People get confused about the difference between the deficit and the debt. The debt is the total amount of money the US government owes. It represents the accumulation of past deficits, minus any surpluses.

The current national debt stands at $36.8 trillion. How about the deficit?

The deficit is the annual difference between government spending and government revenue. Every year, the government takes in revenues in the form of taxes and other income, and spends money on various programs, such as national defense, Social Security, and healthcare. If the government spends more than it takes in, then it runs a deficit. If the government takes in more than it spends, it runs a surplus. — Peter G. Peterson Foundation

According to the Peterson Foundation, the US government has run a deficit in all but four years from 1970 to 1998 to 2001. The annual gap is projected to increase going forward, and that is an understatement.

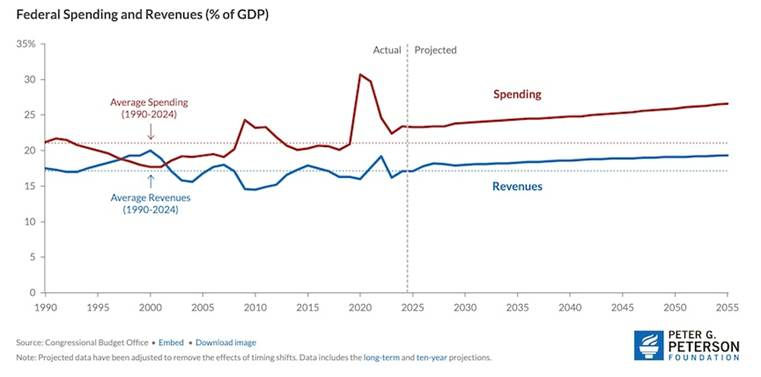

Look at the charts below. The first chart shows that growing deficits are caused by a mismatch between spending and revenues. Spending began outpacing revenues around 2002, with the red line of spending staying consistently above the blue line of revenues. Notice the spikes in spending in 2008-09 (the financial crisis) and in 2020 during the pandemic, when trillions worth of stimulus were doled out.

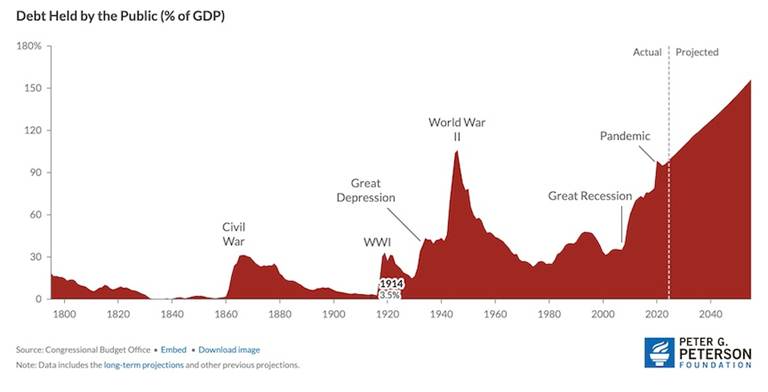

The second chart, federal public debt by percentage of GDP, shows debt is on an unsustainable path. The ratio of public debt to the size of the economy (GDP) has risen from about 35% in 2007 to 100% now, according to the Congressional Budget Office. It is projected to rise to between 120% and 150% of GDP by 2040.

Historically, periods with spikes in the deficit and a corresponding increase in the national debt have been associated with a war or a severe economic downturn. Today, deficits have become the norm and are caused by a long-term, structural mismatch between spending and revenues stemming from an aging population, rising healthcare costs, mounting interest payments, and revenues that are insufficient to cover the promises that have been made.

Adding to the debt

But the real danger facing the US government is the massive, and fast growing, interest currently being paid on the debt. The Committee for a Responsible Budget estimated that President Trump’s “Big Beautiful Bill’ will increase the US debt load by at least $3.3 trillion and boost the annual deficit to more than 7% of GDP by 2034. In 2023 it was already at 6.3% of GDP.

Moody’s cut the US credit rating, citing rising debt and interest payments on the debt that outpace those of similarly rated sovereigns. The US government currently spends more on interest than on the entire defense budget. ($882B on interest vs $874B on discretionary outlays for national defense in 2024)

Video – A Deficit and Interest Rate Time Bomb

A good example of US fiscal irresponsibility is the so-called “Big Beautiful Bill” passed by the House of Representatives on Thursday. The bill, which could only be named by Trump, narrowly passed by 215-214. Two Republicans joined Democrats in voting no. It now heads to the Senate, where the GOP has a majority.

