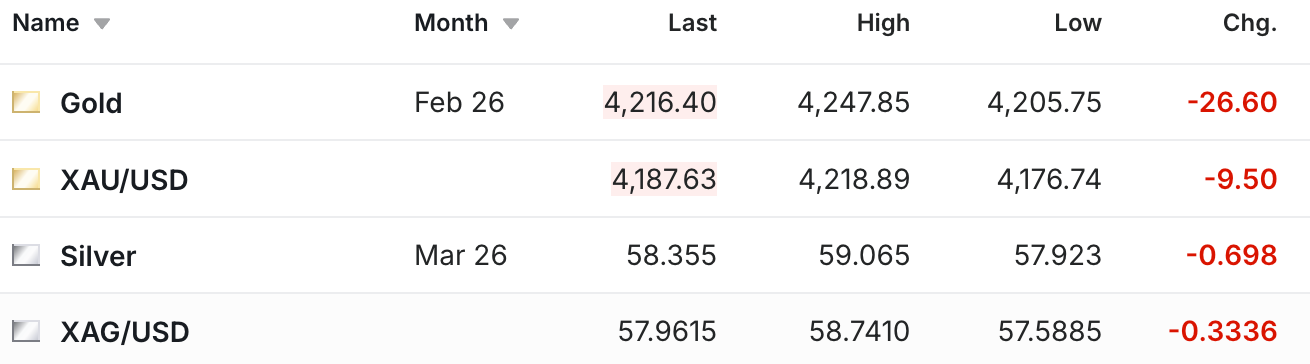

The gold and silver prices are down to start the new week, with the gold futures currently down $27 and the silver futures down 70 cents.

However, as is often the case, there’s plenty of news happening behind the scenes, and we have a guest column from my colleague Vince Lanci, who recently reported on an update about the BRICS 40% gold-backed UNIT currency proposal.

Background- What is The Unit?

‘The Unit’ is a BRICS concept that proposes a 40% gold-backed payment settlement currency that first emerged publicly when Pepe Escobar reported on it back in 2024.

It’s a proposal that would essentially allow BRICS nations to conduct trade while having a gold and BRICS currency-backed payment basket to settle imbalances.

‘The Unit project,’ first revealed by Sputnik in 2024, is emerging as the most viable option for breaking the US dollar’s stranglehold on global trade and investment.

-Pepe Escobar

While many were upset when the 2024 BRICS Summit came and went without a launch (although the meeting did produce an official acknowledgement that the UNIT concept was an ‘issue under discussion’ on the BRICS Pay website), this short video clip of Pepe Escobar suggests that the project is actually still well on schedule.

Executive Frame

For nearly two decades, the global payments system has relied almost entirely on debt-backed sovereign money and correspondent banking trust to conduct trade. That architecture is now fracturing under geopolitical strain, sanctions regimes, and capital controls. As settlement rails bifurcate along East-West lines, experiments are emerging to rebuild trust at the asset level rather than the sovereign balance-sheet level.

UNIT represents one of the clearest formal attempts to do precisely that: engineer a basket-backed, collateral-anchored settlement instrument intended specifically for wholesale, cross-border trade in a multipolar financial world.

“UNIT reflects the rise of collateral-anchored settlement instruments and the geopolitical bifurcation of global payments into bloc-based parallel monetary systems.”

