Gold stocks just surged into another decisive secular breakout, at an unlikely time. Gold remains mired in a six-week-old high consolidation, and is just entering its seasonally-weak summer doldrums. So seeing outsized gold-stock strength now is unusual, though it is certainly fundamentally-justified. Is this gold-stock breakout sound and sustainable, or ill-fated and short-lived? It all depends on how gold fares soon.

Gold enjoyed a heck of a run into mid-April, mostly on frenzied Chinese investment demand. From its mid-November low after the biggest selloff of its mighty cyclical bull, gold soared another 33.5% in 5.2 months! But running so far so fast left it crazy-overbought, stretched a super-extreme 26.6% above its baseline 200-day moving average. That was only gold’s third close 26%+ over since January 2011, very rare!

So a subsequent 10%+ correction was highly-probable based on historical precedent. Back in mid-April I looked at every 10%+ gold move since January 1971, a vast half-century-plus span. The ten largest gold bulls excluding the wild 1970s dollar-gold-standard-decoupling ones averaged 58.0% gains over 13.9 months. That was way smaller than this current huge bull’s entire 88.0% since its early-October-2023 birth!

Those next-ten-largest gold bulls also peaked at an average of 1.265x gold’s 200dma, exactly where gold stretched to in mid-April. After getting so overbought, they were immediately followed by big-and-fast corrections averaging hefty 15.5% losses over a quick 1.9 months! The odds certainly favored a similar selloff, yet gold defied them. Instead of correcting, it has largely consolidated high over these last six weeks.

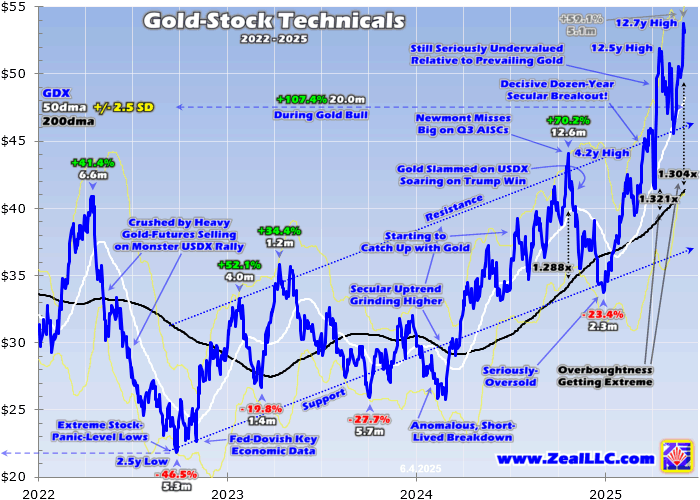

Before we explore that, the major-miner-dominated GDX gold-stock ETF soared 53.7% with gold between late December to mid-April. Yet those big gains were still actually quite poor. Because of gold miners’ great profits leverage to gold, GDX tends to amplify material gold moves by 2x to 3x. Outperformance is necessary to compensate gold-stock shareholders for miners’ big additional risks on top of gold price trends.

At merely 1.6x in that latest surge, GDX was heavily lagging its own precedent. And that was even worse over gold’s entire 88.0% cyclical bull. GDX was merely up 100.3% in that span for a dreadful 1.1x! So when gold soared into crazy-overboughtness, the gold stocks still had big catch-up rallying left to do. Today’s monster gold upleg meaning 40%+ gains was the first since one cresting back in early August 2020.

That weighted in right at 40.0%, yet GDX skyrocketed 134.1% in it for outstanding 3.4x upside leverage! Thus further gold-stock gains in the last six weeks were certainly warranted. Gold miners’ epic record fundamentals greatly buttressed that bullishness. In their latest-reported Q1’25 results, the GDX top 25 gold miners achieved dazzling record revenues, bottom-line earnings, unit profits, and operating cash flows!

Yet the downside risk is gold-stock price action is almost always ironcladly slaved to gold’s. So if their metal suffered that likely healthy rebalancing correction, the gold stocks would amplify its losses like usual. They only significantly outperform gold when it is rallying on balance fueling bullish sentiment. That really hasn’t been the case since mid-April’s peak, as gold has mostly been grinding sideways to lower.

