In an interview last week, the U.S. Secretary of the Treasury made an odd statement that was simultaneously ignored and discarded. We caught it, though, and you should again be made aware of what it foreshadows.

And what was that odd statement from Secretary Bessent?

As you undoubtedly know, the U.S. dollar has not been connected to the gold price since 1971, and the U.S. currently carries its 8,133 metric tonnes of gold at $42.22 per ounce. As such, how in the heck does a rising gold price “help the U.S. substantially”? Why does it even matter? And in this context, it’s a very odd thing for the sitting U.S. Secretary of the Treasury to say.

- However, what if we changed the context?

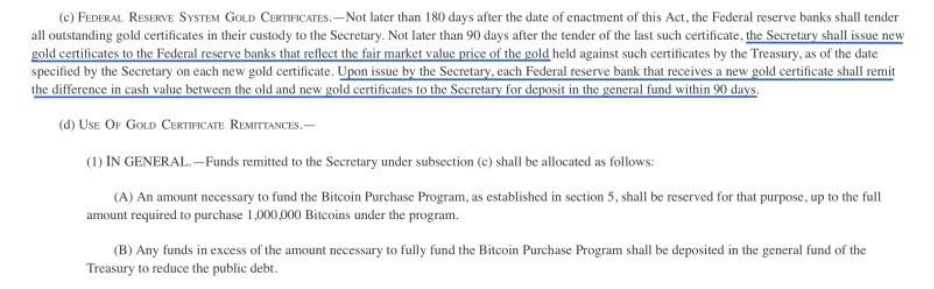

- What if, instead, the U.S. is planning to revalue its gold reserves in order to create a “deficit-neutral” funding vehicle for its planned Bitcoin Reserve?

- What if the U.S. Congress were considering a new bill to codify a gold revaluation as part of a Bitcoin and Sovereign Wealth Fund?

- What if the U.S. Federal Reserve were already studying the impact of an official gold price revaluation?

Under those conditions, the seemingly odd, throwaway comment by Secretary Bessent makes a lot of sense. The higher the gold price, the more “deficit-neutral” funding cash becomes available. Again, here’s the process. It’s plainly written into both bills that are currently before Congress:

Gold Price Analysis

As I write today, it has become quite clear that the gold price has once again begun another consolidation phase. When the price broke out of its most recent consolidation in late August, the target for the next surge was +20% or about $4200. It exceeded that forecast by nearly $200 and is now down nearly 10% from its high, which is also consistent with the long-term pattern. See below.

Gold – Weekly Nearest Candlestick Chart

The gold price will now consolidate its gains again, possibly through year-end and into early 2026. However, as you can see above, the next rally phase will take the price up another 20% and through $5000/ounce. This will occur in 2026 as the U.S. considers “revaluing its gold reserves” and “monetizing the asset side of its balance sheet”. And the gold market has not even begun to consider the impact of Yield Curve Control yet!

Why was Bessent smiling and looking like the proverbial cat that swallowed the canary last week as he discussed the gold price? Now you know.

Read the full article here

Leave a Reply