Electronic Platforms Will Transfer Bullion-Backed Tokens

The future of gold and silver transactions in the United States likely will be defined by states implementing new and amended legal tender laws.

Financial officials and regulators in Arkansas, Florida, Missouri and Texas are finalizing rules and instituting electronic payment systems for digital and tokenized precious metals.

Sound money advocates have paid particular attention to Florida’s new legal tender law, both praising it as a model for other states and maligning its regulatory provisions.

Earlier this year, Florida lawmakers removed sales and use taxes on gold and silver, including bullion coins that qualify as legal tender, while imposing new regulations on precious metal businesses and custodians in the state to protect consumers, reduce financial fraud and deter money-laundering.

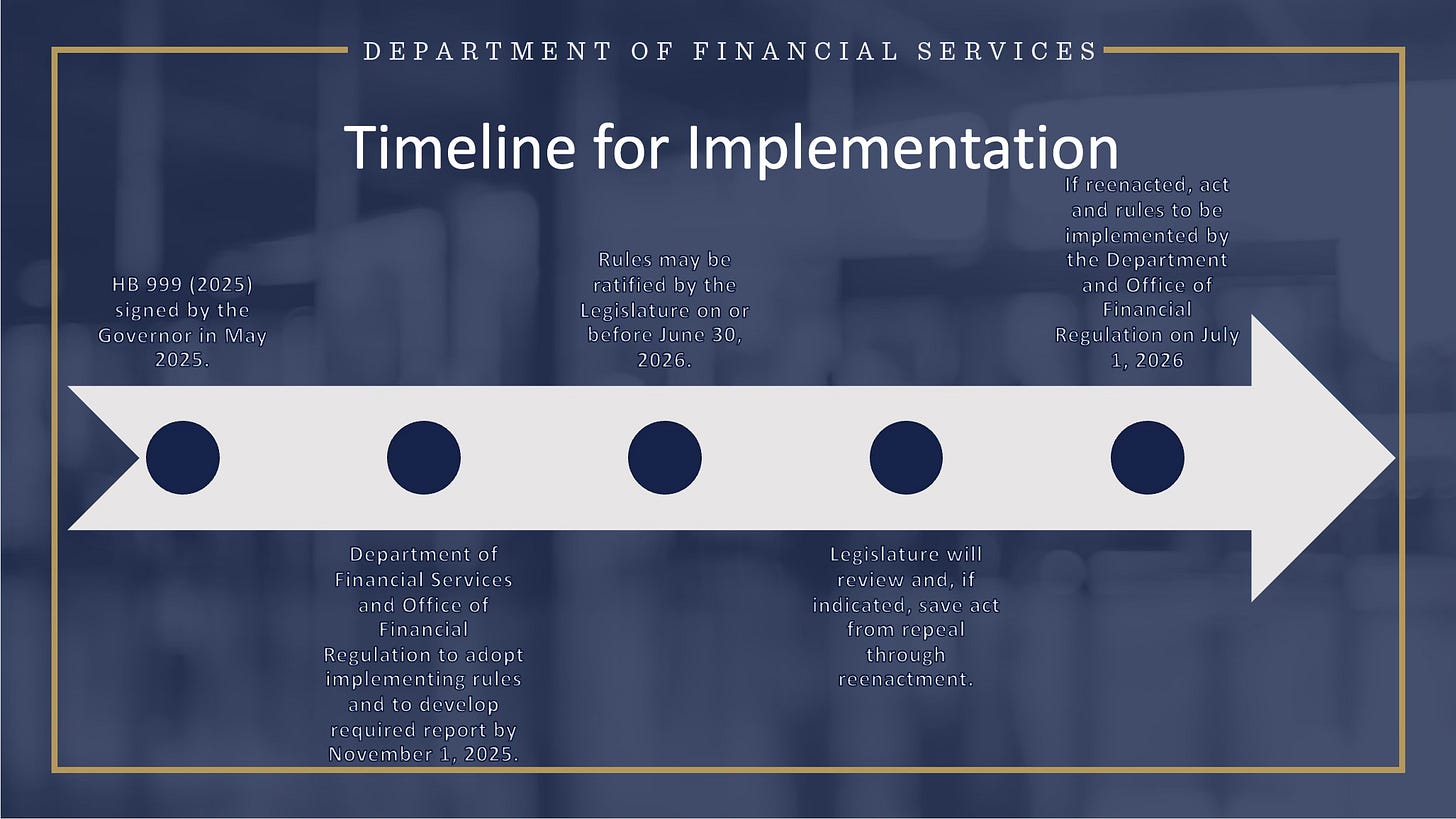

State regulators are finalizing rules to implement Florida’s legal tender law, which Gov. Ron DeSantis signed on May 27. Rulemaking is scheduled for competition Nov. 1. If state legislators ratify the rules, the law will take effect July 1, 2026.

Conflicting Views on Regulatory Framework

While agreeing gold and silver should be restored as legal tender, sound money proponents are at odds about the best way to accomplish that nationwide. They’ve expressed conflicting views about the Florida law and its regulatory framework.

“It was exciting to be part of the process to help get this legislation passed,” said Daniel Diaz, executive director of Citizens for Sound Money (C4SM), in May. “It was a team effort to bring sound money legislation and economic freedom to the state of Florida.”

C4SM campaigned and lobbied for Florida’s legal tender law for two years. The Concord, N.H.-based organization believes the measure is pivotal to advancing tokenization of gold and silver for electronic transactions, and expanding the sound money movement.

Working with Florida legislators and regulators, C4SM helped draft the bill and developed a system that allows Kinesis, Glint and other electronic, asset-based companies to register as precious metal custodians and money services companies in Florida so they can store and complete digital transactions in gold and silver. Kinesis is one of C4SM’s partners and sponsors.

The sound money advocacy group also assisted with regulatory guidelines to provide consumer protections against fraudsters, fake bullion and other precious metal scams, Diaz added.

“The law is not perfect, but it’s a step in the right direction,” said C4SM Chairman Rhyno Coetsee, conceding the legislation will require minor changes related to precious metal custodians and bullion bars with serial numbers.

