| Gold COT Report – Futures | ||||||

| Large Speculators | Commercial | Total | ||||

| Long | Short | Spreading | Long | Short | Long | Short |

| 245,995 | 58,514 | 48,708 | 68,432 | 291,150 | 363,135 | 398,372 |

| Change from Prior Reporting Period | ||||||

| -987 | -563 | 2,650 | -2,473 | -581 | -810 | 1,506 |

| Traders | ||||||

| 191 | 53 | 72 | 51 | 52 | 265 | 154 |

| Small Speculators | ||||||

| Long | Short | Open Interest | ||||

| 54,008 | 18,771 | 417,143 | ||||

| 2,012 | -304 | 1,202 | ||||

| non reportable positions | Change from the previous reporting period | |||||

| COT Gold Report – Positions as of | Tuesday, June 10, 2025 | |||||

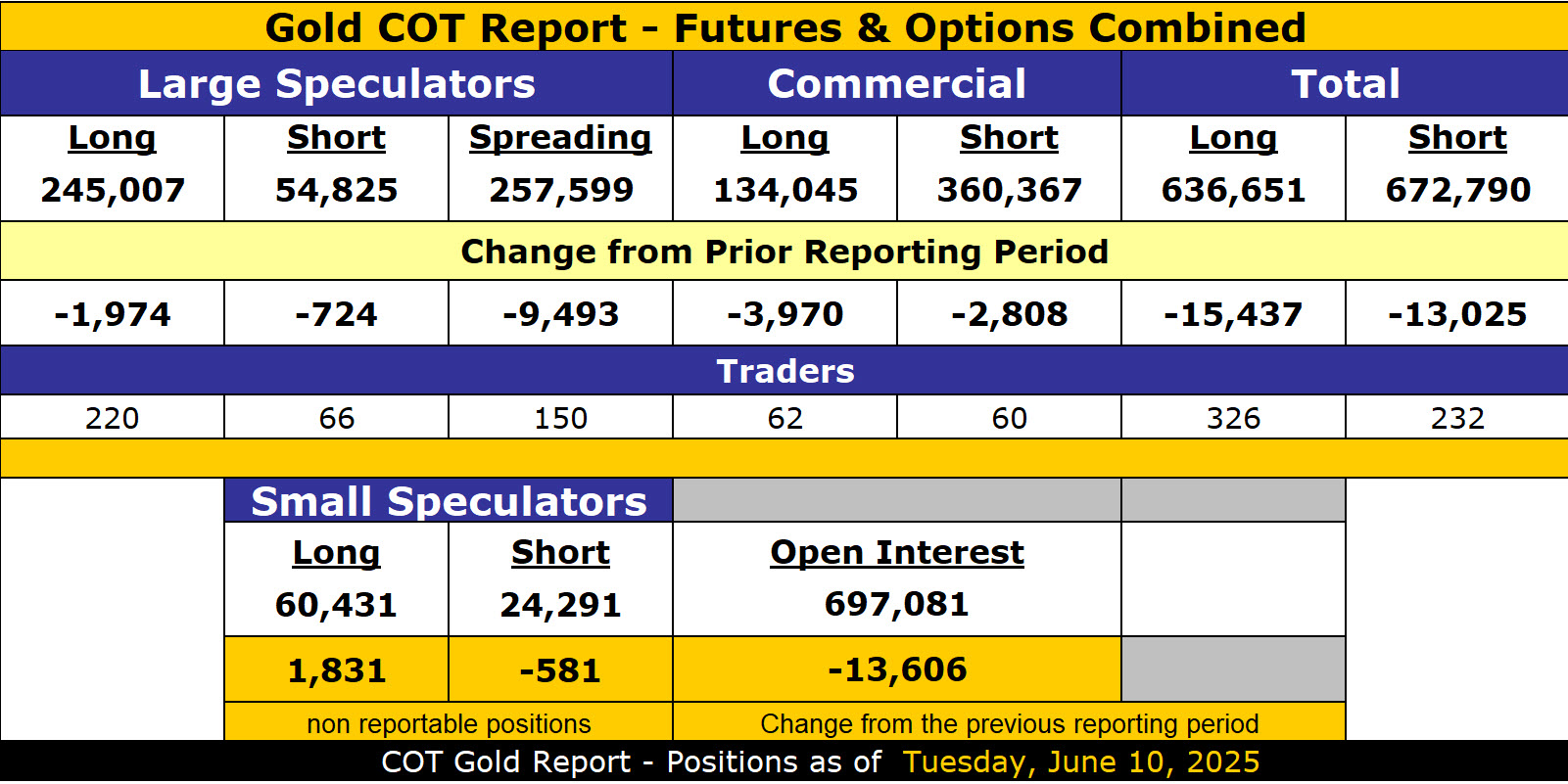

| Gold COT Report – Futures & Options Combined | ||||||

| Large Speculators | Commercial | Total | ||||

| Long | Short | Spreading | Long | Short | Long | Short |

| 245,007 | 54,825 | 257,599 | 134,045 | 360,367 | 636,651 | 672,790 |

| Change from Prior Reporting Period | ||||||

| -1,974 | -724 | -9,493 | -3,970 | -2,808 | -15,437 | -13,025 |

| Traders | ||||||

| 220 | 66 | 150 | 62 | 60 | 326 | 232 |

| Small Speculators | ||||||

| Long | Short | Open Interest | ||||

| 60,431 | 24,291 | 697,081 | ||||

| 1,831 | -581 | -13,606 | ||||

| non reportable positions | Change from the previous reporting period | |||||

| COT Gold Report – Positions as of | Tuesday, June 10, 2025 | |||||

| Silver COT Report – Futures | ||||||

| Large Speculators | Commercial | Total | ||||

| Long | Short | Spreading | Long | Short | Long | Short |

| 85,192 | 18,542 | 20,852 | 34,871 | 120,532 | 140,915 | 159,926 |

| 3,211 | -2,669 | 2,144 | 2,182 | 8,702 | 7,537 | 8,177 |

| Traders | ||||||

| 118 | 39 | 46 | 28 | 52 | 167 | 117 |

| Small Speculators | ||||||

| Long | Short | Open Interest | ||||

| 33,366 | 14,355 | 174,281 | ||||

| 3,397 | 2,757 | 10,934 | ||||

| non reportable positions | Change from the previous reporting period | |||||

| COT Silver Report – Positions as of | Tuesday, June 10, 2025 | |||||

