Mexican gold Pesos rank among the most popular gold coins in North America, and for good reason. They offer genuine gold content at premiums that often beat comparable coins from other countries. The 50 Peso “Centenario” in particular has earned a devoted following for its impressive size and low cost per ounce of gold. Whether you’re looking for fractional pieces or substantial gold holdings, Mexico’s historic coinage provides options across the spectrum.

What Are Mexican Gold Pesos?

Mexico produced gold Peso coins in several denominations throughout the early 20th century, with most original mintages occurring between 1905 and 1931. The Mexican Mint (Casa de Moneda de México, one of the oldest mints in the Americas) later produced official restrikes from 1949 through 1972, making these coins widely available today.

All Mexican gold Pesos contain .900 fine gold, matching the purity of most European gold coins from the same era. The coins feature consistent design elements: Miguel Hidalgo (the father of Mexican independence) on smaller denominations, and the iconic Winged Victory statue on the 50 Peso. That combination of historic significance, substantial gold content, and ongoing availability through restrikes makes Mexican gold a staple of the bullion market.

The Mexican Gold Peso Denominations

2 Peso

The smallest Mexican gold coin, the 2 Peso contains just 0.0482 troy ounces of gold. At about 13mm in diameter, these coins are genuinely tiny. They serve collectors and those wanting the smallest possible gold increment, but most investors skip them in favor of larger denominations. Premiums as a percentage of gold value run higher on these small pieces, reducing their appeal for pure gold accumulation.

2.5 Peso

The 2.5 Peso bumps the gold content to 0.0603 troy ounces. Still a small coin, but slightly more practical than the 2 Peso. The same premium concerns apply: you’ll pay more per ounce of gold on fractional pieces. These coins feature Hidalgo’s portrait and make attractive additions to collections, even if they’re not optimal for bulk gold buying.

5 Peso

At 0.1206 troy ounces of gold, the 5 Peso enters more practical territory for investors. The coin measures about 19mm in diameter and features Hidalgo facing left. Original coins were minted from 1905-1920, with restrikes dated 1955 produced later.

The 5 Peso works well for gradual accumulation or as gifts. Premiums typically run lower than on the 2 and 2.5 Peso coins, making them reasonable for investors who want fractional gold without excessive markup. They’re comparable to European fractional gold in size and utility.

10 Peso

The 10 Peso contains 0.2411 troy ounces of pure gold, slightly more than a German 20 Mark (0.2304 oz). This is where Mexican gold starts getting interesting for serious investors. The coin features Hidalgo and measures about 22.5mm in diameter.

Original mintages ran from 1905-1920, with restrikes dated 1959 produced through the 1970s. The 10 Peso hits a sweet spot: enough gold to matter, low enough premiums to make sense, and small enough for flexible portfolio building. If you’re comparing Mexican gold to European alternatives, the 10 Peso competes directly with Danish 20 Kroner and German 20 Marks.

20 Peso “Azteca”

The 20 Peso jumps to 0.4823 troy ounces of gold, nearly half an ounce. This substantial coin (27mm diameter) depicts the Aztec calendar stone on the reverse, earning it the nickname “Azteca.” The obverse shows the Mexican coat of arms with an eagle perched on a cactus.

Original production ran from 1917-1921, with restrikes dated 1959. The Azteca provides a middle ground between fractional coins and the massive 50 Peso. For investors who want meaningful gold content without committing to full-ounce pieces, the 20 Peso delivers.

50 Peso “Centenario”

The Centenario is the star of Mexican gold coinage. Containing 1.2057 troy ounces of pure gold, it’s one of the largest regularly traded gold coins in the world. The coin measures 37mm in diameter and weighs 41.67 grams total.

“Centenario” means “centennial,” commemorating the 100th anniversary of Mexican independence in 1921. The obverse features Winged Victory (the same figure atop Mexico City’s independence monument), while the reverse displays the Mexican coat of arms with surrounding mountains. It’s a genuinely beautiful coin that photographs well and impresses in person.

Original Centenarios were minted from 1921-1931, with extensive restrikes dated 1947 produced from 1949 through 1972. The restrikes are official Mexican Mint products containing the same gold specifications as originals. They trade at bullion premiums rather than numismatic premiums, which is exactly what gold investors want.

Why the Centenario Deserves Special Attention

The 50 Peso Centenario has earned its reputation for several reasons:

Low premiums. Centenarios routinely trade at lower premiums over spot than American Gold Eagles, Canadian Maple Leafs, or South African Krugerrands. When gold prices are elevated and premiums on popular bullion coins spike, the Centenario often becomes the most cost-effective way to buy gold.

More than an ounce. At 1.2057 oz, each Centenario contains more gold than a standard one-ounce bullion coin. That extra gold adds up when building larger positions.

