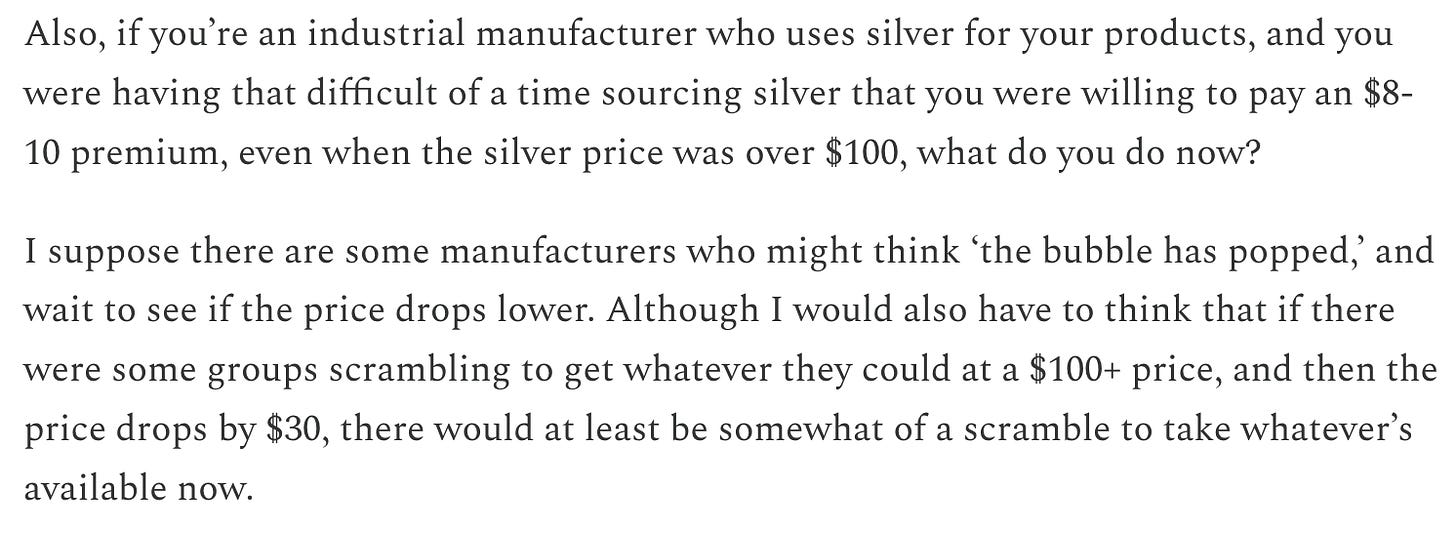

What started off as a relatively benign day in the gold and silver markets has turned into another bloodbath, which we’re also seeing in the other markets as well. Although once again, silver’s decline is substantially larger.

If you click to enlarge the image above, you can see on the right how the stock markets are down too, and the VIX is up almost 16%.

Volatility shook Wall Street as concerns over technology profits spurred an industry rout after Cisco Systems Inc.’s weak margin outlook. Bitcoin sank to $65,000. Gold and silver tumbled. Bonds climbed.

Equities wiped out earlier gains, with the S&P 500 and the Nasdaq 100 dropping 1.3% and 1.8%, respectively. Cisco plunged 12% as its forecast underscored higher memory-chip prices are taking a toll. All megacaps retreated and an exchange-traded fund tracking software companies slumped 3.7%.

Cisco’s down 12%, so at least the silver price isn’t the biggest decliner on the day. Although Cisco did report a weak margin outlook, there’s no similar news in the silver market.

The cliff dive plunge lower never looks all that clean to me, especially when you compare it to the chart of the S&P, where it has a much more gradual decline.

However you want to slice it, the silver price is lower, as is the gold price, where the chart has a very similar pattern to silver’s.

In a separate article from Bloomberg, they suggested that part of the move was being caused by traders selling gold and silver to cover stock market losses.

For what it’s worth, I would suggest that if we are at the beginning of a more significant decline in the stock market, I wouldn’t expect gold and silver to follow that all the way down. Because as we’ve seen in the past years, when the stocks really start getting hammered, that does get the phones ringing at the bullion dealers.