| Silver COT Report – Futures & Options Combined | ||||||

| Large Speculators | Commercial | Total | ||||

| Long | Short | Spreading | Long | Short | Long | Short |

| 84,076 | 18,763 | 44,384 | 44,002 | 128,387 | 172,462 | 191,534 |

| 4,069 | -2,014 | 7,698 | 4,657 | 11,153 | 16,423 | 16,837 |

| Traders | ||||||

| 126 | 46 | 80 | 42 | 56 | 201 | 150 |

| Small Speculators | ||||||

| Long | Short | Open Interest | ||||

| 36,820 | 17,748 | 209,282 | ||||

| 3,803 | 3,390 | 20,226 | ||||

| non reportable positions | Change from the previous reporting period | |||||

| COT Silver Report – Positions as of | Tuesday, June 10, 2025 | |||||

| US Dollar Index COT Report – Futures | ||||||

| Large Speculators | Commercial | Total | ||||

| Long | Short | Spreading | Long | Short | Long | Short |

| 17,027 | 15,625 | 3,943 | 7,344 | 7,379 | 28,314 | 26,947 |

| 1,279 | 494 | 1,828 | -677 | 326 | 2,430 | 2,648 |

| Traders | ||||||

| 34 | 59 | 10 | 4 | 7 | 42 | 73 |

| Small Speculators | ||||||

| Long | Short | Open Interest | ||||

| 2,345 | 3,712 | 30,659 | ||||

| 222 | 4 | 2,652 | ||||

| non reportable positions | Change from the previous reporting period | |||||

| COT US Dollar Index Report – Positions as of | Tuesday, June 10, 2025 | |||||

| US Dollar Index COT Report – Futures & Options Combined | ||||||

| Large Speculators | Commercial | Total | ||||

| Long | Short | Spreading | Long | Short | Long | Short |

| 17,027 | 15,656 | 3,954 | 7,409 | 7,395 | 28,390 | 27,005 |

| 1,279 | 438 | 1,821 | -722 | 318 | 2,378 | 2,576 |

| Traders | ||||||

| 34 | 60 | 10 | 4 | 7 | 42 | 74 |

| Small Speculators | ||||||

| Long | Short | Open Interest | ||||

| 2,363 | 3,748 | 30,753 | ||||

| 207 | 9 | 2,585 | ||||

| non reportable positions | Change from the previous reporting period | |||||

| COT US Dollar Index Report – Positions as of | Tuesday, June 10, 2025 | |||||

About the author

Read the full article here

Leave a Reply