US Dollar

Analysis:

All of wave ^c^ is complete at the 114.75 high and we are falling in wave ^d^. Within wave ^d^, we have adopted our alternate count as preferred, which is suggesting that all of wave a ended at 100.42 and we are moving higher in that tail end of wave b.

Within wave b, we completed wave -a- at 107.05 and wave -b- at 99.86 and we have adopted our count for wave -c-, as shown on our chart.

Our retracement levels for all of wave b are:

50% = 107.59.

61.8% = 109.28.

We have entered our retracement zone, so we need to be on guard for the completion of wave b… and the start of major drop in wave c.

We will provide an updated projection for the of wave c, after we believe that all of wave b is complete!

Trading Recommendation: Short risking to 109.00.

Active Positions: Short, risking to 109.00!

Special Subscription Offer: At $99/mth the Captain Ewave newsletter value is superb, and we have a special offer this week of just $199 for a three-month subscription! Investors get six updates a week from the Captain. Send us an email at [email protected] or click this link and we’ll get you on board. Thank-you!

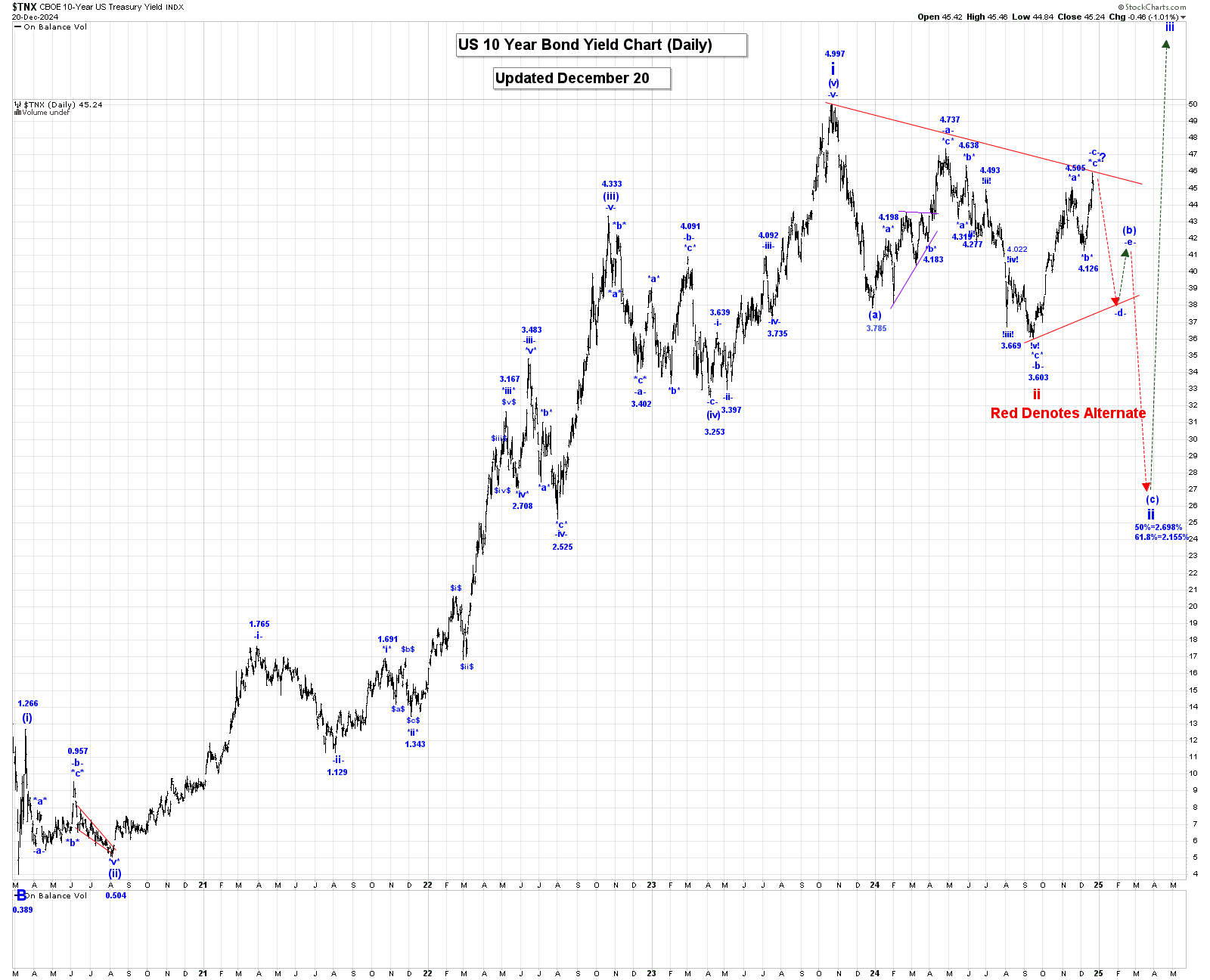

US 10 Year Bond Yield

Analysis:

The US 10-year Bond Yield has completed wave i at the 5.021% high and we are correcting that 5-wave impulsive sequence within wave ii, which has the following retracement levels:

50% = 2.698%.

