production has declined significantly from peak levels above 1,000 tonnes in the 1970s. Deeper mines and higher costs have reduced output, though South Africa retains some major operations.

Mexico, Indonesia, Kazakhstan: Each produces 80-100 tonnes annually, rounding out the top ten.

Total global mine production: Approximately 3,000 tonnes annually. This figure has been relatively flat for the past decade, with new mines coming online offsetting declining production from mature mines.

Impact on international prices:

Supply inelasticity: Gold mining cannot quickly respond to price changes. Discovering deposits takes years, and developing mines takes another decade. When gold prices rise, supply stays relatively fixed in the short to medium term. This inelasticity means price adjustments happen primarily through demand changes rather than supply responses.

Geopolitical shifts in production flows: Russian gold being redirected to Asia rather than London affects global trading patterns. Chinese production staying domestic means global markets outside China must rely on other sources. These geopolitical factors can create regional supply tightness even when global production is adequate.

Mining cost floors: All-in sustaining costs for gold mining average $1,100 to $1,300 per ounce across the industry. This creates an effective price floor. If gold falls significantly below mining costs, marginal producers shut down, reducing supply and supporting prices. With gold near $4,000, mines are highly profitable, but it would take a dramatic price collapse before supply cutbacks would occur.

Exploration and development cycles: High gold prices stimulate exploration and mine development, but the impact takes many years to appear as actual production. The current price environment will likely lead to more production in the 2030s, but near-term supply remains constrained by long development timelines.

Recycled gold matters too: Mine production represents only about 75% of annual gold supply. Recycled gold from jewelry, electronics, and other sources provides the other 25%, roughly 1,000 tonnes annually. High prices stimulate more recycling as people sell old jewelry and other items. This provides some supply elasticity that mining alone doesn’t offer.

Central Bank Gold Buying Trends (2025 Data)

Central banks have dramatically shifted from gold sellers to aggressive buyers, reshaping the international gold market’s supply-demand balance.

Historical context: From the 1990s through the early 2000s, central banks were net sellers of gold. Western central banks, particularly European institutions, sold gold reserves they considered relics of an earlier monetary era. Annual central bank sales reached 400-500 tonnes at their peak.

The tide turned around 2010. Central banks became net buyers, and buying has accelerated dramatically since 2022.

2022-2024 buying surge: Central banks purchased over 1,000 tonnes of gold in both 2022 and 2023, the highest annual purchases in decades. Data through the first three quarters of 2024 suggested another year above 800 tonnes, with full-year 2024 likely finishing between 900-1,000 tonnes.

This represents a complete reversal from the selling era. Central banks have removed significant quantities of gold from available supply, supporting prices.

2025 central bank activity through Q3: Through September 2025, central banks had purchased approximately 750 tonnes of gold on a net basis. Full-year 2025 purchases were tracking toward 900-1,000 tonnes again, continuing the strong buying trend.

Major buyers in 2024-2025:

China (People’s Bank of China): China’s central bank has reported gold purchases every month or nearly every month through 2024 and 2025. Official reported purchases totaled 200+ tonnes in 2024, though many analysts believe actual purchases exceed reported figures due to unannounced buying through state entities.

China’s gold reserves have grown from roughly 1,000 tonnes a decade ago to over 2,300 tonnes officially reported. As a percentage of total reserves, gold still comprises only about 4% of China’s holdings, suggesting room for continued accumulation.

Poland (National Bank of Poland): Poland has been among the most aggressive buyers, adding 130 tonnes in 2022 and continuing substantial purchases through 2024-2025. Poland’s gold reserves have tripled in recent years as the central bank diversifies reserves away from euros and dollars.

Singapore (Monetary Authority of Singapore): Singapore has steadily increased gold holdings, adding over 100 tonnes in 2024 alone. Singapore positions itself as a major precious metals trading and storage hub, and increasing official gold holdings reinforces that role.

India (Reserve Bank of India): India’s central bank has added gold consistently, purchasing 50-75 tonnes annually in recent years. India’s cultural affinity for gold extends to official sector policy.

