Please note: the CoTs report was published 06/28/2024 for the period ending 06/25/2024. “Managed Money” and “Hedge Funds” are used interchangeably.

The Commitment of Traders report is a weekly publication that shows the breakdown of ownership in the Futures market. For every contract, there is a long and a short, so the net positioning will always be zero, but the report shows who is positioned long or short. Historically, Hedge Funds (Managed Money) dominate the price action in both Gold and Silver.

Gold

Current Trends

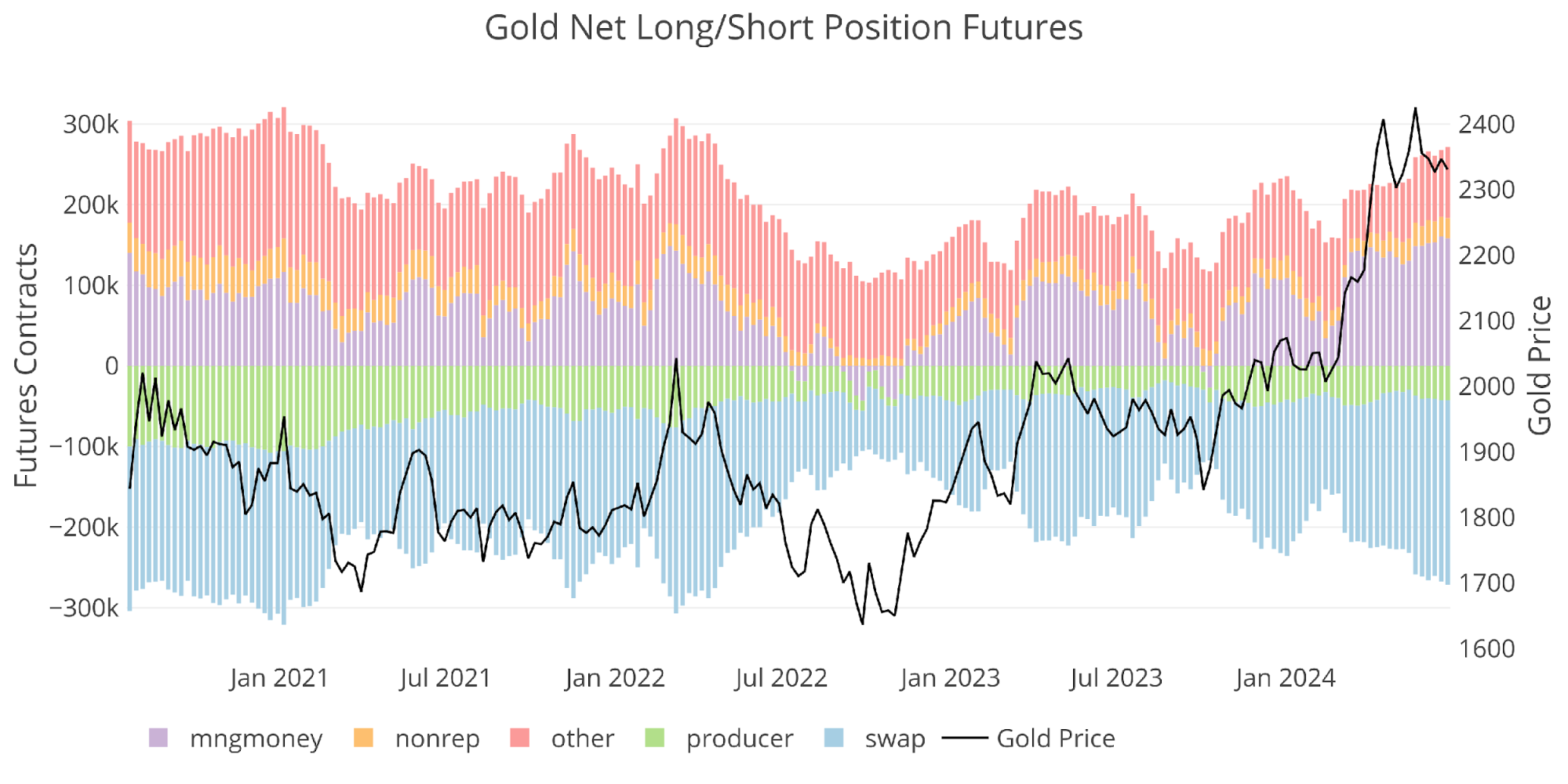

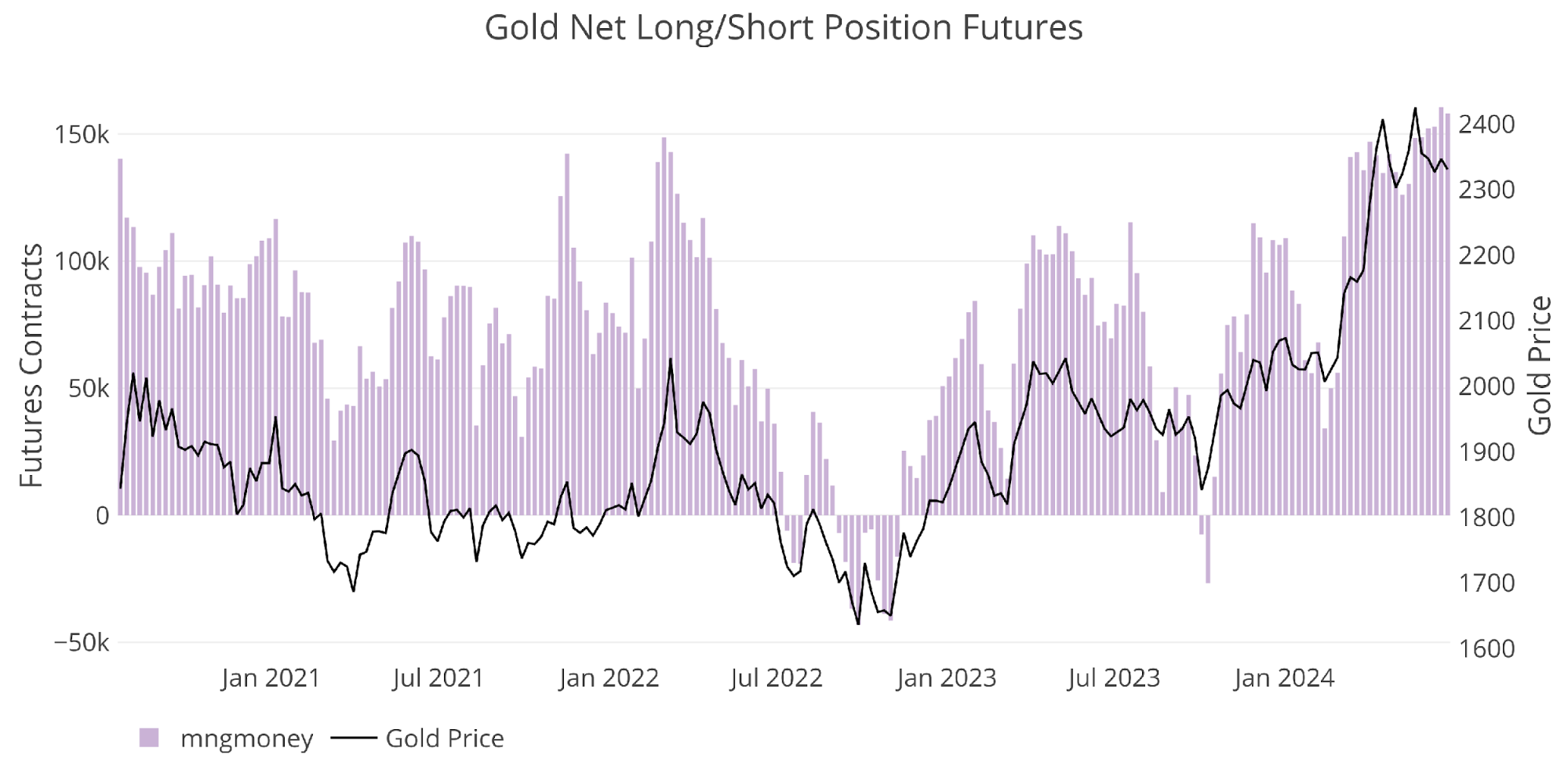

