Gold miners’ stocks were dramatically surging just a couple weeks ago. Mounting bullish sentiment was increasingly attracting back traders, who bid the leading gold-stock ETF to dozen-year-plus secular highs. But this sector’s strong upside momentum reversed since, gold stocks rolling over into a selloff. They are leveraging gold’s sharp reversal out of extreme overboughtness, despite their best fundamentals on record.

Before Trump’s reciprocal-tariffs announcement unleashed market chaos in early April, the leading GDX gold-stock ETF was having a good 2025. It had powered 35.6% higher year-to-date exiting March, which amplified gold’s parallel 19.0% gain by 1.9x. That was decent but on the lower side, as historically gold stocks have tended to leverage material gold moves by 2x to 3x. Their degree of outperformance reflects sentiment.

That waxed pretty bearish after Trump’s Liberation Day press conference, as the extreme fear generated by plunging stock markets sucked in gold stocks. On Friday April 4th as the S&P 500 plunged 6.0%, GDX fared worse collapsing 8.8%! That proved gold stocks’ worst down day since March 2020 during the pandemic-lockdown stock panic. But within days the miners rocketed in a violent V-bounce with their metal.

Over just six trading days into mid-April, GDX catapulted up a huge 25.1%! That amplified gold’s driving 11.9% surge by a better 2.1x. With both the metal and its miners flying higher, traders’ interest mounted. Bullish gold-stock coverage ramped considerably higher in mainstream financial media including CNBC and Bloomberg. While growing bullish psychology was fun, a serious downside risk factor suddenly arose.

