- “Backstop for Asset Owners”

- Wealth Effect and Addiction

- Looking Through Inflation

- Austin, Dallas, Houston, and Je Suis Charlie

No one wants to be a party pooper. It drives away friends and makes you generally unpopular. But if you are a monetary policymaker, ending the party before it gets too wild is quite literally your job.

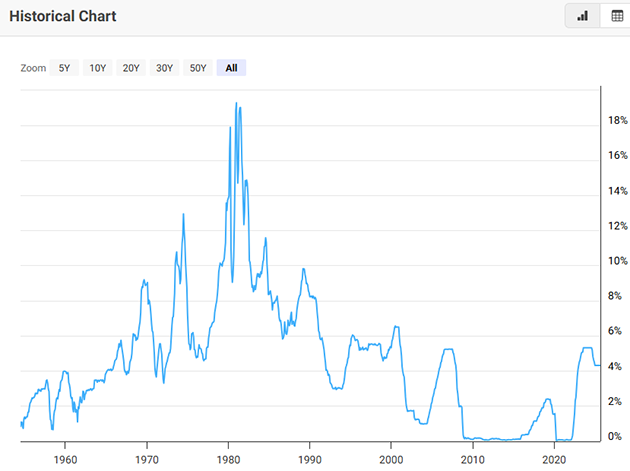

William McChesney Martin, Federal Reserve chair from 1951 to 1970, famously said the Fed’s role is to “take away the punchbowl just as the party gets going,” the metaphorical punchbowl being the low interest rates that enabled economic expansion.

Martin’s term during postwar boom times gave him plenty of party-ending practice. His willingness to do it annoyed Richard Nixon, leading to Martin’s replacement with the more economically flexible Arthur Burns. As I have written many times, he was simply abysmal and the forerunner of even more dovish Fed chairs to come.

That was 1970. An inflation party was already underway. It intensified but no one seemed able to stop it. Finally, Paul Volcker did more than take the punchbowl away; he threw it on the ground, kicked it to pieces, and shoved partygoers right out the door. Which, at the time, was exactly what the economy needed. For those of us who lived through those times, I can tell you it wasn’t pleasant, even if hindsight says it was necessary.