Diaz said the major accomplishment of the law was inclusion of asset-based digital currencies (ABDCs). C4SM views asset-based digital currencies (ABDCs) as the future of finance, with legal tender laws in Florida and Missouri serving as a model for other states to follow.

ABDCs “combine the stability of gold, silver and other precious metals with the flexibility and convenience of digital currencies,” reads a statement on the C4SM website. “Each token of a commodity-backed cryptocurrency corresponds to a real unit of physical precious metal, usually stored by banks or third-party custodians.”

Critics Support Repeal of the Florida Law

The Sound Money Defense League (SMDL) has criticized Florida’s law as a “debacle.” League officials believe the legislation imposes burdensome regulations on precious metals-related businesses, opens the door to financial surveillance and should be repealed.

“This bill that passed in Florida is a disaster,” said SMDL Executive Director Jp Cortez during a July podcast interview with VRIC Media. “This is the most catastrophic thing I’ve ever seen enacted by a state.”

Cortez denounced the law’s regulatory conditions and provisions. “This creates an entirely new regulatory structure that brings everyone in the gold and silver business, the storage business or any related industry under the money services transmitters laws that creates whole new regulation and reporting requirements,” he added. “This is a net negative for sound money.”

The Charlotte, N.C.-based SMDL believes the focus should be on eliminating state taxes and regulations on gold and silver, not imposing a new set of rules that discourage buying, selling, ownership and custodial storage of the monetary metals.

SMDL Chairman Stefan Gleason doubts most precious metal depositories want to be regulated like banks. As written, the Florida law could be counterproductive to restoring gold and silver as legal tender, he said.

“Layering on additional business regulations so frivolously and hastily seems out of character for the state of Florida,” wrote Gleason in a July 12 letter addressed to Catherine Austin Fitts of the Solari Report and Florida activist Saga Stevin.

Gleason, also president and CEO of Money Metals Exchange, an Eagle, Idaho-based precious metals dealer and depository, opposes “sweeping new requirements” on precious metal-related businesses already subject to state and federal regulations. He cited accreditation requirements that don’t presently exist and the difficulty of enforcing chain-of-custody provisions, which are designed to track ownership of bullion bars and coins, but invite intrusive government oversight.