Turkey (Central Bank of Turkey): Despite economic challenges, Turkey’s central bank has been a consistent gold buyer, adding to reserves regularly through 2024-2025.

Qatar, Iraq, Oman, and other Middle Eastern states: Several Gulf and Middle Eastern central banks have increased gold purchases, diversifying oil-revenue-derived reserves into gold.

Czech Republic, Hungary, and other Eastern European states: Multiple Eastern European countries have followed Poland’s lead in adding gold to reserves.

Motives for central bank buying:

Geopolitical hedging: Tensions between great powers, concerns about Western sanctions on reserves (as happened to Russia), and general geopolitical uncertainty drive central banks toward gold as an asset no other country can freeze or sanction.

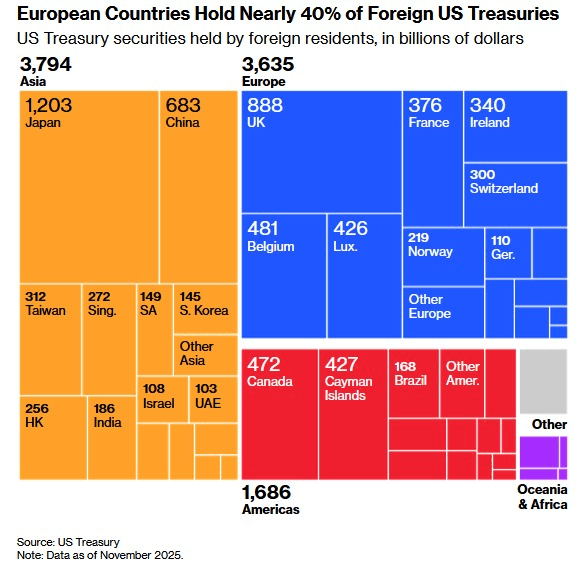

Diversification from dollar and euro: Many emerging market central banks hold massive dollar and euro reserves from trade surpluses. Diversifying some portion into gold reduces concentration risk and exposure to Western monetary policy.

Inflation concerns: Central banks recognize that major currencies face inflationary pressures from massive government debts and deficits. Gold provides a hedge against currency debasement.

Gold’s role as ultimate reserve asset: Unlike any other reserve asset, gold carries no counterparty risk. It isn’t any government’s liability. This makes gold uniquely valuable for central banks seeking absolute security for some portion of reserves.

Impact on international gold prices:

Central bank buying of 800-1,000 tonnes annually represents about 25-30% of annual mine production. This massive official sector demand fundamentally changed gold’s supply-demand dynamics starting in 2022.

Private investors compete with central banks for available supply. When central banks aggressively accumulate gold, less remains available for private markets at any given price. This supports higher prices.

Central bank buying also sends a signal to private investors. If the world’s most sophisticated financial institutions are accumulating gold aggressively, private investors take notice. This “following smart money” effect amplifies the direct supply-demand impact of central bank purchases.

Outlook for continued buying: Most analysts expect central banks to remain net buyers through 2026 and beyond. The fundamental reasons driving purchases – geopolitical tensions, diversification desires, inflation concerns – show little sign of abating. Buying may moderate from the 1,000+ tonne pace of 2022-2023 but likely remains elevated relative to historical averages.

Regional Demand Patterns (Asia, Middle East, West)

Gold demand varies dramatically by region, reflecting different cultural traditions, economic conditions, and investment preferences.

Asian demand (China, India, Southeast Asia):

Asia accounts for roughly 60% of global physical gold demand. The region’s combination of cultural affinity for gold, growing wealth, and demographic scale makes it the driver of international gold markets.

India: The world’s second-largest gold consumer after China. Indian annual demand typically runs 700-900 tonnes, split between jewelry (roughly 75%) and investment (25%). Gold plays a central role in Indian culture, particularly for weddings and religious festivals.

Indian demand is highly seasonal, peaking during wedding season (October-December) and festivals like Diwali and Akshaya Tritiya. Prices often rise during these periods on local supply tightness.

Government policy significantly affects Indian demand. Import duty changes can boost or suppress demand by altering prices. In 2024-2025, India has maintained relatively stable import duties around 15%, supporting steady demand.

