Today, the Financial Times accelerates its longstanding campaign to denigrate the monetary metals and mystify the powerful increase in their prices.

Reporter Bryce Elder writes an analysis headlined “Who’s Been Buying All the Gold?” and subheadlined “Because It Doesn’t Look Like It’s the Central Banks”:

https://www.ft.com/content/

Of course, like most analysts, Elder assumes that all official gold data is accurate and that governments wouldn’t try to conceal some of their purchases, though the secret March 1999 report of the staff of the International Monetary Fund shows that falsifying gold reserve data to conceal gold leases and swaps is actually longstanding central bank policy:

https://www.gata.org/node/

Meanwhile, the FT’s “Unhedged” columnist, Robert Armstrong, writes commentary headlined “Trying to Change Our Minds About Gold” and subheadlined “It’s Not Easy to Rationalize the Rally”:

https://www.ft.com/content/

At least Armstrong is candid about his confusion:

“Unhedged has been loudly, persistently, and hilariously wrong about gold. If there is a world record for financial pundit wrongness, we must be getting close to it. We hated this asset at $2,500, and it just flew past $5,000. Under circumstances like these, rational people generally change their minds. We are trying to, and finding it a challenge.”

Will Armstrong accept some help? Understanding gold may be a challenge for him because his own newspaper and the rest of mainstream financial journalism refuse to pursue the critical angles to the recent explosive rise in gold and silver.

First, there is the longstanding maintenance of naked short positions in gold derivatives maintained by Western central banks and their investment bank agents, positions suspected by the British economist Peter Warburton as long ago as 2001 in his essay “The Debasement of World Currency: It Is Inflation But Not As We Know It”:

https://www.gata.org/node/8303

Warburton wrote:

“How much capital would it take to control the combined gold, oil, and commodity markets? Probably, no more than $200 billion, using derivatives. Moreover, it is not necessary for the central banks to fight the battle themselves, although central bank gold sales and gold leasing have certainly contributed to the cause. Most of the world’s large investment banks have overtraded their capital so flagrantly that if the central banks were to lose the fight on the first front, then the stock of the investment banks would be worthless. Because their fate is intertwined with that of the central banks, investment banks are willing participants in the battle against rising gold, oil, and commodity prices.”