Over the first eight trading days after, gold pulled back 5.5%. Selloffs are defined as pullbacks under 10%, corrections over 10%, and bear markets 20%+. While GDX did leverage that 1.7x falling 9.3%, that was mild reflecting still-bullish psychology. Over the next three trading days gold surged 5.8%, edging to a slightly-higher record close than mid-April’s. GDX only rallied 7.9% in parallel for meager 1.4x amplification.

Then gold rolled over again into mid-May, falling 7.1% in six trading days which was the second-biggest selloff of its entire mighty cyclical bull. That wasn’t far behind an 8.0% one into mid-November 2024, when gold was slammed on the US Dollar Index blasting higher after Trump’s election win. During this latest early-May pullback, GDX dropped 10.3% for 1.5x leverage. That was nowhere near the usual 2x to 3x.

Then over the next dozen trading days into this Monday June 2nd, gold rebounded nicely rallying 6.3%. But much of that came with that day’s blistering 2.7% surge, on a combination of more big tariffs and geopolitical fears. Over that weekend Trump doubled his steel and aluminum tariffs to 50%, and Ukraine reportedly destroyed or disabled a third of Russia’s entire strategic-bomber fleet risking catastrophic retaliation!

That day GDX blasted up a massive 6.2% to $53.74, a fresh 12.7-year secular high! That catapulted its total twelve-trading-day gains to 18.0%, amplifying gold’s an excellent 2.8x. With GDX 3.5% above its mid-April peak, that was a decisive 1%+ breakout! Yet gold remained 1.2% under its own mid-April high, so gold stocks were really outperforming without normal help from their metal. Bullish sentiment is mounting.

That extended GDX’s total gold-bull gains since early October 2023 to 107.4%, still a dismal 1.2x gold’s 88.1% at best in that span. While the gold miners are starting to outperform over the short term, they remain seriously behind over the long term. That makes major gold miners’ latest decisive secular breakout something of a wild card. Can gold stocks keep surging if gold fails to advance supporting their move?

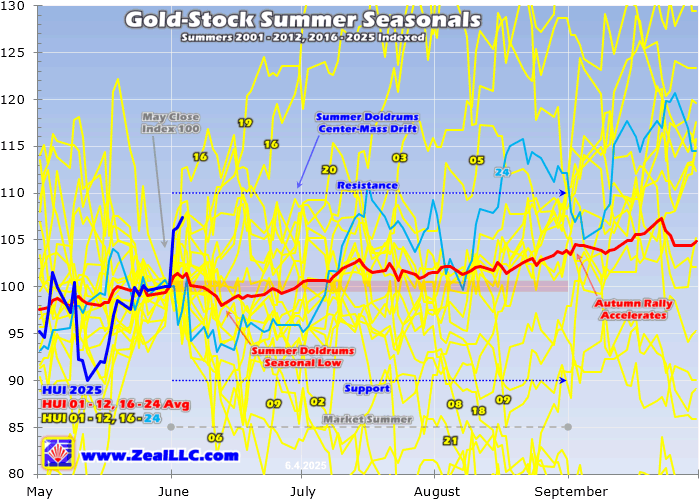

In last week’s essay I analyzed gold’s summer-doldrums outlook this year. This chart updated from there distills down major gold stocks’ summer seasonals during modern gold-bull years. While the HUI gold-stock index is used instead of GDX since the latter hasn’t been around long enough, they are functionally-interchangeable with the same dominant holdings. Each year’s summer price action is indexed to May’s close.

Market summers run June, July, and August, or effectively from the Memorial Day long weekend to the Labor Day one. On average during the gold-bull summers of 2001 to 2012 and 2016 to 2024, gold stocks rallied 1.1% on June’s first trading day. This latest Monday’s 106.0 indexed ranks as the second-biggest in this dataset. June’s best first days clocked in at 106.7 indexed in 2012, 105.1 in 2001, and 105.0 in 2019.

