Excerpted from the November 2nd edition of Notes From the Rabbit Hole (NFTRH 887):

As noted this past week, I am hearing all too much talk about a market crash to feel comfortable in a bearish view beyond the very short-term. Yes, the national debt (along with debts around the globe) is increasing with no end in sight. YouTube’s algo keeps feeding my TV video interviews of deep market thinkers talking about the coming crash. CNN even talked crash with 1929 author Andrew Sorkin. Ooh, scary!

It was October, after all, the most overrated, supposedly bearish month of the year. Well, nothing is foolproof, least of all market seasonals, but we are now in November, the traditional beginning of the supposedly bullish period that ends with “go away in May.”

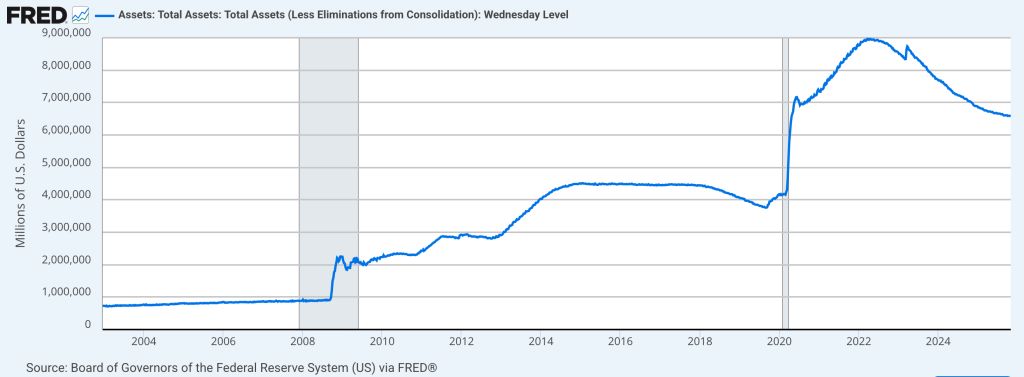

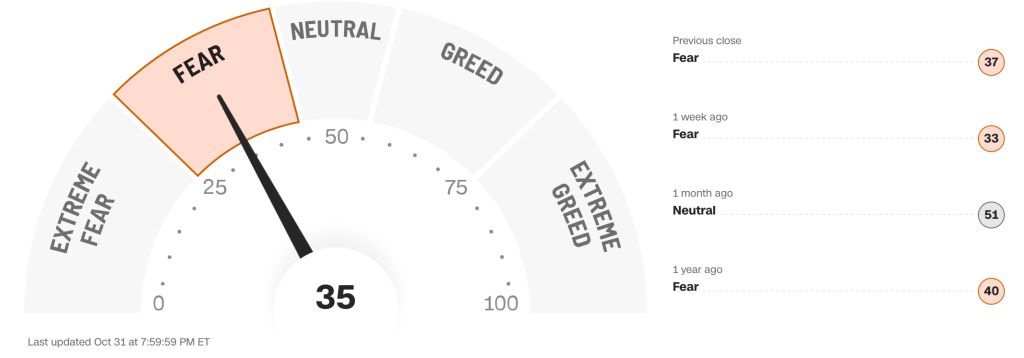

The October crash talk is a “tell” that a crash is probably not imminent. Here is another. While I take issue with minor elements of CNN’s interpretation of the Fear/Greed index, you just don’t tend to get market crashes from all-time highs with sentiment readings like this. Market crashes tend to occur after enough bearish activity has already happened to drive mass sentiment to fearful.

CNN Fear/Greed Index (cnn.com)

Another “tell” is that the Fed, that enemy of gold and honest money/monetary systems so clearly on display after 2011 (see again last week’s report, NFTRH 886, for a look down that Operation Twist-instigated rabbit hole), is getting up to some of its old tricks. Sure, they dropped the funds rate again last week and Powell is talking a little bit tough about the potential of no cut in December. A lump of coal for investors?