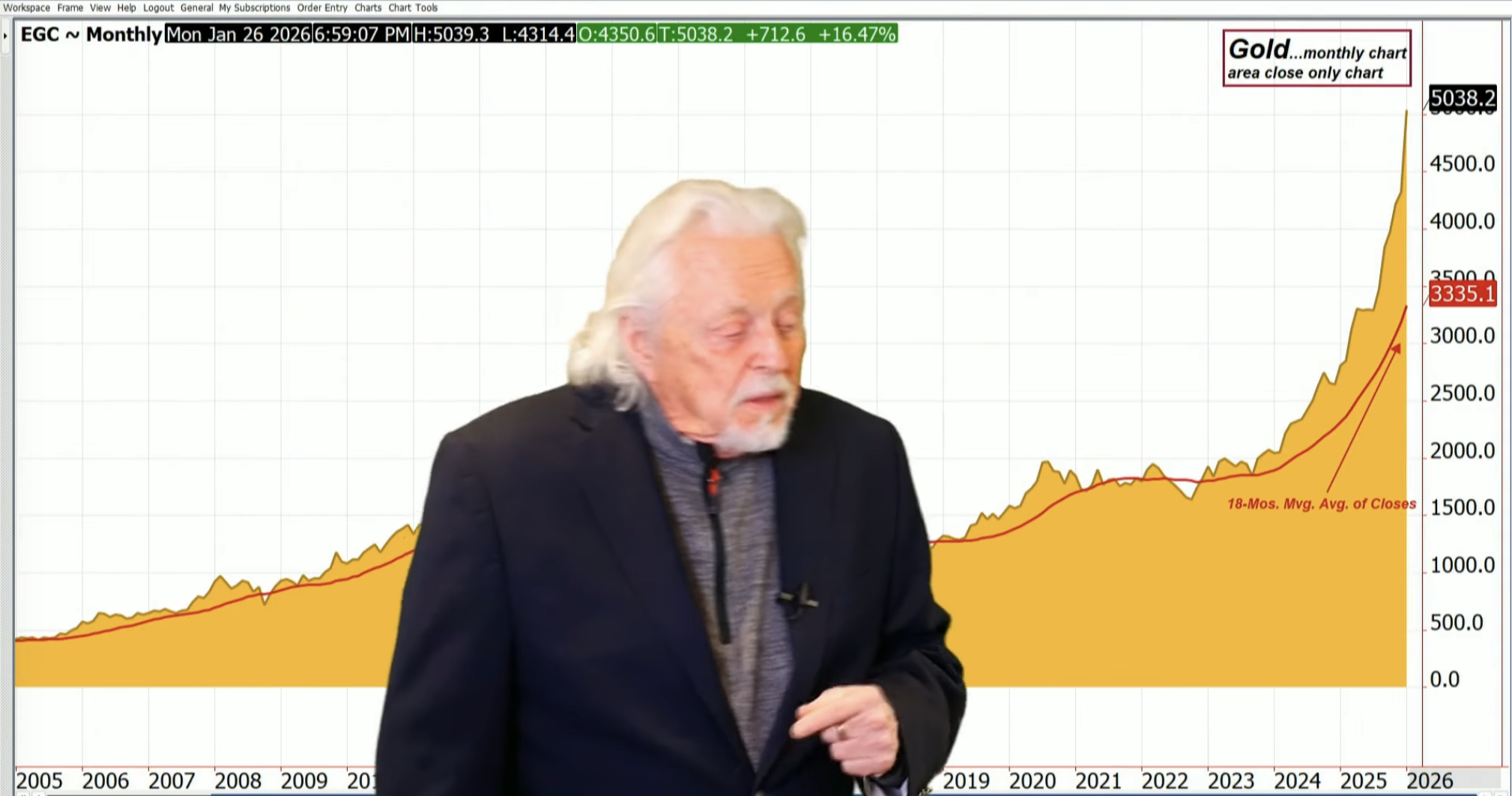

For the next four decades, Volcker’s legacy let his successors keep a lower-key party going. Inflation popped up a few times but was easily handled without such drastic measures. Or was it? I suspect, as we will discuss today, that inflation never really went away; it just changed form. “Innovative” monetary policies like QE raised asset prices while leaving consumer prices relatively (though not completely) stable.

Of course, we love it when rising asset prices vindicate our choices, and not just in stocks or homes. I know quite a few very happy gold bugs, including many of my readers! And I confess that $3,600+ gold doesn’t make me feel bad either. But I wish it was still $300 because that would mean the inflation we have seen in the last 24 years didn’t happen. That would be a great trade-off. Sigh.

That being said, with the Fed all but certain to cut rates next week, we need to talk about how we got here—and where the Fed’s shifting policies may take us.

“Backstop for Asset Owners”

The Fed’s failures came to mind last weekend when I read a Wall Street Journal commentary by Treasury Secretary Scott Bessent. While I disagree with Bessent on tariffs and protectionism plus some other subjects, I think he describes this problem exceptionally well. Quoting (emphasis mine):

“The Fed must change course. Its standard tool kit has become too complex to manage, with uncertain theoretical underpinnings. Simple and measurable tools, aimed at a narrow mandate, are the clearest way to deliver better outcomes and safeguard central bank independence over time.

