Gold enters 2026 trading near $5,000 per ounce and briefly touching $5,500, after a historic run through 2025. Most major bank analysts project prices to remain elevated, with forecasts ranging from $4,400 on the conservative end to $6,300 or higher from the most bullish voices. Whether gold consolidates, corrects, or continues climbing depends on inflation trends, Federal Reserve policy, and geopolitical developments that no one can predict with certainty.

Understanding what drives these projections helps investors make informed decisions rather than chasing headlines.

What Factors Influence Gold Prices?

Gold responds to a handful of primary drivers. None operates in isolation, and their interactions create the volatility that makes forecasting difficult.

Interest rates matter most in normal market conditions. Gold pays no dividend or interest, so when bonds and savings accounts offer attractive yields, gold faces competition for investor capital. When real interest rates fall (nominal rates minus inflation), gold becomes comparatively more attractive. The Federal Reserve’s rate decisions ripple through gold markets within minutes of announcement.

Inflation expectations drive demand for gold as a purchasing power hedge. When investors fear currency debasement, they buy gold to preserve wealth. This relationship explains why gold often rises during periods of monetary expansion and falls when central banks tighten policy.

The U.S. dollar’s strength inversely correlates with gold prices. Since gold trades globally in dollars, a weaker dollar makes gold cheaper for foreign buyers, increasing demand. Dollar strength has the opposite effect. Currency traders and gold traders watch the same data for this reason.

Geopolitical uncertainty triggers flight-to-safety buying. Wars, political instability, banking crises, and pandemic fears all historically pushed investors toward gold. These moves can be sharp and sudden, then reverse equally fast once perceived threats diminish.

Central bank purchasing has emerged as a significant factor in recent years. Countries including China, Russia, India, Poland, and Turkey have accumulated substantial gold reserves, adding consistent demand that supports prices independent of retail investor sentiment.

What Major Analysts Are Predicting

Investment banks and commodity analysts have issued 2026 forecasts spanning a wide range, reflecting genuine uncertainty about where gold goes from current record levels.

The bullish camp sees gold pushing toward $5,400 to $6,300. Goldman Sachs has raised its end-of-year target to $5,400, while J.P. Morgan projects $6,300 and Wells Fargo forecasts $6,100 to $6,300. These projections typically assume persistent inflation concerns, continued Fed rate cuts, sustained central bank accumulation, and ongoing geopolitical tensions. Analysts in this camp point to structural factors like government debt levels and de-dollarization trends as long-term price supports that could push gold deeper into uncharted territory.

Moderate forecasts cluster around $4,800 to $5,400. This view expects gold to consolidate recent gains with potential pullbacks but no dramatic collapse. The assumption is that inflation moderates gradually, the Fed achieves a measure of stability, and no major new crises emerge. Gold holds value but does not surge significantly from current levels.

Bearish outlooks project potential pullbacks to $4,200 to $4,800. Commerzbank, among the more cautious voices, targets $4,400. These scenarios assume inflation falls faster than expected, risk appetite returns to equity markets, and some profit-taking occurs after gold’s extended rally. In this view, gold’s recent gains partly reflected fear premiums that could partially unwind, though few analysts expect a sustained return below $4,000.

No forecast is guaranteed. Analysts working with identical data reach different conclusions based on their assumptions about policy responses and crisis probabilities. Treat all projections as educated guesses rather than certainties.

Technical Indicators Worth Watching

Price chart analysis offers another lens for evaluating gold’s direction. While not predictive, technical levels often become self-fulfilling as traders cluster orders around them.

Support levels represent prices where buying historically emerges. For gold in early 2026, watch the $4,500 to $4,800 zone as significant support. A sustained break below this range would signal potential further weakness toward $4,200.

Resistance levels mark prices where selling pressure typically increases. Gold has recently cleared the $5,000 psychological barrier, which now serves as near-term support. The next significant resistance levels sit at $5,500 and then $6,000. Breaking through resistance with strong volume often leads to continued momentum.