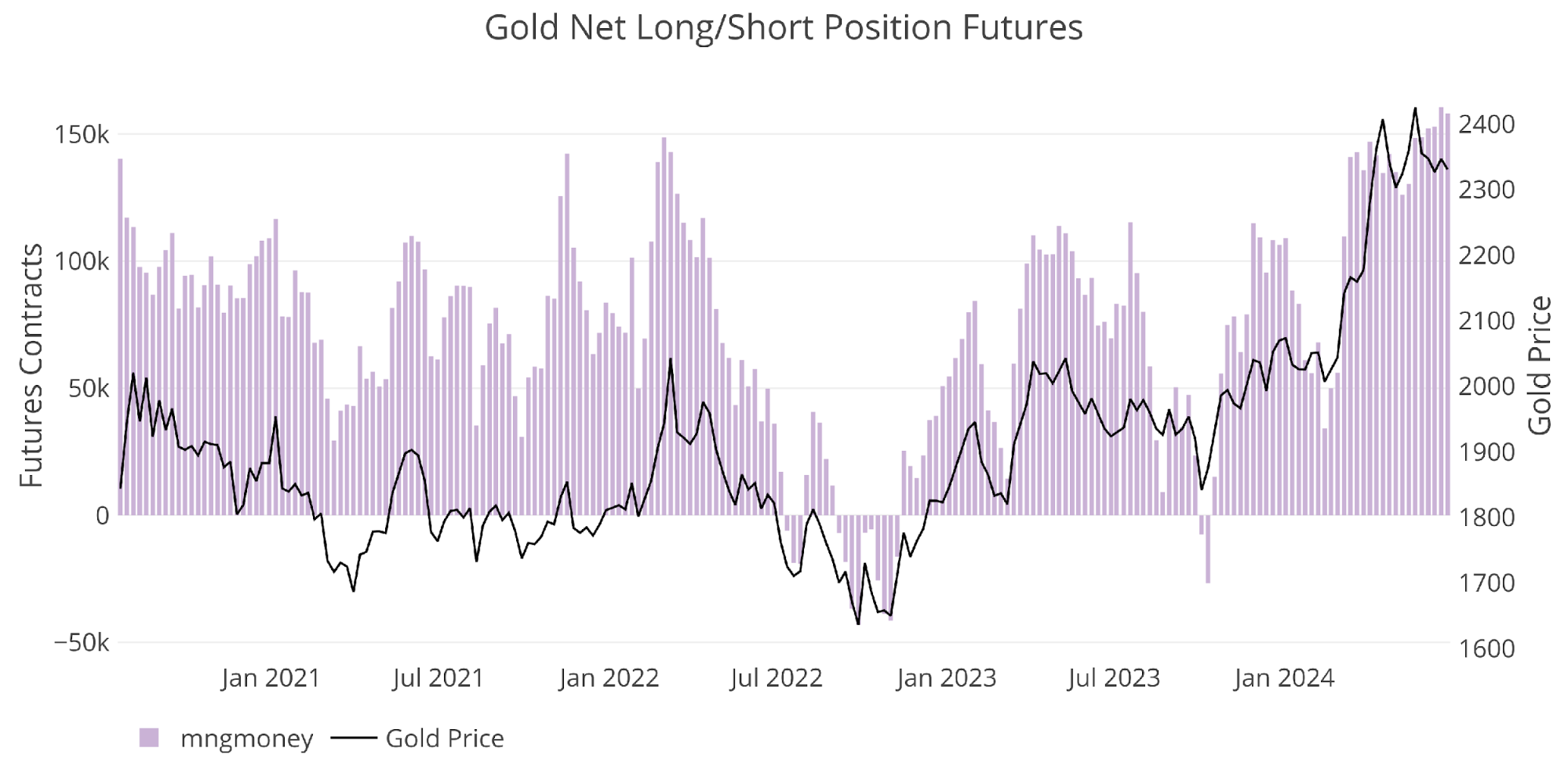

Below shows net positioning for the 5 main groups of futures holders. Net positioning has been drifting up in recent weeks which may make it harder for the rally to continue expanding.

Figure: 1 Net Position by Holder

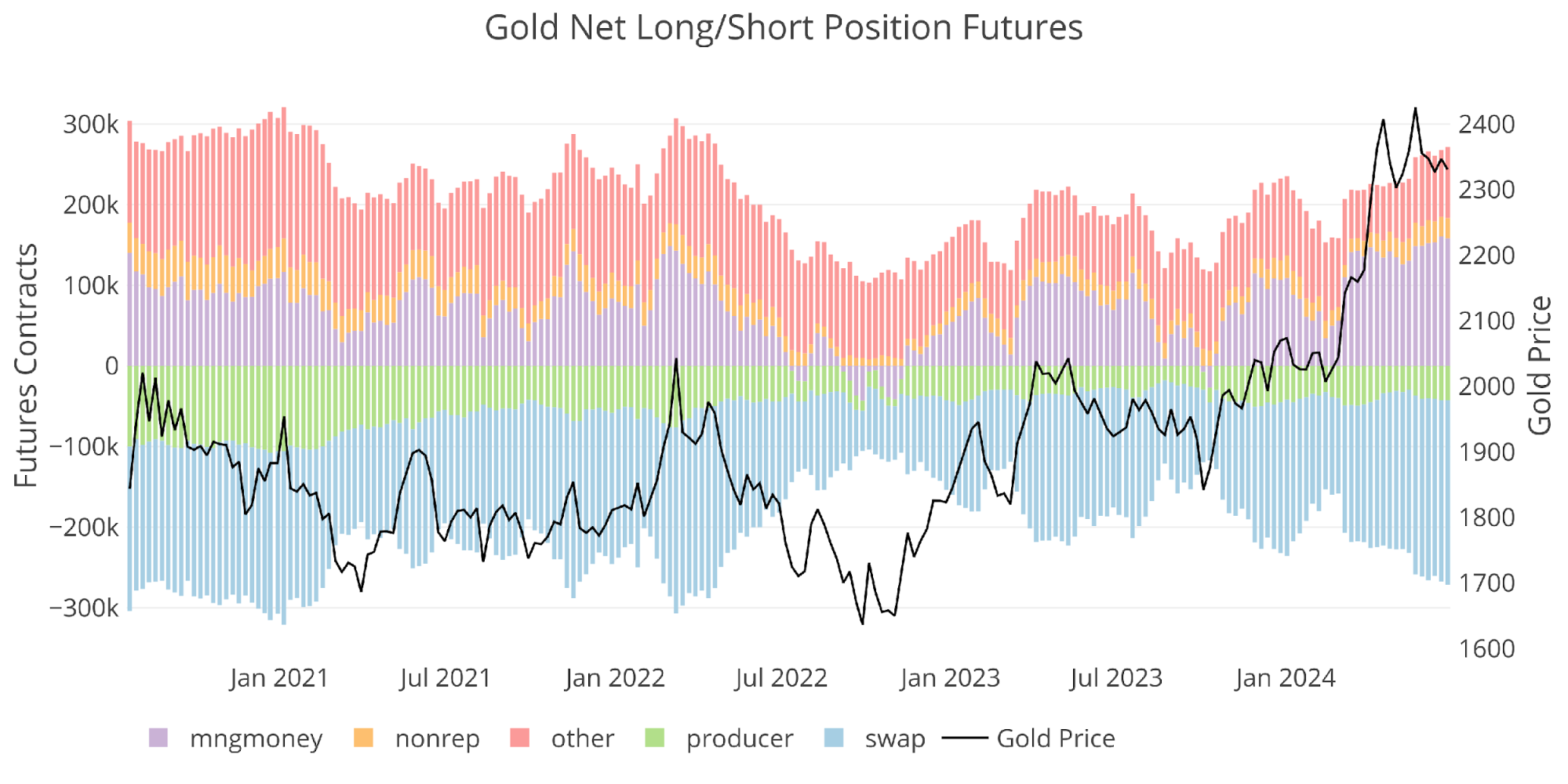

Managed Money is in complete control of the price action, driving prices higher. The recent price spikes were so rapid that the COTs report may not have caught the action of Managed Money from a weekly perspective. It is presumed that quick moves like that were almost definitely Managed Money.