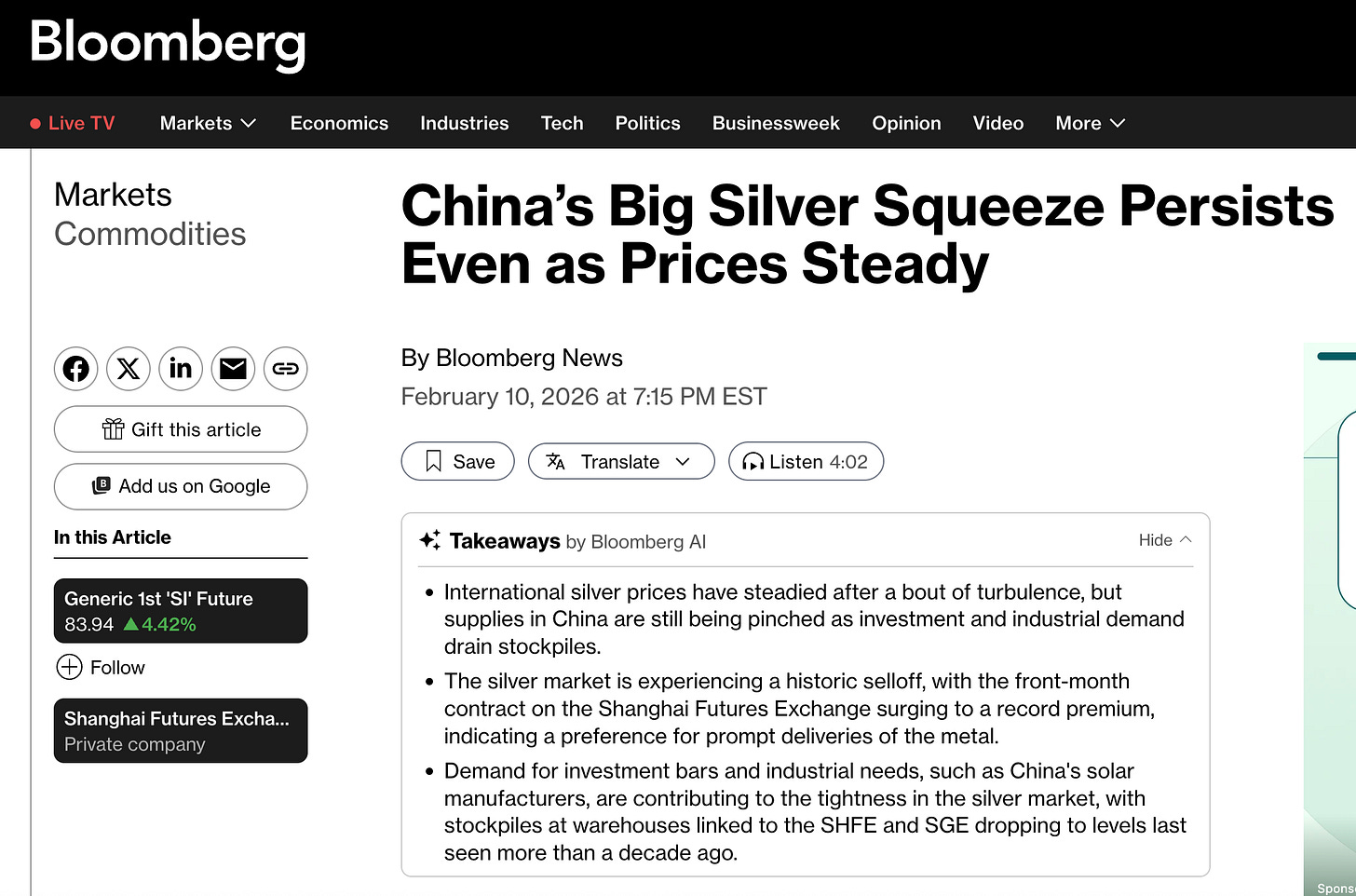

Especially when the pressure on the silver supply continues to grow, with Bloomberg reporting about more tightness in the East.

I mentioned this one briefly, as it came out right as I was about to hit send, but I’d like to share a few quotes, as they speak to what I’ve been detailing over the past two months.

International silver prices have steadied after an epic bout of turbulence, but supplies in China are still being pinched as investment and industrial demand drain stockpiles.

Domestic producers and traders are struggling to fill a backlog of orders, pushing up near-term prices and leaving the market heavily backwardated. The front-month contract on the Shanghai Futures Exchange has surged to a record premium, indicating the market’s overwhelming preference for prompt deliveries of the metal.

“Such a large backwardation is driven by an inventory crisis and the depletion of deliverable material,” said Zhang Ting, senior analyst at Sichuan Tianfu Bank Co.

Meanwhile, short sellers on the Shanghai Gold Exchange, who bet that silver prices would fall, have been paying long-holders deferral fees since late December to avoid having to make deliveries, highlighting a scarcity of metal to close positions.