According to Politico, the bill includes a fresh round of tax cuts, plus hundreds of billions of dollars in new funding for the military and border security. Nonpartisan forecasts say it would increase the federal deficit by trillions of dollars and cause over 10 million people to lose health care coverage, while shifting resources away from low-income households to the wealthiest.

The Congressional Budget Office (CBO) said the bill would reduce spending on Medicaid and food aid by nearly a trillion dollars.

Its analysis found the lowest-income households would see their income fall by 2% by 2027 and 4% by 2033, while the top 10% of households would see their household resources rise 4% by 2027 and 2% in 2033 mainly due to tax reductions.

Trump and his aides brushed off warnings that the tax-and-spending bill could balloon the national debt, with the White House Council of Advisers projecting that the bill would boost GDP by 4.2% to 5.2% in the short term.

White House Press Secretary Karoline Leavitt even claimed the bill “does not add to the deficit” and that it would save $1.6 trillion through spending cuts and Medicaid work requirements.

Axios reported that independent budget experts saw that as laughable:

The Joint Committee on Taxation projects the House reconciliation bill would increase deficits by $3.8 trillion through 2034.

The Penn Wharton Budget Model projects deficits of almost $3.3 trillion, even when accounting for “positive economic dynamics.”

Moody’s, which downgraded the U.S. credit rating on Friday, estimates that extending Trump’s 2017 tax cuts alone — a central component of the bill — would add $4 trillion to the deficit over the next decade.

Bond market blows up

Trump’s determination to continue his first administrations massive tax cut to the wealthy, combined with his trade war, have blown up the bond market — normally a safe haven during market turbulence.

In Thursday’s auction, investors were reluctant to buy and needed rates above 5% to participate. CNBC reported the 30-year Treasury spiked to 5.09% while the 10-year hit 4.61%.

Bloomberg pointed out it isn’t only US government bonds that are acting like kryptonite for investors right now:

From the US to Japan, long-term borrowing costs for the world’s biggest economies are surging as investors question the ability of governments to cover massive budget deficits…

Investors are warning that governments can’t keep borrowing at the pace they did when interest rates were close to zero, particularly since trade tensions and sticky inflation have diminished the probability that policymakers will dramatically ease monetary policy. Meanwhile, a pullback by central banks and pension funds from bond markets has marginalized a once-dependable source of funding.

Yields on Japanese bonds exceeded the highest on record in data since 1999, with long-dated bonds in the UK, Germany and Australia also facing selling pressure.

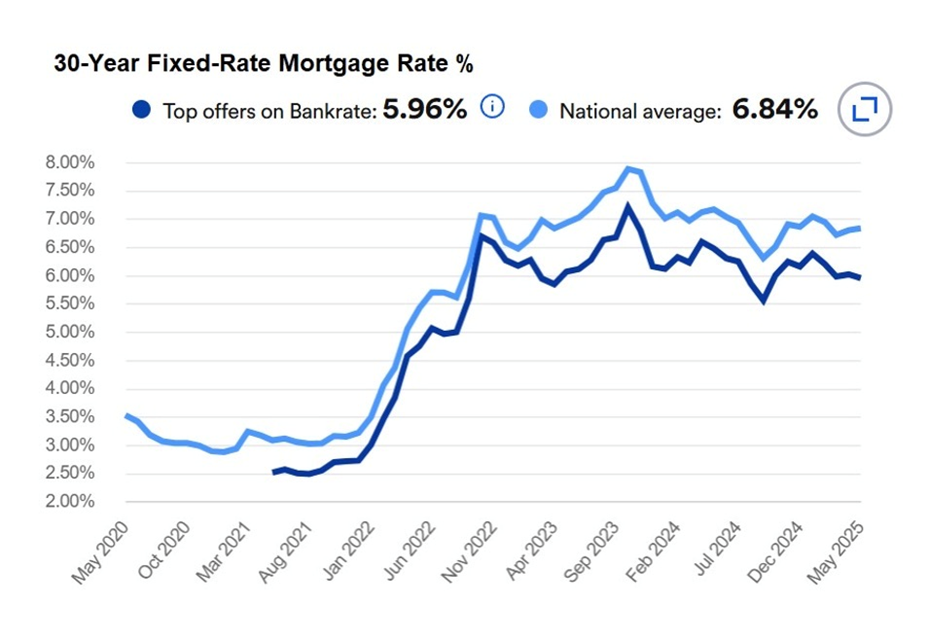

Bloomberg noted the fallout doesn’t stop at the bond market. When the 30-year yield suddenly rose on Wednesday, the S&P 500 stock index fell by 1.6%, the most in a month. Higher government yields also trickle down to businesses and households, which face higher borrowing costs on loans and mortgages.