Figure: 2 Managed Money Net Position

Weekly Activity

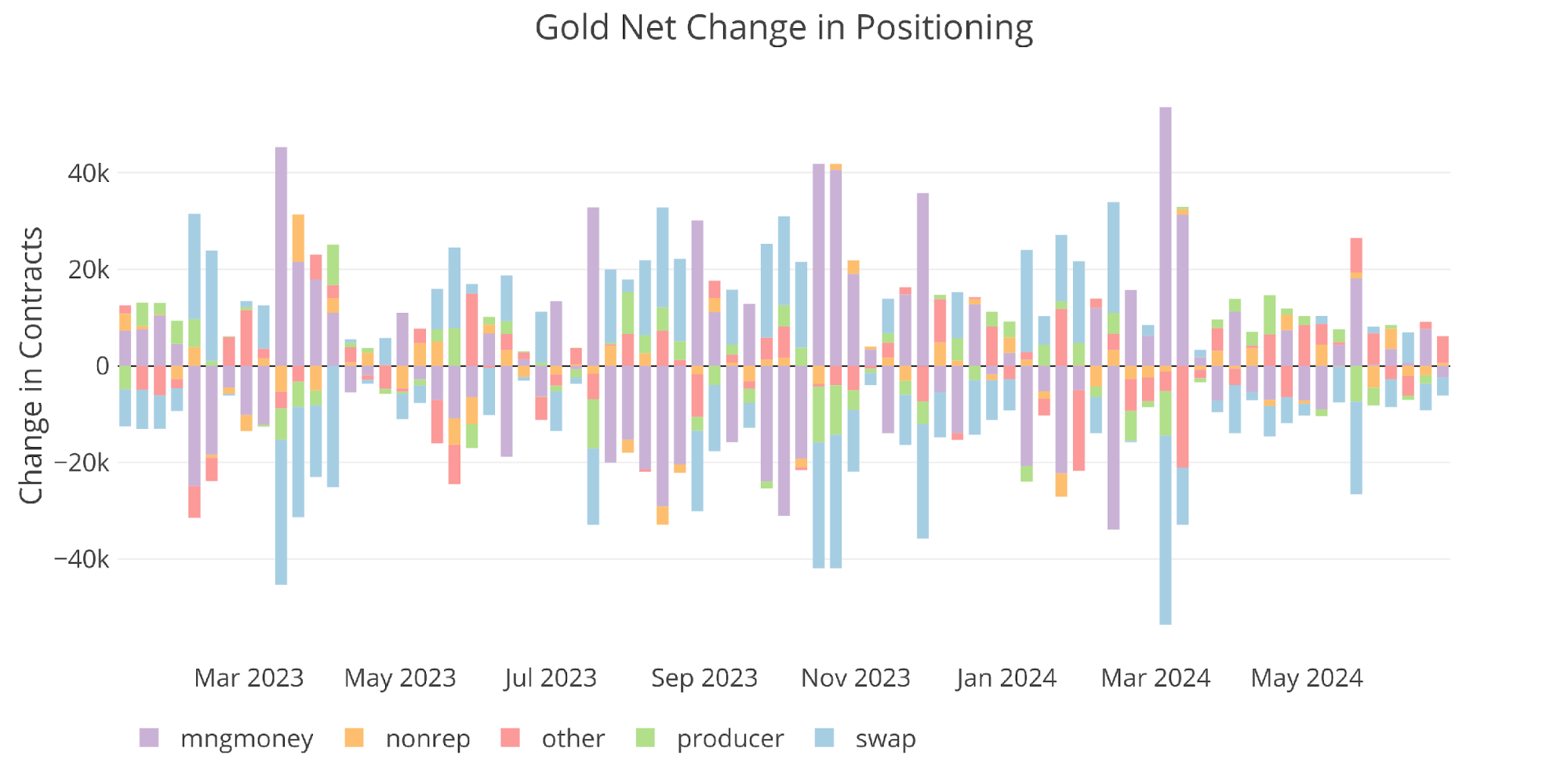

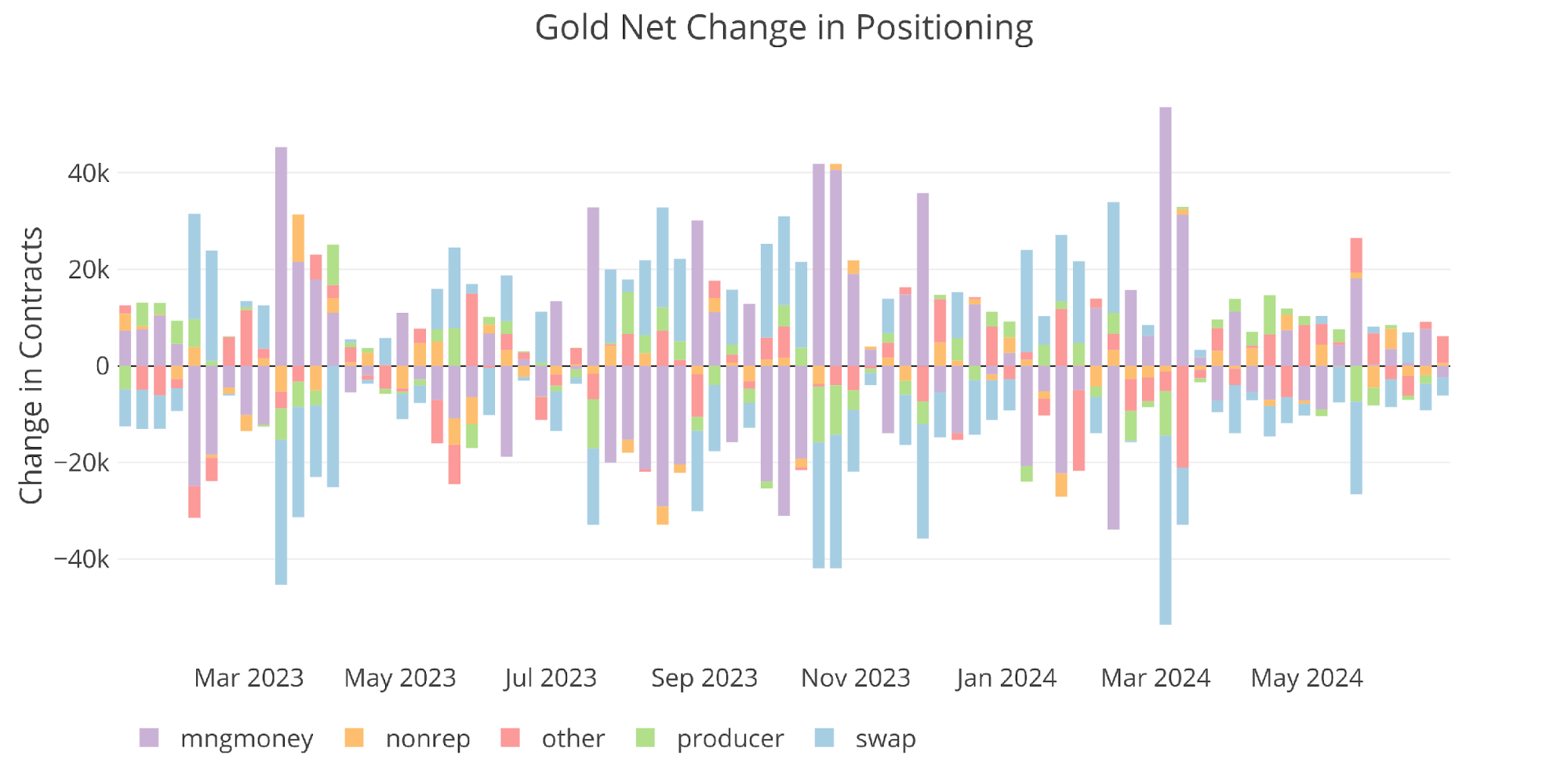

The overall activity has been very muted in recent weeks which is probably why the metal is mostly range-bound for now.