That only modern bigger first day of June way back in 2012 was way different from 2025’s. Between late February to mid-May that year, gold suffered a sizable 13.9% correction. Naturally the gold stocks didn’t fare well in that, with GDX plunging 31.4% for normal 2.3x downside leverage. So gold was very oversold heading into that summer, just starting to bounce. It soared 3.8% on June 1st driving GDX’s huge 6.4% surge.

What drove that particular day? It happened to be a Jobs Friday, when the all-important US monthly jobs report is released. That one printed at a serious miss, just 69k jobs created in the prior month compared to +150k expected. That lowered traders’ expected Fed rate trajectory, fueling massive gold-futures buying catapulting gold from -0.6% before that data to +3.8% on close! Still GDX merely amplified that by 1.7x.

This current summer-2025 setup is way different, with gold entering June still extremely overbought rather than extremely oversold like heading into summer 2012. So with a mean-reversion rebalancing selloff still overdue, gold’s summer-doldrums-2025 outlook is way more bearish which is an ill omen for gold stocks. If gold indeed rolls over into that correction soon, the major gold miners will amplify its losses like usual.

They’ve also been extremely overbought lately, although nowhere near as stretched as gold. This next chart looks at GDX’s technicals over the past several years or so. While extremely-overbought gold levels now start at 15% above its 200dma, GDX’s current threshold for extreme overboughtness is over 30%. Forging much above there signals that gold stocks likely soared too far too fast to be sustainable.

Back in mid-April, GDX rocketed up to 1.321x its 200dma! That was the most overbought gold stocks had been since late August 2020, the month gold’s previous monster upleg crested. Then this Monday as GDX blasted up 6.2% on gold’s big up day, this leading sector benchmark again stretched to 1.304x. So gold stocks are inarguably very overbought. That doesn’t mean they have to correct, but ups the odds they will.

Despite lagging their metal, GDX’s 59.1% surge in the last 5.1 months is quite a move as evident by its verticality shown in this chart. In light of that and GDX stretching 30%+ above its 200dma baseline multiple times recently, a breather would be perfectly normal. All bulls and uplegs naturally flow and ebb, taking two steps forward before one step back to healthily rebalance sentiment. Gold stocks are no exception.

