In a recent episode of Money Metals’ Midweek Memo podcast, host Mike Maharrey argues that the most important economic warnings rarely arrive with flashing lights. They show up first in markets, and right now, he says, precious metals are doing the talking.

Maharrey opens by comparing forecasting to seeing “in a mirror dimly,” borrowing from St. Paul to explain why he refuses to attach dates to predictions. He believes gold will crack $5,000 in the relatively near future, but says too many moving parts make precise timelines unreliable.

That uncertainty is not a reason to ignore what is happening. Maharrey frames the bigger story as what gold and silver are already signaling about debt, monetary policy, and confidence in the dollar as the world moves deeper into 2026.

The Danger of Confident Narratives

Maharrey uses Larry Kudlow as an example of how mainstream economic storytelling can be misleading. Kudlow, a Fox Business host and former Director of the National Economic Council in the first Trump administration, recently praised the stock market, tax cuts, deregulation, and falling energy prices, calling the economy “the greatest story never told.”

Maharrey notes Kudlow used the same phrase before the 2008 financial crisis. He cites a National Review column dated December 7, 2007, where Kudlow dismissed recession warnings, insisted “there’s no recession coming,” and suggested pessimists would end up with “egg on their faces.” Less than a year later, the crisis arrived.

The point, Maharrey argues, is not to single out one commentator. It is to show how political narratives often shape the interpretation of data, while major economic fractures can remain hidden until they suddenly become unavoidable.

Why He Thinks a Cliff Is Still Ahead

Maharrey says he expects serious problems not because today’s economic data is screaming “crash,” but because the underlying setup looks familiar. He ties today’s fragility to decades of easy money, the asset bubbles it fueled, and the failure to unwind extraordinary policy after prior crises.

He points to 2019 as a moment when the economy was already straining under higher rates, forcing the Federal Reserve to pivot toward rate cuts and quantitative easing even before the pandemic. He describes the pandemic as a convenient justification for unprecedented monetary and fiscal stimulus that delayed a reckoning.

At the center of his argument is a “giant debt black hole” that makes normal interest rates nearly impossible. He says this is why policymakers clamor for cuts even with persistent inflation. The Fed, in his view, is walking a tightrope between recession and runaway price pressure.

This is where the title’s warning comes into focus. Maharrey argues that gold and silver repeatedly printing record highs is not simply a story about metals rising. It is a story about the dollar weakening, confidence eroding, and de-dollarization advancing in real time.

He does not claim certainty about timing or outcomes. He leans toward a crash or recession, but allows the economy to slide into inflationary stagnation similar to Japan in the 1990s. Either way, he says, monetary malfeasance has consequences that cannot be dodged forever.

A Historic Run in Metals

Maharrey says a late-year correction does not end a bull market, and he calls the prior year’s performance exceptional. He reports gold gained 64% and set 53 new record highs. He says silver gained just under 148%, platinum rose 125.9%, and palladium was up just over 80%.

He doubts those kinds of percentage gains repeat every year, but believes the broader bull trend still has momentum. In his view, the market action fits the bigger backdrop of debt, monetary easing, and rising uncertainty.

Metals Focus Outlook for 2026

Maharrey bases much of his outlook on analysis from Metals Focus, a London-based consultancy covering gold, silver, platinum, palladium, and rhodium. He says their framework aligns with the themes he has emphasized on the show.

He lists the main drivers as persistent inflation, US trade and foreign policy uncertainty, long-term debt concerns, weaponization of the dollar, shaky labor-market signals, and de-dollarization. Metals Focus expects those forces to persist into 2026, supporting continued demand for precious metals as portfolio insurance.

