What do the biggest banks, the most prominent news outlets, and advanced AI models have in common? They were all wrong about the 2025 gold price by over $1000. While there is always a lot of uncertainty in the financial markets, being off by over $1000(over 30% of gold’s 2024 year-end price), is embarrassing. While it wouldn’t be uncommon for predictions to be wrong, it is interesting but not surprising that all of the predictions were wrong in the same direction, to the same extent. For as widely traded an asset as gold, particularly with how closely it is linked to large macroeconomic trends, there must be a fundamental misunderstanding for everyone to be wrong in the same way. Some theoretical bias must underlie such a predictably wrong group of predictions. While there is always randomness in financial markets, the systemic under-prediction of gold’s price comes from a failure to account for the inherent flaws of fiat money and the American institutional decline of the past few decades.

If you go back to December 2024 and January 2025, almost all gold price predictions for end of year 2025 will be around the $3000 mark or lower. At the time $3000 was seen as a bullish prediction. 4000 was thought to be possible in the next few years, but reaching it as early as early October 2025 was almost unthinkable. Most of the same fundamental factors that drove gold to its current high price were already there, but the instability of Trump’s trade policy may not have been fully accounted for. However, the Fed has not changed significantly, and Trump’s fiscal liberties had already been evidenced in the past. The decline of the dollar and the move to gold by national banks was a strong trend that was only accelerated by the Trump presidency. Such predictable long-term trends being exacerbated were not factored into gold price because a far too stable view of the status quo and two deadly assumptions blinded people to the future march of gold. Only people who grew out of these inherited assumptions could actually predict gold’s trajectory.

The first unspoken assumption of all of these institutions and media sources is the idea that fiat money is the most effective and only conceivable way that the modern world can exchange goods and services. The public dialogue about the merit of fiat money is closed except for a few critical thinkers who are able to step outside and view the world from a more historical perspective. Its many issues are defended because they cannot even conceptualize a different system. The Dollar itself is always painted as the victim of mismanagement or macroeconomic instability rather than an artificial tool of government control. While people in general believe that the central bank can make mistakes, they accept it because they cannot advocate for an alternative. They aren’t able to reevaluate their beliefs because without an Austrian framework, they assume that government control is the only means of ordering human action. The fact that fiat currency is an unsustainable and temporary invention must first be challenged before they could possibly understand the recent price rise of gold.

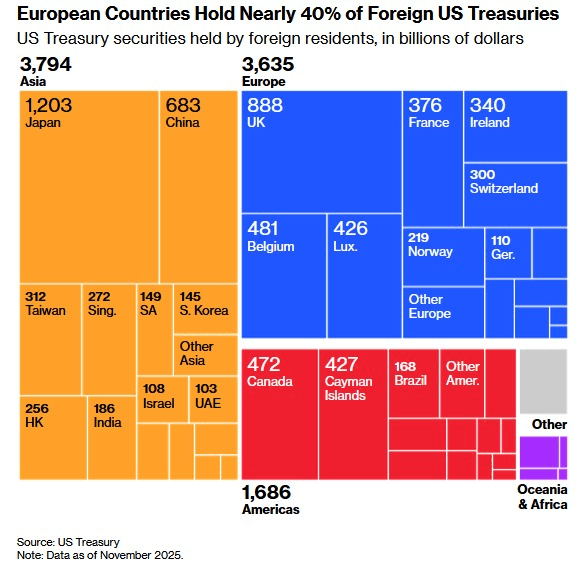

Secondly, these various predictors of gold price all fail to understand the dire state of the US, particularly in the 21st-century. Bureaucracy and the growth of discretion based governance have taken power away from where it can be controlled or understood. More decisions now are made in unaccountable and invisible rooms than ever before. Congress has had its authority whittled away by the presidency continually. Gold is a vote of confidence against the US government, and those who understand its institutional issues can see why gold is performing far above mainstream expectations. All the predictions were made in a theoretical world that did not fully account for the broken trust of the American people and the growing wariness towards the US of almost every other country. Citizens and foreign central banks are no longer confident in the dollar and see America as a place of upside rather than stability. American equities are still performing well, as the economy is still one of the freest in the world, but the unstable management of the central bank is continuing to drive foreign hedging with dollars down. The great loss of trust in America was already occurring, but the nose dive of the Biden and Trump administrations must be accounted for before any accurate assessments of Gold can be made. Predictions made using a model of a stable institutional environment will not hold. Gold is merely a shining symbol of the great replacement of trust in the US with trust in anything else.

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Read the full article here

Leave a Reply