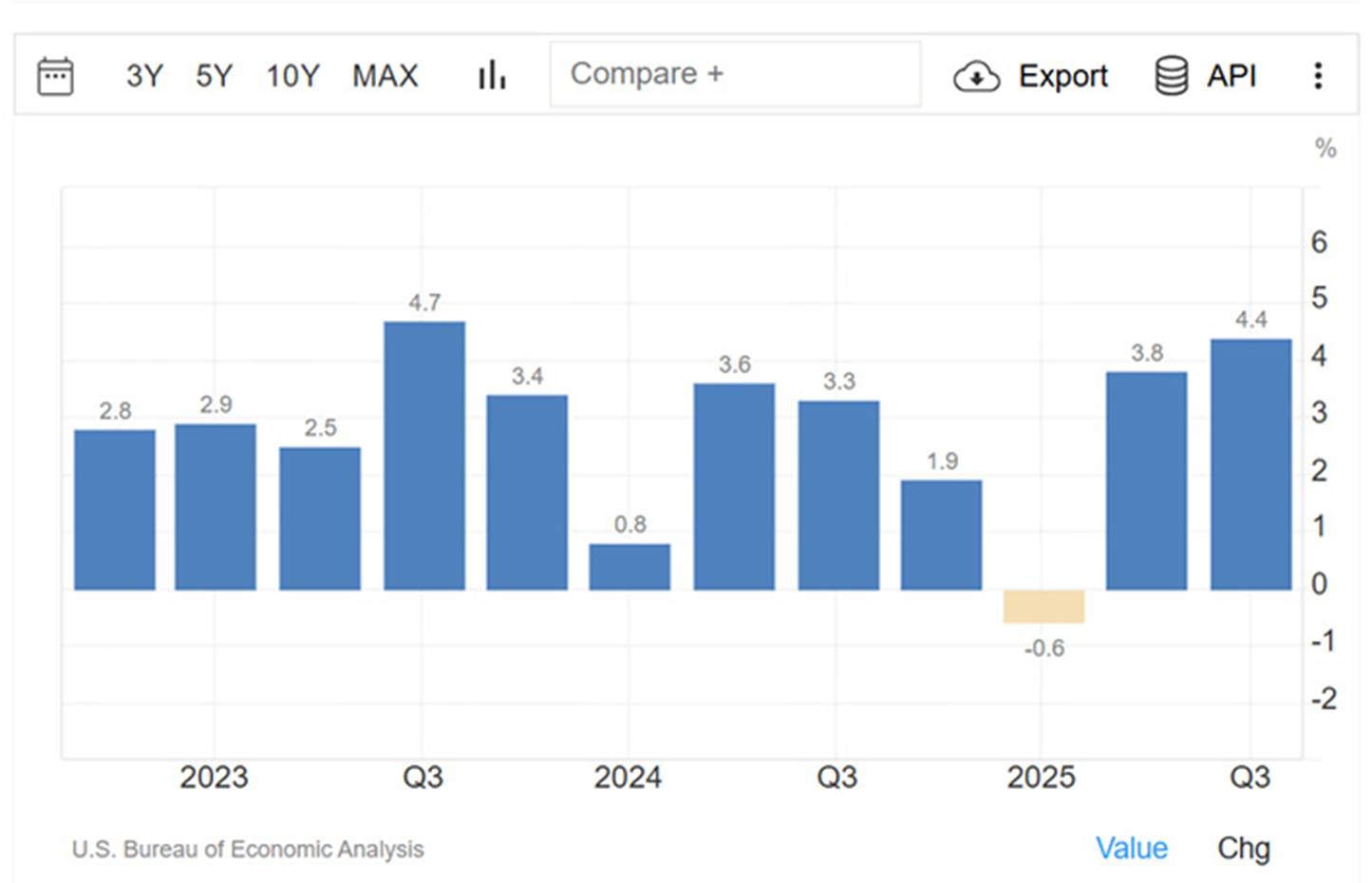

“One might think that new tools created after 2008 and the centralization of the financial market would have given the Fed greater insight about the economy’s direction. At a minimum, all those gained functions should have allowed the Fed to steer the economy more effectively. That didn’t happen. In 2009, the Fed forecast that real gross domestic product would accelerate to 4% in 2011. Instead, growth slowed to 1.6%. Cumulatively over that period, the Fed’s two-year projections overstated real GDP by more than $1 trillion. Repeated misses demonstrate that the Fed placed too much faith in its own abilities and in expansionary fiscal policy to spur growth. When the Trump administration shifted toward tax cuts and deregulation, the Fed’s forecasts were too pessimistic, underscoring its reliance on flawed models and neglect of supply-side effects.

“Successive interventions during and after the financial crisis of 2008 created what amounted to a de facto backstop for asset owners. This harmful cycle concentrated national wealth among those who already owned assets. Within the corporate sector, large firms thrived by locking in cheap debt, while smaller firms reliant on floating-rate loans were squeezed as rates rose. Homeowners saw their property values soar, largely insulated by fixed-rate mortgages. Meanwhile, younger and less affluent households, shut out of ownership and hit hardest by inflation, missed out on appreciation.

“By failing to deliver on its inflation mandate, the Fed allowed class and generational disparities to widen. Its pursuit of a wealth effect to stimulate growth backfired.”