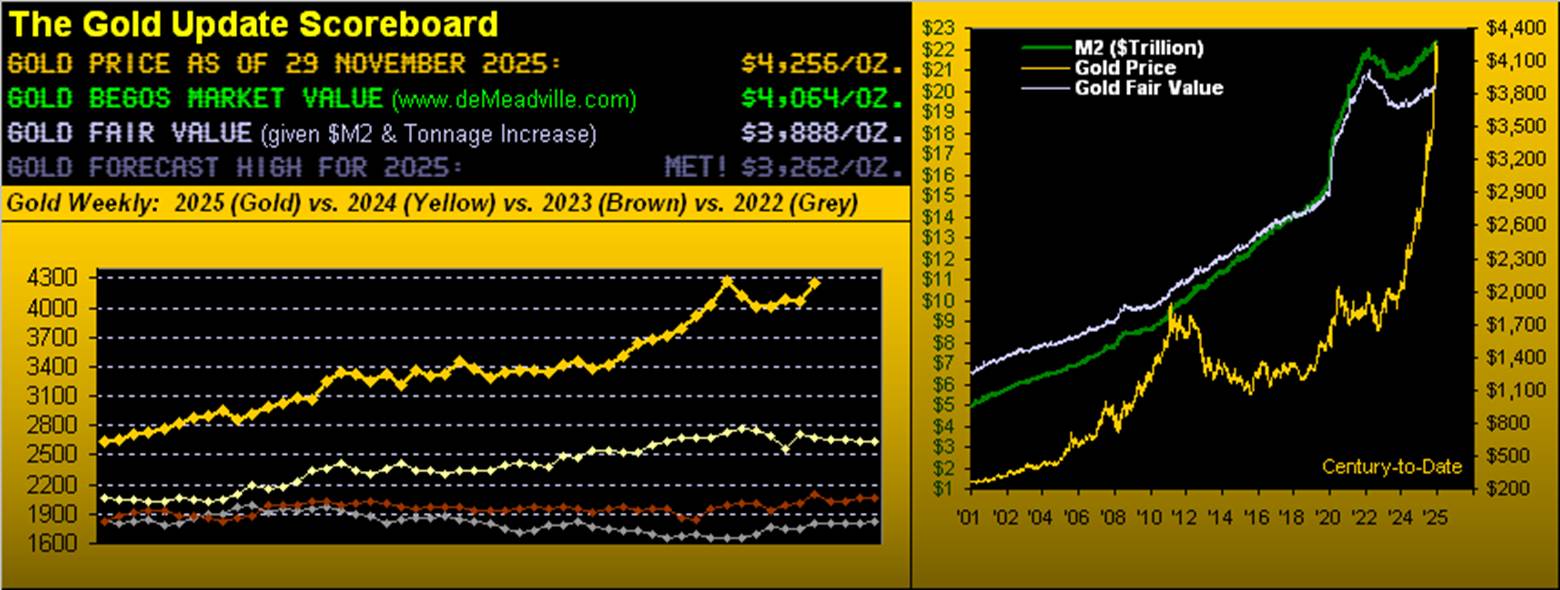

Mid-bull selloffs have nothing to do with fundamentals, only sentiment and technicals. The major gold miners of GDX are going to report their best quarter ever by far again in this current Q2. Now 2/3rds over, gold is already averaging $3,261 on close which shatters the preceding Q1’s previous record of $2,866! These lofty gold levels are going to fuel new record profits for gold miners, which is super-bullish.

My mid-May essay on the GDX-top-25 gold miners’ Q1’25 results analyzed why. These elite gold miners’ full-year-2025 all-in-sustaining-cost guidances averaged $1,426 per ounce. If Q2’s come in somewhere near there, the majors are looking at epic implied sector unit profits of $1,835! That is far higher than the previous record of $1,470 in Q1’25. That would make for colossal 67.0%-YoY growth in this key earnings metric!

And that’s nothing new for the GDX-top-25 majors. Q2 will actually prove their eighth quarter in a row of huge earnings growth, extraordinary and radically better than any other stock-market sector. Starting in Q3’23, GDX-top-25 implied unit earnings have skyrocketed 87.2%, 46.7%, 31.5%, 83.7%, 74.0%, 77.5%, and 89.7% YoY! Make no mistake, gold miners’ fundamentals are flat-out awesome achieving all kinds of records.

But while fundamentals really affect bulls’ ultimate magnitude of gains and longevity, they don’t drive the uplegs and corrections within bulls. Sentiment takes the lead there, oscillating between too much greed as uplegs top and too much fear when corrections bottom. And gold miners’ upcoming legendary Q2 results won’t be reported until late July to mid-August, so traders won’t see new record fundamentals for months.

Like usual, gold stocks’ near-term outlook in these young summer doldrums depends on how their metal fares. Since mid-April’s crazy-overbought peak, gold has been drifting in a high consolidation between about $3,175 to $3,425. If gold can manage to hang around in the upper half of that range for the next month or so until its seasonal autumn rally can get underway, gold stocks will likely mostly drift sideways with it.

But remember the ten largest gold bulls over the last half-century-plus excluding the wild 1970s monsters averaged subsequent 15.5% corrections over 1.9 months. Hitting 10% correction territory requires gold to close under $3,080, and 15% doesn’t come until way down at $2,909! If gold crumbles below this high consolidation’s lower support into correction territory, the gold stocks will almost certainly amplify its losses.

At 2x to 3x leverage, GDX would probably fall 20% to 30% in a 10% gold correction or 30% to 45% in a 15% one! All are serious near-term downside to face, big risks. If that healthy rebalancing selloff indeed comes to pass, speculators and investors alike would be far better delaying deploying new capital in gold stocks until gold’s correction has largely run its course. Why risk chasing extremely-overbought technicals?