Engineering the UNIT Instrument

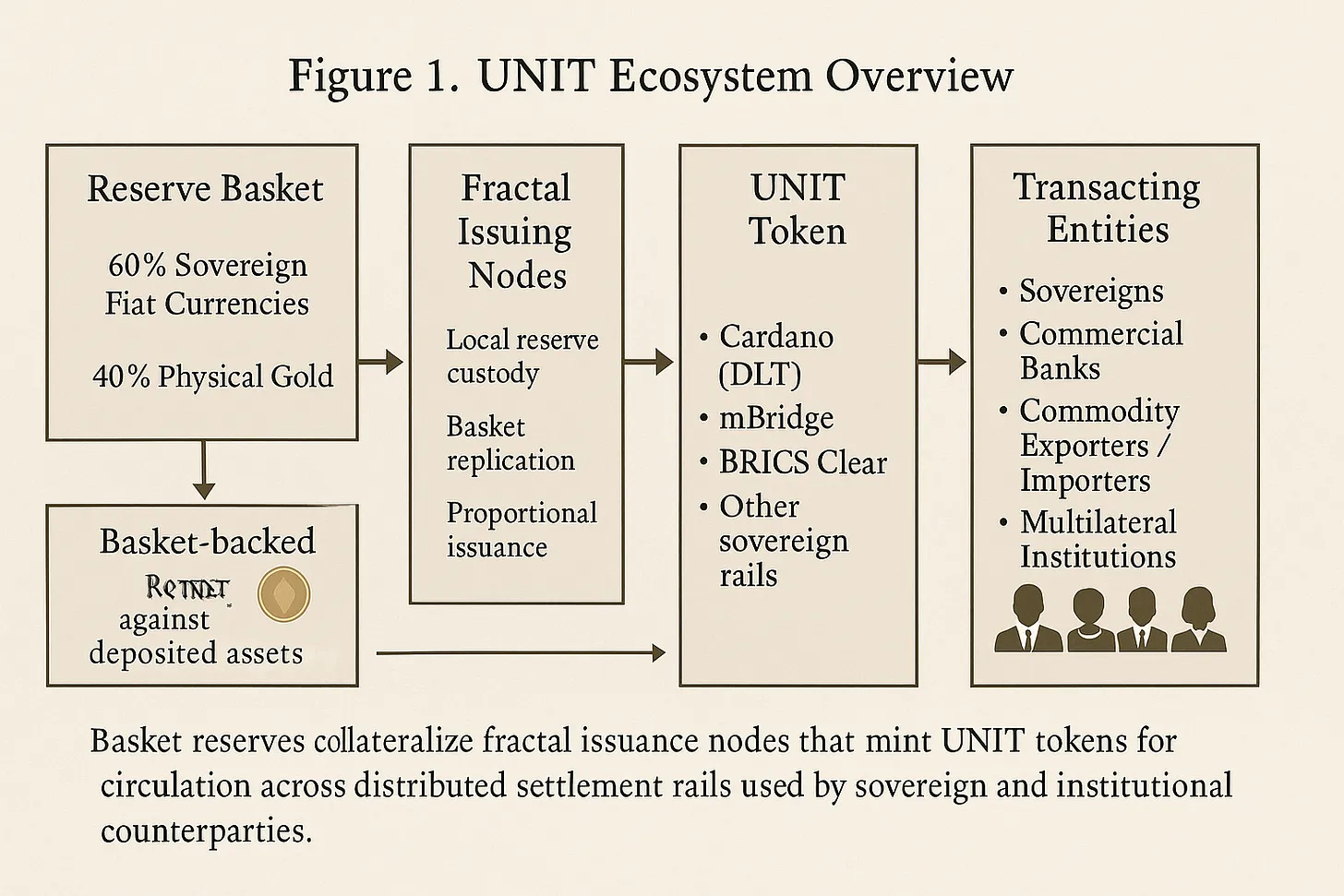

The UNIT concept originates with the Unit Foundation, which describes the instrument as a supranational settlement unit backed by a reserve basket composed of:

Issuance operates through a fractal, node-based model. Each participating node deposits a full replica of the reserve basket locally and mints a proportional quantity of UNIT tokens. There is no single central vault, no supranational issuer, and no sovereign guarantee. Supply discipline arises from asset custody and issuance rules rather than debt issuance authority.

Once minted, UNIT tokens circulate freely across settlement networks as a wholesale medium of exchange.

