Surges in the gold-to-silver ratio above 100 in both March 2020 and April 2025 preceded powerful silver rallies—and if the 2020 analog holds, even more silver gains are ahead.

I wanted to share an update highlighting a fascinating development—and the successful confirmation of a theory I proposed during the bleak days of early April.

That was when silver, along with most financial markets, plunged following President Trump’s surprising ‘Liberation Day’ tariff announcement. Silver sank a staggering 21% in just three trading sessions—a move that was both shocking and disheartening for precious metals investors.

Yet even then, I saw a glimmer of hope in the parallels with the early 2020 COVID lockdowns, which initially caused panic but ultimately sparked a powerful silver rally to seven-year highs. In this update, I’ll walk through how that theory played out—and what it still indicates for silver’s path ahead.

First, I want to show how silver recently broke out above its long-standing $32 to $35 resistance zone—a ceiling that held firm for over a year, from May 2024 to June 2025. This breakout marks, in my view, the official start of silver’s next major bull market. I believe silver is now on track to target $50 and even higher in the months ahead.

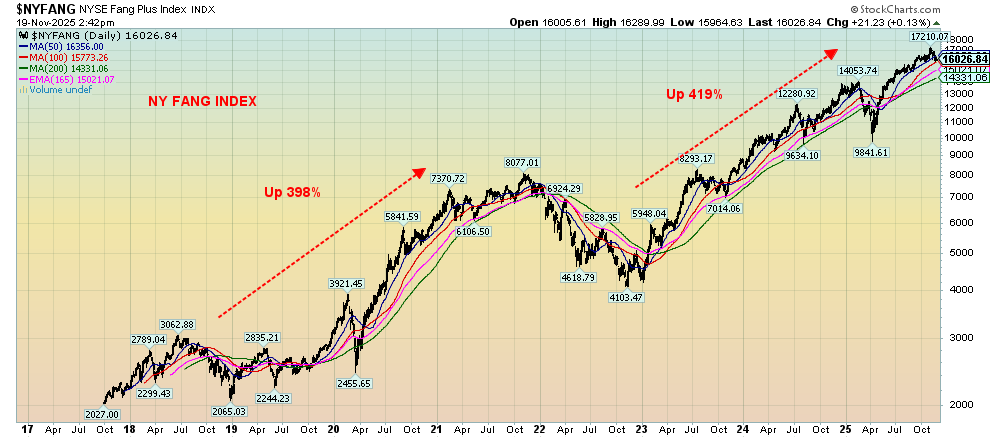

I also want to revisit gold briefly to point out how, from 2020 to 2024, it was capped below the $2,000 to $2,100 resistance zone. This ceiling kept gold suppressed for years until it finally broke out, igniting the powerful bull market it remains in today.

I see strong parallels between gold’s struggle then and silver’s recent battle under the $32 to $35 resistance zone. Now that silver has decisively broken out, there is a very strong chance it will follow in gold’s footsteps—and it’s even likely to outperform gold for the near future.

What’s remarkable—and encouraging—about this rally to 14-year highs is how unexpected it was, especially considering the dramatic selloff in early April when silver plunged 21% in just three trading sessions, falling from around $35 to as low as $27.54.

At the time, many pessimistic voices—including battle-weary and cynical silver investors—were convinced the metal was finished and headed back to $20 or even the teens. But the opposite happened—thankfully.

I have seen strong parallels between the tariff-induced plunge and the sharp 37% drop during the 2020 COVID lockdowns, when silver sank dramatically in just one month:

As a quick aside, it’s worth explaining why silver often sinks during periods of economic panic—despite its status as a precious metal.

Unlike gold, silver is far more tied to the industrial economy, with a much larger share of its demand coming from industrial use. That economic sensitivity can be both a blessing and a curse.