He suggests Florida legislators repeal the law and start over from scratch, removing the accreditation and other regulatory requirements.

“We believe the priority should be removing taxes and then getting states to hold gold to protect the taxpayers and pension funds,” Gleason added.

Voluntary Acceptance of Constitutional Money

Contrary to the U.S. Constitution, which says “no state shall . . . make any Thing but gold and silver Coin a Tender in Payment of Debts,” the Florida statute and other state legal tender laws make acceptance of precious metals voluntary; no business or individual is required to recognize gold and silver as money or accept it as currency for payment of debts. States will continue to accept Federal Reserve Notes for taxes, fees and settlement of debts.

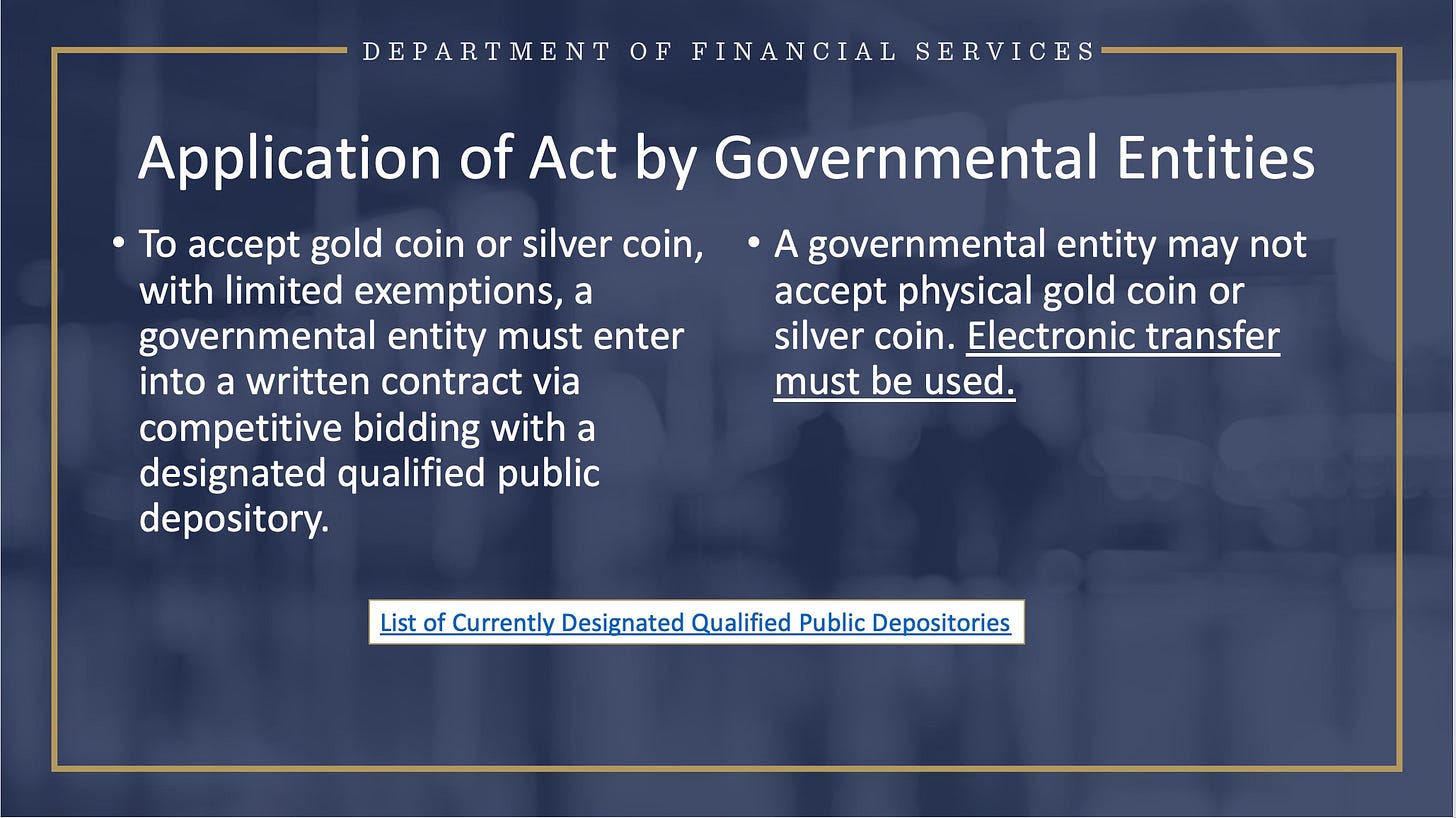

The Florida law also prohibits state agencies from accepting gold and silver in physical form; only electronic transfers of the monetary metals are permitted by governmental entities. Transactions must be made through designated and qualified public depositories, which act as financial intermediaries.

At present, banks and credit unions dominate the list of Florida-approved public depositories. Since monetary gold ownership was outlawed in 1933 and silver was demonetized in the 1960s, most American financial institutions have no experience handling gold and silver deposits or transactions, Gleason said.

Diaz expects private depositories will fill the void and provide electronic platforms to facilitate most digital gold and silver transactions.

Furthermore, not all gold and silver is considered legal tender under the Florida law. To qualify, gold and silver coins either must be designated as U.S. legal tender—such as American Gold Eagles, Gold Buffaloes and Silver Eagles—or meet purity standards of at least 99.5 percent for gold coins, bars and rounds, and 99.9 percent for the same silver items.

Bullion bars and rounds that bear serial numbers or imprinted designs, except the mint mark, weight and purity, do not qualify as legal tender in the current law. Because this disqualifies a multitude of precious metal products, C4SM will seek a legislative revision.

More States Developing Digital, Precious Metal Platforms

Other states with legal tender laws are at various stages of developing and deploying electronic platforms that allow businesses and residents to use digital gold and silver.

Arkansas, which has recognized gold and silver as legal tender since 2023, wants to make it easier for citizens and companies in the Natural State to transact in the monetary metals.