Let’s unpack this. The downturn we now call The Great Recession officially begin in December 2007 and ended in June 2009. At the time, however, we didn’t know a recession had begun or that it had ended, although many of us suspected it. The committee at the National Bureau of Economic Research made both calls in hindsight, telling us in December 2008 that a recession had begun 12 months earlier. Similarly, we didn’t know until September 2010 that the cycle had marked a trough 15 months earlier.

Such delays aren’t unusual. They don’t necessarily impede policy changes. Nothing requires the Fed or anyone else to wait for the NBER to make up its mind. In 2008 the economy was clearly in trouble; the Fed had begun cutting rates in August 2007 (well after I and others forecast a recession for later that year), going from over 5% down to 2% in May 2008. The economy kept weakening despite this aggressive stimulus, and no one at the Fed or Treasury was quite sure why. Though I offered basically the same rationale Bessent used in his op-ed.

The problem was that the Fed was trying to use monetary policy to fix a governance problem. Bernanke thought that providing liquidity because of the banking and mortgage crisis, which did work, meant that monetary policy could fix anything and everything.

Seeking an analogy to describe that period of uncertainty, the best I can imagine is the few minutes when the referee call is under review in an NFL football game. Everyone knows “something” just happened, we can see the replays and apply our own judgment, but it’s still in dispute. The officials confer, reach a decision, and the game proceeds. But for those few minutes, there’s no basis for knowing who is right. And even then, many fans will disagree with the referee’s call.

Economically speaking, we went through about three years of such confusion in 2008‒2010 while the game was still underway. Rate cuts weren’t helping, and the Fed came under intense pressure to “do something.”

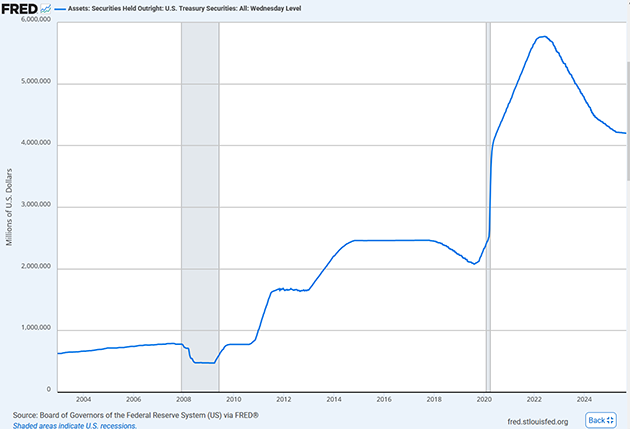

The plan—their “something”—that finally emerged was “quantitative easing,” in which the Fed used its excess reserves to buy Treasury and mortgage-backed securities. This allowed it to influence the longer end of the yield curve, which in theory should have stimulated economic growth. It didn’t, so the answer was more QE, then yet more QE.

I am reminded of the Saturday Night Live skit with Chrisopher Walken. Bernanke and the Fed kept giving us more cowbell. And then even more cowbell as they kept monetary policy excessively loose for many years.

Source: pixelrz

Years of zero rates and QE did have an effect, though. The S&P 500 roughly doubled in the three years after its early 2009 trough, even while the unemployment rate stayed north of 7%. The Fed’s free money served mainly to boost stock prices, along with the net worth of those who owned stocks. It was a great time to be a stockholder, a terrible time to be jobless.

Let’s review that again. The Fed kept rates at the zero bound (see chart below) from December of 2008 until December 2015. It was July of 2017 before rates exceeded 1%. Bernanke explicitly told us he wanted a wealth effect. But he screwed retirees and savers with 0% interest rates for almost 8 years! He cared about the stock market but not retirees who are supposed to be conservative in their investments. And don’t get me started on Yellen and then Powell. It began with the Greenspan put and went downhill, distorting the economy and contributing to the polarization we see in the country. It was the perfect storm for what Peter Turchin called the overproduction of elites and the immiseration of the masses. (I wrote about Turchin’s theories here and here.)

Source: Macrotrends

Wealth Effect and Addiction

Bessent said, I think correctly, the post-2008 Fed created “a de facto backstop for asset owners.” I would go further and say Fed officials thought such a backstop was a good idea. They thought it would produce a beneficial “wealth effect” as stock market gains trickled down to everyone else. We know this because, as Wolf Richter reminded me, Bernanke himself said so at the time. Here’s Wolf, reacting to the Bessent piece:

“OH, I so agree, and have said so many times. I have a special page for the Wealth Effect, citing among other notables, Yellen’s article on the benefits of the Wealth Effect, that she wrote in 2005 when she was still president of the San Francisco Fed, titled, ‘Housing Bubbles and Monetary Policy.’”