China: The world’s largest gold consumer with annual demand of 900-1,100 tonnes. Like India, China splits demand between jewelry (60-65%) and investment (35-40%). Chinese investors view gold as a store of wealth and portfolio diversifier.

Chinese demand is less seasonal than Indian demand but responds to domestic economic conditions, stock market performance, and property market trends. When Chinese stocks and property struggle, gold demand typically strengthens as investors seek alternatives.

The Shanghai Gold Exchange is the world’s largest physical gold exchange by volume. Chinese capital controls mean gold often trades at premiums to international prices within China when domestic demand is strong.

Southeast Asia (Thailand, Vietnam, Indonesia, Malaysia): Combined demand of 100-150 tonnes annually. Similar cultural affinity for gold as India and China, though smaller economies mean lower absolute volumes. Gold serves as savings, jewelry, and investment across the region.

Middle Eastern demand:

The Middle East consumes 150-250 tonnes of gold annually, with demand split between jewelry, investment, and official sector purchases.

Cultural significance: Gold plays an important role in Middle Eastern culture, particularly for weddings and as a traditional store of wealth. High-karat gold jewelry (22K and 24K) is preferred over the 14K common in Western markets.

Dubai’s role: Dubai serves as the gold trading hub for the broader region, with gold souks attracting buyers from across the Middle East, South Asia, and Africa. Dubai’s favorable tax treatment and trading infrastructure make it a price-discovery center for regional physical markets.

Oil wealth diversification: Gulf states with massive oil revenues periodically diversify into gold. Both central banks and private wealth from the region view gold as a hedge against oil price volatility and geopolitical risks.

Western demand (North America, Europe):

Western markets account for roughly 15-20% of global gold demand. Demand is primarily investment-focused rather than jewelry-focused, contrasting sharply with Asian markets.

United States: Annual demand of 150-200 tonnes. The U.S. market focuses on investment gold – coins, bars, ETFs – rather than high-karat jewelry. American Gold Eagles and Gold Buffalos dominate retail investment demand.

U.S. demand responds to economic concerns, inflation fears, and equity market performance. When stocks struggle or inflation rises, U.S. gold demand typically strengthens.

Europe: Annual demand of 100-150 tonnes. European investment demand focuses on gold bars and coins, with popular products including British Sovereigns, French 20 Francs, and modern bullion coins.

European demand has strengthened in recent years as negative interest rates, inflation concerns, and geopolitical tensions drove investors toward tangible assets.

Canada, Australia: Smaller markets with demand of 20-40 tonnes annually each. Both countries have strong gold mining industries and populations familiar with gold investment.

Regional premium variations:

Asian premiums: Gold often trades at premiums to London spot prices in Asian markets during periods of strong demand. Chinese premiums can reach $10-30 per ounce above London when domestic demand is robust. Indian premiums vary seasonally, widening during wedding season.

Western discounts: U.S. and European markets sometimes trade at small discounts to London spot when demand is weak, as dealers compete for customers.

These regional patterns matter for international prices because:

Strong Asian demand, particularly from China and India, creates a physical demand floor supporting prices. When Asian buyers are active, international prices have trouble falling significantly because physical gold flows to Asia where buyers await.

Seasonal Asian demand patterns can create predictable price strength during certain periods. Smart investors watch for price dips before major Indian festivals or Chinese New Year, knowing demand will likely firm during those periods.

Western investment demand is more volatile and sentiment-driven. During financial panics or inflation scares, Western demand can spike rapidly, driving sharp price increases. But Western investors also sell quickly when sentiment shifts, creating volatility.

The shift of demand toward the East over the past two decades has fundamentally changed gold market dynamics. Asian buyers with strong hands and cultural attachment to gold provide more price stability than Western speculators who trade in and out. This structural shift supports the long-term bull market in gold.

International Gold Market Forecast 2026

Projecting gold prices involves uncertainty, but analyzing current trends and likely developments provides a framework for thinking about 2026 possibilities.

Base case forecast: $4,200 to $4,800 per ounce

This scenario assumes continuation of trends supporting gold in 2024-2025 without major new catalysts or negative shocks.

