The Money Metals Midweek Memo celebrates its milestone 50th episode with host Mike Maharrey delivering an in-depth analysis of economic principles, investment trends, and the current state of the gold market.

This episode offers valuable guidance for navigating an increasingly volatile financial landscape.

The Economic Principle of Scarcity

Maharrey begins by highlighting scarcity as the cornerstone of economic thought. Scarcity reflects the reality that human wants are unlimited, but resources are finite. This fundamental principle underscores the necessity of efficiently allocating resources—a task Maharrey argues is best handled by free markets rather than central planning.

He critiques the U.S. healthcare system, noting how scarcity necessitates rationing. Whether through insurance companies denying claims or government healthcare systems imposing long waits, no system can escape scarcity. Free markets, driven by price mechanisms, provide a more efficient approach to distributing limited resources compared to politically driven systems.

The Gold Market: A Case of Misguided Selling

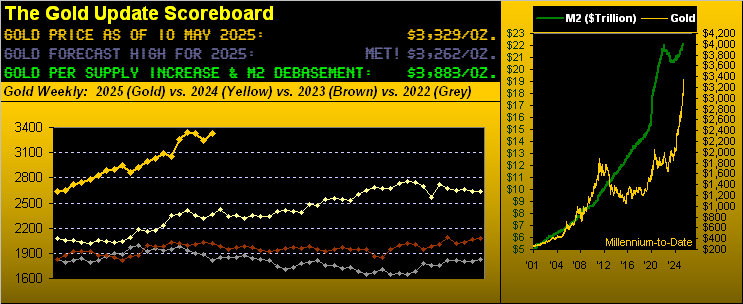

Recent weeks have seen significant selling pressure in the gold market, with prices fluctuating around the $2,000 mark.

Maharrey identifies a paradoxical trend: investors selling gold—traditionally an inflation hedge—amid rising inflation concerns.

This behavior, he explains, is rooted in fears that persistent inflation will prompt the Federal Reserve to slow its pace of interest rate cuts. As gold is a non-yielding asset, higher interest rates often diminish its appeal. Maharrey draws comparisons to the “Bizarro Market Dynamics” of 2023, where inflationary news paradoxically drove gold prices lower.

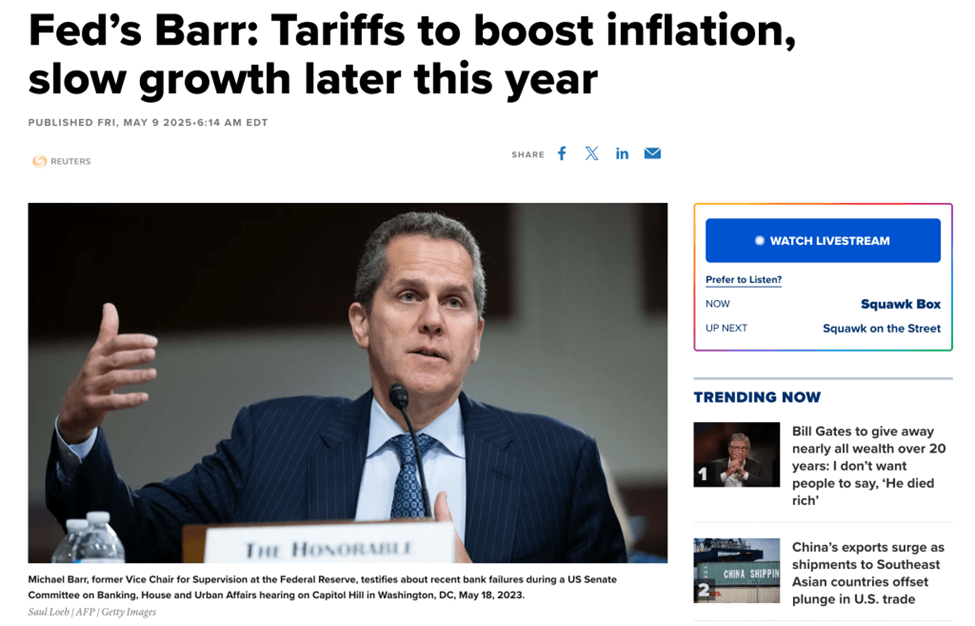

Inflation: Persistent and Unyielding

Contrary to mainstream narratives, Maharrey challenges the idea that inflation is under control. He points to troubling data:

- Producer Price Index (PPI) rose 3% year-over-year in November, the highest annual increase since February 2023.

- Monthly PPI climbed 0.4%, doubling October’s rate.

Surging producer costs are likely to trickle down to consumers, fueling further price increases. Maharrey argues that the Federal Reserve’s modest rate hikes and balance sheet reductions are insufficient to address inflation generated by over a decade of money creation, including $9 trillion during the Great Recession and pandemic eras.

The Federal Reserve’s Tightrope Act

Maharrey critiques the Federal Reserve’s delicate balancing act between controlling inflation and preventing economic collapse. With the national debt exceeding $36 trillion and fiscal 2024 interest expenses surpassing $1 trillion, the economy remains heavily reliant on low interest rates.

This “debt-addicted” system, he contends, makes it inevitable that the Fed will return to easy money policies, including rate cuts and quantitative easing, with severe inflationary consequences.

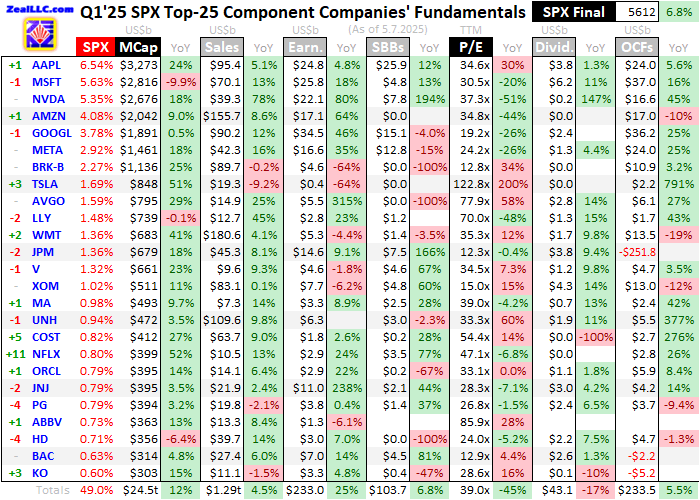

Lessons from History: Parallels to 2007

Drawing comparisons to 2007, Maharrey warns of eerie similarities to the lead-up to the Great Recession. Back then, stock markets were peaking, the Fed was cutting rates, and mainstream analysts were optimistic—until the financial crisis struck. He also observes similarities to the dot-com bubble, with tech stocks once again reaching frothy valuations.

A Call for Long-Term Thinking

Maharrey urges investors, particularly those holding gold, to resist the herd mentality and focus on long-term trends.

“Don’t jump off a cliff just because everybody else is doing it,” he advises, suggesting that current dips in gold prices may present buying opportunities.

Celebrating 50 Episodes

As the Money Metals Midweek Memo marks its 50th episode, Maharrey reflects on the podcast’s journey and the insights it has offered listeners. He encourages those interested in gold and silver investments to explore options at Money Metals Exchange, especially as the holidays approach.

This milestone episode combines timeless economic lessons with timely market analysis, offering listeners actionable insights to navigate uncertain times.

For more information and updates, visit MoneyMetals.com and subscribe to the podcast.

Read the full article here

Leave a Reply