“And my page cites Fed Chair Bernanke’s 2010 editorial in The Washington Post, where he explained to the astonished American people that the Fed was using QE and ZIRP to create this wealth effect, whose explicit purpose and will was to make the wealthy even wealthier so that they feel more confident and spend a little more. The Wealth Effect was a central bank horror story but it occurred in real life.

“There is nothing more toxic on society, as far as central bank policies are concerned, than the pursuit of the Wealth Effect. And it’s bipartisan: Yellen was appointed by a Democrat and Bernanke by a Republican.”

To be clear, the wealth effect is real. When stock and real estate prices raise the top tier’s net worth, wealthy people will spend more money on a wide variety of products and services, and so on. All these produce jobs and raise incomes for lower-income people. That’s not imaginary.

At the same time, the wealth effect has limits because even wealthy people can only spend so much. Most of their gains simply stay in the market, helping prices rise even higher. This concentrates wealth, as Bessent said, widening the gap between top and bottom. That gap further widened with time. Then the return to ZIRP and additional QE in 2020 blew it even wider. And here we are.

With QE, the Fed essentially created an addiction. Addicts don’t respond well when their supply is threatened. Remember the 2013 “Taper Tantrum?” The mere mention that QE might possibly end at some unspecified point in the future almost caused a market meltdown. Here’s how the normally dry and sanguine Investopedia describes it (emphasis mine).

“In 2013, Federal Reserve Chair Ben Bernanke announced that the Fed would, at some future date, reduce the volume of its bond purchases. In the period since the 2008 financial crisis the Fed had tripled the size of its balance sheet from around $1 trillion to around $3 trillion by purchasing almost $2 trillion in Treasury bonds and other financial assets to prop up the market. Investors had come to depend on ongoing massive Fed support for asset prices through its ongoing purchases.

“This prospective policy of reducing the rate of Fed asset purchases represented a massive negative shock to investor expectations, as the Fed had become one of the world’s biggest buyers. As with any reduction in demand, with reduced Fed purchases (bond) prices would fall. Bond investors responded immediately to the prospect of a future decline in bond prices by selling bonds, depressing the price of bonds as a result. Of course, falling bond prices always mean higher yields, so yields on U.S. Treasuries shot up.

“It is important to note that no actual sell-off of Fed assets or tapering of the Fed’s quantitative easing policy had occurred at this point. Chair Bernanke’s comments referred only to the possibility that at some future date the Fed might do so. The extreme bond market reaction at the time to a mere possibility of less support in the future underscored the degree to which bond markets had become addicted to Fed stimulus.”

Unlike some addictive drugs, QE is very slow to leave the body. Maybe we need a 12-step program to help market participants overcome easy monetary policy addiction. The effects happen not just when the Fed buys assets like T-bonds, but as long as it holds those assets on its balance sheet. They are effectively “off the market,” causing higher prices for the reduced supply that still trades.

Subsequent attempts to reduce the Fed’s balance sheet on its bond holdings produced smaller-scale tantrums. As a result, the Fed still holds most of the trillions in Treasury and MBS bonds it purchased since 2008. The “QT” or quantitative tightening we have seen occurred mostly in 2022‒2023 when it was useful in fighting inflation. That effort is now ending with the Fed still holding over $4 trillion of its QE bond purchases.

Source: FRED

The worst part of all this is that QE has apparently become the Fed’s go-to crisis strategy. When COVID came along in 2020, Powell and crew immediately filled the punchbowl, buying another trillion or so of bonds within months, followed by that much more in the next year. And it had a similar effect: Asset prices rose sharply and are still doing so now.