Moving averages smooth daily noise to reveal trends. Gold trading above its 200-day moving average is generally considered bullish. Extended periods below that average suggest bearish conditions. The 50-day average crossing above or below the 200-day (golden cross or death cross) attracts significant attention from technical traders.

Relative strength indicators help identify overbought or oversold conditions. After gold’s extended rally, readings suggest the metal is stretched, though overbought conditions can persist longer than logic suggests during strong trends.

How Economic Scenarios Could Play Out

Rather than picking a single price target, consider how gold might respond to different economic environments.

Scenario one: Persistent inflation. If inflation remains sticky despite Fed efforts, gold benefits from continued hedging demand. This environment favors the bullish forecasts, potentially pushing gold toward $5,500 to $6,000 or beyond as investors seek protection from currency erosion.

Scenario two: Soft landing. If the Fed successfully guides inflation lower without triggering recession, gold likely trades sideways to modestly lower. Reduced fear removes crisis premium, but eventual rate cuts would provide support. Expect range-bound trading between $4,600 and $5,200.

Scenario three: Recession. Economic contraction typically sparks initial gold buying as investors flee risk assets. However, severe recessions can trigger forced selling across all asset classes as investors raise cash. Gold usually recovers faster than stocks in these scenarios but may experience short-term volatility before resuming its uptrend.

Scenario four: Geopolitical escalation. Worsening conflicts or new crises would likely push gold sharply higher as safe-haven demand spikes. This scenario offers the highest potential upside but is inherently unpredictable.

Positioning for Uncertainty

Given forecast dispersion, rigid price targets matter less than strategic positioning. Consider these principles:

Dollar-cost averaging reduces timing risk. Regular purchases over time mean you buy more ounces when prices dip and fewer when prices spike. This approach suits investors who believe in gold’s long-term role but cannot predict short-term moves.

Portfolio allocation beats speculation. Most financial advisors suggest gold represent 5% to 15% of investment portfolios as a diversifier and hedge. This allocation provides meaningful protection without overconcentration in any single asset.

Physical ownership eliminates counterparty risk. Unlike gold ETFs or mining stocks, physical gold coins and bars represent direct ownership with no dependence on any institution’s solvency. This distinction matters most in the crisis scenarios where gold typically performs best.

Liquidity considerations affect product choice. Standard bullion coins like American Gold Eagles trade with tighter spreads and faster transactions than obscure products. When building positions, stick with widely recognized formats from sovereign mints.

What History Suggests

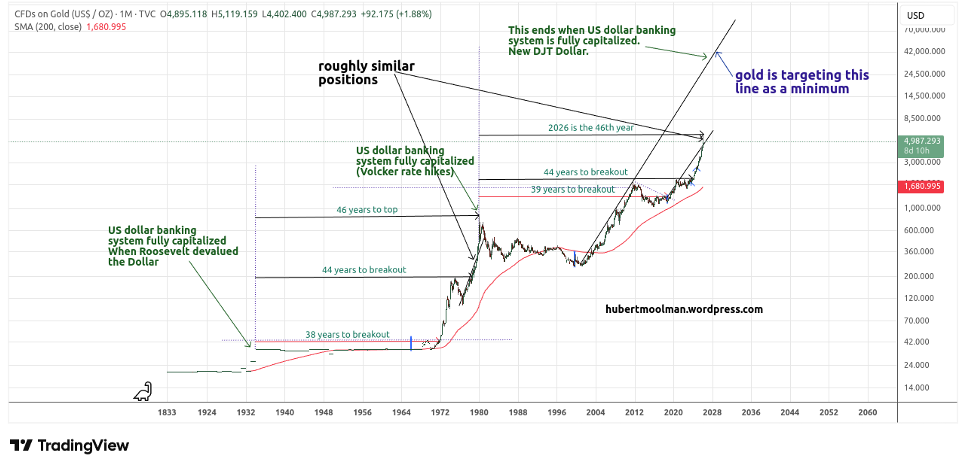

Gold’s long-term track record provides context for 2026 expectations. Since 1971, when the U.S. abandoned the gold standard, gold has risen from $35 per ounce to current levels above $5,000. That represents substantial long-term appreciation, though the path included extended flat periods and sharp rallies.

