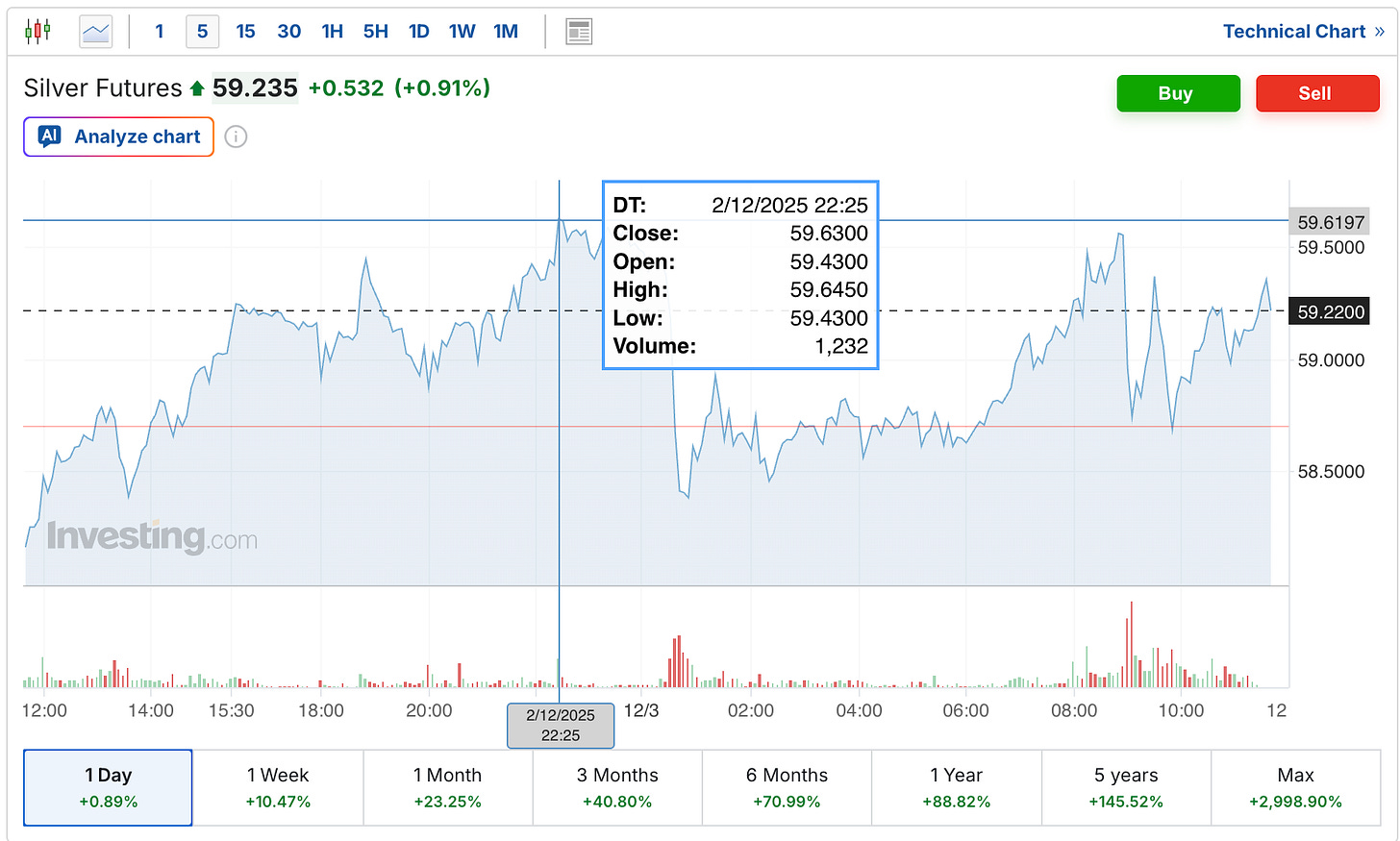

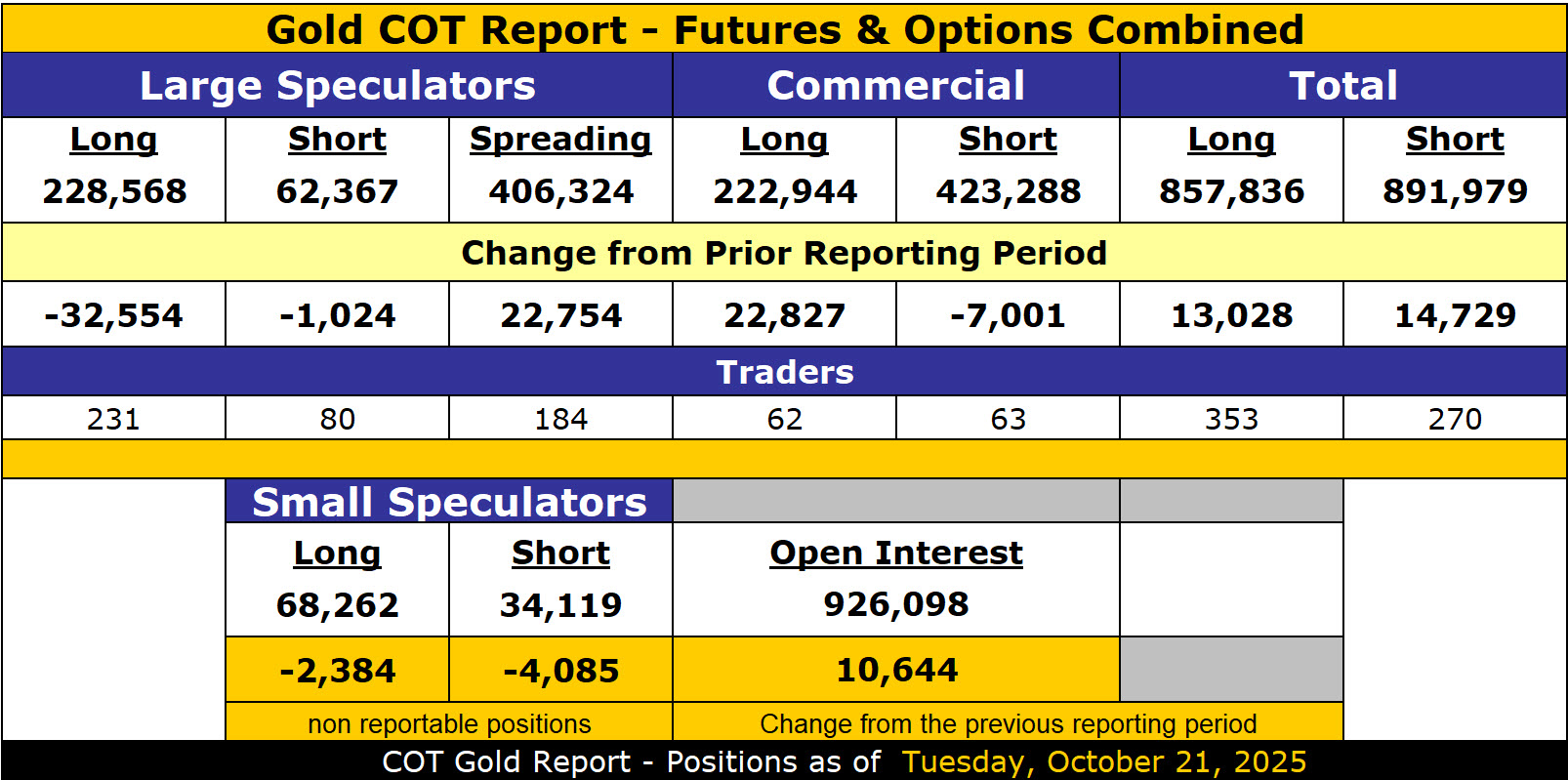

Spot gold plunged on Wednesday October 22, dropping another 1.5% to trade near $4,065.65 per ounce—down roughly $245 from Monday’s close as investors digested profit-taking after this month’s record rally. Silver followed suit, easing by 0.5% to $48.58 per ounce in active early trading. The selloff came as the U.S. dollar firmed and bond yields stabilized after recent safe-haven flows boosted both metals to historic highs. Economic data released this morning showed inflation expectations moderating slightly—Cleveland Fed’s nowcast pegged October headline CPI at 2.95% year-over-year, with core at 2.93%, a level consistent with gradual disinflation heading into the next Federal Reserve meeting. Equity futures steadied while traders priced in a renewed 56% probability of a Fed rate cut by December, suggesting the broader market sees cooling inflation but ongoing volatility in commodities and currencies. Despite the day’s sharp drop, gold remains up more than 54% year-to-date—one of its best performances in modern history.

A widely shared tweet by Alexander Stahel (@BurggrabenH) added perspective on Wednesday’s extreme gold volatility. He noted that the day’s 5.7% decline represents a rare 4.46-sigma move—a statistical event that, under normal distribution, should occur only once every 240,000 trading days. Yet gold’s history since 1971 shows that similar declines of 4.67% to 6.00% have happened 34 times in roughly 13,000 trading sessions (or once every 385 days), underscoring that gold is a far more volatile asset than often perceived. Stahel’s message cuts through market noise: this correction reflects not panic but normalization after a FOMO-driven surge, with profit-taking shaking out momentum buyers. His inference—supported by historical frequency analysis—is that large moves seldom cluster; periods of relative calm often follow. The insight reframes Wednesday’s plunge not as a reversal but as a healthy reset within a structurally bullish environment for gold, reinforcing the value of statistical literacy amidst emotional markets.

Read the full article here

Leave a Reply