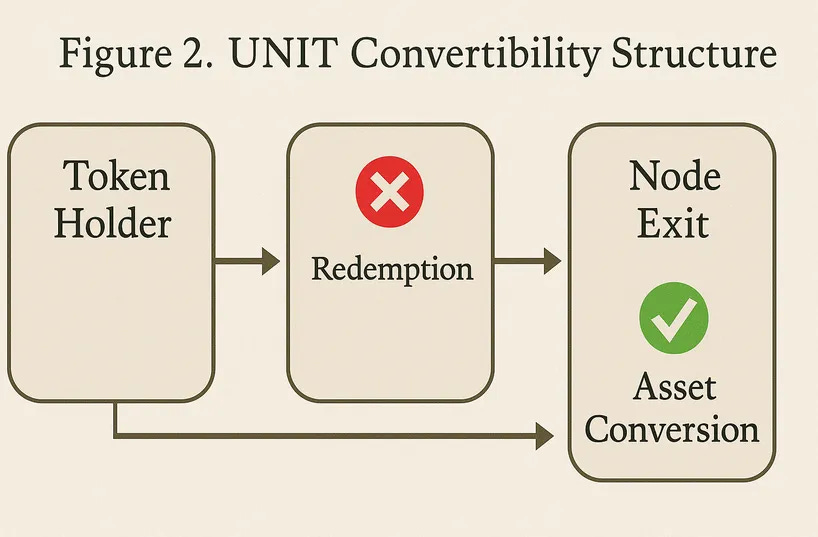

Critically, UNIT is non-redeemable at the holder level. Token holders cannot convert UNIT into gold or fiat. Only entire nodes may liquidate reserves during structured exits or buyouts. This design stabilizes reserves and mirrors historic trade-clearing units rather than consumer currencies.

“Gold anchors valuation confidence without introducing redemption risk.”

What UNIT Is and Is Not

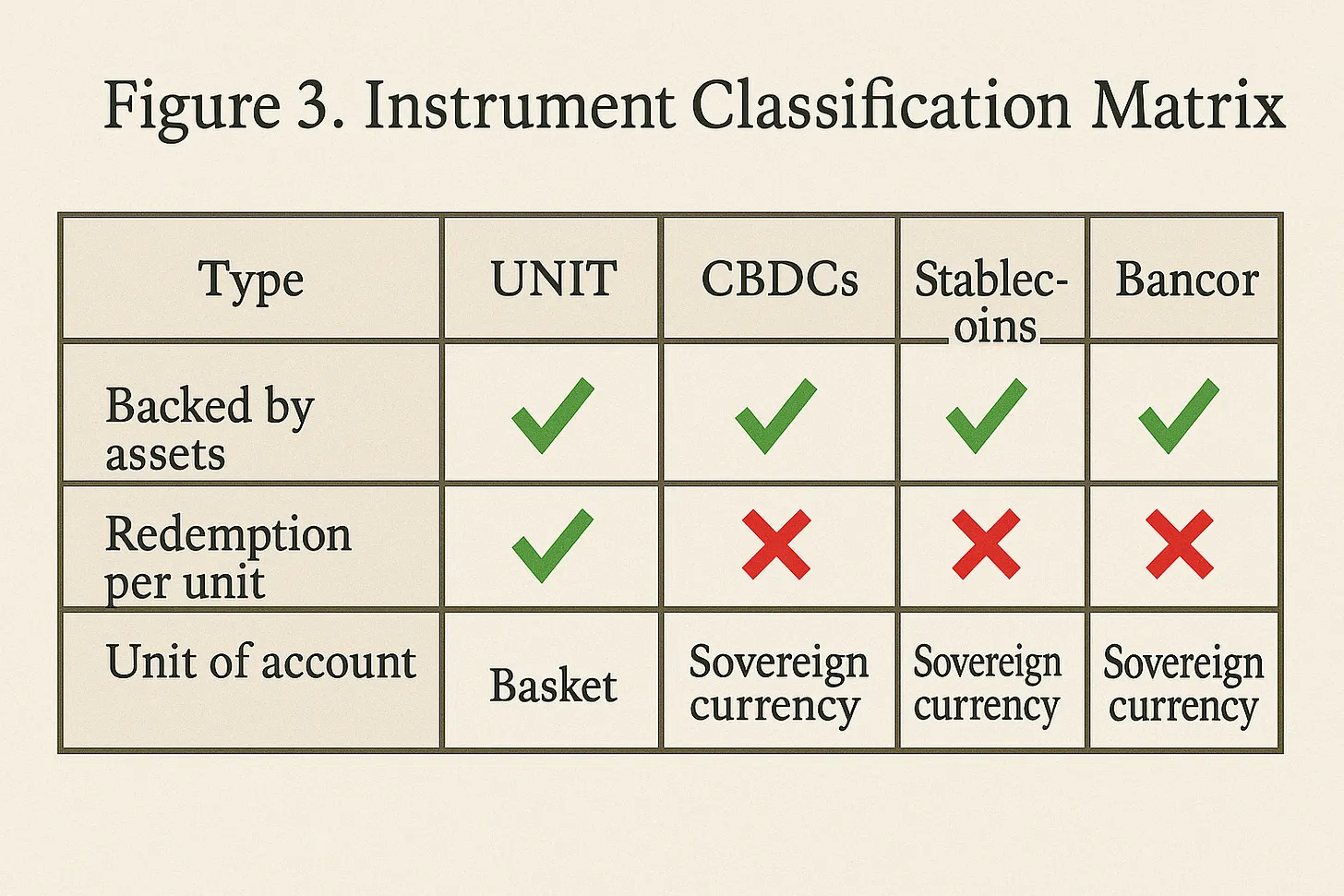

UNIT’s structure places it in a narrow category distinct from modern CBDCs or crypto stablecoins.