61.8% = 2.155%.

We are current working on the assumption that our internal wave count for wave ii to is suggesting that wave (a) ended at 3.785% and that wave (b) has become a bearish triangle formation that is still underway as shown on our chart.

After wave -c- ends we expect another drop in wave -d-, which will then be followed by another wave -e- rally to complete all of our wave (b) bearish triangle.

The alternate count is that all of wave ii is complete at the 3.603% low and that interest rate cuts have ended and that long term rates will start to climb again sharply in wave iii.

After wave (b) ends we expect a final drop in wave (c) to complete all of wave ii.

Trading Recommendation: Short, risking to 5.050%.

Active Positions: Short, risking to 5.050%!

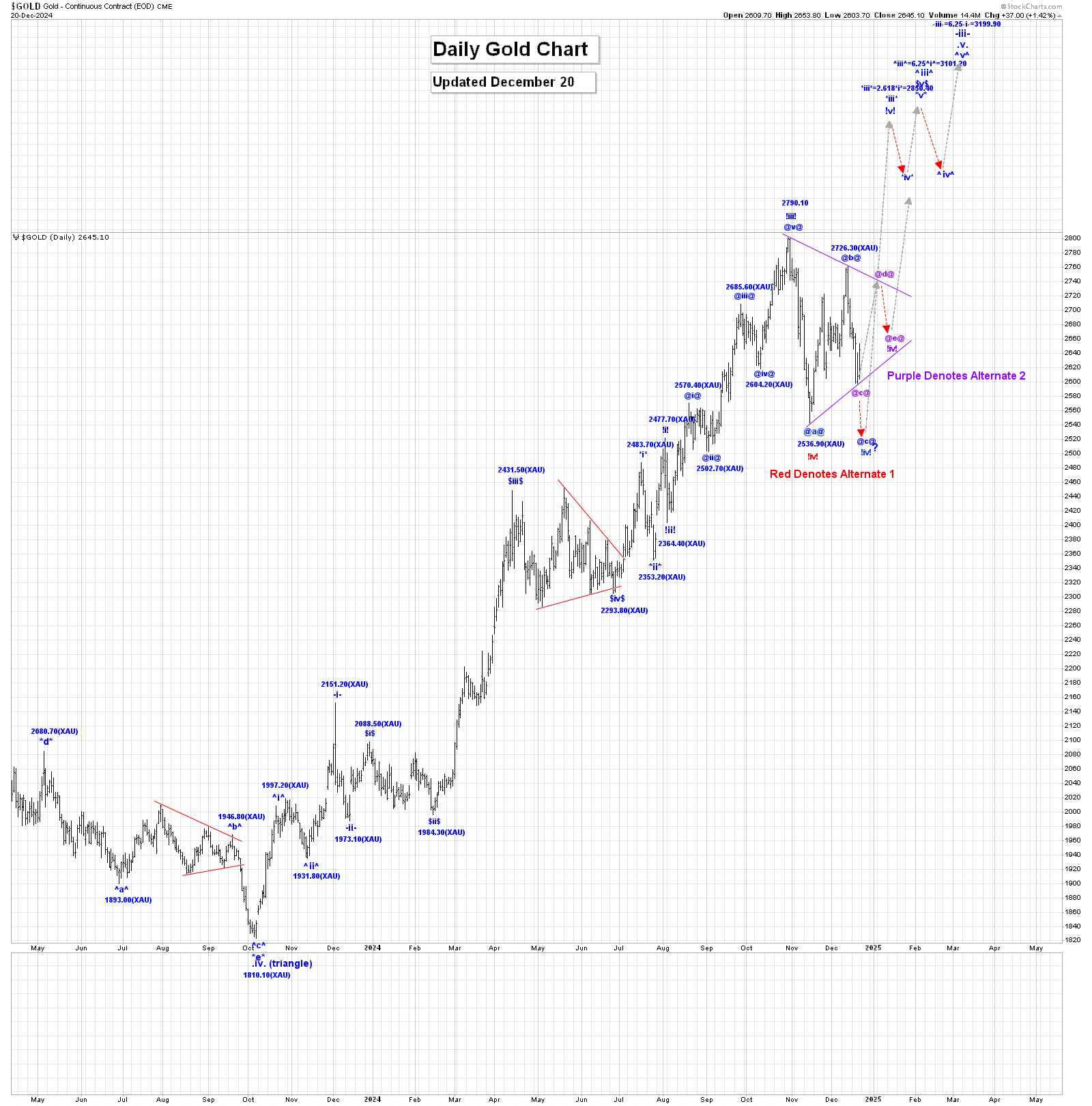

Gold:

Analysis:

We continue to rally in wave .v. of -iii-. Within wave .v., we completed wave ^i^ of *i* at the 1997.20 high and all of wave ^ii^ at the 1931.80. We continue to rally in wave ^iii^, which has a projected endpoint of:

^iii^ = 6.25^i^ = 3101.20.

Our preferred count (barely), is that within wave !iv!, wave @a@ ended at the 2536.90 low and wave @b@ at 2726.30. If that is the case then we are falling in wave @c@, which has a minimum target of the wave @a@ low of 2536.90.

The other option is that wave @b@ is going to become more complex and continue higher to create a flat corrective pattern for wave !iv!.

Wave @b@ could even reach all-time new highs in this corrective pattern, before it ends.

Other alternate counts to consider are:

Red Alternate 1: Wave !iv! ended at the 2536.90 and we are moving higher in wave !v!.

Purple Alternate 2: Wave !iv! is becoming a bullish triangle with wave @a@ ending at 2536.90, wave @b@ at 2726.30 and we are falling in wave @c@, with waves @d@ and @e@ still to develop. In this case wave @c@ cannot fall below the wave @a@ low of 2536.90 for this pattern to remain valid.

Our projected target for the end of wave -iii- is:

-iii- = 6.25-i- = 3199.90!

We still expect higher prices as wave !iii! continues to develop. After wave !iii! ends we expect a wave !iv! correction that retraces between 23.6 to 38.2% of the entire wave !iii! rally.

Trading Recommendation: Go long gold. Use puts as stops.

Active Positions: Long gold, with puts as our stops!

Free Offer For Website Readers: Please send me an Email to [email protected] and I’ll send you our free “Silver Rally Time & Stk Mkt Danger!” report. Detailed wave counts and analysis are included in this exciting key markets update!

Thank-you!

Captain Ewave & Crew

Email: [email protected]

Website: www.captainewave.com

Risk: CAPTAINEWAVE.COM IS AN IMPERSONAL ADVISORY SERVICE. AND THEREFORE, NO CONSIDERATION CAN OR IS MADE TOWARD YOUR FINANCIAL CIRCUMSTANCES. ALL MATERIAL PRESENTED WITHIN CAPTAINEWAVE.COM IS NOT TO BE REGARDED AS INVESTMENT ADVICE, BUT FOR GENERAL INFORMATIONAL PURPOSES ONLY. TRADING STOCKS DOES INVOLVE RISK, SO CAUTION MUST ALWAYS BE UTILIZED. WE CANNOT GUARANTEE PROFITS OR FREEDOM FROM LOSS. YOU ASSUME THE ENTIRE COST AND RISK OF ANY TRADING YOU CHOOSE TO UNDERTAKE. YOU ALSO AGREE TO BEAR COMPLETE RESPONSIBILITY FOR YOUR INVESTMENT RESEARCH AND DECISIONS AND ACKNOWLEDGE THAT CAPTAINEWAVE.COM HAS NOT AND WILL NOT MAKE ANY SPECIFIC RECOMMENDATIONS OR GIVE ADVICE TO YOU OR ANY OF ITS CLIENTS UPON WHICH THEY SHOULD RELY. CAPTAINEWAVE.COM SUGGESTS THAT THE CLIENT/MEMBER TEST ALL INFORMATION AND TRADING METHODOLOGIES PROVIDED AT OUR SITE THROUGH PAPER TRADING OR SOME OTHER FORM OF TESTING. CAPTAINEWAVE.COM, ITS OWNERS, OR ITS REPRESENTATIVES ARE NOT REGISTERED AS SECURITIES BROKER-DEALERS OR INVESTMENT ADVISORS EITHER WITH THE U.S. SECURITIES AND EXCHANGE COMMISSION OR WITH ANY STATE SECURITIES REGULATORY AUTHORITY. WE RECOMMEND CONSULTING WITH A REGISTERED INVESTMENT ADVISOR, BROKER-DEALER, AND/OR FINANCIAL ADVISOR. IF YOU CHOOSE TO INVEST WITH OR WITHOUT SEEKING ADVICE FROM SUCH AN ADVISOR OR ENTITY, THEN ANY CONSEQUENCES RESULTING FROM YOUR INVESTMENTS ARE YOUR SOLE RESPONSIBILITY.