Supporting factors:

Continued central bank buying: Central banks likely remain net buyers at 700-900 tonnes annually through 2026. This sustained official sector demand supports prices even if private investment demand moderates.

Persistent inflation concerns: Core inflation likely stays above 2% targets in major economies through much of 2026. This keeps gold attractive as an inflation hedge.

Modest Fed rate cuts: If the Fed cuts rates by 0.50% to 1.00% during 2026 as consensus expects, lower rates reduce gold’s opportunity cost and provide modest tailwinds.

Stable geopolitical tensions: Current geopolitical tensions likely persist through 2026 without major escalation or resolution. This baseline level of uncertainty supports continued gold allocation.

Asian demand remains solid: Chinese and Indian demand continues at current robust levels, providing physical demand support.

This scenario suggests gold appreciates another 5-20% from November 2025 levels, a healthy but not spectacular continuation of the bull market.

Bullish scenario: $5,000 to $6,000 per ounce

This scenario requires new catalysts driving accelerated gold demand or supply constraints.

Potential catalysts:

Major geopolitical escalation: Significant military conflict involving major powers, particularly in the Middle East or between great powers, could drive panic buying of gold as a safe haven.

Inflation reacceleration: If inflation proves more stubborn than expected and reaccelerates above 4-5%, gold demand could surge as investors lose confidence in central banks’ ability to control prices.

Financial system stress: Banking sector problems, sovereign debt crises, or other financial instability would likely drive aggressive gold buying as the ultimate safe asset.

Currency crisis: A major currency crisis affecting the dollar, euro, or Chinese yuan could drive enormous flows into gold as people seek to escape troubled currencies.

Supply disruptions: Major mining disruptions from political instability, labor issues, or disasters could tighten physical supply while demand remains elevated.

Accelerated central bank buying: If central bank purchases increase to 1,200-1,500 tonnes annually, this massive official sector demand would put extraordinary upward pressure on prices.

This scenario is less likely than the base case but not implausible. Gold has shown it can move rapidly when fear and uncertainty spike. The $850 to $1,900 rally from 2008 to 2011 demonstrates gold’s potential during crisis periods.

Bearish scenario: $3,200 to $3,600 per ounce

This scenario requires significant negative developments for gold.

Potential negatives:

Inflation quickly defeated: If inflation falls rapidly to 2% or below early in 2026, gold’s inflation hedge appeal diminishes. Investors might shift back to bonds and stocks.

No Fed rate cuts: If strong economic growth keeps the Fed from cutting rates, or if inflation persistence forces rate increases, higher opportunity costs could pressure gold.

Geopolitical tension easing: Unexpected resolution of major conflicts or improvement in great power relations could reduce safe-haven demand.

Strong dollar: If the dollar strengthens significantly against other currencies, gold becomes more expensive for international buyers, reducing demand.

Equity market surge: A major stock market rally might pull investment funds out of gold and into equities seeking higher returns.

Central bank buying pause: If central banks significantly reduce gold purchases for budget reasons or policy changes, this would remove major demand support.

This scenario seems unlikely given structural factors supporting gold, but corrections of 15-25% from highs happen periodically even in bull markets. The $1,900 peak in 2011 to $1,050 low in 2015 shows bear markets can happen.

Most probable path:

The base case appears most likely. Gold probably continues its uptrend through 2026 with volatility along the way. Periodic corrections of 5-10% should be expected as normal profit-taking and consolidation.

The structural drivers supporting gold – central bank buying, geopolitical tensions, inflation concerns, massive government debts – aren’t resolving quickly. These factors support a continued bull market.

Investors should prepare for both opportunities to buy dips and risks that require discipline to manage. Setting allocation targets and rebalancing when gold moves significantly above or below those targets makes sense in uncertain conditions.

How to Trade International Gold Price Movements

International gold price movements create both opportunities and challenges for investors. Understanding how to navigate global gold markets helps you optimize timing and execution.

Tracking international prices:

Real-time price tracking: Websites like Kitco, BullionVault, and GoldPrice.org provide real-time spot prices updated continuously as global markets trade. USAGOLD displays live gold prices and market commentary.