Looking Through Inflation

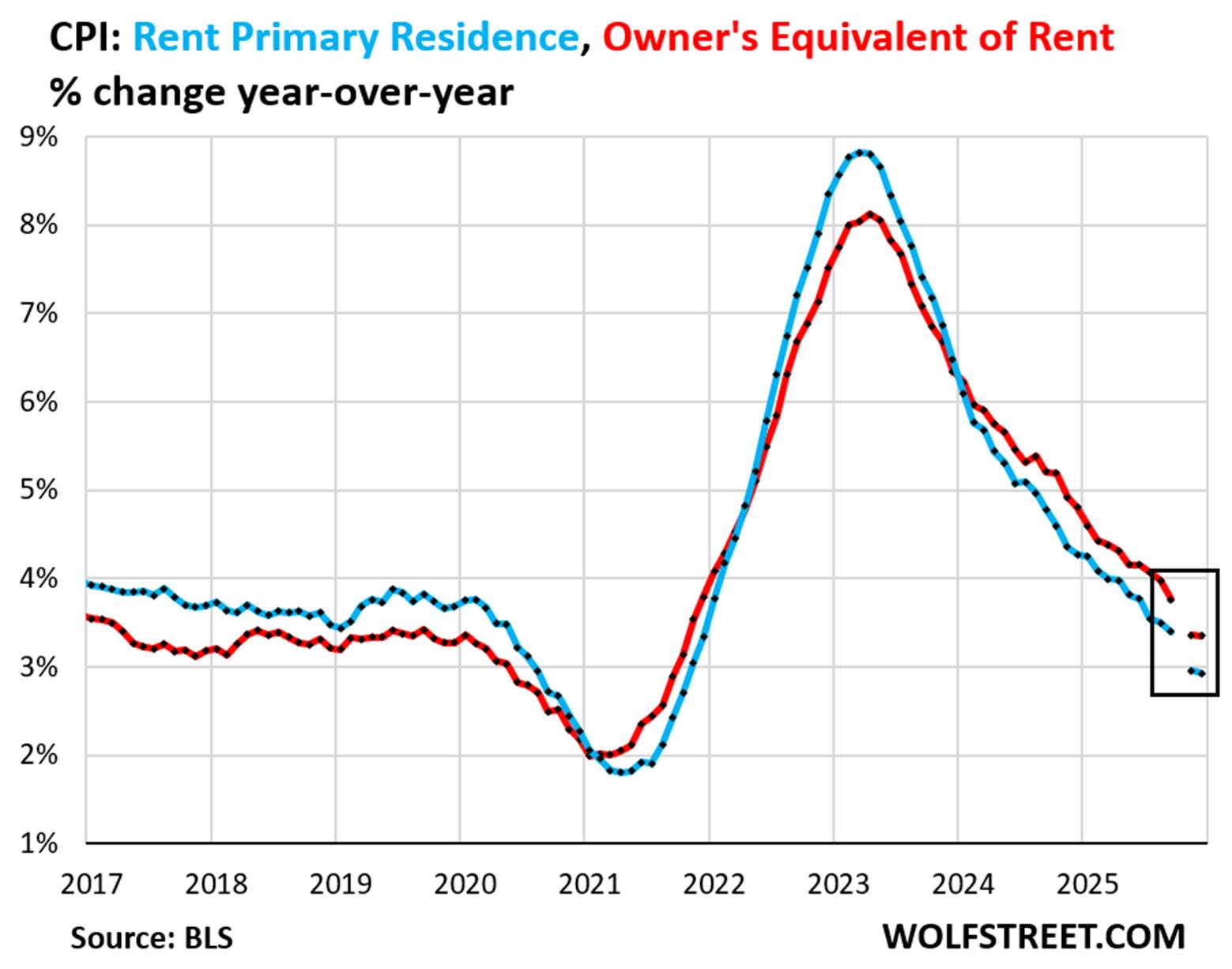

When Bernanke first used QE, many analysts said it would be inflationary, only to see inflation stay stubbornly low. Were they wrong? I don’t think so. I think it showed up differently as asset inflation rather than the price inflation that CPI tries to measure. The effects were different but no less harmful.

Higher asset prices aren’t bad if they occur because of good business practices and services. Or even exuberance. But the Fed does not have an upspoken third mandate to drive stock market prices. Or as with any good or service, higher prices happen naturally when demand exceeds supply. The problem occurs when central banks use their tools to juice demand in ways that produce few other benefits.

Thankfully, more QE doesn’t seem to be on the agenda right now. But, as noted, merely keeping this massive bond portfolio off the market has a distorting effect (which they seemingly want), as does the possibility the Fed could employ this tool again.