Figure: 3

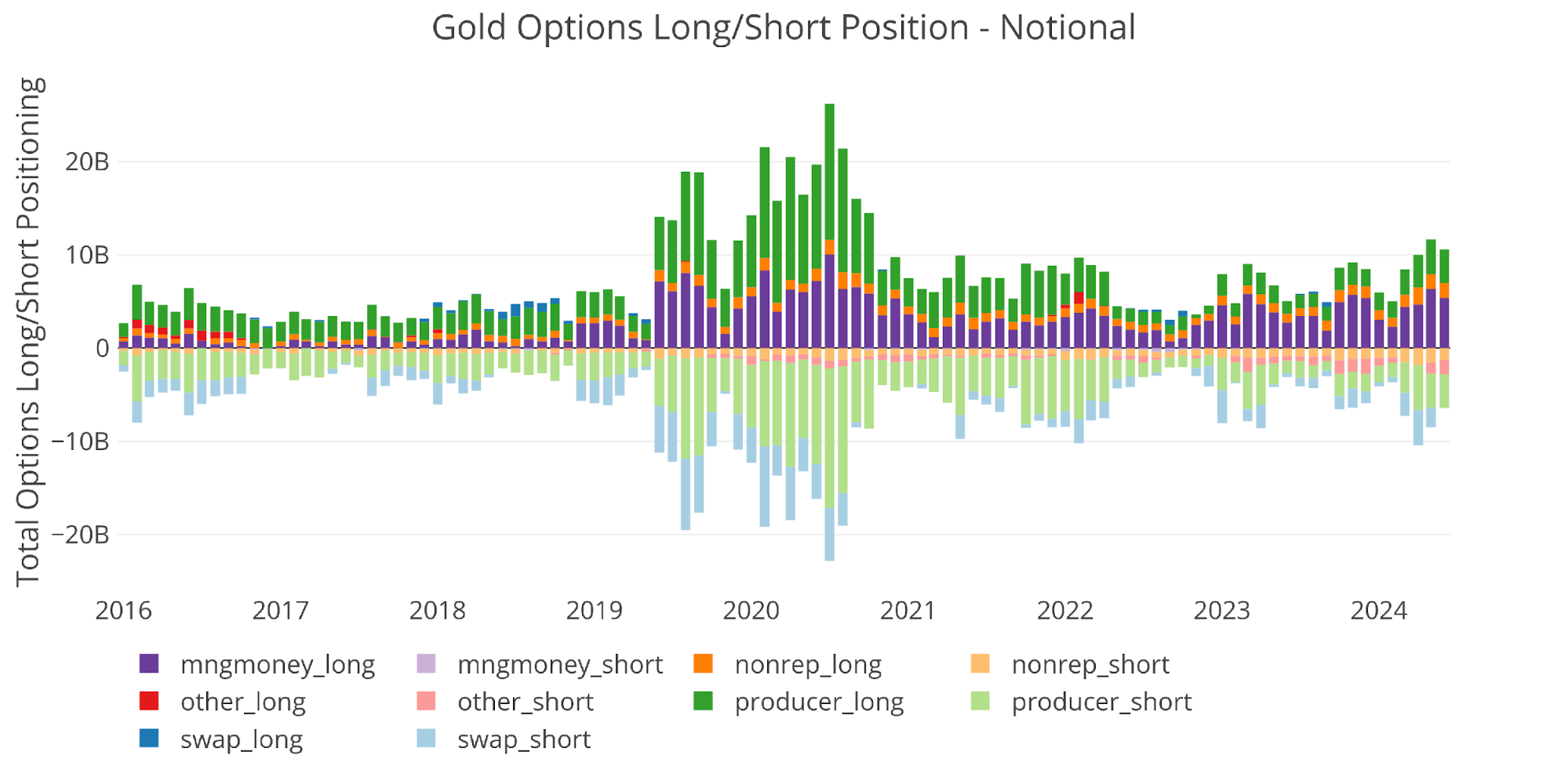

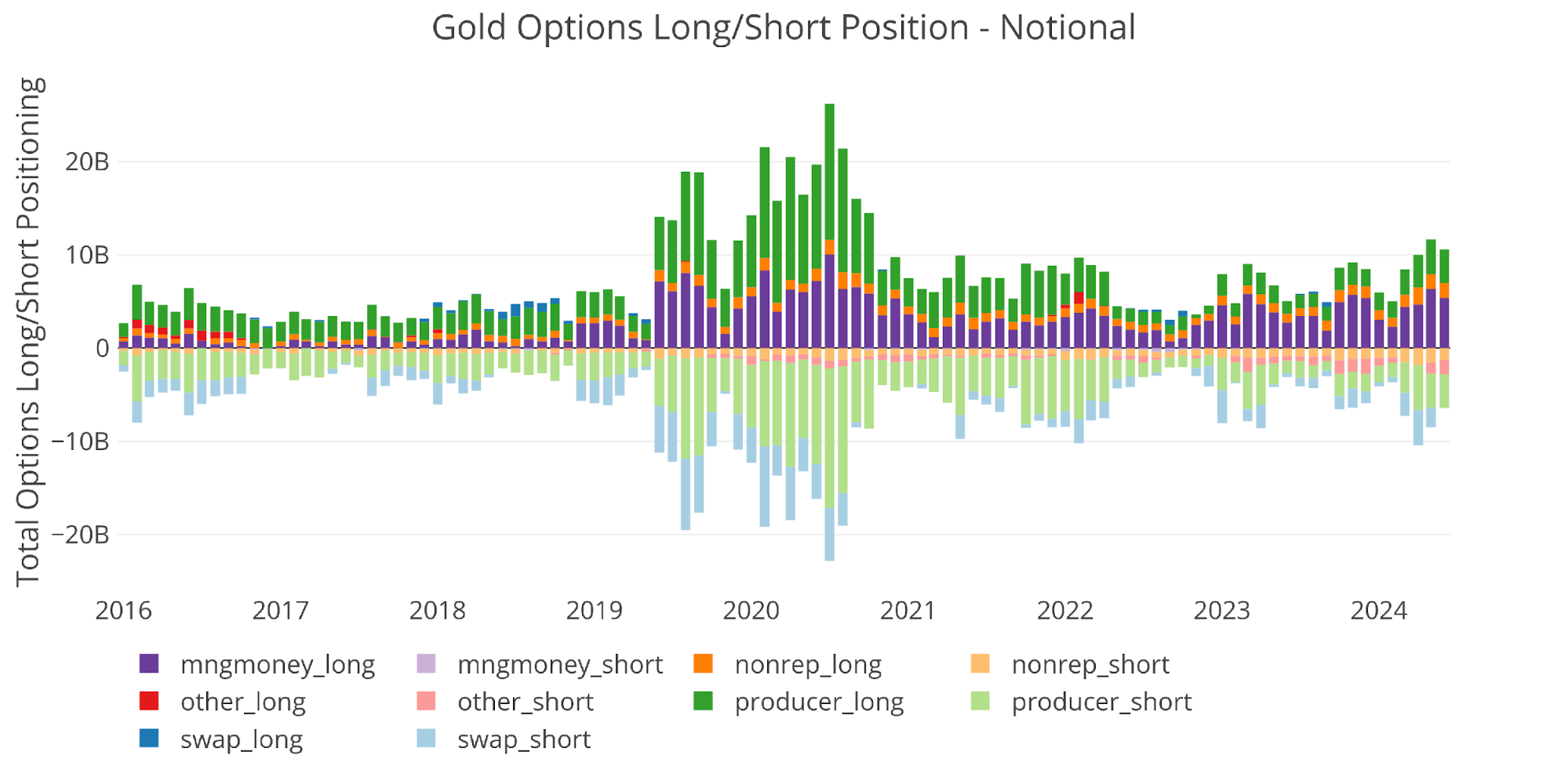

The activity in the options market is starting to pick up some, reaching multi-year highs.