LBMA fixes: Check the twice-daily LBMA Gold Price auctions at 10:30 AM and 3:00 PM London time for benchmark prices. These fixes set pricing for many physical transactions.

Futures markets: COMEX gold futures in New York provide price discovery during U.S. trading hours. Futures prices typically trade slightly above spot due to carry costs but move closely together.

Regional premiums: Track premiums in your region relative to London spot. If local premiums widen significantly, it might signal tight physical supply and potential price strength ahead.

Using currency movements:

Dollar strength matters: Watch the Dollar Index (DXY) alongside gold prices. When the dollar weakens, gold typically strengthens in dollar terms. International investors might see even larger gains in their local currencies.

Currency hedging considerations: If you’re a non-U.S. investor buying dollar-priced gold, you have currency exposure. A weakening dollar reduces your returns in local currency terms even if gold rises in dollars. Some investors hedge this currency risk, though it adds complexity and costs.

Local currency buying: In some markets, you can buy gold priced directly in local currency, eliminating dollar conversion but potentially accepting wider spreads or premiums.

Timing purchases around global patterns:

Asian market hours: Asian trading (Sunday evening through Friday morning U.S. time) often sets the tone for Western markets. Strong Asian physical demand can create price floors.

London morning: The LBMA morning auction at 10:30 AM London time often sees significant price movements as European markets open and global participants set positions.

New York afternoon: The LBMA afternoon fix at 3:00 PM London (10:00 AM New York) coincides with peak COMEX trading. Heavy volume and volatility can occur around this time.

Friday PM fix: The week’s final LBMA fix on Friday afternoon can see position squaring and portfolio rebalancing, sometimes creating volatility.

Seasonal patterns: Indian wedding season (October-December) and Chinese New Year (January-February) typically see firmer prices on Asian physical demand. Summer months often see weaker prices as demand seasonally declines.

Trading strategies for different investor types:

Long-term holders (buy and hold): Don’t try to time international price movements perfectly. Buy consistently when you have funds available. Focus on building positions over time rather than catching exact bottoms.

Watch for significant price dips of 5-10% from recent highs as opportunities to add to positions. These corrections happen periodically in even the strongest bull markets.

Medium-term traders (3-12 month holds): Pay attention to Federal Reserve policy signals, central bank buying trends, and geopolitical developments. These factors drive multi-month trends you can position for.

Buy when negative sentiment creates price weakness but fundamentals remain supportive. Sell portions of holdings when prices surge significantly above long-term trend lines and sentiment becomes euphoric.

Active traders (days to weeks): Focus on technical analysis, chart patterns, and short-term sentiment indicators. International gold markets provide excellent liquidity for active trading.

Watch for oversold conditions on daily or weekly charts as entry points. Take profits when short-term momentum indicators show overbought conditions.

Use futures markets for active trading rather than physical gold, as transaction costs and bid-ask spreads are lower. Physical gold works better for longer-term positions.

Practical execution tips:

Compare dealers: Prices vary between dealers. Check several before buying to ensure competitive pricing. Online dealers often offer better prices than local shops due to lower overhead.

Buy near spot: Minimize premiums over spot price. Bars typically carry lower premiums than coins. Common coins like Gold Eagles or Maple Leafs have lower premiums than rare numismatic pieces.

Consider storage: If buying in quantity, professional storage may be cheaper and safer than home storage. Allocated storage segregates your metals from others, providing maximum security.

Verify authenticity: Buy from established dealers with strong reputations. For significant purchases, consider professional verification or buy only certified products from major mints.

Tax implications: Understand tax treatment of gold in your jurisdiction. Some countries tax gold purchases, sales, or both. Capital gains tax may apply to profits. Plan accordingly.

Liquidity matters: Buy forms of gold you can easily sell later. Well-known coins and bars from major mints offer the best liquidity. Obscure or unusual forms may be harder to sell at fair prices.

Ready to participate in the international gold market? Visit USAGOLD’s special offers to explore investment options, get current pricing, and receive guidance from professionals who’ve navigated global gold markets since 1973.

Read the full article here

Leave a Reply