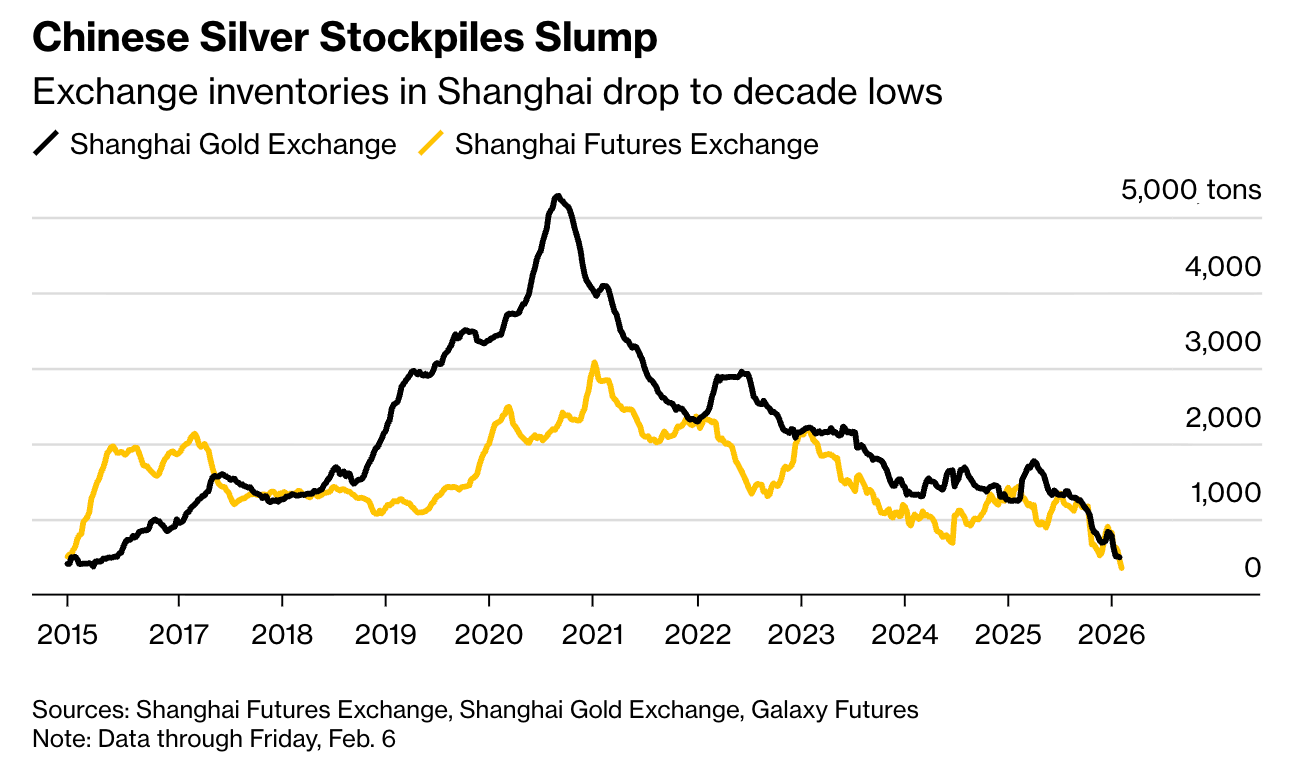

The relatively illiquid silver market is no stranger to extreme moves, including a worldwide squeeze on supplies in the autumn. That left Chinese inventories already depleted when investment demand spiked in December. Since then, stockpiles at warehouses linked to the SHFE and SGE have dropped to levels last seen more than a decade ago.

Below you can see just how far the inventories have fallen, which, as I’ve been mentioning recently, is rather alarming, especially when you consider that the Comex inventories are down to 25.7 million ounces (they were at 36 million ounces two weeks ago), while the LBMA ran into its own crisis when its free float got down to 141 million ounces last October.

Demand for investment bars has stayed high. In Shuibei market in Shenzhen, the country’s biggest bullion hub, merchants can easily find buyers for bars at premium prices. “Whenever there are stocks, they’re sold off quickly,” said Liu Shunmin, head of risk at Shenzhen Guoxing Precious Metals Co.

Industrial needs are also contributing to the tightness. China’s solar manufacturers, which use silver in panels, are front-loading production to meet demand ahead of the loss of export tax rebates on April 1. Many firms have taken advantage of the recent price collapse to buy the dip, said Jia Zheng, head of trading at Shanghai Soochow Jiuying Investment Management Co.

I speculated two weeks ago, after the $30 silver sell-off, that with the price lower, right after indications that Indian and Chinese solar manufacturers were having a hard time sourcing the silver they needed, there was a good chance that some of them would be eager to buy on the lower prices. And it seems like that turned out to be what happened.

The only way to ease the market’s immediate tightness in supply is if smelters can ramp up production during the week-long Lunar New Year break, said Jia, although that’s a time of year when activity typically tails off.

I’m sure the latest sell-off will leave some investors unnerved, but my guess is also that we will see more buying on the dip on the retail level, which is becoming increasingly important, since there are signs of the retail market finally shifting from a lot of selling over the past few years, to a more balanced order flow now. Which, if that continues, would only add further pressure to the supply deficit.

I have some notes ready to cover some recent silver developments in India that we will go through, but at least for now, just about everything is selling off, and we’ll see how things look in 24 hours.

Sincerely,

Chris Marcus

Read the full article here

Leave a Reply