Figure: 4 Options Positions

Silver

Current Trends

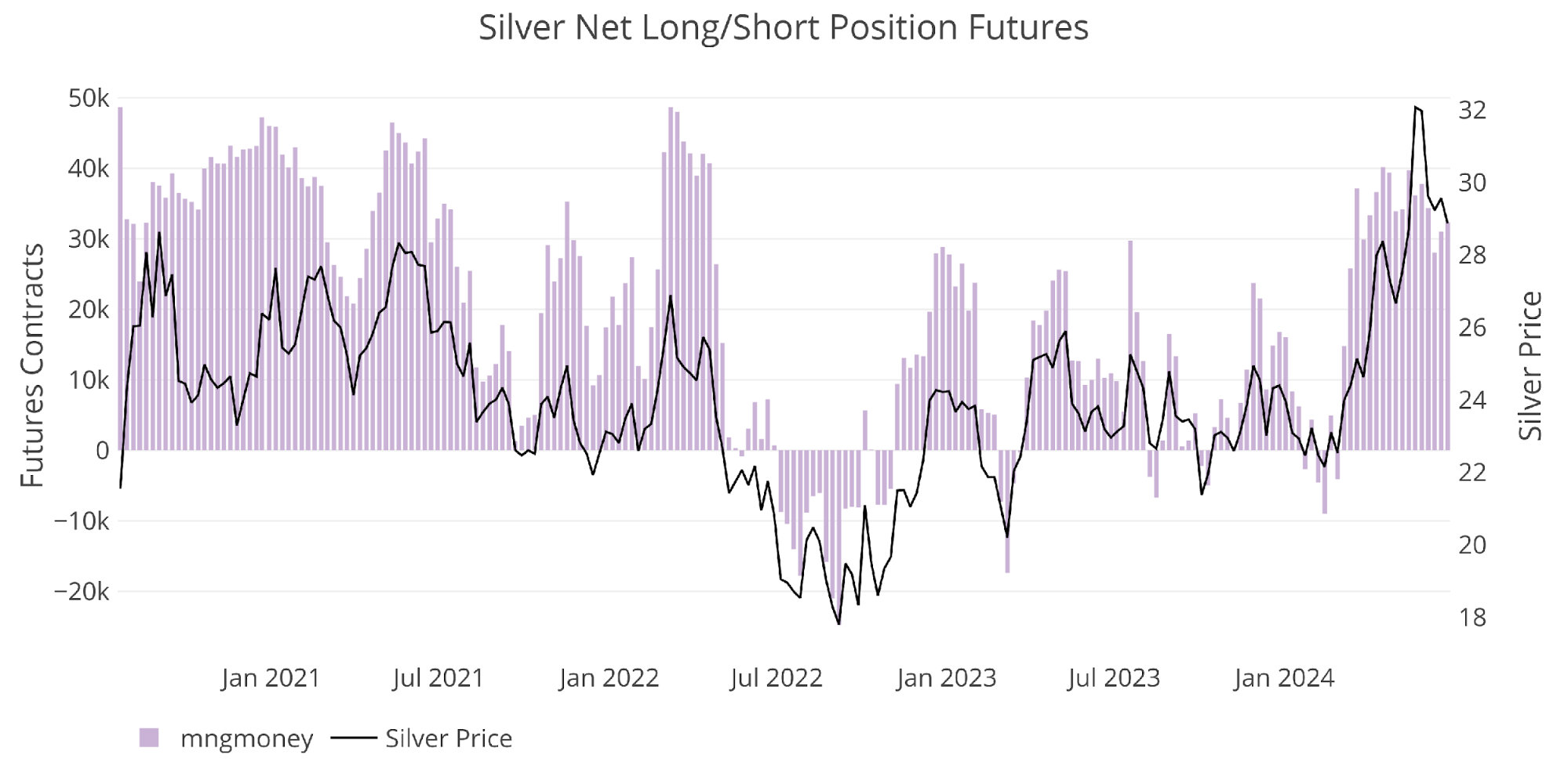

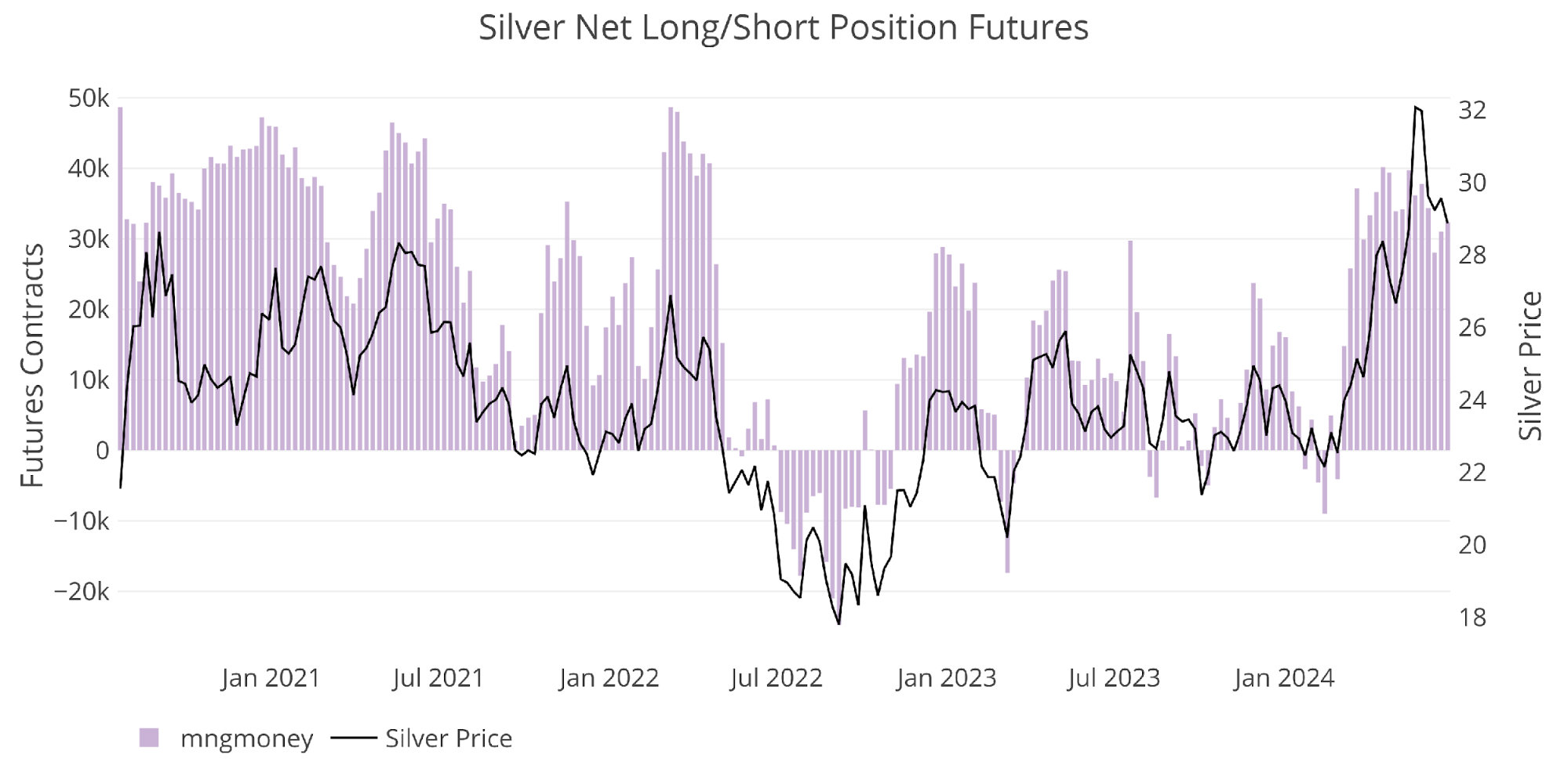

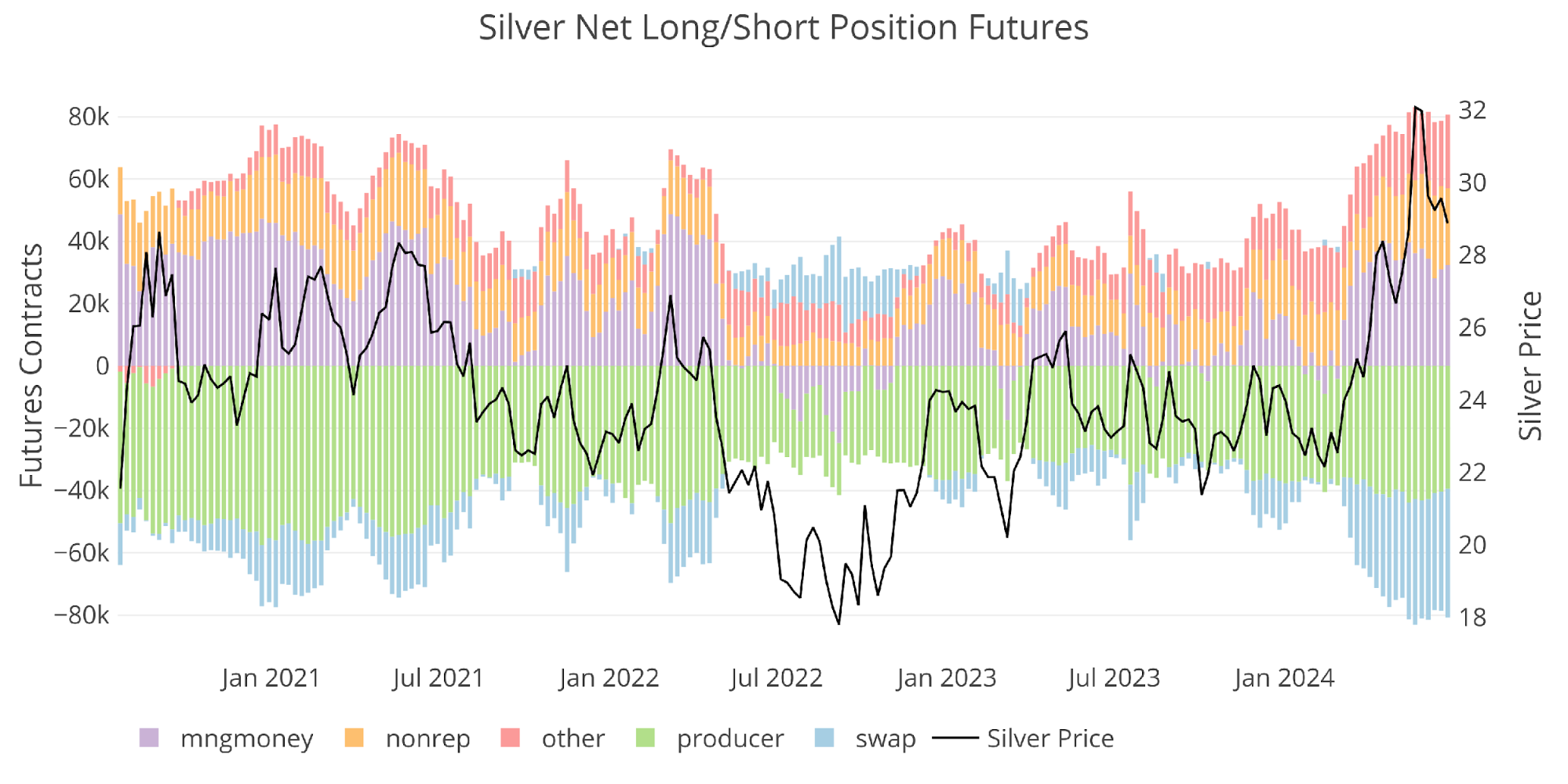

Silver total net positioning has reached the highest point in several years raising concerns about the amount of energy left to fuel the market higher.