Strong liquidity. Despite being a “foreign” coin, Centenarios enjoy excellent liquidity in North America. Any reputable gold coin dealer will buy or sell them readily. The coin’s popularity ensures active markets.

Recognizable design. The Winged Victory image is distinctive and widely recognized. Authentication is straightforward for experienced dealers, and counterfeits are less common than with some other coins.

For investors focused on maximizing gold content per dollar spent, the Centenario often represents the best value in the market.

Original Dates vs. Restrikes

Mexican gold Pesos exist as both original mintages and official restrikes. Here’s what you need to know:

Original coins were minted during their stated production years (1905-1931 depending on denomination). These trade at the same premiums as restrikes for most denominations, though a few specific original dates carry collector premiums.

Restrikes were produced by the Mexican Mint from 1949 through 1972, bearing dates of 1945 (2 Peso), 1945 (2.5 Peso), 1955 (5 Peso), 1959 (10 and 20 Peso), and 1947 (50 Peso). These are genuine Mexican government coins containing the stated gold content. They’re not reproductions or counterfeits.

For investment purposes, restrikes work perfectly well. They contain identical gold to original coins and trade at the same per-ounce premiums. USAGOLD only sells the original pre-1931 coins, to protect our clients from potential government confiscation.

How Mexican Gold Compares to Other Options

Mexican Pesos compete effectively across the gold market:

The Centenario’s combination of high gold content and low premium makes it hard to beat for investors who prioritize value. The 10 and 20 Peso coins compete favorably with European fractional gold while offering a distinctly different origin.