While gold has proven incredibly resilient throughout its entire monster upleg or mighty cyclical bull since early October 2023 not yet suffering a single correction, it faces some formidable downside risks. Since Trump’s Liberation Day colossal reciprocal tariffs, big gold days have usually been driven by trade-war news. Increasing tensions often fuel strong buying, while good deal-progress news has driven outsized selling.

So if Trump’s aggressive big-tariffs gambit leads to some great trade deals being signed with major US trading partners, gold could fall hard. For years before that, gold’s biggest mover was often US economic data which affected perceived Fed rate trajectories. Better-than-expected prints on monthly jobs or hotter-than-expected inflation releases would erode Fed-rate-cut odds, probably goosing the US Dollar Index.

That is what gold-futures speculators often watch for their trading cues, then do the opposite. And the USDX hit extreme oversoldness in mid-April, the polar opposite of gold! It has mostly languished there since, consolidating low. So a big mean-reversion dollar rally remains overdue to erupt, likely spawning big gold-futures selling. While specs’ longs are quite low, they still have massive room to short sell gold futures.

It would be great if gold continues consolidating high rather than correcting, but everything lines up to the latter remaining a serious imminent risk. Another factor is gold’s powerful surge into mid-April was mostly driven by frenzied Chinese gold investment demand. And a big driver of that was Trump’s embargo-level 145% tariffs on Chinese imports, which would’ve shuttered much of the export-factory sector of China’s economy.

With those crushing reciprocal tariffs delayed for 90 days and Trump talking more about reaching a trade deal with China soon, fears Chinese stock markets will plunge are waning. That may retard that country’s big shift into gold, at least temporarily. It wouldn’t be hard for gold to still roll over into a correction given these major risks. And if that happens, the gold miners’ stocks will follow it lower amplifying its losses like normal.

So although gold stocks’ latest breakout surge is absolutely sound fundamentally, it is fragile given gold’s greedy sentiment and way-overextended technicals which are both really near-term-bearish. Gold stocks need gold powering higher on balance to consistently outperform and catch up with its monster gains. Gold-stock traders always fold like cheap lawn chairs whenever gold rolls over into larger selloffs, rapidly fleeing.

Given all these factors, it is prudent to wait and see what happens before shifting significant capital into gold stocks. This is a good time to research great fundamentally-superior smaller gold miners, and build a shopping list for when buying opportunities look more favorable. That’s what I’ve been doing recently, as most of our previous newsletter gold-stock trades were stopped out at solid-to-excellent realized gains.

Successful trading demands always staying informed on markets, to understand opportunities as they arise. We can help! For decades we’ve published popular weekly and monthly newsletters focused on contrarian speculation and investment. They draw on my vast experience, knowledge, wisdom, and ongoing research to explain what’s going on in the markets, why, and how to trade them with specific stocks.

Our holistic integrated contrarian approach has proven very successful, and you can reap the benefits for only $10 an issue. We extensively research gold and silver miners to find cheap fundamentally-superior mid-tiers and juniors with outsized upside potential. Sign up for free e-mail notifications when we publish new content. Even better, subscribe today to our acclaimed newsletters and start growing smarter and richer!

The bottom line is gold stocks just surged to another decisive secular breakout without their metal helping much, which is quite unusual. This is certainly fundamentally-sound, as gold-stock prices should be way higher with these lofty prevailing gold prices. The miners are achieving dazzling record financial results and still trading at low valuations. But epic fundamentals don’t nullify risks of sentiment-driven corrections.

Gold stocks’ near-term fortunes remain slaved to gold’s. Since soaring to crazy-overbought extremes in mid-April, it has defied the odds to consolidate high. Yet waning trade-war fears, better-than-expected major US economic data lowering rate-cut odds, or the oversold US dollar bouncing could all spawn big gold-futures selling hammering gold. The gold stocks wouldn’t take a gold correction well, amplifying its losses.

Adam Hamilton, CPA

June 6, 2025

Copyright 2000 – 2025 Zeal LLC (www.ZealLLC.com)

Read the full article here

Leave a Reply