Figure: 5 Net Position by Holder

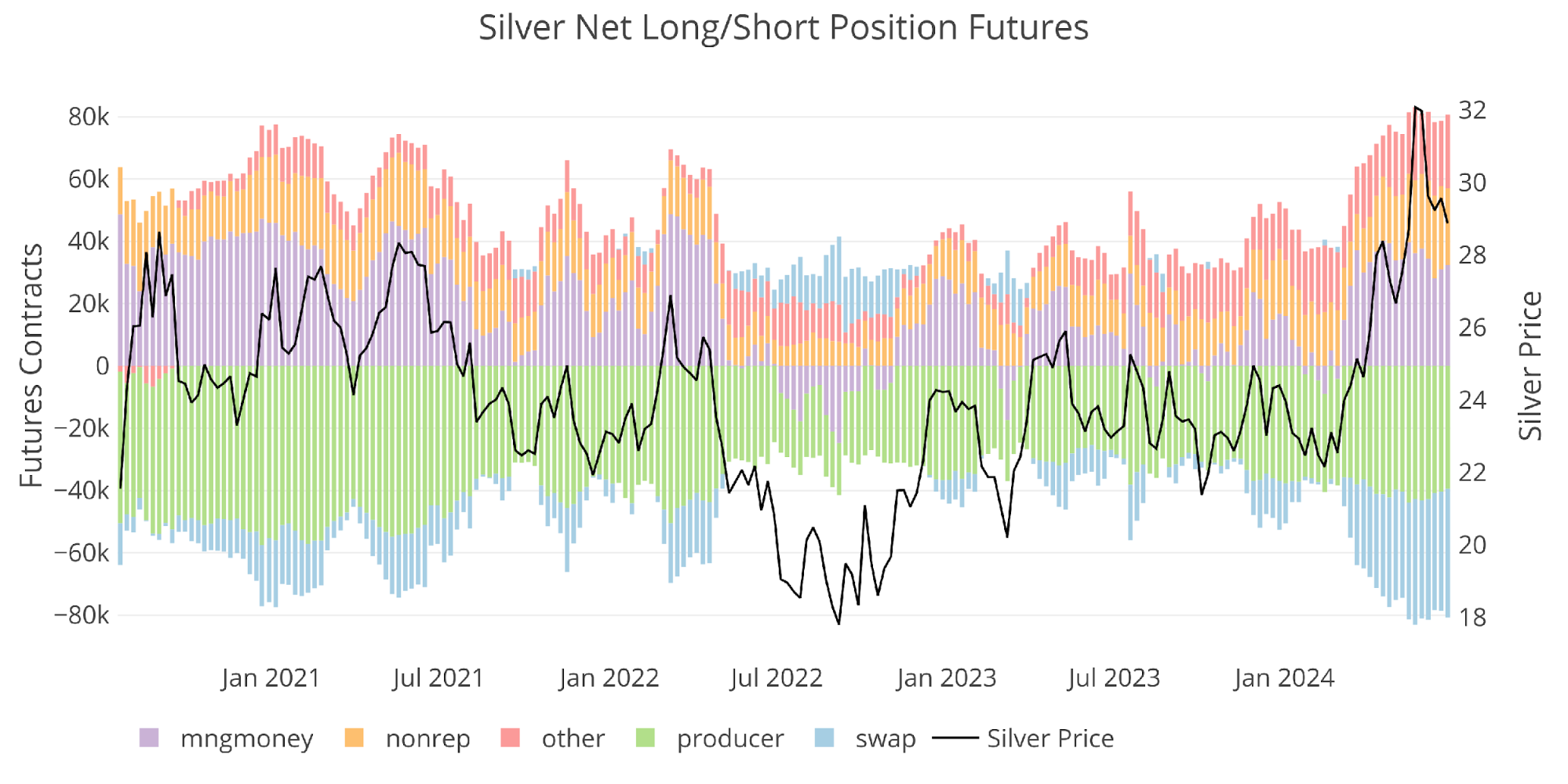

Just like gold, the price of Silver is overwhelmingly dominated by Managed Money positioning.