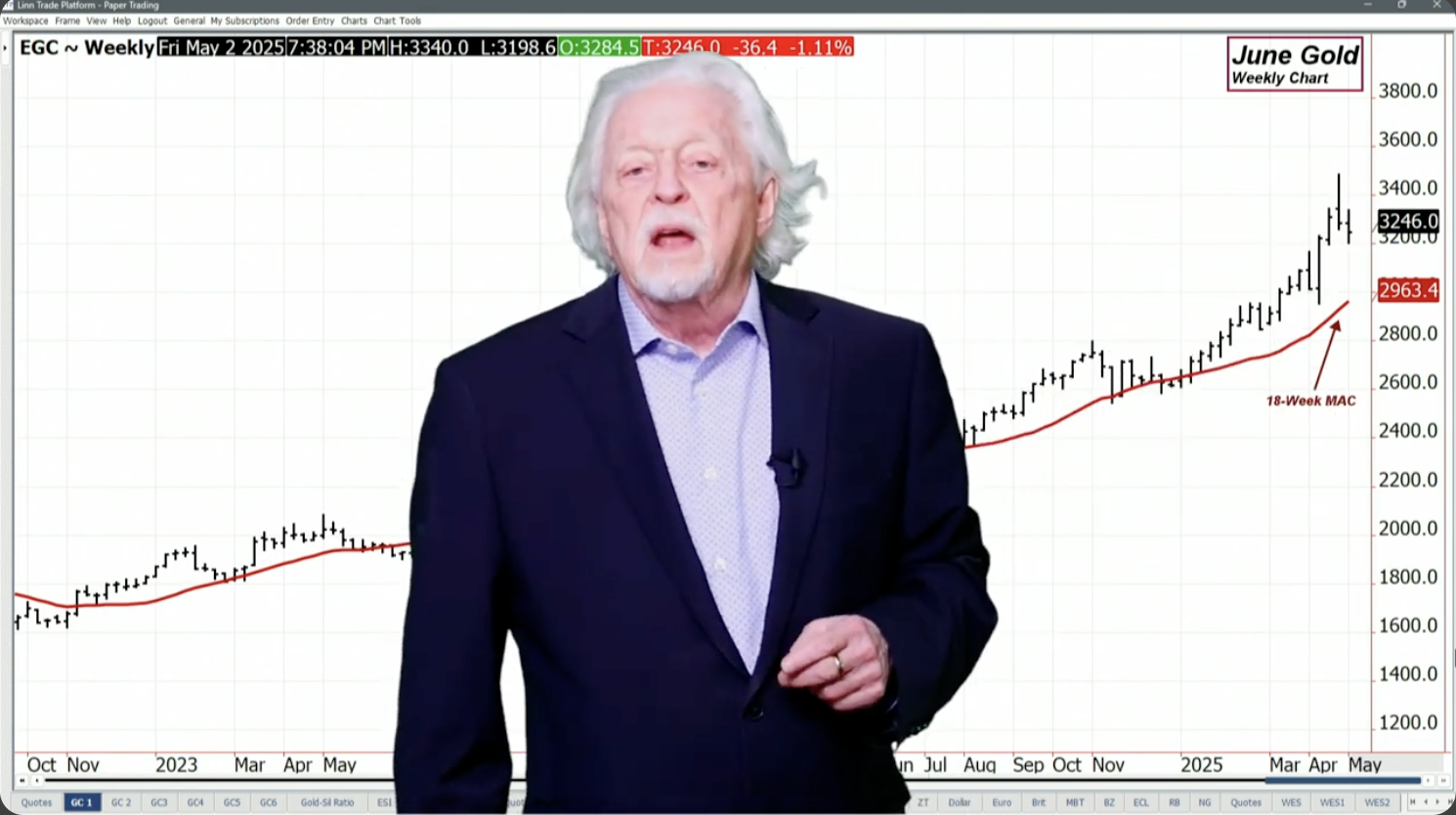

Gold had soared to extreme crazy-overbought levels, which I analyzed in depth in another essay last week. Gold had rallied so far so fast it was stretched way up to 1.266x its 200-day moving average. That was only the third day since January 2011 that gold had closed 26%+ above that key baseline! In order to better understand how risky that was for gold, I examined every 10%+ gold move since January 1971.

Rocketing up to that extraordinarily-overbought level extended gold’s mighty cyclical bull born in early October 2023 to huge 88.0% gains over 18.5 months! That ranked as gold’s sixth-largest cyclical-bull run since 1971. The top four were all 1970s ones, ranging from 99% to 128% gains. But that decade where the US dollar’s gold standard was severed was a once-in-a-currency’s-lifetime shock, not very comparable to today.

Excluding all those wild 1970s cyclical bulls and today’s, the next-10-largest gold cyclical bulls over gold’s entire 54.4-year modern history averaged 58.0% gains over 13.9 months. Provocatively they peaked at an average of 1.265x gold’s 200dma, exactly where it returned last month! The average gold selloffs after those massive cyclical bulls proved big and fast, averaging hefty 15.5% gold losses over a quick 1.9 months!

So in our popular weekly newsletter on April 22nd the very next day after gold’s record $3,421 close at 1.266x its 200dma, I warned “…I’m changing my bias on gold to short, and adding some GLD puts. While gold stocks are nowhere near as overbought as gold, they will follow it lower like usual amplifying any significant selloff. So I’m starting to ratchet up our trailing stops…” Miners can’t escape material gold drawdowns!

That has certainly proven true during today’s mighty cyclical gold bull, which is also a monster upleg since gold hasn’t yet seen a single 10%+ correction! Since gold miners’ profits leverage gold’s moves, so do their stock prices. No matter how fantastic gold miners’ fundamentals become, they always get sucked into meaningful gold selloffs. This chart illuminates several previous episodes during gold’s current bull run.

From early October 2023 to late December that year, gold’s initial surge climbed 14.2% achieving gold’s first new nominal record close in 3.3 years! GDX rallied 23.5% during that span, for weaker 1.7x upside leverage. While gold wasn’t overbought at all, it still took a breather with a minor 4.2% pullback into mid-February 2024. You’d think that wouldn’t be a big deal to gold-stock traders, right? They wildly overreacted.

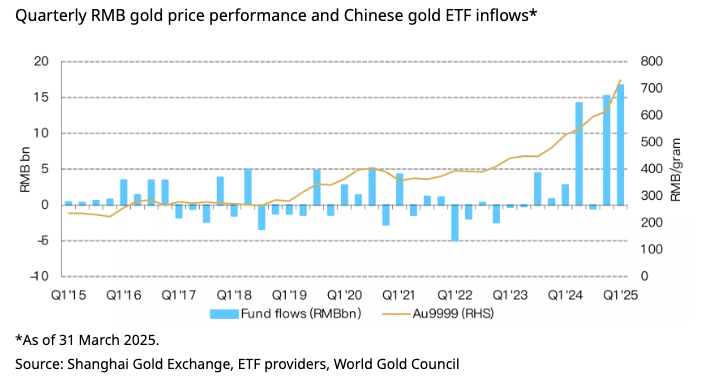

From late December into late February, GDX plunged 19.4% for colossal 4.7x downside leverage! Then gold resumed powering higher again, on big buying from Chinese investors and central banks. By mid-May it had surged another 21.8%, driving GDX 44.5% higher for better 2.0x upside leverage. Gold had blasted into extremely-overbought territory more than 15% above its 200dma that time, so it sold off again.

