Investors have to manage their emotions and deal with surprises in order to succeed. This is particularly true for bullion investors, who can expect more than their share of volatility and unexpected price action.

Gold and silver don’t enjoy genuine support on Wall Street or in Washington, DC. And the metals have few friends among the central planners at the Federal Reserve or other central banks in the Western World.

Gold and silver are not favored assets, unlike real estate, Treasuries, or U.S. equities.

Regulators have turned a blind eye or have given a slap on the wrist to banks caught red-handed rigging prices. People betting on higher prices have been punished, including the Hunt brothers, who were brutalized by a COMEX move to limit investors to sell orders only.

In fact, the system for price discovery in U.S. futures markets may have been “purpose-built” to discourage broad ownership of physical gold and silver.

The following is a quote from a memo sent from the U.S. Embassy in London to the Treasury Department in 1974. It outlines what was expected to happen following the creation of a futures market for gold.

EACH OF THE DEALERS EXPRESSED THE BELIEF THAT THE FUTURES MARKET WOULD BE OF SIGNIFICANT PROPORTION AND PHYSICAL TRADING WOULD BE MINUSCULE BY COMPARISON. ALSO EXPRESSED WAS THE EXPECTATION THAT LARGE VOLUME FUTURES DEALING WOULD CREATE A HIGHLY VOLATILE MARKET.

IN TURN, THE VOLATILE PRICE MOVEMENTS WOULD DIMINISH THE INITIAL DEMAND FOR PHYSICAL HOLDING AND MOST LIKELY NEGATE LONG-TERM HOARDING BY U.S. CITIZENS.

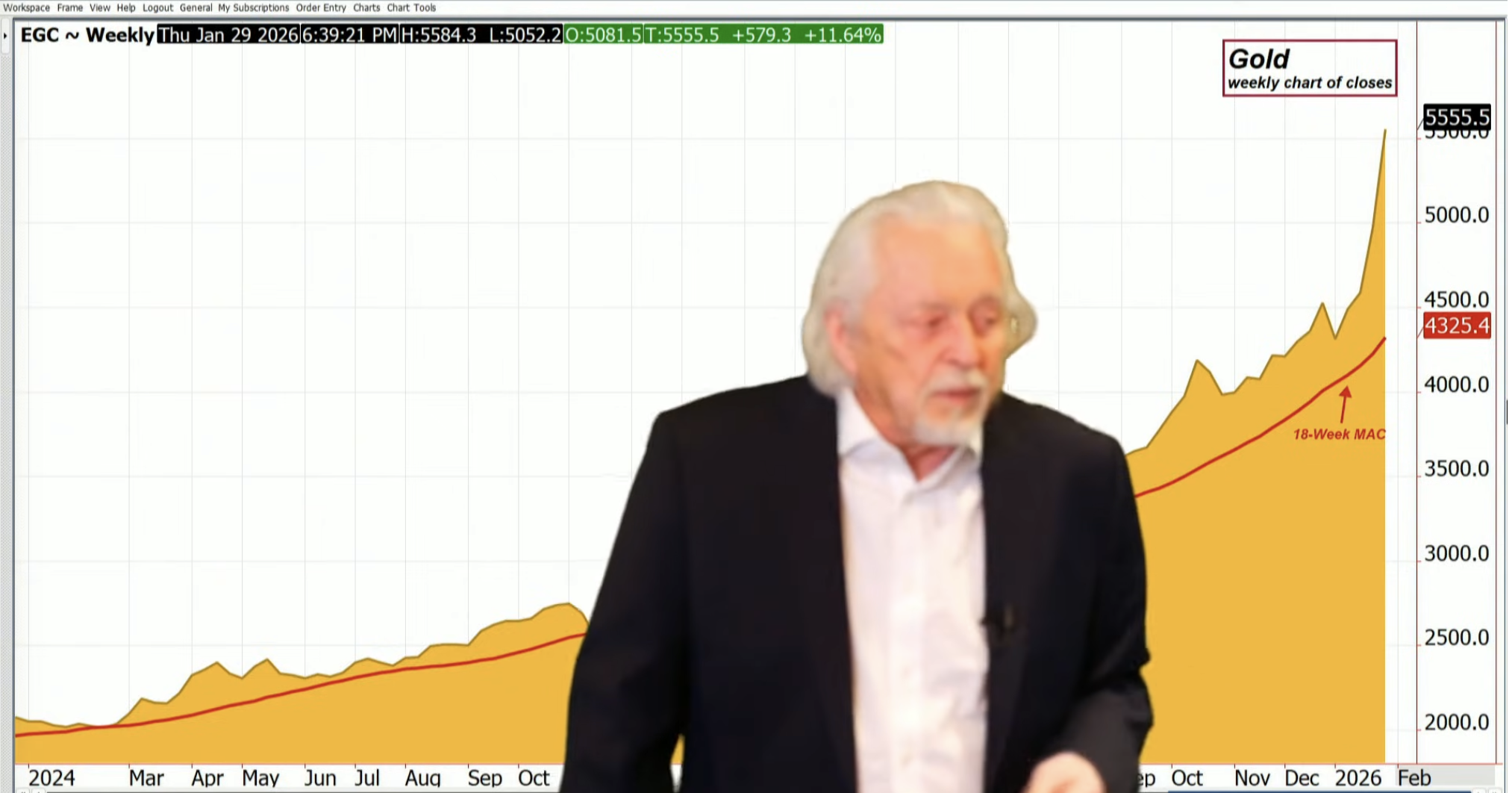

Coming back to the present, it’s fair to question whether or not precious metals have put in a top, at least for the short term. But before deciding whether now is the right time to sell, investors should consider a few things.

Avoiding volatility might be hard to do. There was a time in America when putting cash in the bank or buying Treasuries was a relatively safe option. Today, even those options carry more risk than many people realize.

The Federal Reserve Note “dollar” has fallen precipitously in terms of purchasing power over the past five years. Official inflation data indicates the dollar buys about 20% less. The real decline, according to www.shadowstats.com, is closer to double that.

And recent years have been among the most volatile ever in the Treasury markets. The U.S. government has been flooding the market with trillions of dollars worth of new bonds each year.

Unless Congress does something unprecedented, that is going to continue – and probably even accelerate.

The best reason to sell metal is that you have identified another asset you expect will outperform gold and silver. In other words, investors should ask themselves what has changed since they made the decision to buy metal in the first place.

Are you more optimistic about where the U.S. dollar is headed?

Does real estate look cheap? Are the valuations on stocks more reasonable now?

Does it make sense to buy fixed-rate, dollar-denominated Treasury bonds even though they are backed by the most profligate government in the history of the world?

There has been a run-up in metals prices. Does that mean they are now expensive relative to the alternatives?

We don’t think so. In our view, the real bubbles aren’t in gold and silver. Investors can find those somewhere else. However, whether you are buying OR selling, Money Metals is here to help you facilitate that.

Read the full article here

Leave a Reply