Figure: 6 Managed Money Net Position

Weekly Activity

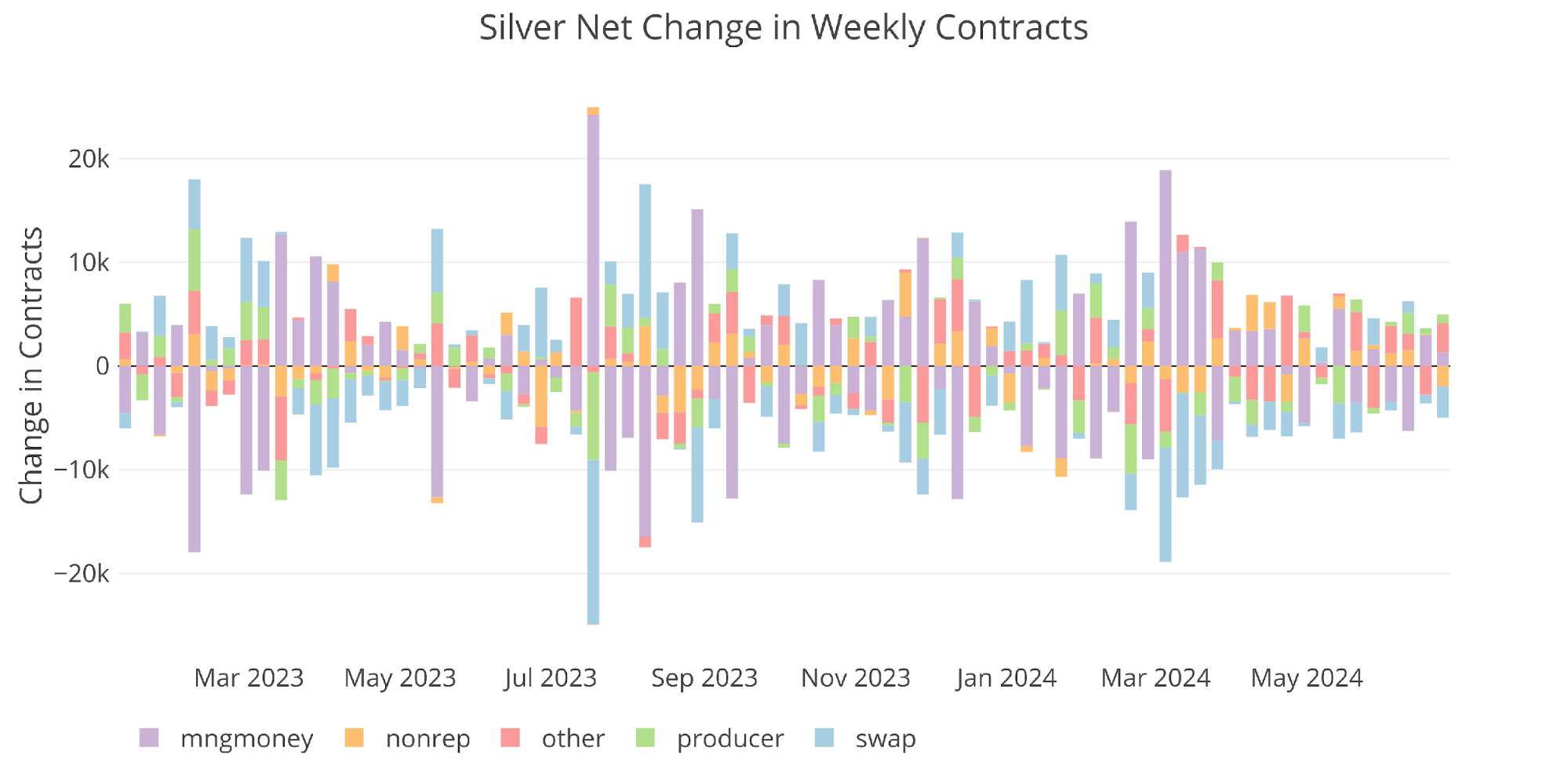

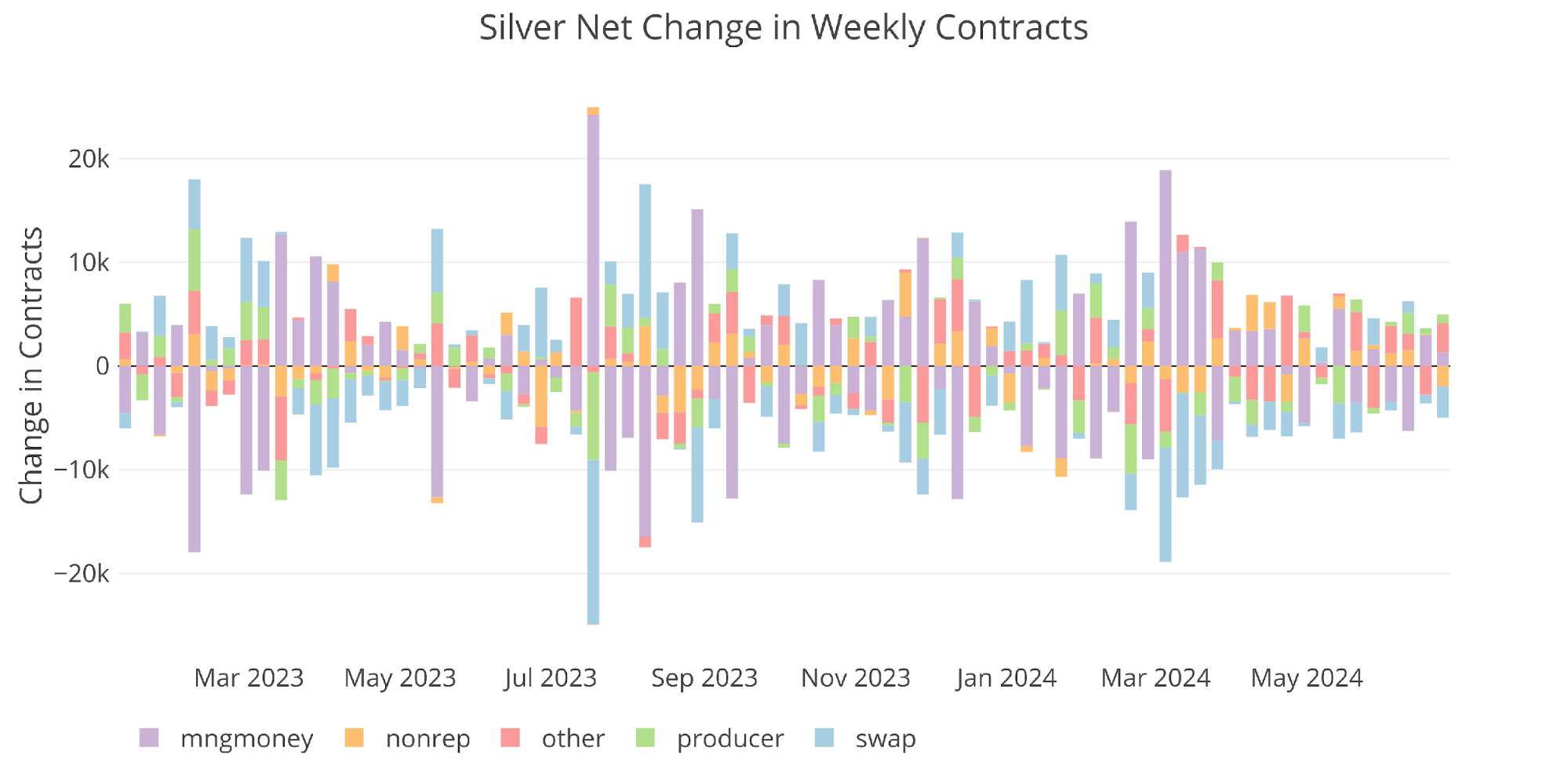

Also similar to gold, the activity has been fairly muted the last several weeks.