-

Unlike CBDCs, UNIT is not issued by any state nor used for domestic payments.

-

Unlike stablecoins, UNIT is not designed for retail circulation or reserve convertibility.

-

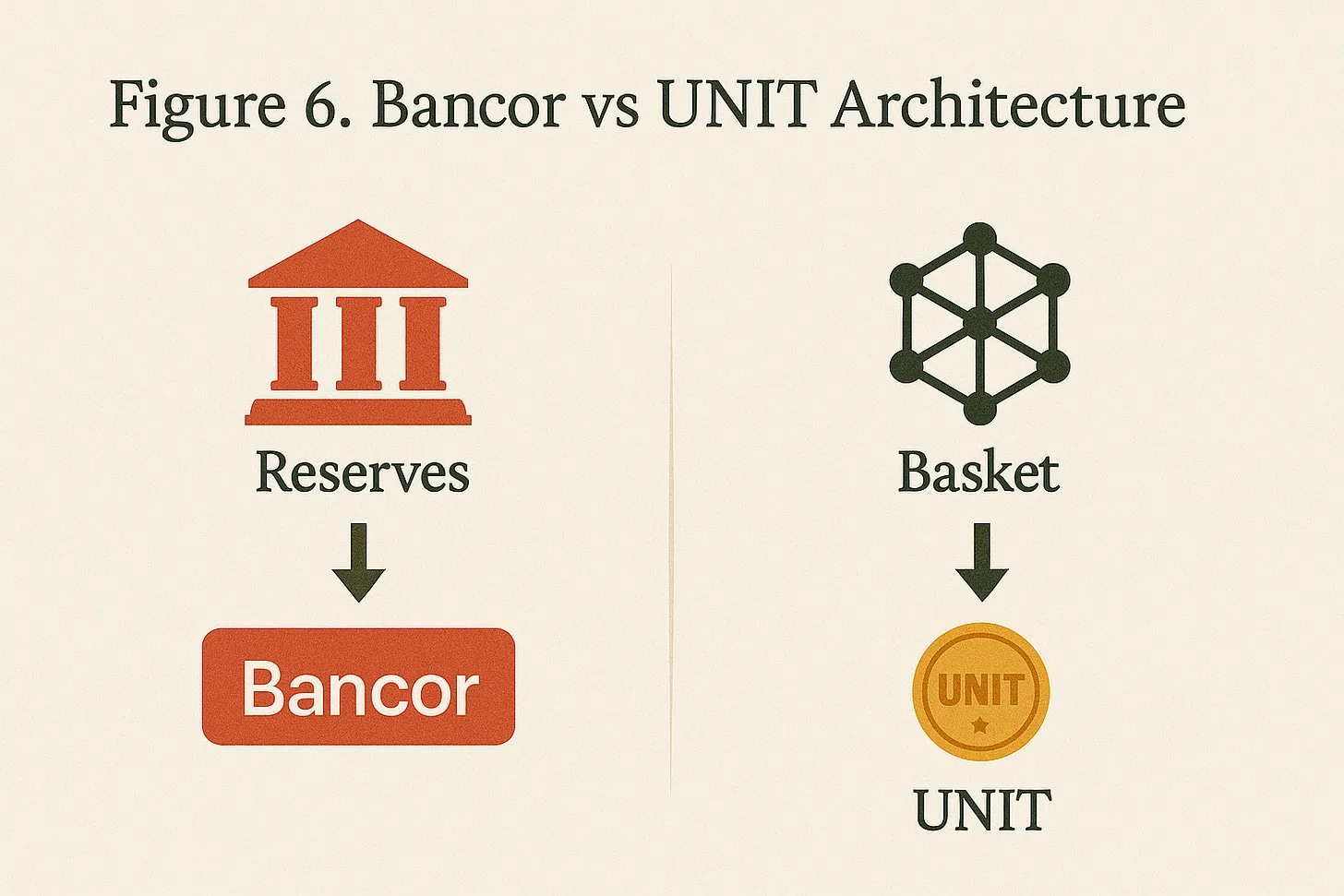

It most closely resembles Keynes’s proposed Bancor: a non-redeemable, basket-anchored settlement unit designed specifically for international clearing.