ALL INFORMATION POSTED IS BELIEVED TO COME FROM RELIABLE SOURCES. CAPTAINEWAVE.COM DOES NOT WARRANT THE ACCURACY, CORRECTNESS, OR COMPLETENESS OF INFORMATION AVAILABLE FROM ITS SERVICE AND THEREFORE WILL NOT BE LIABLE FOR ANY LOSS INCURRED. DUE TO THE ELECTRONIC NATURE OF THE INTERNET, THE CAPTAINEWAVE.COM WEBSITE, ITS E-MAIL & DISTRIBUTION SERVICES AND ANY OTHER SUCH “ALERTS” COULD FAIL AT ANY GIVEN TIME. CAPTAINEWAVE.COM WILL NOT BE RESPONSIBLE FOR UNAVAILABILITY OF USE OF ITS WEBSITE, NOR UNDELIVERED E-MAILS, OR “ALERTS” DUE TO INTERNET BANDWIDTH PROBLEMS, EQUIPMENT FAILURE, OR ACTS OF GOD. CAPTAINEWAVE.COM DOES NOT WARRANT THAT THE TRANSMISSION OF E-MAILS, OR ANY “ALERT” WILL BE UNINTERRUPTED OR ERROR-FREE. CAPTAINEWAVE.COM WILL NOT BE LIABLE FOR THE ACTS OR OMISSIONS OF ANY THIRD PARTY WITH REGARDS TO CAPTAINEWAVE.COM DELAY OR NON-DELIVERY OF THE CAPTAINEWAVE.COM NIGHTLY EMAILS OR “ALERTS”. FURTHER, WE DO NOT RECEIVE ANY FORM OF PAYMENT OR OTHER COMPENSATION FOR PUBLISHING INFORMATION, NEWS, RESEARCH OR ANY OTHER MATERIAL CONCERNING ANY SECURITIES ON OUR SITE OR PUBLISH ANY INFORMATION ON OUR SITE THAT IS INTENDED TO AFFECT OR INFLUENCE THE VALUE OF SECURITIES.

THERE IS NO GUARANTEE PAST PERFORMANCE WILL BE INDICATIVE OF FUTURE RESULTS. NO ASSURANCE CAN BE GIVEN THAT THE RECOMMENDATIONS OF CAPTAINEWAVE.COM WILL BE PROFITABLE OR WILL NOT BE SUBJECT TO LOSSES. ALL CLIENTS SHOULD UNDERSTAND THAT THE RESULTS OF A PARTICULAR PERIOD WILL NOT NECESSARILY BE INDICATIVE OF RESULTS IN FUTURE PERIODS. THE RESULTS LISTED AT THIS WEBSITE ARE BASED ON HYPOTHETICAL TRADES. PLAINLY SPEAKING, THESE TRADES WERE NOT ACTUALLY EXECUTED. HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN INHERENT LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED TRADES DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT ACTUALLY BEEN EXECUTED, THE RESULTS MAY HAVE OVER OR UNDER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS SUCH AS LACK OF LIQUIDITY. YOU MAY HAVE DONE BETTER OR WORSE THAN THE RESULTS PORTRAYED. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE SHOWN. NO INDEPENDENT PARTY HAS AUDITED THE HYPOTHETICAL PERFORMANCE CONTAINED AT THIS WEBSITE, NOR HAS ANY INDEPENDENT PARTY UNDERTAKEN TO CONFIRM THAT THEY REFLECT THE TRADING METHOD UNDER THE ASSUMPTIONS OR CONDITIONS SPECIFIED HEREAFTER. WHILE THE RESULTS PRESENTED AT THIS WEBSITE ARE BASED UPON CERTAIN ASSUMPTIONS BELIEVED TO REFLECT ACTUAL TRADING CONDITIONS, THESE ASSUMPTIONS MAY NOT INCLUDE ALL VARIABLES THAT WILL AFFECT, OR HAVE IN THE PAST AFFECTED, THE EXECUTION OF TRADES INDICATED BY CAPTAINEWAVE.COM. THE HYPOTHETICAL RESULTS ON THIS WEBSITE ARE BASED ON THE ASSUMPTION THAT THE CLIENT BUY AND SELLS THE POSITIONS AT THE OPEN PRICE OF THE STOCK. THE SIMULATION ASSUMES PURCHASE AND SALE PRICES BELIEVED TO BE ATTAINABLE. IN ACTUAL TRADING, PRICES RECEIVED MAY OR MAY NOT BE THE SAME AS THE ASSUMED ORDER PRICES.

Read the full article here

Leave a Reply