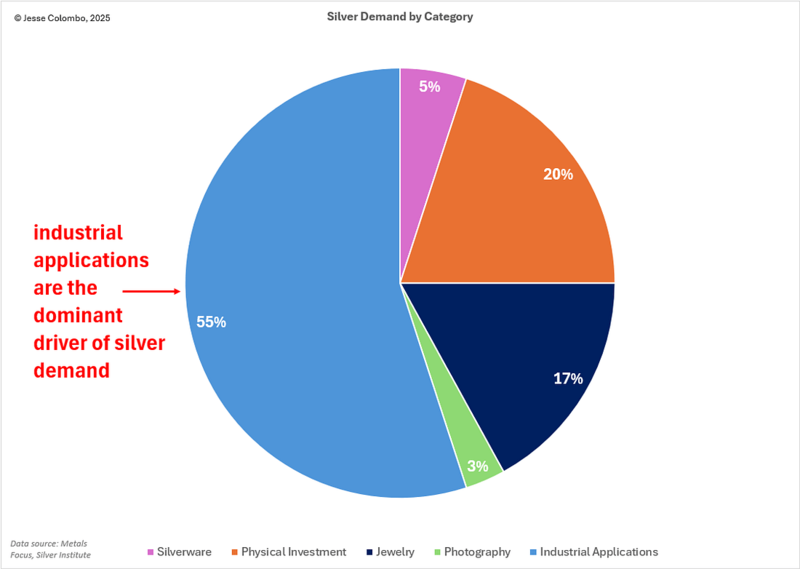

As the pie chart below shows, the majority of silver demand—about 55%—comes from industrial use, while only around 20% comes from investment.

In contrast, gold demand is driven largely by investment (44.57%) and jewelry (48.74%), with much of that jewelry serving as a form of investment as well, particularly in developing countries like India and China.

Returning to the main narrative, the weekly silver chart below highlights the striking parallels between silver’s 2020 and 2025 plunges—both followed by sharp recoveries to new highs:

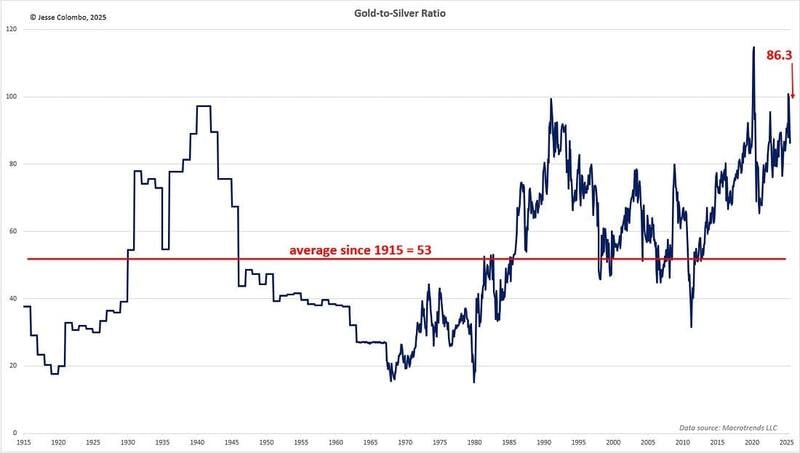

Another key factor that tipped me off to a likely silver rebound after the April plunge was the behavior of the gold-to-silver ratio. In both 2020 and 2025, the ratio spiked above 100—an extreme level that signaled silver was deeply undervalued relative to gold.

For perspective, the long-term average since 1915 is 53, so a reading above 100 is a true anomaly. Such extremes have historically marked bullish turning points, and I saw it as a clear signal that silver was a screaming buy.

I likened the ratio to a rubber band stretched to its limit—unsustainable and primed to snap back. And sure enough, that’s exactly what happened.

Assuming the 2020 analog still holds, there is even more room for the ratio to decline, which would imply much higher silver prices ahead. That’s precisely what I expect.

As I mentioned earlier, the long-term gold-to-silver ratio dating back to 1915 averages 53, making the current reading of 86.3 still extremely elevated by historical standards.

I believe this ratio will fall significantly as silver’s bull market progresses.

Using some rough math, if gold remains at its current spot price of $3,367 and the ratio returns to its historical average of 53, that would imply a silver price of $63.52—a remarkable gain of about 63%. And that’s assuming gold doesn’t rise any further.

If gold continues to climb, as I expect it will, then the upside potential for silver grows even larger. I fully expect gold to reach at least $15,000 an ounce within the next five to ten years, driven by a severe global debt crisis and an eventual financial reset.

If the gold-to-silver ratio returns to its historical average of 53, that would imply a silver price of $283—an astonishing 625% gain from current levels.

In the shorter term, $4,000 gold is likely just around the corner, with both Goldman Sachs and JPMorgan forecasting that level by 2026—and I share that view.

Assuming that plays out, and the gold-to-silver ratio merely returns to 70 (where it was as recently as 2021), it would imply a silver price of $57—a solid and realistic gain of nearly 50%.

To wrap things up, the recent plunge in the gold-to-silver ratio has powerfully validated the theory I shared back in early April—that the ratio was stretched to an unsustainable extreme, like a rubber band ready to snap back.

And snap back it did, in a big way. If silver continues to track the 2020 analog, we should see the ratio drop even further and silver prices climb significantly higher. That would be a long-overdue reward for us patient, battle-tested silver investors—and will finally attract the broader attention and capital this undervalued asset deserves.

If you found this report valuable, click here to subscribe to The Bubble Bubble Report for more content like it.

Read the full article here

Leave a Reply