UNIT’s defining attributes:

-

Basket stability

-

Non-redeemable issuance discipline

-

Distributed reserve custody

-

Sovereign neutrality

-

Wholesale-only settlement use

Blockchain as Execution Rail

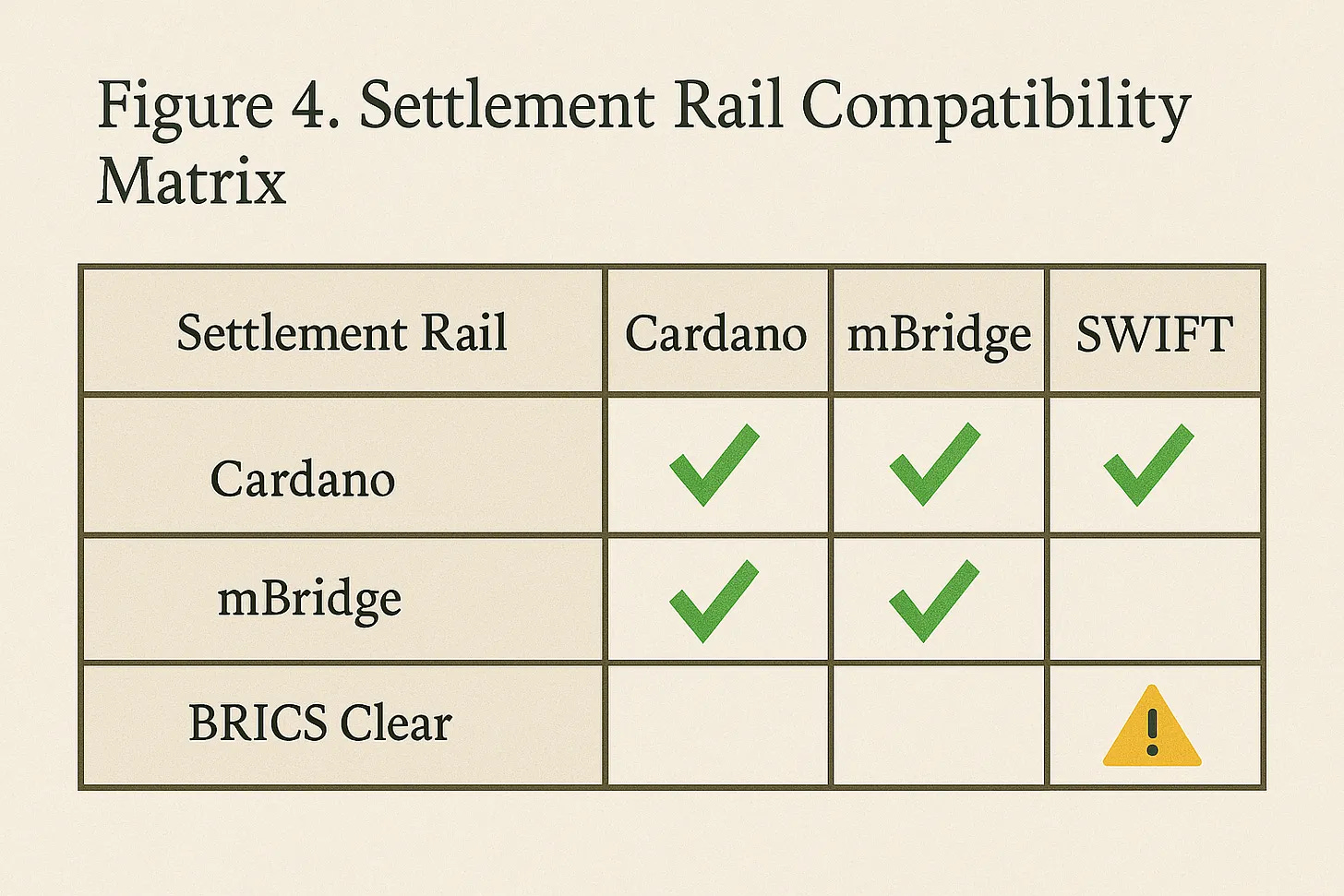

The UNIT’s digital execution has been undertaken by the International Research Institute for Advanced Systems (IRIAS), which announced deployment of the UNIT token on the Cardano blockchain.

