Gold spot prices advanced $10.70 (+0.32%) to $3,358 per ounce on Wednesday, while silver surged $0.60 (+1.60%) to $38.45 per ounce, marking the second consecutive day of gains for both precious metals. The bullish momentum came as July inflation data reinforced market expectations for Federal Reserve rate cuts, with traders now pricing in a 94% probability of a 25 basis point reduction at the September FOMC meeting.

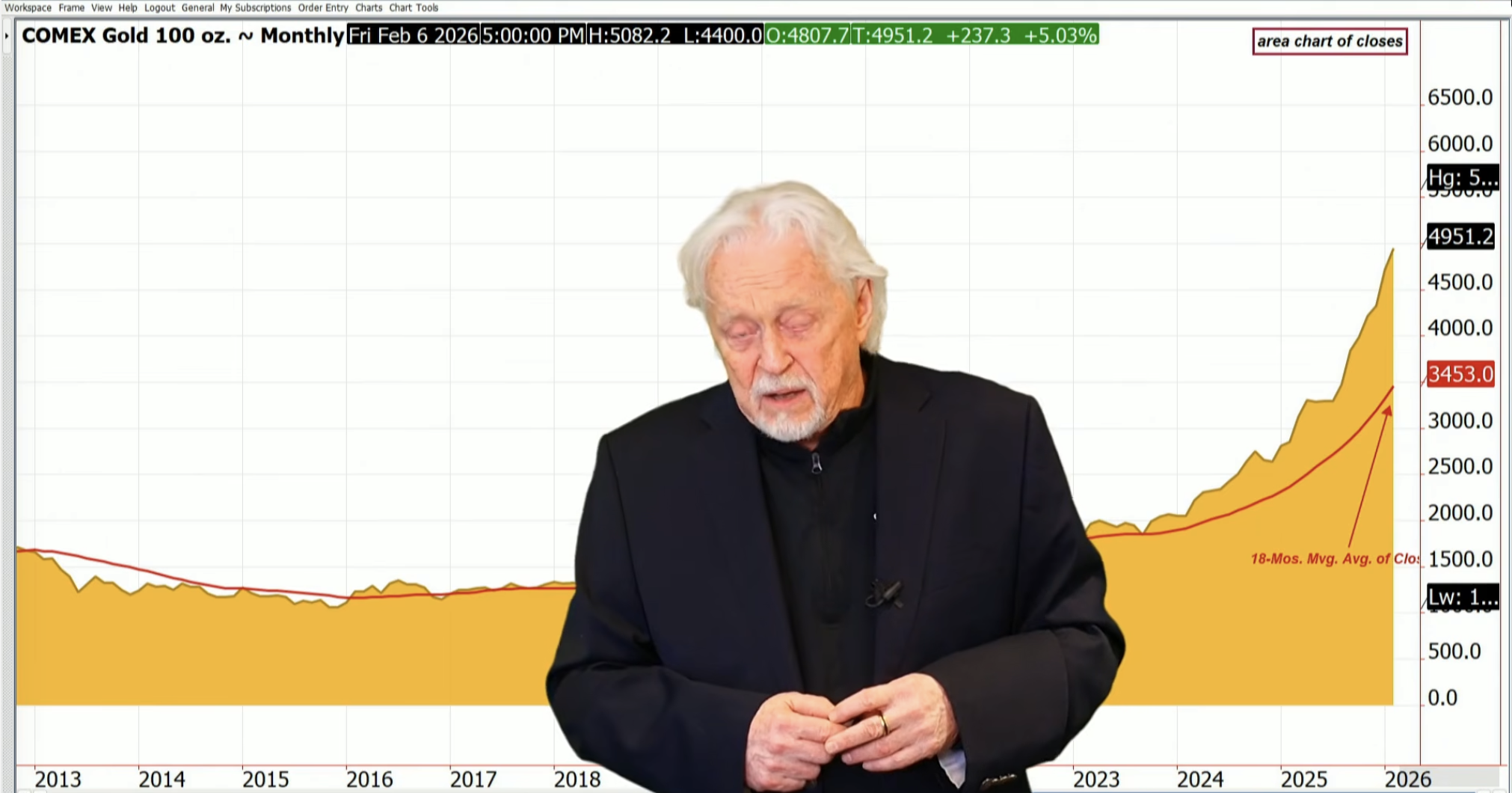

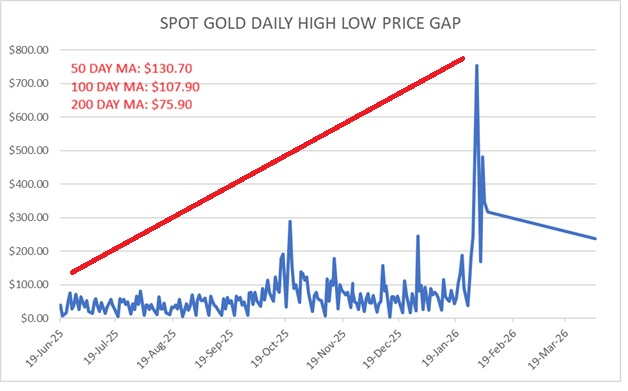

Gold has surged over 25% in 2025, continuing a rare streak of double-digit annual gains and outperforming all major asset classes since 2020. However, its rise has been volatile and less linked to traditional drivers like real yields or the dollar, instead driven by heightened geopolitical tensions and central bank buying—especially by countries aiming to reduce dependence on the US dollar. Despite this impressive performance, gold has shown price stagnation in recent months, and faces headwinds from steady US economic growth, manageable inflation, and stronger real yields, as well as the growing (though less convincing) competition from Bitcoin and stablecoins. Nevertheless, gold remains a strategic portfolio asset, valued for its role as a liquid diversifier and crisis hedge, even as its objective valuation remains challenging due to its lack of yield and inelastic supply.

Read the full article here

Leave a Reply