Yet gold just retreated 5.7% into early June, a moderate-yet-sharp pullback. Realize corrections don’t start until 10%, anything less is defined as a pullback. That still worried gold-stock traders enough that GDX fell 11.0% by mid-June for 1.9x downside. The gold miners’ stocks couldn’t avoid getting sucked into even minor gold pullbacks, despite their earnings already soaring to records! I’ll elaborate on those later.

Gold soon resumed charging higher, forging one of its most-remarkable years ever. By late October it had powered another 21.9% higher to extremely-overbought levels. I warned earlier that month that gold’s selloff risk was high after getting so overextended! Unfortunately gold stocks really underperformed that entire surge, with GDX only rallying 33.0% for 1.5x upside. That should’ve moderated their subsequent selloff.

But sadly it didn’t, as in gold-stock-land the excitable traders seem to assume any gold retreat is apocalyptic. Trump’s election win was a big-enough surprise to unleash a massive US dollar surge, fueling gold selling. So by mid-November the yellow metal had plunged a sharp-yet-still-pullback-grade 8.0%. That was this cyclical gold bull’s largest selloff, still on the moderate side yet still terrifying gold-stock traders.

GDX not only plunged 19.5% around that several-week span for 2.4x, but continued correcting well after gold into late December! This leading gold-stock ETF eventually bottomed with a 23.4% loss which was 2.9x gold’s. Gold stocks actually suffered a 20%+ bear-market-grade selloff on a fairly-minor sub-10% gold pullback. Gold-stock speculators and investors really, really hate gold weakness no matter how mild!

Gold surged again out of that post-election pullback into late March, rallying another strong 21.9%. The parallel GDX upleg starting later in December only climbed 36.1% for 1.6x upside. Then Trump’s big reciprocal-tariffs declaration unleashed market chaos in early April, briefly engulfing gold and thus its miners’ stocks. Gold’s 4.6% pullback in just over a week proved minor again, but GDX still fell 9.8% for 2.1x.

As gold is the ultimate portfolio diversifier ideal for times of outsized stock-market volatility, it roared back 14.8% higher in a violent V-bounce! GDX soared a sympathetic 25.2% in just seven trading days, a great run but still just amplifying gold a substandard 1.7x. That blistering gold surge is what catapulted it to that crazy-overboughtness 26%+ above its 200dma. That left gold at high risk for an imminent correction-grade selloff.

Again gold’s ten-largest cyclical bulls excluding the 1970s ones averaged subsequent 15.5% corrections over 1.9 months, after cresting at an average of 1.265x gold’s 200dma. So after gold just hit 1.266x again on April 21st, odds would seem to favor another 15%ish retreat. The problem with anything rallying too far too fast is it entices in all-available near-term buyers too soon, quickly exhausting their capital inflows.

Once those burn out, only sellers remain forcing healthy selloffs to rebalance away overextended technicals and greedy sentiment. If gold saw another average post-big-cyclical-bull selloff again, 15.5% in 1.9 months would slam it way back down near $2,891 by mid-to-late June! Corrections following cyclical bulls are perfectly normal, not impairing larger secular bulls encompassing cyclical bulls and bears alike.

Yet even worse, corrections tend to bottom near 200dmas. In those top-ten gold bulls excluding the 1970s’, the subsequent corrections ended at an average of 1.024x gold’s 200dma. Ominously today that trailing baseline is still way down at $2,736, illuminating how extraordinarily-overbought gold has just been! If that forces gold to rebalance with a 15%+ correction, gold miners’ stocks aren’t going to handle it well.

Again historically GDX has tended to amplify material gold moves by 2x to 3x, which would imply a 30%-to-45% gold-stock cyclical bear coming! That whole range sounds pretty brutal, implying a major gold-stock bottoming somewhere between GDX $28.50 to $36.25. Interestingly excluding February 2024’s outlying downside leverage, GDX has amplified gold’s pullbacks during this cyclical bull by an average of 2.3x.

If that holds in gold’s coming selloff, GDX would be looking at a 35%ish loss near $34. This leading gold-stock ETF was challenging $52 in mid-April before gold grew too overbought, and was running near $49 midweek. So gold stocks still face serious downside from here if gold indeed corrects out of its most-extreme overboughtness since August 2011! Far from being a threat, such a selloff would be a great opportunity.

Just a couple weeks ago, speculators and investors alike were starting to grow excited about gold stocks again for the first time since the summer of 2020. They were starting to aggressively chase this sector’s strong upside momentum, buying in relatively-high. That briefly drove GDX a little into its own extreme-overboughtness territory 30%+ above its 200dma, when it hit 1.321x on April 16th. Buying high is always risky.

