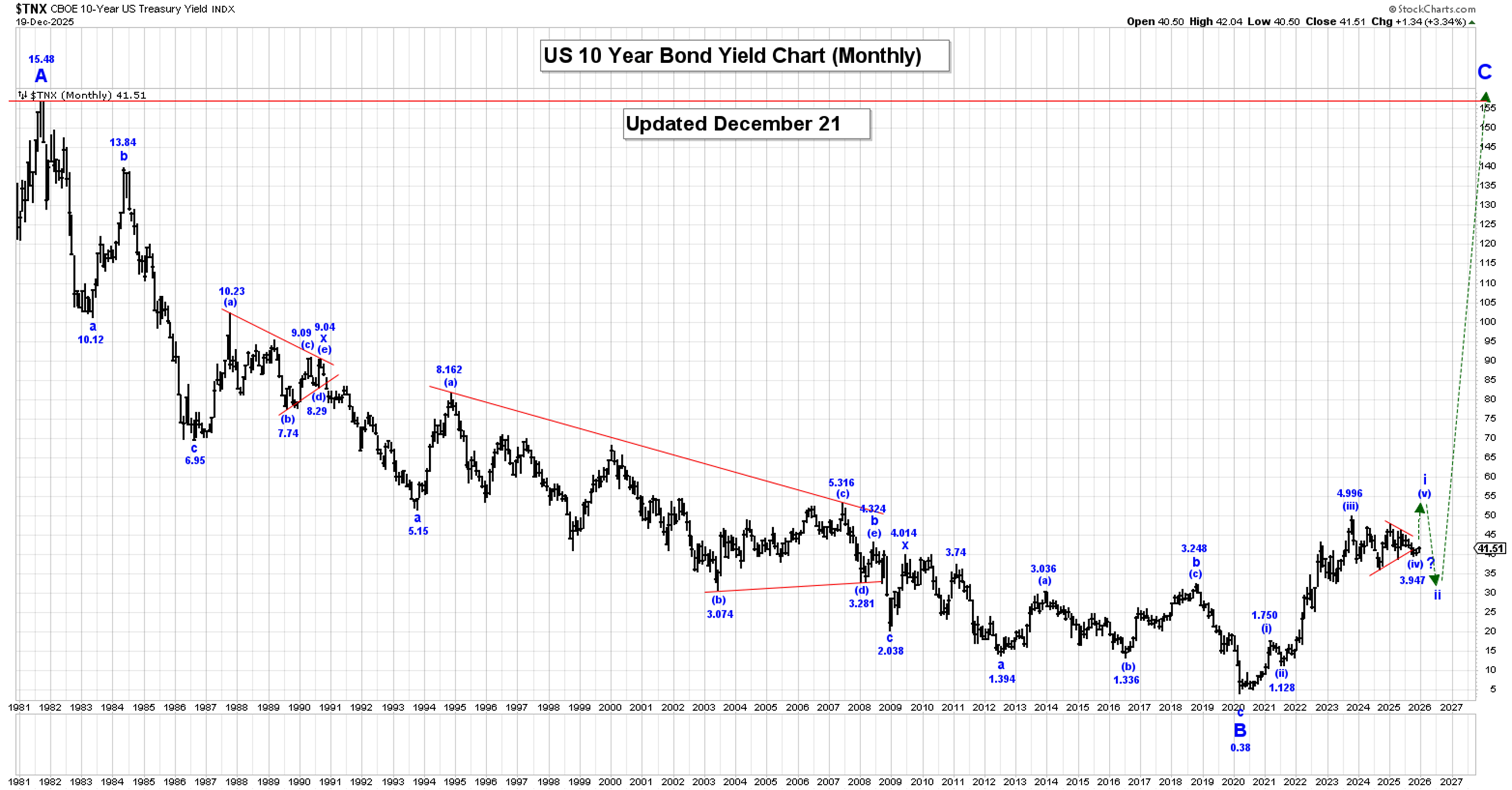

Ten-Year Rates:

The Captain’s monthly US 10-year rates chart.

The short-term chart.

The short-term chart.

Analysis:

Within a multi-year wave C, we are rallying in wave i, which is now still underway.