What is on the Fed’s agenda, and will likely happen next week, is lower interest rates. Employment data has weakened enough to convince even Jerome Powell that the Fed should “look through” the current inflation pressure and do what it can to encourage more hiring.

The question in my mind is whether lower interest rates will affect either jobs or inflation. There is an argument that current rates are above the “r-star” neutral rate. Many estimates peg r-star closer to 3%. That would mean current rates are restrictive—which is desirable if inflation is the greater threat. If not, and r-star is somewhat higher, which I think it is, the Fed has a little room to cut. Not the 3 percentage points Trump wants, but one point over the next 6‒8 months might be fair, unless we get a recession, which will sadly deal with inflation but not in a way we will like.

Note that inflation came in at 3% this week. A 3% fed funds rate is hardly “neutral” in that environment. And as I have written for months, inflation is likely to trend higher through the end of the year.

Next week’s FOMC statement, and the minutes we will see a few weeks later, may give us a little more clarity on the committee’s thinking. But the clarity may not last long if, as seems likely, the committee’s composition changes in the next few months. Will Powell’s term as chair ends in May. Stephen Miran will join soon, and Lisa Cook may leave depending on her legal situation.

Last week, the president said the top candidates for new Fed chair were White House economist Kevin Hassett, former Fed governor Kevin Warsh, and current Fed governor Christopher Waller. Hassett and Waller are both openly dovish. Warsh might be, too, but he’s been a hawk in the past, and I don’t think he will change his stripes. Warsh is my favorite for the next Fed chair.

We’ll see how all this sorts out. The new Fed chair could still be someone not yet known to be in the running. In my opinion, inflation is still the bigger threat. A small rate adjustment should do no harm but a return to ZIRP, much less QE, would be flirting with another 1970s inflation wave.

Jerome Powell is certainly not like William McChesney Martin. We should all hope his successor doesn’t act like Arthur Burns. There’s an excellent chance we will need someone—another Volcker, even—to take the punchbowl away. Just ugh.

Austin, Dallas, Houston, and Je Suis Charlie

As you read this, I am in Austin with so many friends celebrating Brad Rotter’s birthday, which is really just an excuse for 200 people to get together and enjoy a little fellowship. I have lots of questions for Pippa, Lacy, Victor, and the scores of serious market participants and economists who will be there. Sunday afternoon I fly to Dallas. I will meet up with Dr. Mike Roizen, who will be doing a longevity seminar on Monday night, September 15, at North Park partially as an introduction to our new clinic. We have a few spots left and if you are interested in coming, email [email protected] and we will get right back to you with the details.

The next day I fly to Houston where I’m with David Bahnsen and his team from The Bahnsen Group, talking to a lot of my readers and their clients. Those are fun nights. Then back to Puerto Rico.

10 years ago, we were all horrified by the mass terrorist murder of 12 people at the offices of Charlie Hebdo, a French satirical weekly that believed in free speech and freedom of the press. The slogan that developed from that horrific event was “Je Suis Charlie.” This week, another Charlie, who believed in free speech and open dialogue, was assassinated.

While the event itself was shocking, to see some of the response of people actually celebrating his death, the mainstream media shoot-from-the-hip reactions, was just as shocking to me. I guess I should be more used to it by now. The New York Times had to issue a retraction when it called Charlie Kirk anti-Semitic, using a quote from his podcast. It turns out he was reading a statement from someone else which he went on to severely criticize. And it goes on and on.

Charlie was a happy warrior and believed in the power of ideas. I hope that his death inspires literally tens of thousands of young people to become more open and involved in the political process, not just from the right but from all spectrums, with the point of dialogue and the presentation of ideas, not violence. With the joy and celebration of ideas, not the inciting to violence and characterizing the other side as the enemy.

In my naïveté 10‒15 years ago, I would keep asking Neil Howe, author of The Fourth Turning, where would the war—the violence—come from that seems to always accompany the end of The Fourth Turning? I no longer ask that question. The response now is how do we avoid such a situation?

I think there is a real possibility that we will look back on this week and realize that it was a turning point for our country. The question is which way will we turn?

And with that somber note, it’s time to hit the send button. Have a great week!

Je Suis Charlie,

|

|

John Mauldin |

Read the full article here

Leave a Reply