The Fed of Oz

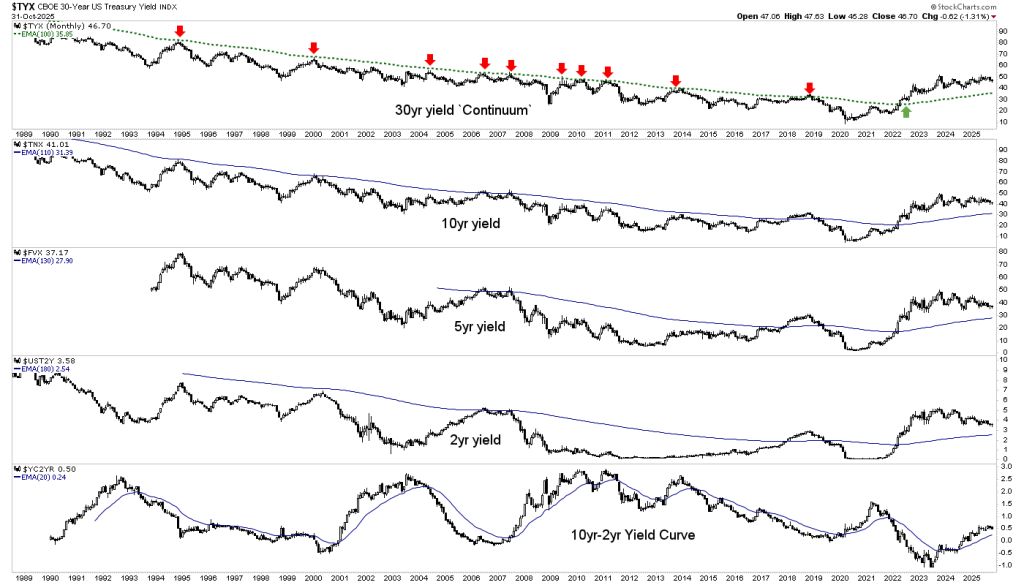

Not really. Out the back door the Fed has ceased its Quantitative Tightening (QT, which has driven the Fed’s balance sheet holdings downward since 2022) and will now either embark on a market pleasing expansion of its balance sheet through forward QE or at least stop it from declining (depending on what they do with other bonds, like MBS, as they bring more Treasury bonds onto the balance sheet).

The Fed will be going back into the bond market and liquefying the system by buying Treasury bonds. You can bet their aim is to do what they always eventually get back to, which is inflate a system that runs on inflation with a side benefit of helping the government not look like quite the chronic fiscal inflator that it is. In other words, monetizing this debt is how they will allow the government to at least partially inflate away its debt.

Fed Balance Sheet (St. Louis Fed)