That creates a feedback loop in which budget deficits swell even further amid weaker tax revenues…

The concern over fiscal policy is also undermining the dollar, which would typically gain when yields rise.

Others were more scathing in their criticism of Trump’s legislation as it relates to the bond market and the deficit.

“People are getting fed up. It’s clear that there are no adults in the room in Washington. Zero. No accountability,” said John Fath, managing partner at BTG Pactual Asset Management US LLC.

In a commentary, John Rubino said that the Treasury interest rate increases following Moody’s credit rating slash translate into an annual government interest expense of $1.4 trillion, which must be borrowed, ballooning future deficits.

He went on to illustrate how cheap mortgages used to be and how much they’ve risen, from a national average of 3.5% in May 2020 to the current range of 6.5-7%.

Also, for the first time in nearly four years, millions of Americans are seeing student delinquencies appearing on their credit reports:

According to the Fed, nearly 6 million student loan borrowers- 13.7 percent of those required to repay- were 90 or more days delinquent or in default in the first quarter of 2025. That figure, while slightly lower than the 14.4 percent seen before the pandemic, marks a disturbing return to pre-COVID patterns.

Rubino concludes with the pessimistic view that $2 trillion annual deficits will persist, and that the vast cross-section of America that has student loans and/or would like to buy a house or a car can’t tolerate higher interest rates.

Deutsche Bank earlier this week warned that the US economy is experiencing “death by a thousand cuts”, pointing to the escalating debt burden that has prompted warnings that the country’s long-standing fiscal credibility may be at risk, especially as growth in the economy may no longer be sufficient to sustain rising interest payments and public spending.

Conclusion

The CBO has projected a federal budget deficit of $1.9 trillion this year, and federal debt rises to 118% of GDP in 2035, according to the CBO.

As mentioned, the national debt currently stands at $36.8 trillion.

While the size of these numbers is of concern, as long as the federal government can pay the interest on its debt, meaning it can cover the interest on the bonds it’s issued, the government is solvent. Failing to pay bondholders would mean the government has effectively defaulted on its debt, which would be a disaster for the US government and the American economy.

The United States has had a budget deficit every year except four since 1970. It isn’t going to stop with the Trump administration. According to the Joint Committee on Taxation, the House reconciliation bill would increase deficits by $3.8 trillion through 2034.

The chances of the bill getting stopped in the Senate, where Republicans have a majority, are nil. It will then proceed to the president for signing into law.

As the debt keeps climbing, it may never have to be paid off, but at a minimum, the US government must pay the interest owed to its bondholders. Concern about Washington’s ability to make those payments, and the fact that Treasury buyers require a higher rate to take on what are now considered developing country bonds, are driving Treasury yields higher, making it even harder for the government to pay its bondholders due to the increased interest rates.

According to the Committee for a Responsible Federal Budget, interest will rise from $881 billion in 2024 to $1 trillion in 2026 before climbing to nearly $1.8T in 2035. Interest on the debt is already larger than spending on Medicare and national defense and is second only to Social Security.

Apart from ever-increasing budget deficits and interest on the debt, arguably an even bigger problem is the damage to America’s reputation caused by the Trump administration, which affects the rest of the world’s willingness to sop up Treasury bonds and thus pay for US overspending.

The ironically named Big Beautiful Bill – it is anything but beautiful in the context of US fiscal responsibility – downloads a tax cut for the rich to America’s poorest households, worsening the current $1T budget deficit.

The Republicans are doing everything they can to save money so they can afford the tax cuts, which were started during Trump’s first term. They’re doing it by cutting Medicaid and food aid, hurting low-income people and working Americans.

The answer isn’t to cut USAID either. The program started by President John F. Kennedy has been gutted. From disbursing $61 billion in foreign aid last year, making the United States the world’s largest humanitarian donor, on the day of his inauguration, Jan. 20, Trump issued an executive order mandating a 90-day pause on all foreign development assistance “for assessment of programmatic efficiencies and consistency with United States foreign policy.”

According to the Yale School of the Environment, In late March, the Trump administration told the U.S. Congress it had terminated 5,341 projects worth a total of $75 billion (86 percent of its portfolio), and the State Department said it will reduce USAID to the legally required 15 people, thus ending its existence in all but name.

The amount of good will generated by such programs is immeasurable. Well, not quite. Two days ago China announced it will give an additional $500 million to the World Health Organization over five years, to offset the expected loss of its top donor, the US.

Donations that used to arrive in boxes labeled “Made in the USA” will now say “Made in China”.

Read the full article here

Leave a Reply