The blockchain does not define monetary policy. It performs three operational functions:

-

Authenticity certification: Guarantees non-duplication and traceable transfers of UNIT tokens.

-

Settlement execution: Enables cross-border transfers without dependence on correspondent banking chains.

-

Accounting reconciliation: Provides immutable ledgers for jurisdiction-spanning settlements.

UNIT itself remains the monetary object; blockchain is the rail that carries it.

“The blockchain is the vessel. UNIT is the value.”

UNIT is native to distributed ledger and CBDC rails and only indirectly compatible with legacy messaging systems like SWIFT, which lack asset-exchange functionality.

Role in Global Trade

UNIT is not intended to be a consumer currency. Its roles are purely institutional:

-

Medium of Exchange: Direct settlement of commodity and trade invoices without intermediary FX conversions.

-

Unit of Account: Pricing reference for cross-border contracts and intergovernmental agreements.

-

Settlement Instrument: Alternative clearing unit capable of bypassing correspondent banking chokepoints.

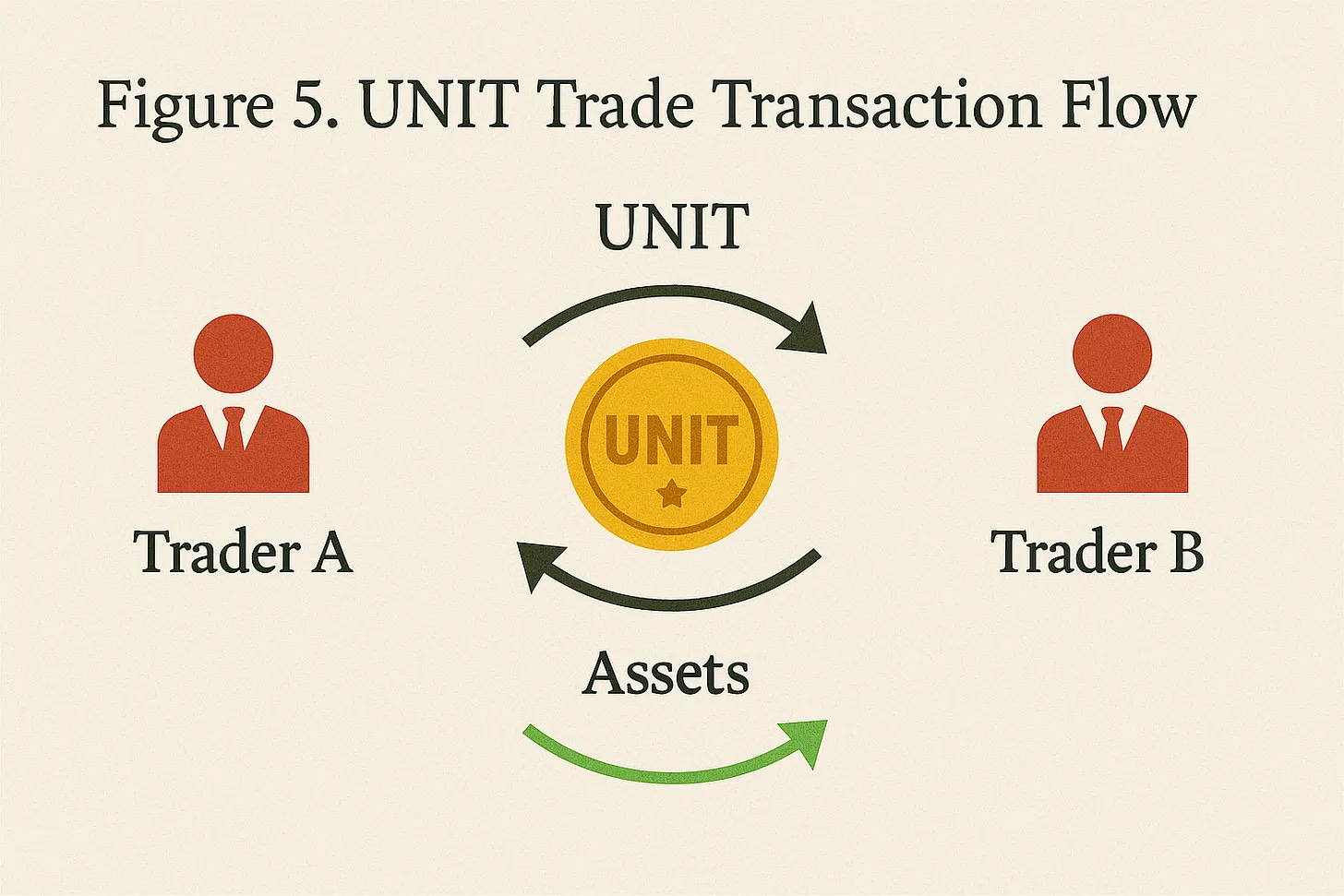

In practice, a UNIT transaction follows a simple flow:

-

Trade invoice denominated in UNIT.

-

Payment transmitted across blockchain or sovereign settlement rail.

-

UNIT credited to exporter or counterparty.

No retail conversion. No physical delivery. No bank-to-bank FX chains.

The Historical Parallel

UNIT echoes the original Keynes Bancor vision from 1944:

-

Multilateral settlement unit of account.

-

Collateral anchoring without redemption rights.

-

Issuance governed by contribution rules, not credit expansion.

-

Designed to stabilize trade balances rather than serve domestic consumption.

The primary innovation is technological: Bancor was ledger theory; UNIT is ledger execution.

What This Actually Means

UNIT does not represent a monetary coup or instantaneous de-dollarization. It represents something more subtle and more powerful:

A working proof that collateral-based settlement systems are being formally engineered as the global payments network fragments.

In that sense, UNIT is neither marketing fiction nor geopolitical weapon. It is a progress marker:

-

Confirmation that asset anchoring is replacing trust anchoring.

-

Evidence that multipolar settlement is moving from talk to infrastructure.

-

A case study validating the structural themes observed over the past decade.

Closing

The UNIT does not “solve” the multipolar settlement.

It signals that the solution set is being built.