Within wave i, we completed wave (i) at 1.266%, wave (ii) at 0.504%, wave (iii) at 4.997% and our large wave (iv) bullish triangle at the 3.947% low.

We are starting to thrust higher in wave (v) to complete all of wave i and therefore expect higher yields in the days and weeks ahead.

After wave i ends, we expect a wave ii, a correction that retraces between 50 to 61.8% of the entire wave i rally.

On our Long-Term Monthly Chart, all of wave A ended at the 15.83 high in 1981, and since that high was made, we have fallen in a triple 3 wave correction within wave B that ended at the 0.38% level.

We have started to rally higher in a multi-year wave C rally that will eventually see rates reach at least the 15.83 high again.

Active Positions: Long, risking to 3.880%!

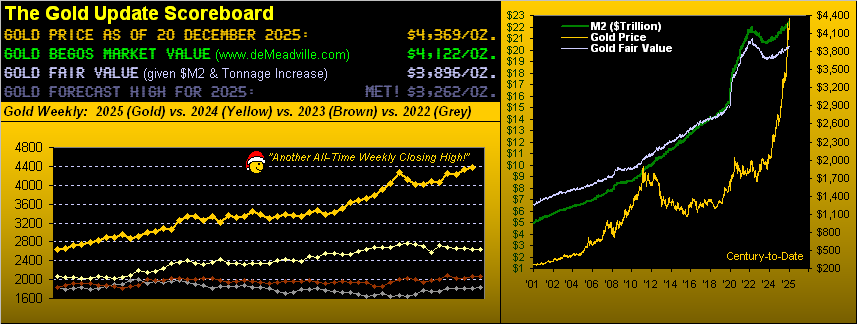

Gold:

The Captain’s daily gold chart.

The Captain’s daily gold chart.

Analysis:

We exited all long positions for gold, silver, and our miners near the $4380 area highs. We entered these positions in late 2015.

It’s not a top call. Our profits were so large that we had to book them… and we plan to re-enter the market at the end of “little wave b” with our biggest positions yet!

Our current long-term gold count, starting from the 35.20 low made back in 1971, which remains incomplete, is as follows:

1 = 1920.80.

2 = 1046.20.

3:

i = 2073.40.

ii = 1614.40.

iii:

(i) = 2073.30.

(ii) = 1810.10.

(iii):

-i- = 2790.40.

-ii- = 2539.90.

-iii- = 3500.30.

-iv- = 3280.60.

-v- = 4381.40, to complete all of wave (iii).

We are falling in a multi-month wave (iv) correction that has the following retracement levels:

23.6% = 3774.60.

38.2% = 3399.20.

Within wave (iv) we completed wave -a- at the 3886.50 low and it now looks like wave -b- is still underway, although it could now be complete at the 4374.40 high. After wave -b- ends we expect another drop in wave -c-.

For the time being, we are assuming that wave (iv) is becoming a bullish triangle, and therefore wave -c- cannot fall below the wave -a- low of 3886.05.

The other option is that wave -b- is going to become more complex, and in this case, wave (iv) could still become a flat or irregular type correction, where in the latter formation, gold will make another all-time high in wave -b-, before it falls again into our suggested retracement zone.

We still expect that wave (iv) is going to take many more months to develop.

A projection for the end of wave iii is:

iii = 4.236i = 5965.60.

Projections for the end of wave 3 are:

3 = 2.618(1) = 5936.00.

3 = 4.236(1) = 9033.60.

Active Positions: Flat!

CDNX:

