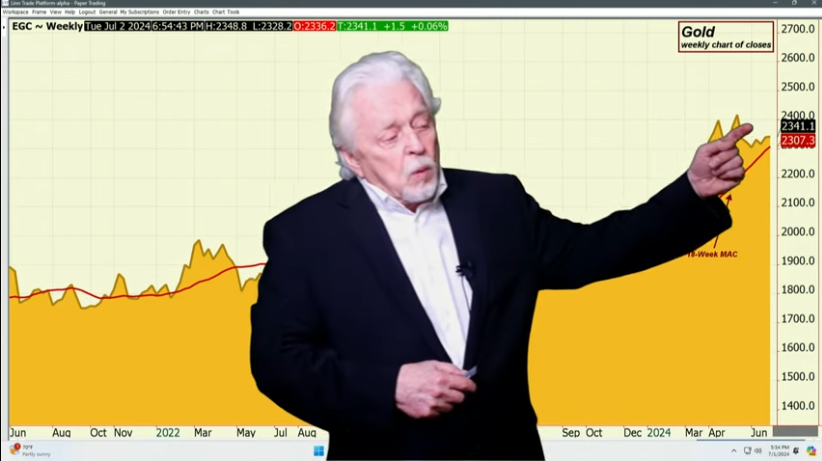

The question, of course, is whether prices will come down to the 18-week moving average of closes or elect to hold and just stay above it. Look at the chop action you’ve had here. You tried to break out up but failed. You tried coming down last week but failed and came right back in here. This is how you get burned in these markets right in front of holidays, and it’s what’s happening now. You have the higher high and lower low pattern. The market is fighting right at the 18-day average of closes.

The Bollinger top and bottom, as you can see, are very close to this 18-day average. It’s not total sideways action but is tracking it in an interesting fashion. Could you get another buy signal in gold? Well, if you were to get over $2356, you’d certainly have higher lows and a higher high, assuming you didn’t take out today’s lows first. I don’t know.

When we look at momentum, it had been oversold down here, which ties in with this break. Now the market is corrected; it’s a difficult market right here.

Read the full article here