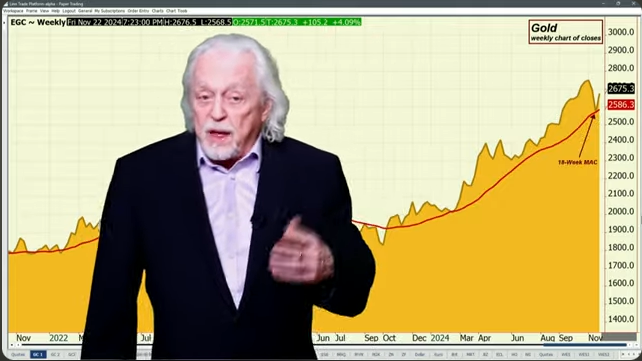

When we go to the chart action and that’s where I want us to head now. Gold on that one correction down held nicely, and this week has been spent going up and we are for the week up, 4% percent. So that is impressive. It’s been a neat correction from the $2550 area, back to about a 50%, not quite there from this break low. This is one of the reasons I think the market is stalled.

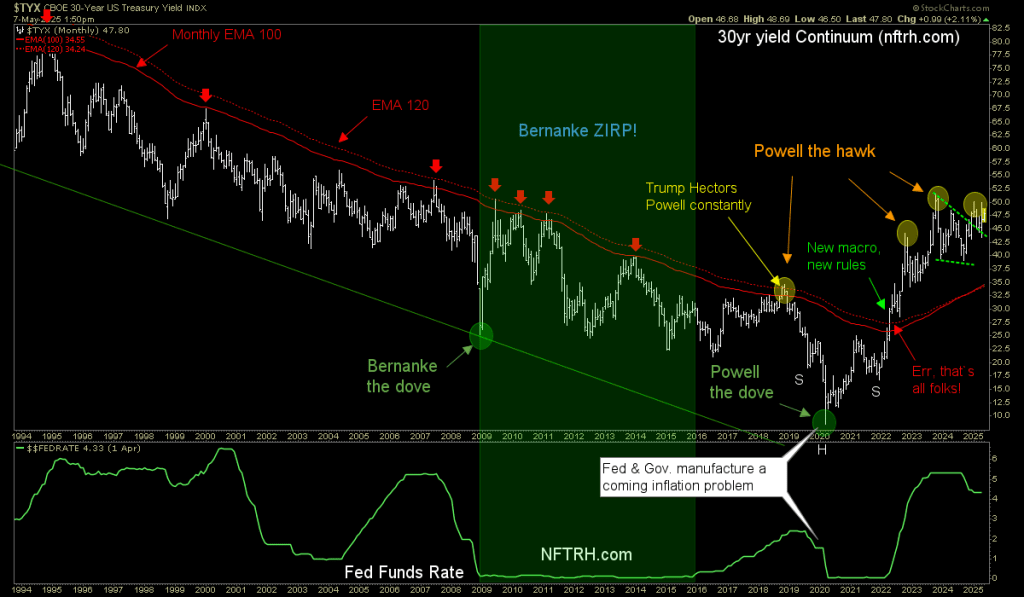

You still have the pattern of lower highs and lower lows. The market rallied to the 18-day average. If you take a look at the 50-day[moving average], you’ll also see that’s a resistance point. So far what has happened: The first break to the hundred-day average held. Now the first rally back into the 18[-day average] is restraining, the market at this point, the Bollinger Band, which we got under in that.

The free fall that the market had has come back, but the market hasn’t regained that oomph it had. When you first heard back here, that Trump had won the presidency in the market was running. I think you’ll remember if anything the market peaked out and came down on the Trump presidency.

Read the full article here

Leave a Reply