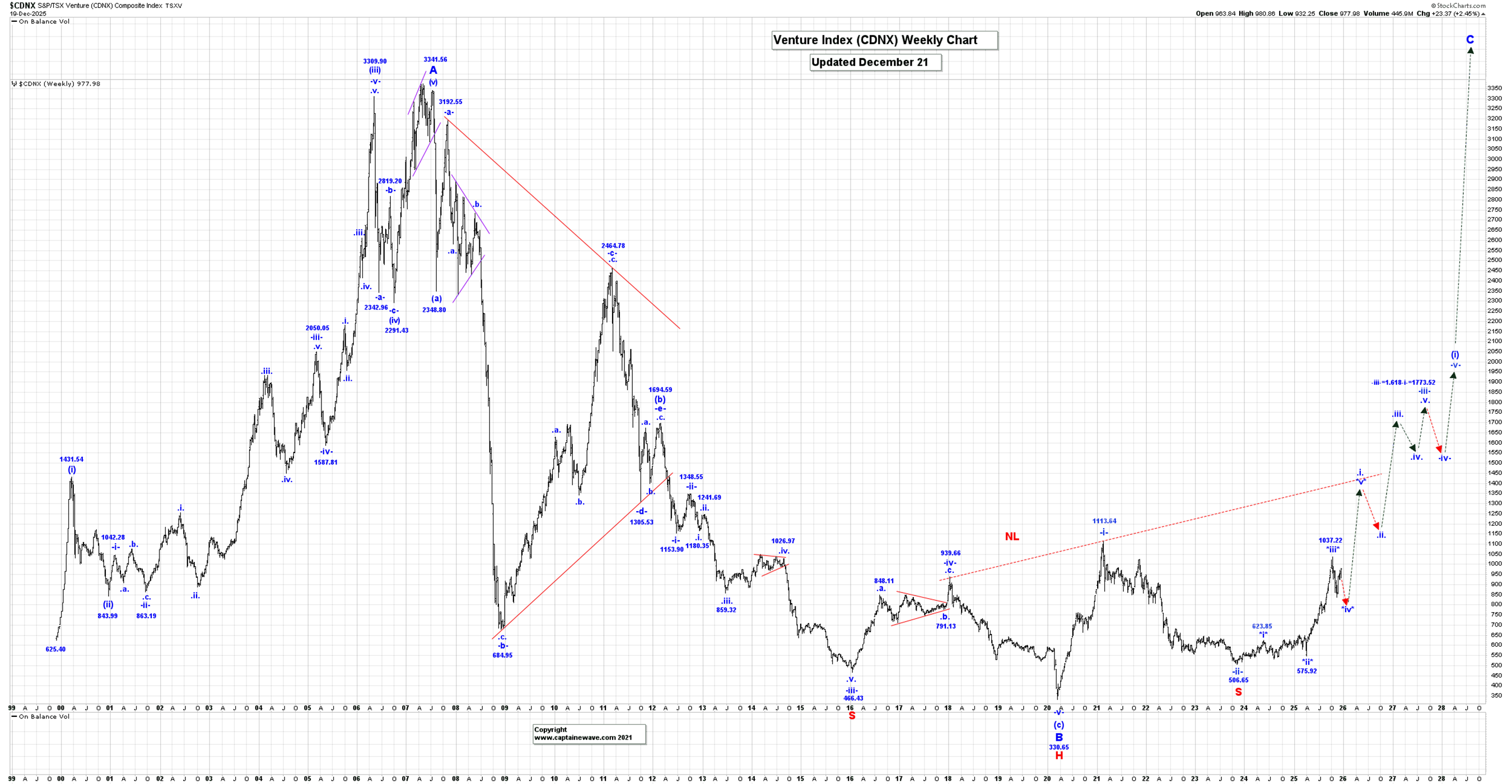

The Captain’s weekly CDNX chart.

The Captain’s weekly CDNX chart.