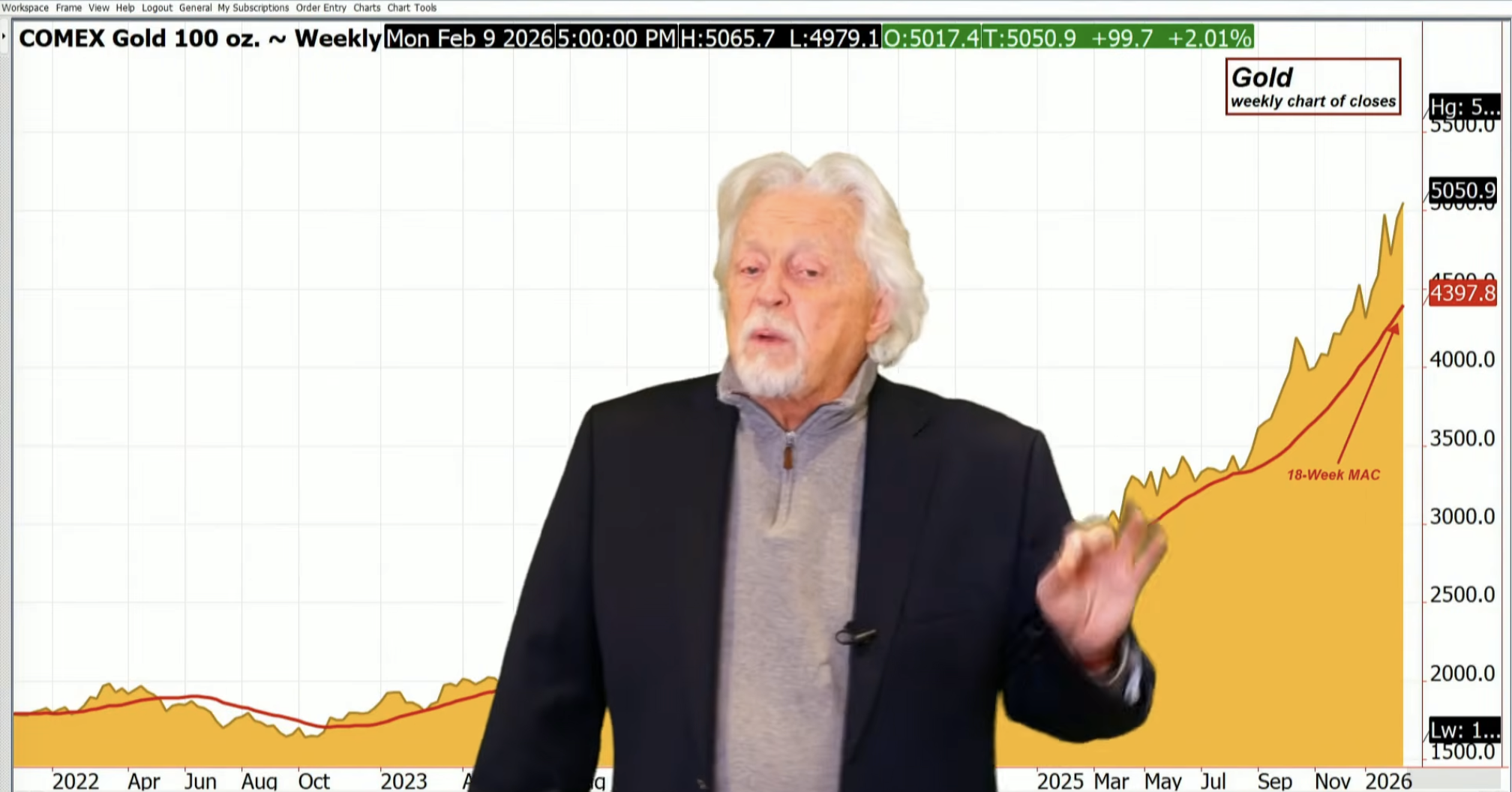

Gold and the Push Above $5,000

Maharrey describes gold’s volatility around year-end, including a correction from over $4,500 per ounce to about $4,330, then a rebound toward the $4,550 high hit on December 26, 2025. He notes gold breaking through $4,600 per ounce “yesterday,” calling the move wild.

He says Metals Focus expects gold highs “well above” $5,000. He highlights US “regime uncertainty,” meaning abrupt or unpredictable policy shifts, as one driver of safe-haven demand. He also stresses monetary easing. He says the Fed has cut rates multiple times despite elevated inflation and has pivoted back to quantitative easing, which he characterizes as inherently inflationary.

Maharrey adds that President Trump is expected to choose a new Federal Reserve chair in the coming months and suggests the replacement could be even more favorable to loose policy than Jerome Powell. He emphasizes persistent fiscal deficits and the rapid accumulation of US debt as a growing source of doubt about long-term debt sustainability and the dollar’s reserve role.

He also highlights central bank buying as a foundational support. He reports central banks increased gold reserves by over 1,000 tons for three straight years, and that the World Gold Council expects 2025 to likely be a fourth year above 1,000 tons. He notes 2022 was the highest net central bank buying on record, dating back to 1950, compared with an average of 473 tons annually from 2010 through 2021.

Maharrey acknowledges that record prices can reduce jewelry demand while increasing recycling and mine output. Even so, he says Metals Focus expects institutional investment to absorb surplus supply. He also references a “60/20/20” portfolio concept, where some bond exposure shifts into alternatives like precious metals, arguing even small adoption could drive major new demand because many investors hold little or no gold.

Silver and the Deficit That Won’t Quit

Maharrey says silver benefits from the same macro forces as gold, but its larger industrial role makes it more volatile. Metals Focus expects early-year selling pressure from profit taking and index rebalancing, and even sees a possible correction toward $50, but expects it to be brief.

They anticipate silver recovering to new all-time highs above $80. Maharrey says the bigger story is not a short-term pullback, but the supply squeeze underneath the entire market.

He says silver demand has exceeded supply for four straight years, and the Silver Institute projects 2025 will be the fifth straight deficit. He cites a 2024 structural deficit of 148.9 million ounces and says the four-year shortfall totals 678 million ounces, with an estimated additional 100 million ounces for 2025. He frames that cumulative deficit as roughly equal to one year of global mine supply.

He describes squeeze dynamics driven by metal shifting from London to New York in April due to tariff worries, plus strong Indian demand. He says this helped push silver above $50 in October, and a later “silver squeeze 2.0” briefly drove prices above $80. Metals Focus expects tight physical liquidity in London, citing investment demand, tariff uncertainty, US-held stocks, refining bottlenecks, and the structural deficit. Maharrey says they see a three-digit peak as likely, pointing directly at the “silver $100” half of the warning.

He acknowledges industrial substitution efforts, especially in solar, but argues retooling takes time, and silver is difficult to replace because it is the best electrical conductor at room temperature.

Under-Spot Junk Silver and the Takeaway

Maharrey notes Money Metals is selling junk silver under spot, defining it as pre-1965 dimes, quarters, and half dollars that are 90% silver. He says the melt value of a single silver quarter has been over $12 recently, illustrating how far silver has moved.

He closes by urging listeners to own a precious metals portfolio and echoes Money Metals CEO Stefan Gleason’s view that ignoring gold and silver is “professional malfeasance” for advisors at this stage. He directs listeners to call 1-800-800-1865 or visit MoneyMetals.com, and mentions a monthly program that allows building a portfolio with as little as $100 per month.

Read the full article here

Leave a Reply