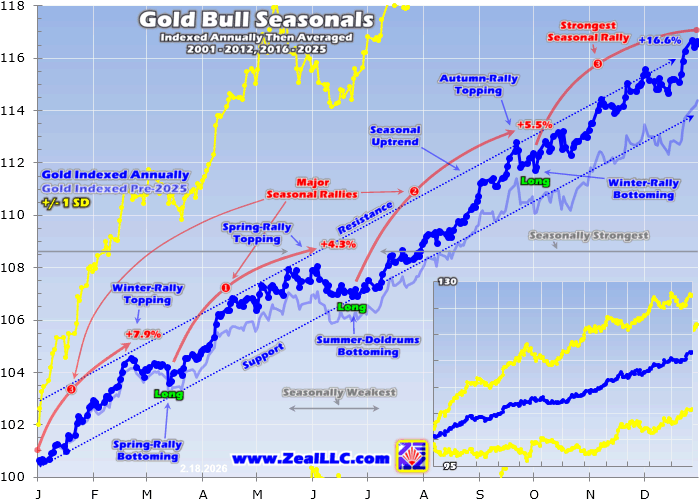

The metal tends to move in long cycles. The 1970s bull market took gold from $35 to $850. A two-decade bear market followed. The 2000s bull market lifted gold from $250 to $1,900. Consolidation followed until the 2020s breakout initiated the current cycle.

If historical patterns hold, the current cycle may have room to run before exhaustion, with some analysts pointing to inflation-adjusted highs from 1980 as a potential target. However, no cycle replicates exactly, and pattern recognition fails precisely when investors rely on it most heavily.

Frequently Asked Questions

Will gold prices go up in 2026? Most analyst forecasts project stable to higher prices, with the consensus expecting gold to trade between $5,000 and $6,000 for much of 2026. However, forecasts frequently miss, and unexpected events can move prices sharply in either direction. No one knows with certainty.

What is the best time to buy gold? Historically, buying during periods of low volatility and investor complacency has produced better long-term returns than chasing prices during crisis-driven spikes. Dollar-cost averaging eliminates the timing question entirely for investors focused on building positions over time.

Should I wait for gold prices to drop before buying? Waiting for pullbacks sounds logical but often results in never buying at all. Investors who waited for gold to return to $1,800 after it crossed $2,000 missed significant gains. If you believe gold belongs in your portfolio, starting a position at current prices while reserving capital for potential dips represents a balanced approach.

How does the Federal Reserve affect gold prices? Fed policy influences gold through interest rates, inflation expectations, and dollar strength. Rate cuts typically support gold prices by reducing competition from yield-bearing assets and often weakening the dollar. Rate hikes have the opposite effect. Fed commentary about future policy moves markets as much as actual decisions.

Is gold a good hedge against inflation? Gold has preserved purchasing power over very long time horizons, outpacing inflation over decades and centuries. Over shorter periods, the relationship is inconsistent. Gold lagged during early 2020s inflation but caught up dramatically in 2024-2025. Consider gold a long-term hedge rather than a short-term inflation trade.

What percentage of my portfolio should be in gold? Financial advisors commonly recommend 5% to 15% allocation to precious metals including gold. Conservative investors and those concerned about systemic risks often hold toward the higher end. Younger investors with long time horizons and high risk tolerance may hold less. There is no universally correct answer since allocation depends on individual circumstances, goals, and existing holdings.

Where can I track gold prices daily? Live gold prices are available through financial news sites, trading platforms, and dealer websites. The USAGOLD live price page displays current spot prices updated throughout trading hours, along with historical charts showing price trends over various timeframes.

Read the full article here

Leave a Reply