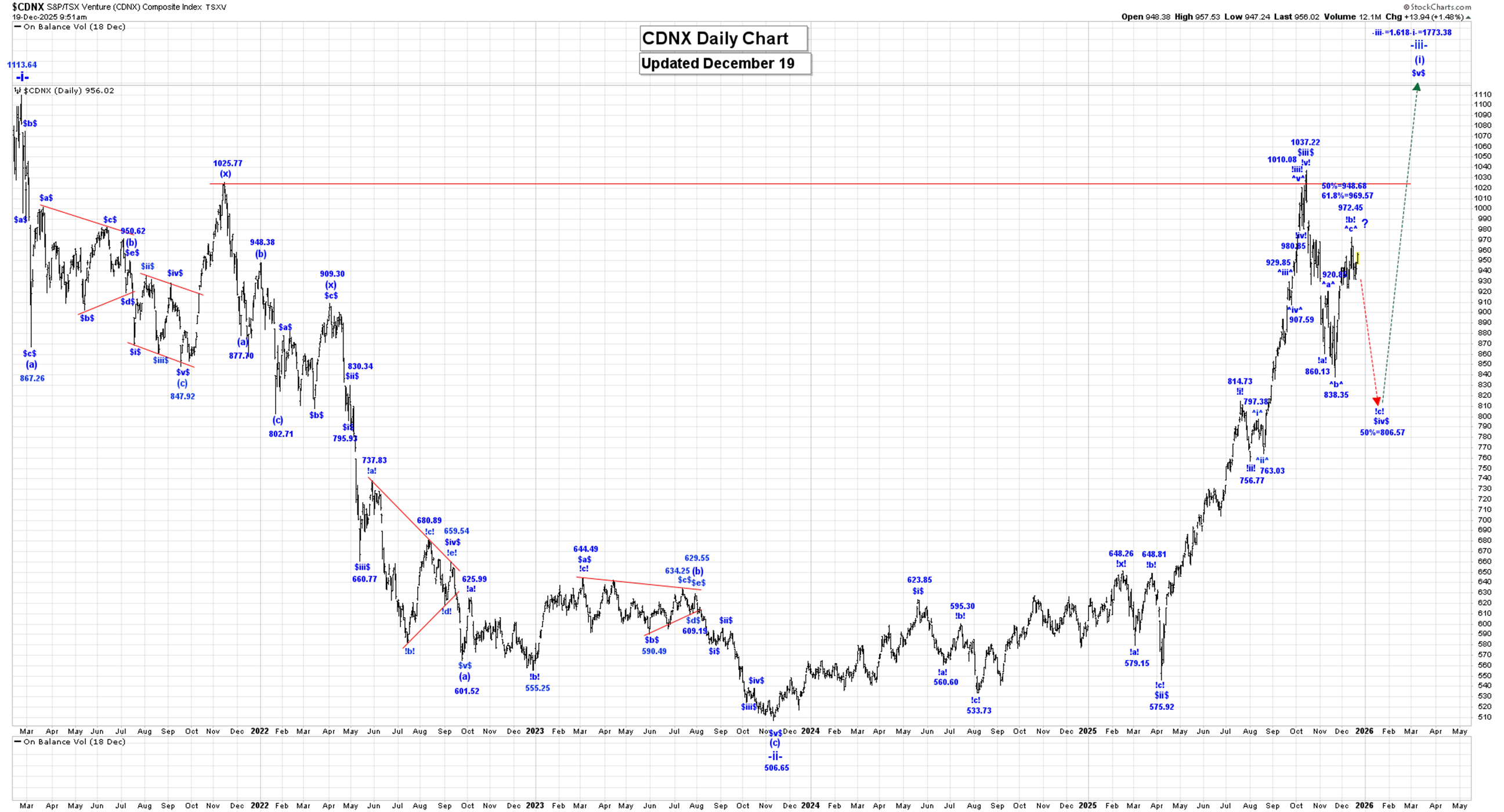

The daily chart.

The daily chart.

Analysis:

Our long wave -ii- correction, which is a triple three wave pattern, is complete at the 506.65 low. We are rallying in wave -iii-, which has an initial projected endpoint of:

-iii- = 1.618-i- = 1773.38.

Within wave -iii-, we are now rallying in wave (i) and within wave (i), we have updated our count to suggest that all of wave $iii$ ended at the 1037.32 high and that we are now falling in wave $iv$, which has a retracement level of:

50% = 806.57.

We have updated the internal wave structure of wave $iv$ as shown on our daily CDNX Chart. It suggests that within wave $iv$ we completed wave !a! at 860.13 and we are still rallying in wave !b!, which has the following retracement levels:

50% = 948.68.

61.8% = 969.57.

We have now reached our 61.8% retracement level, so we need to be on guard for the completion of wave !b!, perhaps at the 972.45 high, and the start of another drop in wave !c!…

Which should at least reach the 838.35 low, but more likely our 50% retracement level of 806.57, before all of wave $iv$ ends.

Active Positions: Flat!

Thank-you!

Read the full article here

Leave a Reply