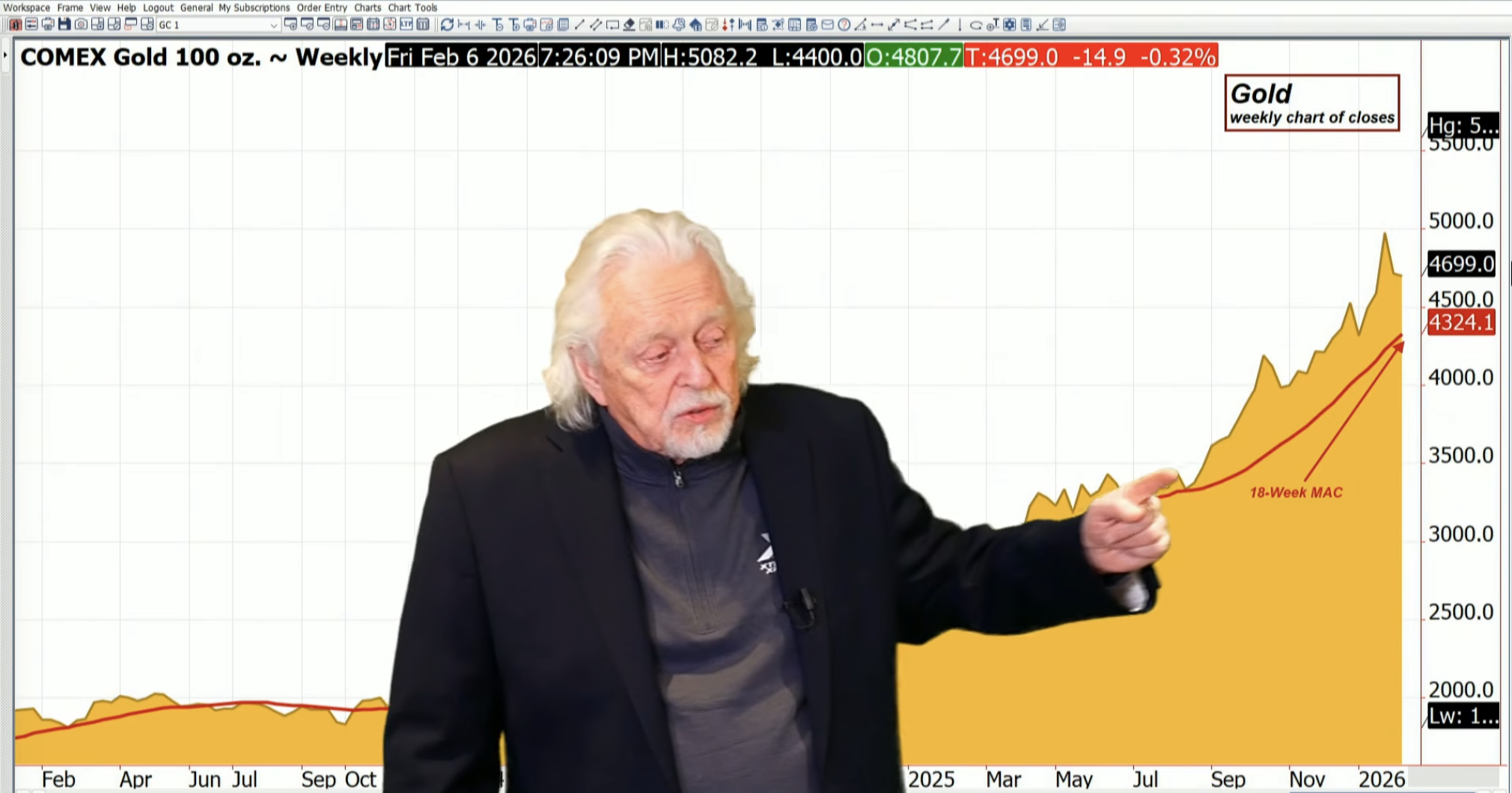

Current Gold Melt Values (February 2026)

Based on a gold spot price of approximately $4,895 per troy ounce (as of February 5, 2026), the following table shows the approximate gold melt value for each Mexican gold Peso denomination. Actual dealer prices will include a premium above these melt values.

|

Denomination |

Gold Content (oz) |

Gold Melt Value |

Total Weight (g) |

|

2 Peso |

0.0482 |

$235.94 |

1.67 |

|

2.5 Peso |

0.0603 |

$295.17 |

2.08 |

|

5 Peso |

0.1206 |

$590.34 |

4.17 |

|

10 Peso |

0.2411 |

$1,180.18 |

8.33 |

|

20 Peso Azteca |

0.4823 |

$2,361.66 |

16.67 |

|

50 Peso Centenario |

1.2057 |

$5,903.90 |

41.67 |

Gold melt values calculated at $4,895/oz spot price as of February 5, 2026. Actual purchase prices will include dealer premiums. Gold prices fluctuate throughout the trading day.

Buying Mexican Gold Pesos

When shopping for Mexican gold, consider these factors:

The 50 Peso offers best per-ounce value. If you’re buying for gold content rather than fractional flexibility, the Centenario typically delivers the lowest premium per ounce.

The 10 Peso works for gradual accumulation. At roughly a quarter ounce, the 10 Peso allows steady portfolio building without large individual purchases. Compare premiums to similar European coins and buy whichever offers better value at the moment.

Skip the smallest denominations unless collecting. The 2 and 2.5 Peso coins carry higher percentage premiums. They’re interesting as collectibles but inefficient as gold investments.

Condition matters less than you might think. Because most Mexican Pesos trade as bullion rather than numismatic coins, minor contact marks or bag wear don’t significantly affect pricing. You’re buying gold content, not grade.

Work with experienced dealers. Mexican gold is generally straightforward to authenticate, but purchasing from established precious metals dealers eliminates any concern about counterfeits.

Frequently Asked Questions

How much gold is in a Mexican 50 Peso?

The 50 Peso Centenario contains 1.2057 troy ounces (37.5 grams) of pure gold at .900 fineness. Total coin weight is 41.67 grams.

Are Mexican gold Peso restrikes real gold?

Yes. Restrikes were produced by the official Mexican Mint using the same specifications as original coins. They contain genuine gold and carry Mexican government backing.

Which Mexican gold Peso is best for investment?

The 50 Peso Centenario typically offers the lowest premium per ounce of gold. For fractional purchases, the 10 Peso provides good balance between size and value.

Can I include Mexican gold Pesos in an IRA?

No. The Mexican 50 Peso does not meet IRS fineness requirements for precious metals IRAs. Consult with an IRA custodian for specific guidance.

Why do Centenarios have lower premiums than Gold Eagles?

The Centenario lacks the aggressive marketing of U.S. Mint products and doesn’t carry the same collector crossover appeal. Lower demand relative to supply keeps premiums competitive. That’s an advantage for investors focused on gold content rather than brand recognition.

What’s the difference between the 1921 and 1947 dated Centenarios?

The 1921 date indicates original mintage during that year. The 1947 date appears on restrikes produced from 1949-1972. Both contain identical gold content and trade at similar premiums for common examples.

Are Mexican gold coins hard to sell?

Not at all. Centenarios in particular enjoy strong North American liquidity. Dealers readily buy all Mexican gold Peso denominations at competitive prices.

The Bottom Line

Mexican gold Pesos deserve a place in any serious gold investor’s consideration set. The Centenario delivers more than an ounce of gold at premiums that regularly beat the competition, while smaller denominations provide fractional flexibility at reasonable costs. Whether you’re building a diversified gold portfolio or simply looking for the most gold per dollar, Mexican coins consistently deliver value that’s hard to match.

Read the full article here

Leave a Reply