This is documentation of an ongoing architectural shift in global finance: from sovereign debt trust to collateral trust, from single-rail settlement to multi-rail clearing, and from centralized monetary authority to distributed issuance logic. In other words: It’s likely happening.

-Vince Lanci, GoldFix

The UNIT is still in its infancy phase, and appears to represent a Russian private sector solution (with state level encouragement) to the global settlement layer that exists in between retail and sovereign transactions. That is an admittedly huge range of transaction size and volume. They conducted a public capital raise in order to mint the first tokens, so that doesn’t strike me as a project with explicit state backing.

UNIT is very distinct from mBridge/BRICS bridge, and runs on a completely different blockchain. BRICS Bridge is much more mature, and functions as the new and growing settlement layer between the correspondent banking system and commodity exchanges of BRICS nations. BRICS adjacent financial institutions and sovereigns also participate with prior authorization.

For example, the big four Chinese banks, ICBC, BOC, ABC, and CCB, are currently using the mBridge system to conduct settlement with HSBC, Standard Chartered, and a host of Russian and Middle Eastern banks. There are a growing host of bilateral and multilateral settlement systems being created that function as financial tunnels under the wall between the G7 and BRICS sides of the financial iron curtain.

Where UNIT really contributes to this new monetary ecosystem is by providing businesses with a unit of account that can function as a reference point for contracts across the financial iron curtain. BRICS Bridge and other settlement cross border layers currently index currencies and FX rates on a transaction by transaction basis.

While it is extremely secure and works at the sovereign level, that is not conducive to forming long term contracts or handling the volumes required for the growth of cross border trade. In a mercantilist world (or capitalist with Chinese tendencies), the BRICS+ financial system needs a method for business entities to engage in cross border contracts and assume FX risk on their own.

Enter the UNIT.

-Matt Riley, EF Bullion

Hopefully that was a helpful update. In case you’d like to better understand the unit concept, we did this video last year (with Matt Riley who was just quoted above) which came out as a great overview of what’s actually happening.

I’ll have some more thoughts on this later this week, but that’s it for now, and I’ll look forward to checking back in with you.

Read the full article here

Leave a Reply