If traders liked gold stocks in mid-April, they should love these same gold miners about a third lower in maybe six weeks or so! As our existing newsletter gold-stock trades are stopped out with big unrealized gains, I’m salivating at the opportunity to redeploy after gold’s necessary selloff. Gold miners’ fundamentals have never been stronger, led by earnings forging ever-deeper into record territory quarter after quarter.

The major gold miners dominating GDX are now starting to report their full Q1’25 results. Once those are all published by mid-May, I’m going to analyze the GDX top 25’s like usual in another essay. I’ve been doing this for 35 quarters in a row now, gradually amassing some of the best fundamental data on gold miners in the world. The keystone element is their implied sector unit earnings, distilling down everything else.

That’s simply calculated by averaging the GDX top 25’s all-in sustaining costs per ounce then subtracting them from that quarter’s average gold prices. This reveals major gold miners’ average per-ounce profits, which is a great metric for how they are faring. During the last six fully-reported quarters ending in Q4’24, these have soared 87%, 47%, 35%, 84%, 74%, and 78% YoY to a dazzling record $1,207 per ounce exiting 2024!

No other sector in all the stock markets even comes close to such spectacular sustained earnings growth. And that’s going to continue accelerating in this recently-completed Q1’25. Gold averaged an amazing record $2,866 last quarter, rocketing an incredible 38.3% YoY! A quarter earlier, the GDX-top-25 gold miners guided their full-year-2025 AISCs to a $1,512 average. Q1’s will likely shake out somewhere near there.

Assume $1,525, and that yields implied sector unit profits of $1,341 last quarter. That would prove the highest ever again by far, soaring another 70%ish YoY making for the seventh consecutive quarter of enormous earnings growth! Plenty of great gold miners are already trading at teens or even single-digit trailing-twelve-month price-to-earnings ratios even before Q1 results. This sector remains deeply-undervalued.

So if gold’s crazy-overboughtness forces a correction-grade selloff which gold stocks will amplify like usual, they are going to be much cheaper when that bottoms. As the gold miners would be screaming buys today if not for gold prematurely exhausting its near-term upside, they will look even more appealing fundamentally after a big correction or quick bear. I can’t wait to fully redeploy in this high-potential sector then.

A gold correction following a mighty cyclical bull is nothing to fear, gold’s own fundamentals remain quite strong. I elaborated on those in a gold-trade-war-refuge essay several weeks ago if you need to get up to speed. So gold’s secular bull is highly likely to continue powering higher on balance after this normal and healthy selloff. The gold miners’ stocks will amplify those coming gains, ultimately blasting far higher from here.

So don’t get caught up in mounting fear as gold stocks retreat with their metal. The whole purpose of selloffs after strong bull runs is rebalancing sentiment, bleeding off greed while fear flares. Instead of worrying, traders need to be doing their homework during post-cyclical-bull selloffs. That means researching and studying individual gold miners to uncover fundamentally-superior ones to soon redeploy in at lower prices.

Successful trading demands always staying informed on markets, to understand opportunities as they arise. We can help! For decades we’ve published popular weekly and monthly newsletters focused on contrarian speculation and investment. They draw on my vast experience, knowledge, wisdom, and ongoing research to explain what’s going on in the markets, why, and how to trade them with specific stocks.

Our holistic integrated contrarian approach has proven very successful, and you can reap the benefits for only $10 an issue. We extensively research gold and silver miners to find cheap fundamentally-superior mid-tiers and juniors with outsized upside potential. Sign up for free e-mail notifications when we publish new content. Even better, subscribe today to our acclaimed newsletters and start growing smarter and richer!

The bottom line is gold’s selloff is hitting the miners. After catapulting up to crazy-overbought levels, gold is due for a correction to rebalance away overextended technicals and greedy sentiment. The past half-century of gold precedent suggests that running around 15% over a couple months. While normal and healthy within larger secular bulls, major gold stocks still tend to amplify post-cyclical-bull selloffs by 2x to 3x.

That implies gold stocks losing about a third of their value in a quick cyclical bear in coming months. So traders with existing positions should tighten their stop losses to protect more of their big unrealized gains. While a gold correction will drag gold stocks lower, the miners’ fundamentals remain their best ever. Thus the buying opportunities after this necessary gold selloff runs its course will be excellent for prepared traders.

Adam Hamilton, CPA

May 2, 2025

Copyright 2000 – 2025 Zeal LLC (www.ZealLLC.com)

Read the full article here

Leave a Reply