In April, Gov. Sarah Huckabee Sanders signed an amended law authorizing the state’s chief fiscal officer to contract with an accredited U.S. bullion depository to create “a precious metals-backed electronic system for vendors to do business within this state.”

In the Lone Star State, Gov. Greg Abbott signed a law in June that will allow Texans to spend precious metals stored in the state-run Texas Bullion Depository on routine purchases using debit cards and mobile apps. The law authorizes the state comptroller to establish an electronic system that converts gold and silver into U.S. dollars at the point of sale. The system be will be phased in beginning next September and is slated to be completely operational by May 1, 2027.

In July, Missouri Gov. Mike Kehoe signed the Constitutional Money Act, which makes gold and silver legal tender in both digital and physical form in the Show Me State. The law allows the precious metals to be exchanged in private and public transactions. The state Department of Revenue is charged with writing rules so the metals can be electronically transferred to pay public debts and fees. No deadline has been announced for launch of the digital payments portion of the law.

Meanwhile, Utah Gov. Spencer Cox in March vetoed a bill that would have authorized the state treasurer to seek competitive bids for creation of a precious metals-based electronic payments platform. He described the law as “operationally impracticable.”

“Additionally, I am concerned that a specific entity offered to fund the bill, which could jeopardize the required competitive process in the bill,” Cox wrote.

The proposed digital platform would have allowed state vendors and service providers to be paid in physical gold and silver—vaulted in the Beehive State—through a secure electronic system. Utah became the first state to reaffirm gold and silver as legal tender in 2011.

Regardless of how legal tender laws, electronic platforms and tokenized precious metals are viewed, the measures being advanced are certain to set a national precedent. They’ll likely be used as templates by other states seeking to restore constitutional money while pursuing technological transactions of gold and silver in the digital age.

© 2025 Stuart Englert. All rights reserved.

Englert is the author of “Rigged: Exposing the Largest Financial Fraud in History.”

Stuart Englert’s Substack is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Read the full article here

Leave a Reply