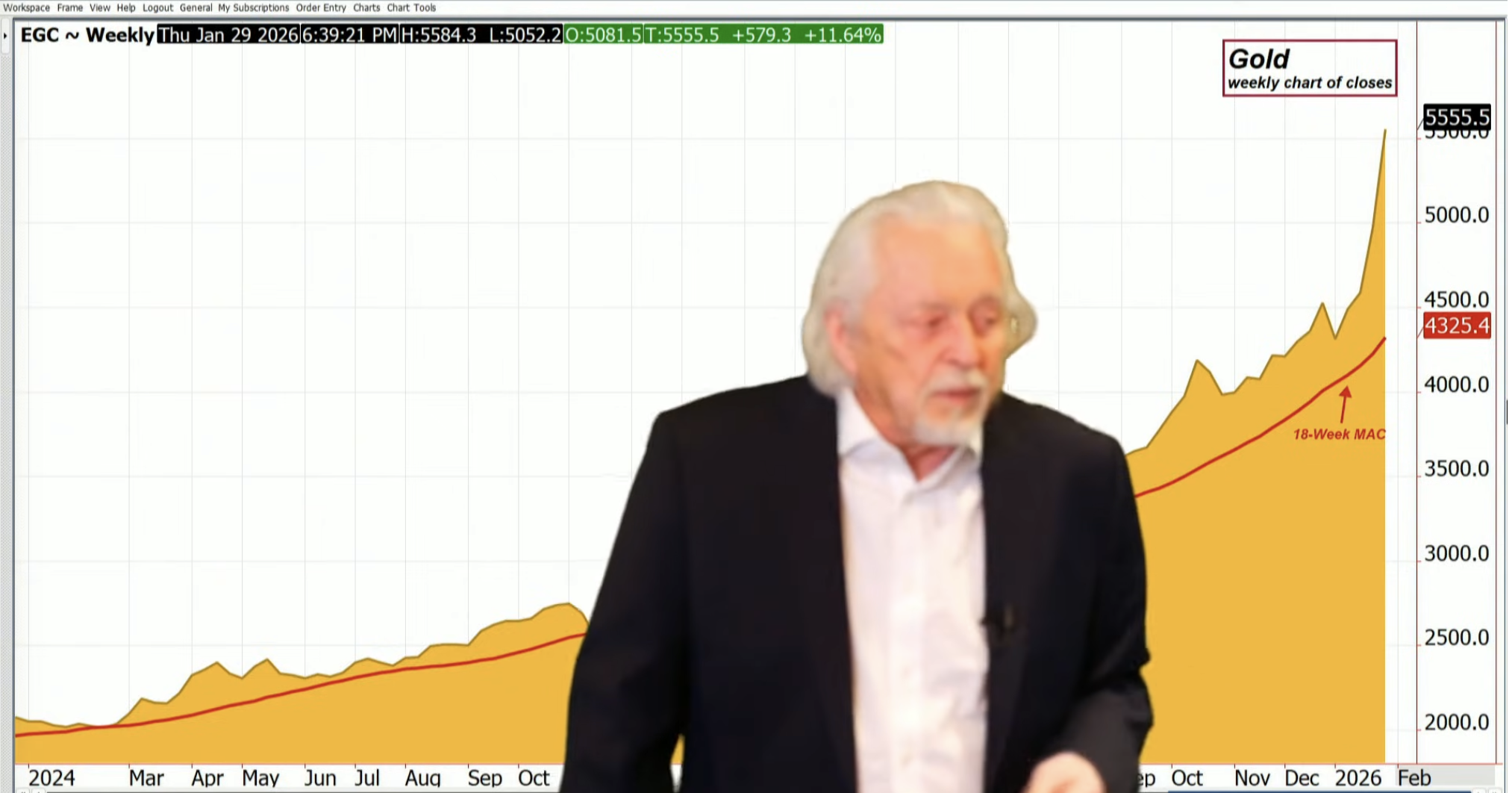

And second, there is the violence of the rise in gold and silver prices, which is typical of a short squeeze and might be fully expected with the monetary metals now, as geopolitical and industrial issues have combined at the same moment to increase demand for delivery of the real thing, not to increase contentment with mere derivatives.

In a paper written in 2022, “Don’t Forget the Golden Rule: Whoever Has the Gold Makes the Rules” —

https://www.gata.org/sites/

— The British businessman and gold mining entrepreneur Peter Hambro called attention to the stunning increase of gold derivatives in the U.S. banking system and the use of those derivatives — “paper gold” — to suppress monetary metals prices and thus protect government currencies against competition.

Hambro wrote:

“Central banks have followed the Bank for International Settlements’ instruction to hide the perception of inflation by rigging the gold market. Of course, they cannot be seen to do this, and they need cover. The only way to achieve the cover is by smashing the price of physical gold by the alchemical production of ‘paper gold.’

“With the help of the futures markets and the connivance of the alchemists, the bullion traders — yes, that includes me, as I was deputy managing director of Mocatta & Goldsmid — managed to create an unshakeable perception that ounces of gold credited to an account with a bank or bullion dealer were the same as the real thing. ‘And much easier, old chap! You don’t have to store or insure it.’

“Once investors swallowed this stupefying pill, it was easy to sell them gold that simply didn’t exist.”

For years, the documentation of Western gold price suppression policy and its purposes has been repeatedly supplied to the Financial Times and other mainstream financial news organizations. The most important documents are summarized here:

https://www.gata.org/node/

They show that gold always has been and remains the secret knowledge of the world financial system.

Once upon a time, the job of journalism was to bust secrets open when the world was being deceived and exploited.

Today, the Financial Times and its colleagues in journalism seem intent on keeping gold mysterious lest certain governments and financial interests — many of them advertisers — be offended.

Read the full article here

Leave a Reply