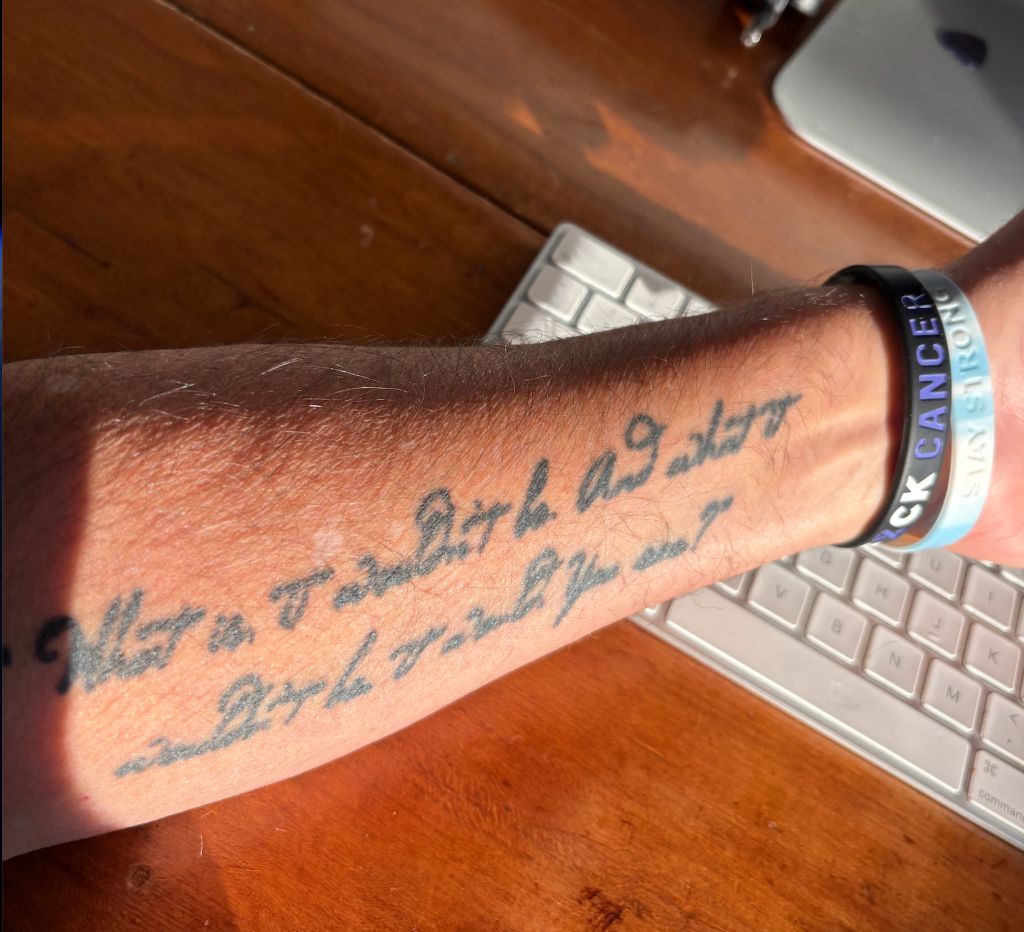

The Fed claims that it fights inflation, even as it is inflation’s creator. From Alice (by way of my left arm):

“And contrary wise, what is, it wouldn’t be. And what it wouldn’t be, it would. You see?”

There is a reason that this quote is tattooed on my arm (to go with lovely images of Alice, the Red Queen and Rabbit on my right arm). The Wizard, pictured above, is going to pull his levers and blow his smoke to whatever degree necessary to try to keep the bubble* going.

Of course, the macro changed in 2022. My theory has been that these manipulations will not work quite so efficiently as they did in past, due to the rebellion by the bond market, which punched yields up above our long-term trend marker, a big picture inflationary signal.

But in the interim, as we projected, yields have been bending downward even before the Fed’s termination of QT. Perhaps it was the bond market’s anticipation of that well telegraphed termination, as opposed to gathering disinflationary market signals. Here we consider the possibility that the disinflation we anticipated might be on its last legs.

Perhaps the bond market is anticipating that the Fed will try to create a disinflationary macro picture to bring she who shall not be mentioned in the Gold Bug-O-Sphere, but will be mentioned here, Goldilocks, to the fore. In my opinion, from here any further disinflation story that may get a “Goldilocks” interpretation will be an ill-fated and short-lived thing.

Perhaps the bond market is anticipating that the Fed will try to create a disinflationary macro picture to bring she who shall not be mentioned in the Gold Bug-O-Sphere, but will be mentioned here, Goldilocks, to the fore. In my opinion, from here any further disinflation story that may get a “Goldilocks” interpretation will be an ill-fated and short-lived thing.

This is not the post-2011 phase by any means because the structure of the bond market is completely different with the Continuum’s upward trend change in yields.

Goldilocks

We have managed to squeeze three childrens’ stories into one segment and that is appropriate. We are, and for decades have been down a rabbit hole of incredible possibilities as the Wizard pulls his levers with the intended result being a macro manipulated (e.g. Ben Bernanke’s epic hit job, the 2011 inflation “sanitizing” Operation Twist) to be not too hot and not too cold, but instead “just right” for Goldilocks’ consumption, with respect to inflation.

I do believe a strong “tell” on such a phase (fleeting though it may be) would be a temporary flattening of the 10yr-2yr yield curve. Again, please reference NFTRH 886, linked above, for more details on why this could be important bond market signaling for gold, silver and commodities on the one hand, and risk-on speculative markets on the other. We’re talking short-term stuff here.

Also, see the segment below this one for an alternate view showing that while I may turn out to be right about a flattening and then once again steepening yield curve, the internal bond market dynamics and deflation/inflation view may be in transition sooner than previously expected.

As yet, the curve is only slithering sideways. I’ve noted the area below which to really start thinking “flattener”. By extension, if we see “flattener”, we also see “Goldilocks” potential, in the interim. If the curve holds here and resumes steepening then forget Goldilocks and prepare for market liquidity problem or a hell of an inflationary situation. Again, we’ll add more context in the next segment.

And we are still talking “interim” here. But if the market is going against you, “interim” is not going to feel so temporary while it is inflicting damage (inflationary or deflationary steepening) that participants are on the wrong side of. Going the other way, it may feel like permanence to many, if it is injecting joy and euphoria (Goldilocks flattening).

* A reminder that in my view, the real bubble is not the stock market, AI or other manifestations. The real bubble is in decades of unfettered monetary policy designed to inflate the system by non-free market means through bond market manipulation, to keep asset prices, and ultimately debt, rising at all costs (and it will cost)

Read the full article here

Leave a Reply