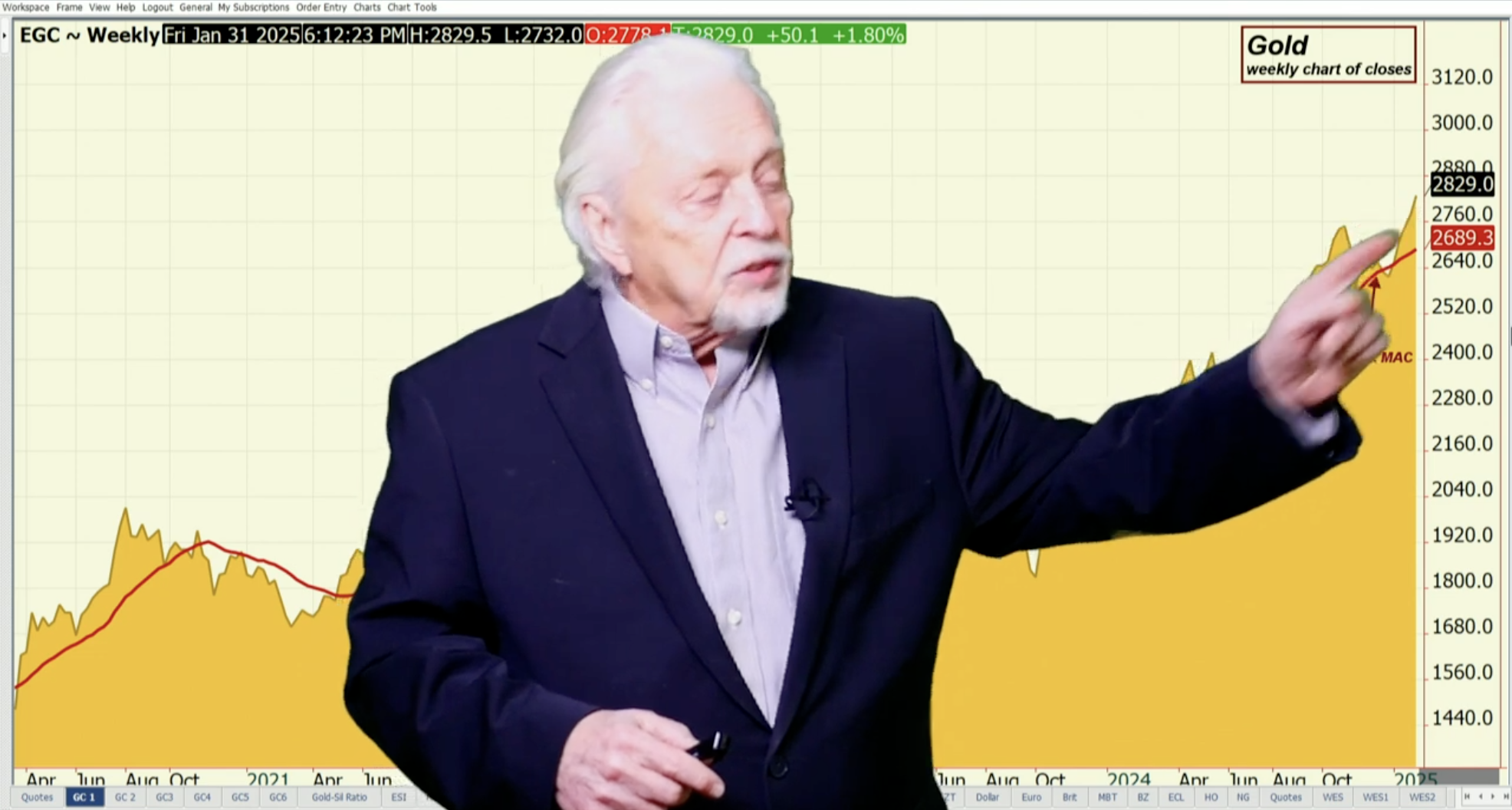

When we take a look at gold, just on a closing basis, you’re up at new highs. If the market were to finish here for the week, you’re up 50 on the week—away you go. When you take a look at the chart action, it’s been very much an upside. But earlier on in the week you stepped out of the trend when you got down here and went to $2760. You then started the recovery process, and the tariffs are carrying the market to the new highs or the threats of that.

Where’s the resistance? Well, it’s certainly not in 18-day average, or a 100 or 200-day average of closes. It’s most likely the upper Bollinger Band, and it’s exactly what it is. The market keeps hitting it just the way it did there. It broke back, it broke back, and so on. But bullish is the way to look at it. The dollar is the way to look at it, and bullishness as well. When you look at the momentum, we have lost the bullish embedded reading.

Read the full article here

Leave a Reply