Figure: 7 Net Change in Positioning

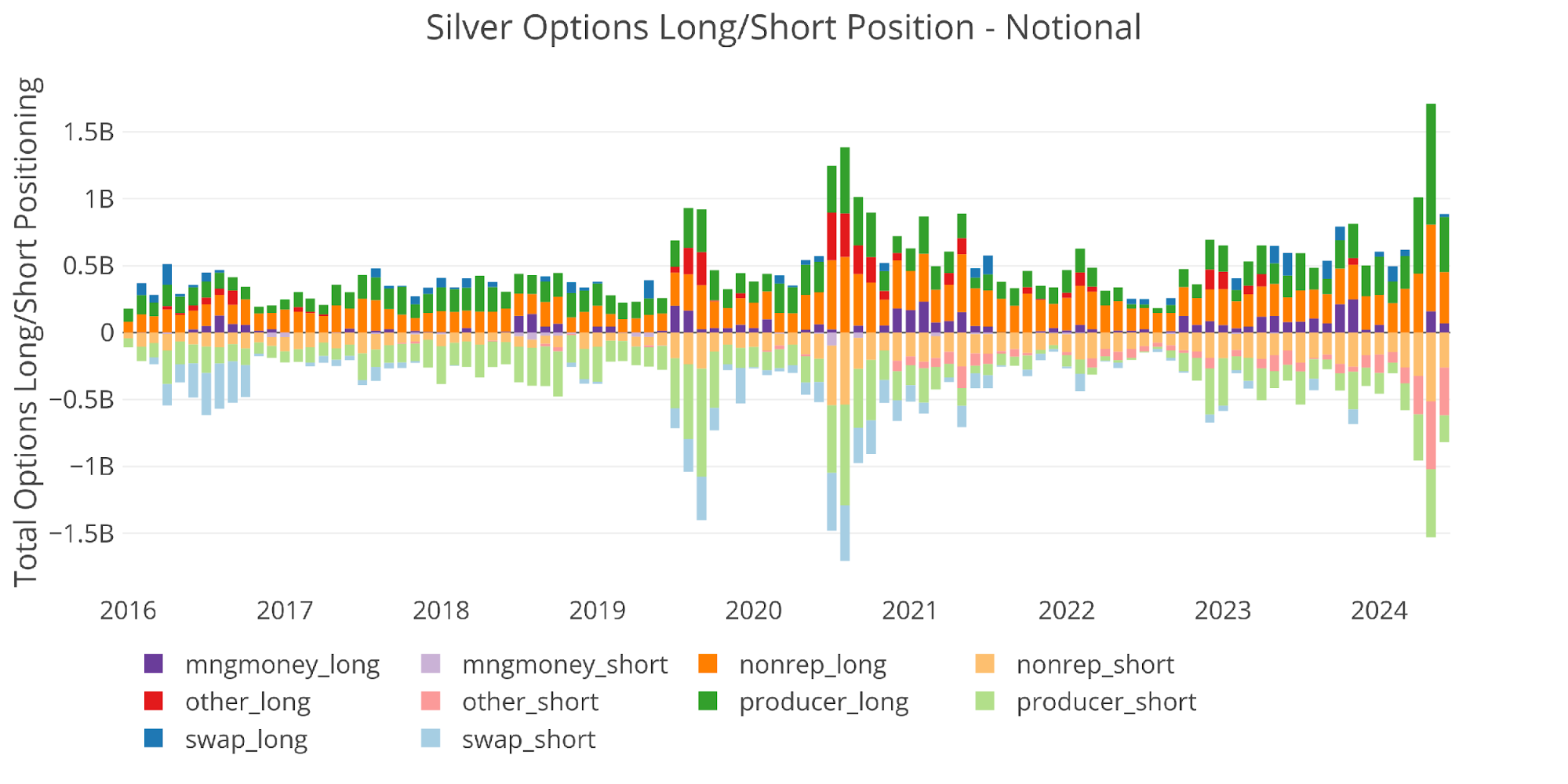

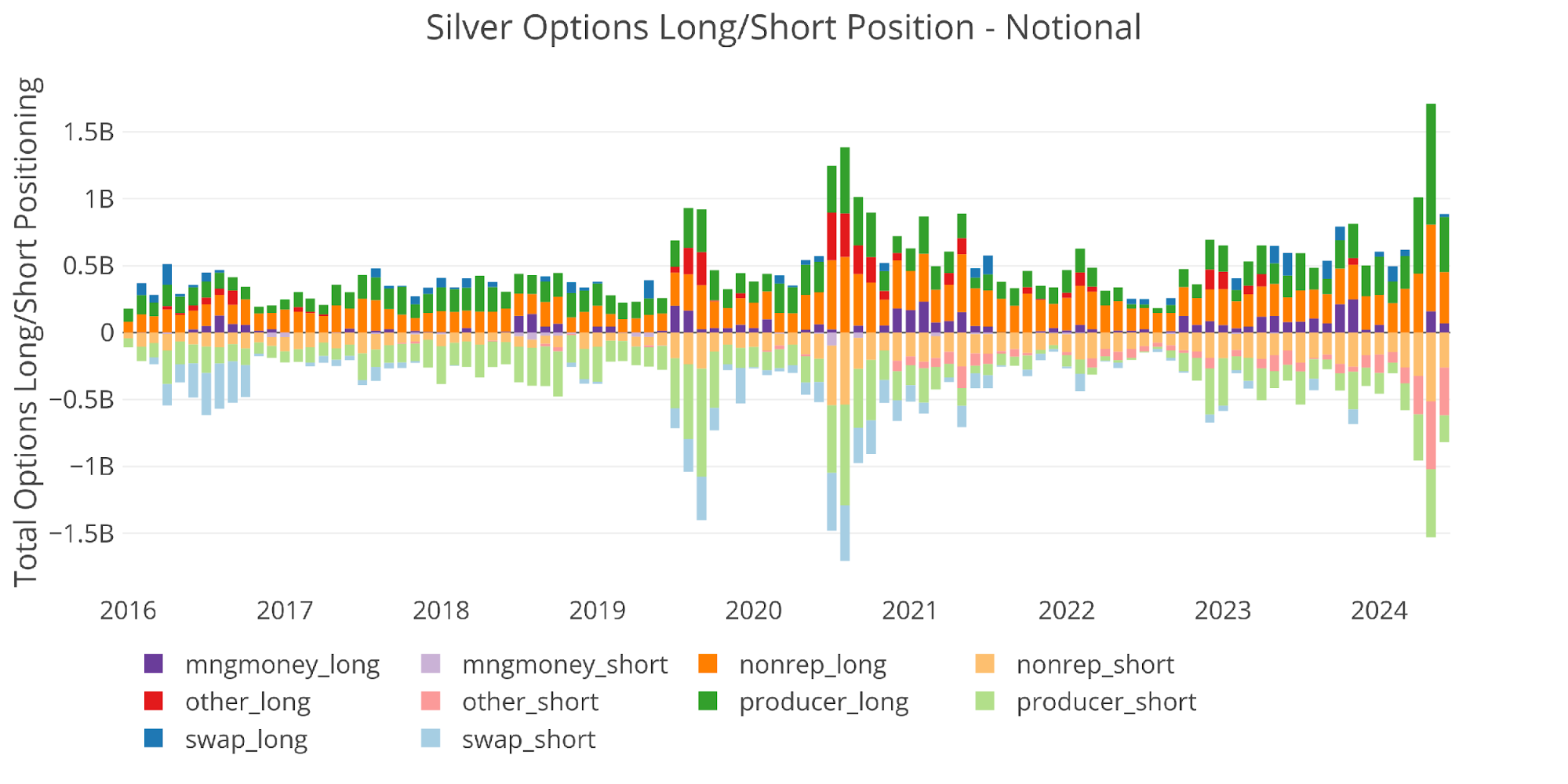

The options market is starting to show signs of life, indicating that speculators could be a driving factor behind recent price moves.

Figure: 8 Options Positions

Conclusion

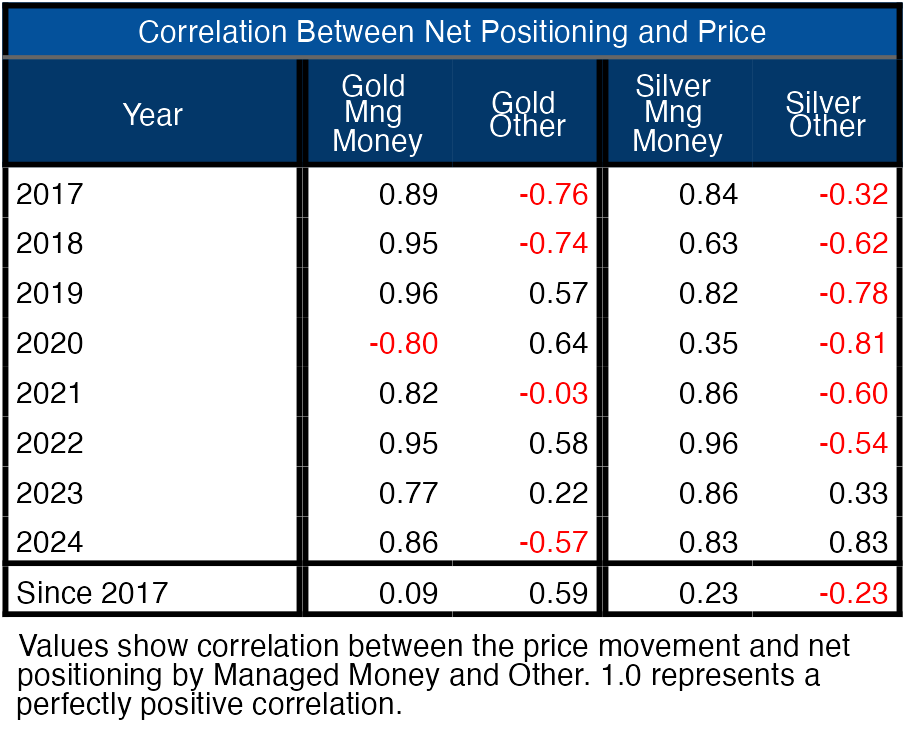

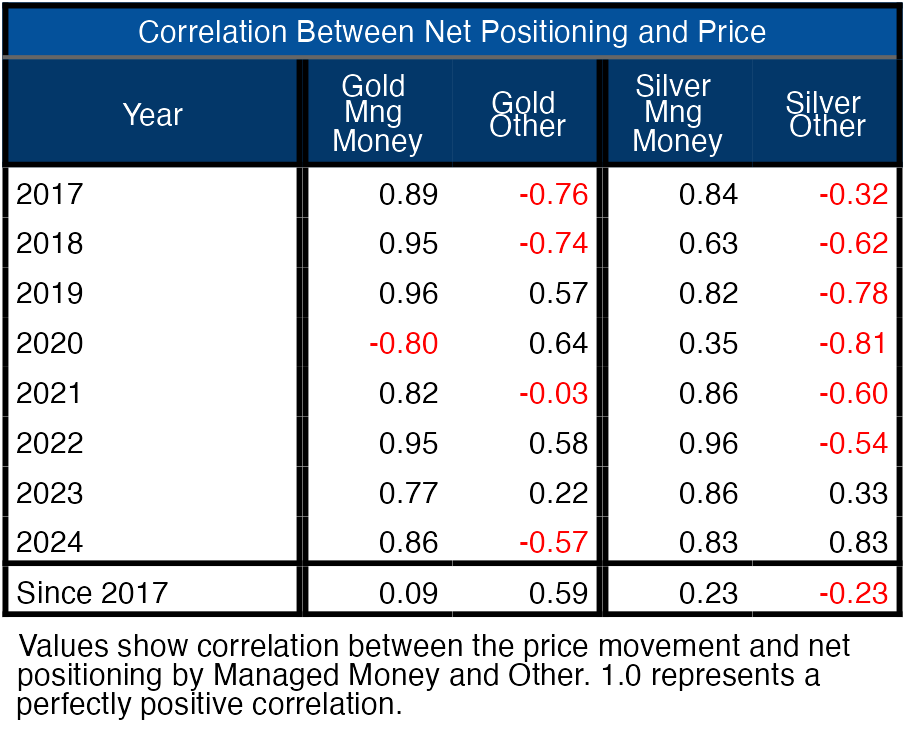

The table below shows the correlation of price action to positioning for Managed Money and Others (presumably non-institutional). You can see how Managed Money dominates the price action except for 2020. At some point, the price action will not be driven by futures traders, but by physical demand. That is when prices will explode higher as people realize there is not enough gold and silver to go around.

Figure: 9 Correlation Table

No matter how you slice it though, the short-term moves in gold and silver are clearly driven by the futures traders. Over the long term though, the slow and steady price advance in gold is being driven by fundamentals such as central bank buying and physical accumulation.

Data Source: https://www.cftc.gov/MarketReports/CommitmentsofTraders/index.htm

Data Updated: Every Friday at 3:30 PM as of Tuesday

Last Updated: Jun 25, 2024

Gold and Silver interactive charts and graphs can be found on the Exploring Finance dashboard: https://exploringfinance.shinyapps.io/goldsilver/

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Read the full article here